Good morning. Trinity Mirror (LON:TNI 115p) interim results (six months to 30 Jun 2013) have been issued this morning. As regulars will know, many of us did tremendously well on the re-rating which began exactly a year ago, as I spotted the astonishing value in the shares at 25p. They were great value when I bought at 25p last summer, but I don't see them as good value any more, at 115p.

Even though the PER is very cheap, at about 4 times, you can only value a business on a PER basis if profits are sustainable. In the short term (or even medium term) profits are sustainable, as today's interims demonstrate. However, the continued decline in turnover (down 8.5%) to £332m for the six months, puts a fairly finite life on the print businesses. There will come a time when they just can't strip out any more costs to maintain profitability. Hence it should be priced on a low PER.

EPS actually rose 5.5% to 15.4p, so they are heading for about 30p for the full year probably, which is a bit ahead of broker consensus of 28.1p.

Good progress has been made on debt repayment, with net debt down to £120.3m, with £36.7m having been repaid in the six months, which is very impressive. As I mentioned last year, Trinity Mirror's debt repayments are scheduled to coincide almost perfectly with its cash generation. So the net debt was never going to be a problem, the market just got that wrong last year in regarding it as a major problem, when it never was. Also the debt is covered by freehold property assets, which have a book value of considerably more than the net debt now, although the group was very coy about what the free market value of those properties actually is, when they were asked directly at the AGM a couple of years ago, which I attended.

The pension deficit has remained stubbornly high, which is disappointing. As mentioned yesterday, rising bond yields should now be shrinking pension deficits, but in this case it has fallen only marginally, to £297.7m (equal to £229.2m net of deferred tax).

Remember that pension deficit recovery payments will rise from £10m to (from memory) about £30m in a year or two. Not a problem whilst profits & cashflow are so strong, at over £100m still, but roll forward 3 or 4 years, and the pension deficit could be eating up a lot of reduced cashflow from a shrinking business.

On the upside, the Mirror is declining more slowly than the sector average, and I've always believed it has a better than average market position, and it is the only left-wing national tabloid. So people with leftie views who want a tabloid have only got one choice, to buy the Mirror.

I like their comments in the section headed "Capital Structure". This seems to raise the prospect of dividend payments resuming in 2014:

We remain confident that following the repayment of £98.7 million of maturing debt over the next 11 months, we will have increased financial flexibility during 2014 to consider all options for driving value for shareholders. This will include considering further investment opportunities to build a stable and growing portfolio of print and digital assets and the return of capital to shareholders, alongside meeting our obligations to fund the Group's defined benefit schemes to address historic deficits.

I like the strategy of new CEO, Simon Fox. He seems to be maximising the performance & cost efficiency of their print businesses, instead of scattering money around on half-baked digital ideas like the old management, whose unfocussed "planting lots of seeds" approach just didn't work.

You rarely find that old economy companies become leaders of new economy activities, even though they should be the best placed, with the cashflow available, but a lack of ideas. Also, how will news actually make money in a digital world, especially when the BBC distorts the market so much, since their licence fee model means they can put out high quality content free at the point of use?

I'm not quite sure where TNI goes from here. We're in a bull market, so investors might chase it higher, on the short term good news. Longer term though, I'm not sure. If it was 25p again, then I'd load up to the max with the shares again. At 115p, which is a market cap of £299m, I think they are probably priced about right.

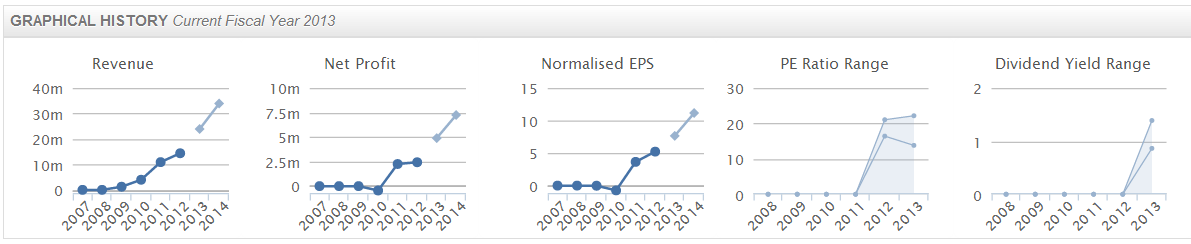

Interim results from Portmeirion (LON:PMP 650p) caused my heart to skip a beat this morning. This is one of my favourite long term holdings at the moment, due to its reasonable price, strong Balance Sheet, decent operating margin, and track record of growing earnings and dividends consistently without putting a foot wrong. Also they have strong recurring sales on certain key product lines.

