Good morning!

Zytronic (LON:ZYT)

Share price: 246p

No. shares: 15.2m

Market Cap: £37.3m

It's a pleasant start to the day for shareholders in this English maker of high-end touch sensitive screens. The company has issued a trading update today, saying;

The Board is pleased to announce that the increased sales of larger touch products and the significant improvement in margins reported upon at the time of the? Interim results, on 13 May 2014, have continued further into the second half of the financial year.

Group revenue is currently around 8 per cent. above the corresponding period last year, and the Board now expects pre-tax profit for the full year to be significantly above the market consensus.

That's great, but now means we have to play a guessing game to estimate how far "significantly above" means? I tend to guess something like 10-30%-ish is the probable range for "significantly ahead", as regards earnings. That would tie in with an 8% increase in sales, on improved margins. So I'm going to firm up on a guesstimate of about 20% ahead of forecasts.

Valuation - Broker forecast is currently 15.0p EPS for this year (ending 30 Sep 2014). So if I'm right about the company being c.20% ahead, then that points towards roughly 18p EPS for this year. Therefore at 246p this morning, the share price is setting a valuation on a PER basis of 13.7, which looks reasonable to me, even good value once you take into account the strong Bal Sheet with net cash, and the very good dividend yield.

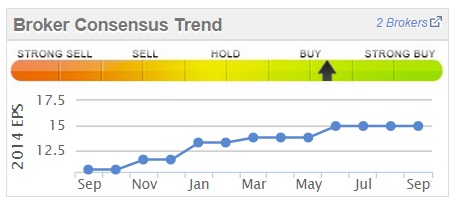

Rising broker forecasts - Stockopedia has a particularly useful little chart buried near the bottom of the StockReport, which shows changes to broker EPS forecast (consensus) in the last year.

I've found that usually a steadily rising line (meaning brokers are repeatedly upgrading forecast earnings) is a very good sign. That has proven to be the case here for Zytronic - chart of broker forecasts shown above right.

Perhaps the reason might be that, after a serious mishap such as happened with the profit warning in May 2013, brokers tend to err on the side of caution for a while - it takes time for companies to rebuild market confidence. This provides an opportunity for investors - small companies often have lumps & bumps in their order books, it's almost inevitable when you rely on a relatively small number of key products, clients, contracts, and staff. So a quality company that warns on profit can, and I stress only can, be a great buying opportunity for investors who are prepared to be patient for a year or two until things get back on track.

Dividends - The company maintained its dividend throughout the difficult patch, and a divi of about 10p looks likely for this year. That would give a very acceptable yield of 4.1%, even after taking into account today's share price rise. Not bad at all, in fact very good for a smaller growth company.

Growth - The company has some interesting new products, including very large touch sensitive screens, which can cope with multiple touches, so ideal for multi-player gaming. Also very good for vending. Note that the company has a good operating profit margin which has ranged from 11-20% in the last six years. So clearly Zytronic has a degree of pricing power. The recent drop in sterling should help them, as the company manufactures in England and exports nearly all production globally.

My opinion - It's good to see my faith in this company & management turn out to be correct (I bought originally on the first positive trading update in Oct 2013 at about 172p). There's a lot to like about the company - modest PER, strong Bal Sheet, good divi yield, hard-working & grounded management, decent operating margin, niche products with a technical edge, etc.

So I've happily topped up my shareholding this morning, as an 8% rise in price seems a modest price to pay for an out-perform trading statement. Broker upgrades will no doubt follow in the next few days. DYOR as usual, just my opinion. However, one must bear in mind that another gap in the order book could happen any time, so it's not a share to chase up to an inflated valuation (i.e. PER over 20) in my view. I think a PER of 15-18 is about the right price.

Note also that Stockopedia gives the company a very high StockRank of 97, which gives me comfort that I'm probably on the right lines (it's not a silver bullet, but a good StockRank is a positive factor in my view - a useful tool to have in the armoury).

Revised broker forecasts - It looks as if my guesstimate of 18p EPS for this year (ending 30 Sep 2014) is in the right ballpark, as I've had updates from two brokers this morning, which have both upgraded their EPS forecasts for this year to 17.9p and 17.4p, so the consensus (I think it's only 2 brokers that cover Zytronic) is just under 17.7p. Both brokers are enthusiastic in their narrative, and are talking about the shares regaining 300p+ in due course, which sounds sensible to me if the commentary with the next set of results sounds positive.

Parity (LON:PTY)

Share price: 21p

No. shares: 101.6m

Market Cap: £21.3m

A reader has asked me to take a look at this company. It starts off badly, with the company falling into the common trap of failing to explain in simple terms what it actually does. When will companies and their advisers realise that this is hugely counter-productive? It just winds up potential investors, and creates confusion. Less is more. Please.

