Pre 8 a.m. comments

Regular readers of this Blog will remember that my biggest success of 2012 was Trinity Mirror (LON:TNI), when I gave chapter & verse on why TNI shares were ridiculously cheap at 25p a share here on 22 June 2012.

A lot of us did very well on the shares, although personally I made my usual mistake of selling far too early at 64p, when new phone hacking revelations emerged and panicked me into selling. We're in a bull market of course, so the money from selling TNI was recycled into other things which have since risen strongly too, so all is not lost.

Well, amazingly TNI shares have risen almost 5-fold since I wrote that article, and they still look cheap on conventional valuation measures!

Preliminary results for the 52 weeks ending 30 Dec 2012 are issued today, and the story is the same, i.e. of declining turnover, but cost savings out-pacing that decline, hence delivering an increase in adjusted EPS of 10.7% to 29.9p. Therefore the PER is only just over 4. The market cap at 120p is £310m.

The very strong cashflows (since capex is largely done, with up-to-date printing presses already installed) have enabled TNI to reduce its net debt further to £157m, which should continue falling rapidly. So no worries there.

The prospect of a dividend is dangled in front of shareholders in today's announcement, but then whipped away again, as they have decided to play it safe and not pay dividends until after the big loan note repayment due in 2014. Bear in mind also that over-payments into the pension fund will rise from £10m to £33m in 2015 and onwards. Although they do make this interesting comment about the pension deficit (bolding below added by me):

It is clear that a change in the financial markets over the coming years, in particular an increase in long term interest rates could have a material beneficial impact on our pension scheme obligations.

TNI's pension deficit has risen in accounting terms to £298m, or almost the same as the market cap. Although as I've mentioned before, TNI does have a large offsetting asset in freehold property, which taken together with the likely reduction in the pension deficit due to rising interest rates in the future, could eradicate this problem.

Personally I don't see much upside in the current share price of 120p, since it is a declining business, the digital strategy is not convincing, and the pension fund & debt repayments are likely to be the main (or only) beneficiaries from cashflows over the next few years. There could also be some impact from phone hacking claims. It was an amazing bargain at 25p, but it isn't a particular bargain at 120p, is my current view.

Post 8 a.m. comments

Home Retail (LON:HOME) was another success from last year, where I repeatedly flagged the value in the balance sheet (£300m net cash plus a £500m debtor book from the in-house store card business) effectively left the business thrown in for free, at 70-80p a share. Hence an excellent, low risk investment. There was also good turnaround potential at Argos, their largest subsidiary.

The other interesting angle on HOME is that it's one of the most shorted shares in the UK market, with over 20% of the entire shares in issue being out on loan to short sellers. As I've mentioned before, this creates a situation where a massive bear squeeze could occur - i.e. good news is released, and all those short sellers become panic buyers, chasing the price higher & higher, which in turn escalates the margin calls for remaining bears, who unless they have very deep pockets, also become forced buyers.

Well, that's exactly what has happened this morning - HOME has released a positive trading update, and the shares have shot up 20p to 152p. We've seen this happen in the past, and the initial spike has then faded.

Their trading statement is impressive in that Argos (which had delivered several years of declining LFL sales) is now reporting strong LFL sales increases - the end of year trading statement issued today shows that Argos delivered full year sales up 2.1% on a like-for-like ("LFL") basis. This accelerated to a very impressive 5.2% in the 8 weeks to 2 Mar 2013. Remember that also included the period of snow, which Debenhams said badly affected them, funny that it didn't affect Argos or John Lewis!

Homebase delivered LFL sales down 4.9% for the year, but that slowed to -1.5% in the last 8 weeks of the year, being reported today.

Despite this improvement in trading, HOME says that it will only report benchmark profit of £90m, which is paltry considering they have sales of over £5bn. However, they have at least stopped the decline, and should benefit from a convincing turnaround strategy from the new head of Argos, who is a highly impressive figure that I met at the AGM, full of ideas for transforming Argos into the UK's no.1 internet retailer - and they're very close, with 43% of Argos sales already booked online or on mobile. So people who think it's a dinosaur are badly mistaken.

The bears were clearly wrong on HOME, it is not going the way of Jessops, JJB, HMV, etc. However, at 150p the market cap is over £1.2bn, which even allowing for the bullet-proof balance sheet, is probably up with events for the time being. Short closing could easily take it up to 200p in the coming months though.