However, their interim profits issued today show a stomach churning drop in profits of 38% to £0.9m.

However, on closer inspection, there is nothing to worry about, and this might provide a buying opportunity today hopefully, as I want some more. The issue is Anti-Dumping Duty imposed by the EU on products imported from China. On reading the narrative, it says this has been accommodated by action taken, and that it's just had a disproportionate impact on the first half due to it being the seasonally slow half of the year. So full year figures should be fine, as they specifically state:

we remain confident of the outcome for the full year to 31 December 2013.

Full year consensus forecast is for 50.8p EPS, which at 640p puts Portmeirion shares on a current year PER of 12.6, which is not a demanding rating at all in my opinion, given where we are in the economic cycle, with key markets like the USA and UK probably in the early stages of economic recovery.

The full year dividend is forecast at 24.2p, up 11% on last year, and just over twice covered by forecast earnings. At the current mid-price of 640p that gives a healthy, and growing yield of 3.8%.

The Balance Sheet is terrific, with current assets of £27.3m and only £6.0m of current liabilities. It's very unusual to see such a strong net working capital position as that, with current assets at 455% of current liabilities.

Long-term liabilities contains a pension deficit of £4.7m, which is a nuisance, and at the moment is consuming £800k of cashflows for overpayments each year. In common with other final salary schemes, the problem has mainly arisen from the rate used to discount scheme liabilities falling relentlessly. It was 5.4% in 2010, 4.7% in 2011, and fell to 4.3% in 2012. QE has caused a lot of this damage, but as bond yields are now rising again, and are likely to continue doing so as the economy improves, the deficit should reduce in future, if my reading of the situation is correct.

Utilitywise (LON:UTW 114p) issue a pre-close trading statement today. It is a "leading independent utility cost management consultancy". So they negotiate utility deals for businesses, and are paid a commission by the utility companies & the client. So there is an inherent conflict of interest in their business model, which makes me a little uncomfortable. Also this type of business is very dependent on what commission rates the utility companies offer. If they decide en masse to only deal direct with customers, then this business will disappear. So I'm a little wary of this one for those reasons.

So, their trading update is for the year ended 31 Jul 2013, and says that adjusted profit before tax is in line with market expectations. Net cash is approximately £3.7m.

Things seem to be going fine at the moment, with them saying:

Trading remains strong and the Board is confident in the Company's ability to deliver continued organic growth.

That's all good, so what's the price?

At 114p the market cap is £81.2m. Market expectations for the year that finished yesterday, are £23.9m turnover (so that's a very high PSR of 3.4 times), and net profit of £4.89m, giving 7.65p per share EPS.

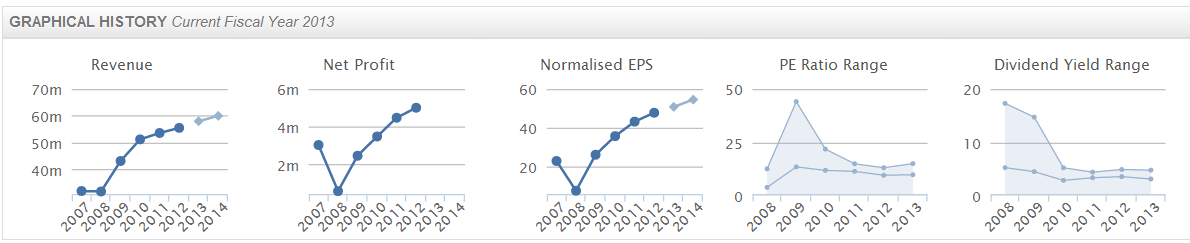

I make that a PER of 14.9, which looks about right for a company delivering excellent growth, see the graphical history charts on Stockopedia below:

So really, the crux is that if you think they can carry on growing & generating these high margins, then the shares could be a good bet.

I'm not so sure. Companies like this tend to hit a sweet spot, then the goal posts are moved by the big companies who are paying their fees. And/or competitiors enter the market, and chip away at the profits. Personally I'm not terribly comfortable with their business model, so won't be partaking of any shares here.

Note also the enormous Director sales of shares in the last year, which tots up to £27m roughly. They still retain very large stakes, but selling is selling, and they know the business better than anyone else ...