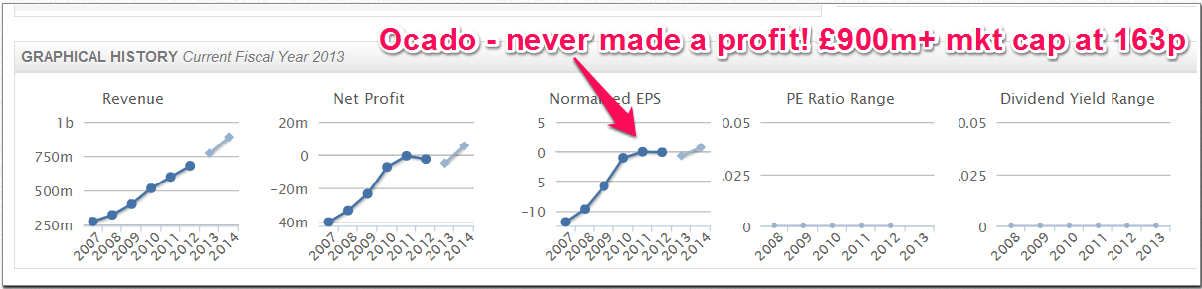

Another retailer where bears are being burned alive is Ocado (LON:OCDO), whose shares have shot up 21p to 158p at the time of writing. This gives a market cap of an astonishing £913m, despite it never having made a profit, and having a pretty laughable business model - non-exclusivity on delivering low margin products, in a highly competitive sector, which requires massive capital expenditure to implement.

For the moment the market seems wowed by their state of the art automated dispatch centres, and Stuart Rose joining as Chairman, who has a remarkable track record for joining retailers at the right time, when the heavy lifting on turnarounds has arguably already been done, in my opinion (e.g. Arcadia, and Booker).

There are two announcements today from OCDO, one confirms that it is in talks with Morrisons which may lead to some kind of commercial co-operation, but it falls shorts of Morrisons taking an equity stake in OCDO. Difficult to know what to make of that, other than it seems to confirm OCDO's expertise in logistics.

The second announcement from OCDO is an Interim Management Statement ("IMS") for the 12 weeks to 24 Feb 2013, which reports continued sales growth of 14.4% against the same period last year. All very nice, but sales are for vanity & profits are for sanity, and I am yet to be convinced that OCDO has even the makings of a profitable business.

I don't have any position in OCDO, but in my view the bears are more right than the bulls, if one looks at the long term profit outlook for the business, which is surely very weak?

I don't see the need for automated picking of groceries. Since a minimum wage human can do about 4 or 5 orders per hour, then that's only costing about £1.50 per delivery, or 1-2% of the total price, and can be done locally to the end customer, thus minimising the delivery cost. Difficult to see how it makes sense to spend hundreds of millions of pounds on capex to automate something that can be done quickly & cheaply by hand. Also, the more you centralise and automate, the more you have to spend on delivering longer distances to the final customer. Ocado's business model just doesn't make sense to me. But for the moment it's a darling of the stock market. Let's revisit that when the profit (or rather, loss) figures are next released!

I don't usually short any shares, as historically I wasn't any good at it (requires patience, and willingness to absorb large drawdowns, even when you know you're right!). However I'm sorely tempted to open a short on Ocado (LON:OCDO) today now it is up 30% to 177p, an absurd over-valuation of a loss-making business.

Moving on, next I'm looking at results from Regenersis (LON:RGS). I saw upside in the share price of RGS when they reported positive outlook & results on 25 Sep 2012, as reported on my blog on that day, but foolishly omitted to actually buy any shares myself, they were 96p at the time. Drat! My view of upside to 140p then was actually too conservative, and the shares have since risen to 193p.

Regenersis presented very well at an investor evening organised by Equity Development in January (there is another one planned for 17 April, so if you are able to get to central London early evening presentations, that's a date for the diary. I always try to attend such investor evenings, as it definitely adds value meeting the people behind a company, and having a chance to ask questions, and see how they respond under pressure.

The presentation slides from that meeting are still on ED's website, and can be accessed here (you might need to register to view), and are well worth a look if you like RGS.

Turning to the interims released this morning (six months to 31 Dec 2012), I should first mention the market cap, which is currently £84m at 193p per share.

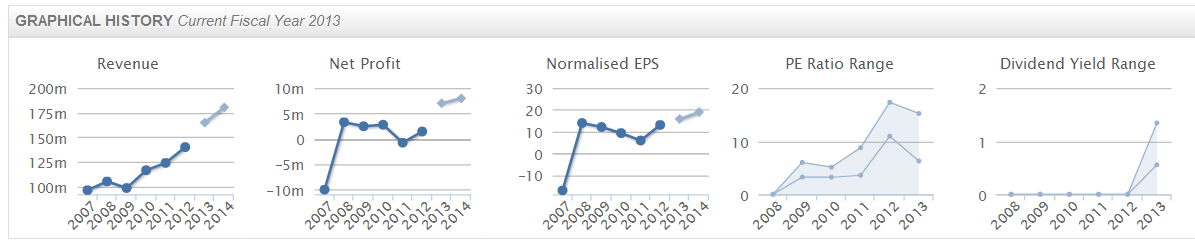

Revenue is up strongly by 29% to £90.2m for the six months, and headline operating profit is up 21% to £4.6m, so it should be noted that the profit margin is on the lowish side at 5%.

Net debt of £7.7m looks reasonable to me.

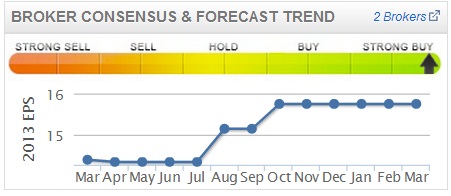

Note from the useful Stockopedia chart which appears on the StockReport (bottom right hand side) how broker consensus EPS forecasts were creeping up last year - a bullish sign.

The key driver of valuation is obviously adjusted EPS, which is up 18% to 7.96p. There does not seem to be any particular seasonality to that, so doubling it to 16p for the full year looks approximately in line with market consensus forecast, which is for 15.8p EPS for the current year, ending 30 Jun 2013.

That puts the shares on a PER of 12, which looks about right to me for the time being, although another year or two of earnings growth should feed through to a higher share price. Note the turnaround in EPS in the last couple of years, as management strategy to aim for higher margins is paying off (see the third chart below):

The dividend yield is about 1%. My view is that this is a sound company, with a good strategy to grow in emerging markets, where margins are higher. They provide outsourced repair services to consumer electronics companies, so they e.g. send someone to repair your Sky+ box if it's not working, etc.

The all-important outlook statement is also solid, confirming what I had already worked out above, that they are in line with market expectations. It also confirms that growth opportunities remain strong. So although I'm kicking myself for missing the boat in not buying these shares when I saw the value at half the current share price, it's not quite cheap enough for me to buy now. But if I held the shares, then I would sit tight, as it seems to me that a price of 200-300p could conceivably be on the cards over the next year or two, based on these figures & growth prospects.

Stockopedia Useage Tip

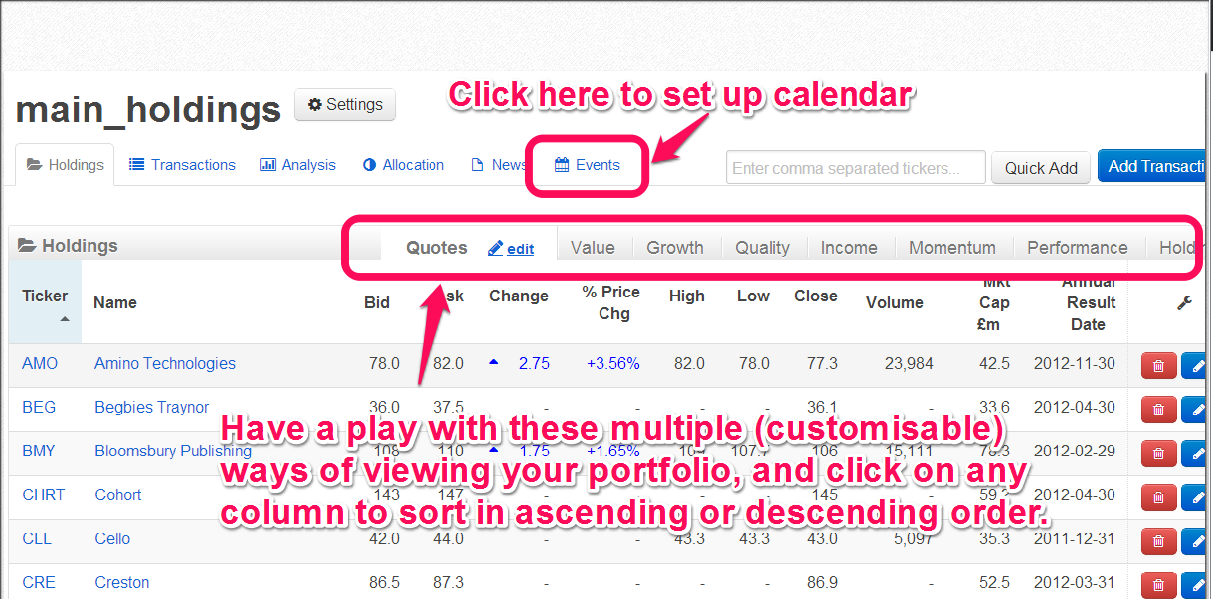

Just as an aside, I found a great Calendar feature buried in Stockopedia that readers will I'm sure find useful, so I'm flagging it up here.