There's an interesting trading update from Clean Air Power (LON:CAP 8.75p), which is a speculative stock that I have in my portolio. Perhaps we could call it SARP (Speculation At Reasonable Price)?! This is the UK company which has developed a system for diesel-engined trucks, which allows them to run on a mixture of diesel and natural gas. Given the shale gas boom, especially in the USA, and the fact that liquid gas is already very cheap in the UK and elsewhere, this could be a very interesting growth area.

I'm happy to be having a flutter on it, because the market cap is reasonable at about £16m. Personally I don't mind buying speculative stocks occasionally, but have a mental cut-off point at above £20m market cap. Also, I like things that are already selling, rather than projects which are years away from commercialisation. Things always take much longer to commercialise than people expect, so buying zero turnover companies at racy prices is a mug's game in my experience, in the long run. Although in bull markets, you can make a lot of money, providing you treat it as what it is - riding a speculative wave, rather than proper investing.

It seems generally good news from their trading update today. Turnover for H1 (six months to 30 Jun 2013) rose slightly to £4.1m. The order book is growing, and they describe system sales (which I think is sales plus orders in the year to date?) of over 350 in 6 months, versus 300 for the whole of last year. Not bad.

Production of their USA product is commencing in early 2014, so that could get investors really excited if it shows promising signs, hence I will be sitting tight on these for at least another six months.

I suspect they might need to raise a bit more cash in the not too distant future, but in a buoyant stock market, with interesting products, that should not be a problem. It's much easier to raise a smallish amount from Placings at the moment, there is just a lot more investor appetite than for the last five years, from what I've observed subjectively.

I've been sceptical about Communisis (LON:CMS 63.5p) in the past, because of their slim profit margins, and weak balance sheet. However, they've fixed their balance sheet with an equity fundraising, and have recently won some big new contracts. So I'll now do a quick review of their interim results issued today.

Communisis has 191.4m shares in issue, and they've dropped about 6% to 63.5p at the time of writing, so that gives a live market cap of £121.5m.

Turnover is up 7.6% to £121.2m, and adjusted (before amortisation & exceptional items) profit was £3.7m for the six months. Finance costs are material, at £1.48m, so going back a level to operating profit from operations, that is £5.15m. These figures are roughly 20% up on the prior year, so improved but not dramatically.

There were £2.5m of exceptional costs, which is mostly relating to the pension fund.

Looking at the Balance Sheet, it's not a lot better actually, even after a £20m equity fundraising. If you strip out intangible assets, which I always do unless it's something readily marketable, like rights to music or films, then NTAV drops out at £26.8m negative! Current assets are £73m, and current liabilities roughly the same at £71.4m, which is just about OK.

However, there are also £49.2m in long term liabilities, being £27m in loans, and £22m in pension fund deficit. These are pretty large liabilities in the context of a group that only made £2.6m in post-tax profit in six months.

So I'm afraid this one fails my Balance Sheet test, so I won't be investing in it. Although maybe I'm being too harsh, as the net debt at the period end was £12.9m, which isn't too bad actually. The outlook statement says (my bolding):

Our markets are providing further growth opportunities for transactional and marketing communication services, both in the UK and internationally. Taken together with the benefits of our continuing investment in market-leading technology, new skills and from the progressive migration from legacy capacity, the Board is confident about the Group's prospects for the remainder of the year.

So looking at broker consensus, that is for 4.97p normalised EPS this year, so at 63.5p share price, that puts it on a PER of 12.8, which is just about OK for a low margin business with a rather weak Balance Sheet.

The vauation really depends on how much profits are going to grow from the major new contracts they have announced recently? I have no idea, but see that the broker forecast for 2014 is showing 5.5p EPS, so that would bring the PER down to 11.5, which is probably about right.

So in summary, I can't see any upside on the current price, IF they perform in line with broker forecasts. So the bull case must rely on them beating forecasts, which is possible. It's not for me.

Finally, I note that as from Monday next week, 5 August 2013, AIM shares will for the first time be allowed into ISAs. This should provide a very useful boost to many AIM shares, and it's not a one-off either, fresh money is likely to be coming into AIM shares over quite a long period of time. That can surely only be bullish? Hence I'm very happy to be already invested in mostly AIM shares. There could be more good times ahead, but as always this type of factor should not make us lose sight of the fundamentals for each stock. If something is expensive, I will sell it, regardless of any other factors such as this.

Also, check out the revamped home page on Stockopedia, I rather like it, there are some useful tables on there, so I'm going to have a proper look at it myself now too!

Bye for now, and see you again from 8 a.m. tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in CAP, and PMP, and no short positions.

A Fund to which Paul provides research consultancy services also has a long position in PMP).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.