You can set up multiple portfolio monitors under the "Folios" tab on the right hand side of the black menu bar at the top of the screen. Here is a screen shot of one I set up, which is a mixture of shares I own, and things I'm monitoring:

It is well worth spending a bit of time trying out all the different ways of displaying and sorting portfolios.

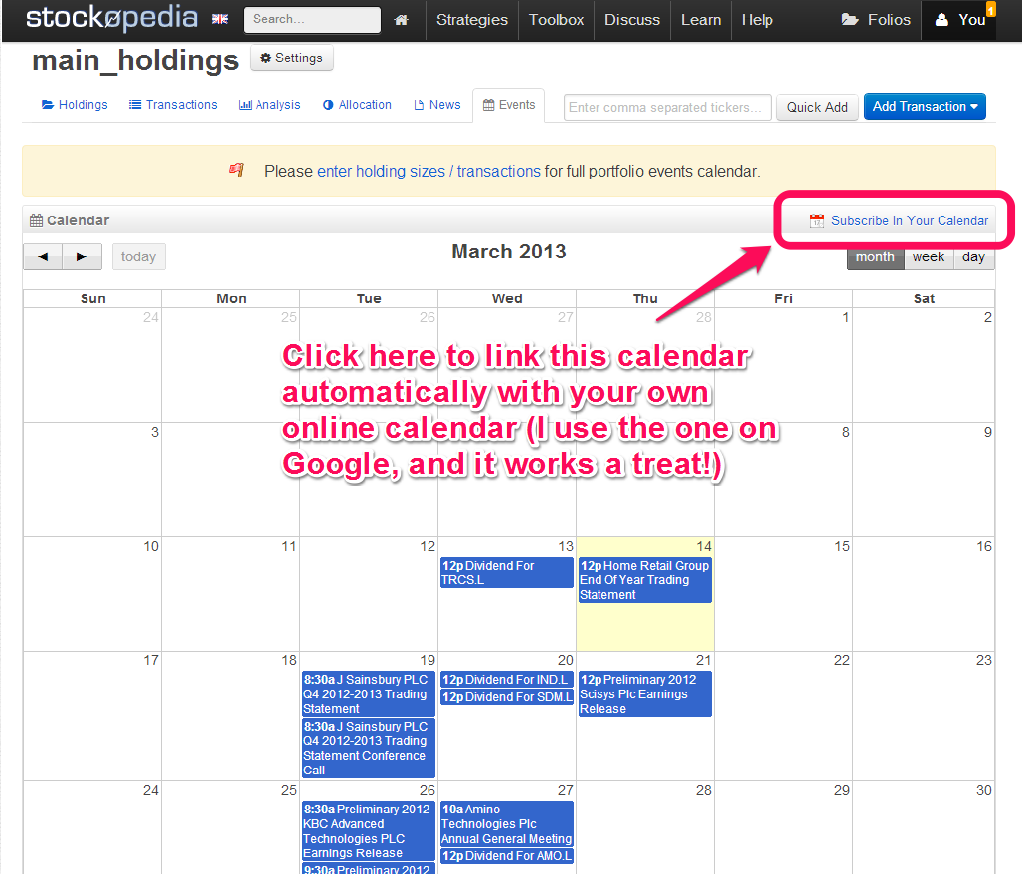

But the feature I'm flagging today is the Calendar one, so if you click on the "Events" tab (shown above in screen shot), that takes you to the following screen, where Stockopedia has generated an online calendar showing all future announcements expected for the shares in the portfolio I created.

Neat, eh?! But the best bit, is that by clicking on the "Subscribe In Your Calendar", it will link the Stockopedia calendar to your own personal everyday calendar (on Google, or whatever software you use, it should work with most apparently). So now, all my company announcements appear on my usual everyday use calendar automatically, so I'm not usually caught out by company results any more, as it includes pre-announced results, but also makes forecasts based on last year's timings too.

Finally, Ed has made some excellent videos to demonstrate live how to use Stockopedia, which are well worth a look, as seeing something done is so much quicker than someone trying to explain it in writing. So check this one out, on how to use the Portfolio features on Stockopedia.

That's it for today, see you same time tomorrow.

I'm meeting the management of Indigovision (LON:IND) later today, so should hopefully have some more comments on that in due course. It will be interesting to see how their turnaround plans are progressing - there were certainly some positive signs in the most recent results, with a bullish outlook for the full year.

Regards, Paul.

(of the shares mentioned today, Paul has a long position in IND only, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.