So in plain english, it looks to be mainly a recruitment company, with a few other bits & bobs added on.

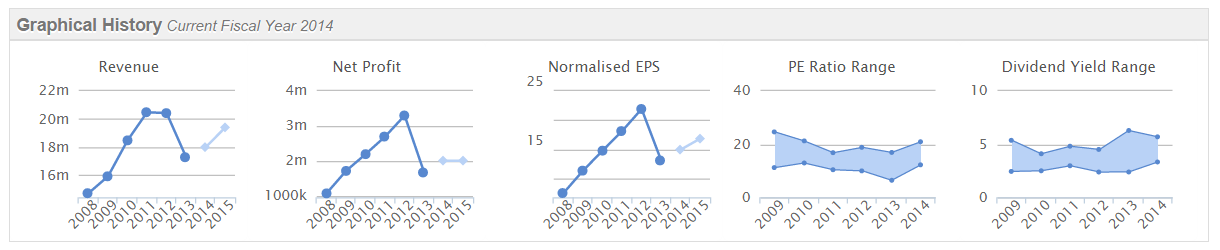

I always review the Stockopedia historic figures & graphics first, when researching any company, to set the context. In this case, it's been a poor performer for six years now. So I'd want to know what they have done to make things change, to take an interest in the shares. One such positive change is the expiry of onerous leases, which is mentioned in today's results narrative, so that's worth looking into, to quantify the benefit.

These graphs above tell us quite a lot & raise questions as follows;

- High turnover, but negligible profits even in a good year - low quality business?

- Consistently loss-making, but forecast to move into small profit this year - credible?

- PER looks high against forecasts - so needs to beat forecasts to make valuation stack up.

- No dividends, so Bal Sheet might be stretched. What chance of divis being paid in future?

- Is this a lifestyle business - i.e. providing jobs for mgt/staff, but nothing for investors?

.

Interim results to 30 Jun 2014, published today show an improvement against last year's H1, but hardly shoot the lights out. Turnover is up 3.8% to £48.3m, and the company scraped a profit before tax of just £120k, although this is improved from a £520k loss last year. So a lot of work for little reward - are they busy fools I wonder?

Although I note from the income statement that the pre-exceptional operating profit (probably the best measure of how a business is really performing) was actually down from £450k last year H1 to £346k this H1. Therefore I wonder if the headlines of improved profitability are accurate? It's usually best to ignore the headlines (which will selectively show positive figures only usually!) and go direct to the actual figures.

Balance Sheet - I'm not keen on companies that don't make much (or any) profit having debt. So this is not a company I would invest in, given that there is net debt of £6.9m, and that breaks down into cash of £4.6m, and bank loans/overdraft of £11.5m. That's too much given there's no profit. How will this debt be repaid? It's fine if the Bank are happy to have revolving debt, but they might change their mind in another economic downturn, who knows? It all adds to risk. There is a £15m facility with PNC Bank at the moment, extended to Dec 2016.

Note that the company capitalised £482k of purchased intangible assets in H1, so it would be worth checking what that is? If it's internal development costs, then remember that boosts profits in the short term. This is described as "software" on the Bal Sheet - and they do mention a new accounting system in the narrative, so it's probably OK in this case. Seems a lot to be spending on an accounting system though?

Pension deficit - note that there is a £2.2m pension deficit shown on the Bal Sheet. The cashflow statement shows that payments of £833k were made into the scheme last year (which doesn't go through the P&L remember), although the H1 figure was lower this year at £168k (vs £569k). So this is a material cashflow item, which would need further investigation. I'm not going to do that now, as I've already seen enough to know that I won't be buying any shares in this company.

Outlook - These shares really seem to be a punt on management delivering on a plan for new services, which is detailed in the report today. The outlook statement gives some idea of what they are doing;

Parity Professionals expects to continue its steady margin improvement in the second half of 2014 whilst it evolves its new service offerings ready for a 2015 launch.

SuperCommunications will continue to invest in the coming months; whilst looking at opportunities to extend its skill base. The current investment in senior management, marketing and product offerings is designed to support the business in first delivering good growth in the UK and then in overseas markets, over time.

Notwithstanding these investments, current Group trading is in line with expectations, with an improved second half performance expected.

This is an exciting year for all our people as we prepare for revenue and profit growth to increase in future years. This followed the restoration of the Group's prospects by new management and the enaction of the strategic plan put in place in early 2011. This has come to fruition with two profitable, growing divisions with market-leading propositions. The Board pays tribute to all our staff and their continued enthusiasm and motivation which underlies all the good work that has been done in recent years.

We continue to look very seriously at acquisition prospects which we can progress with our cash reserves, in order to add necessary additional skills to our SuperCommunications offering.

In the second half of this year we must complete the necessary work and be ready for a good start to 2015. With the Group finally freed of heavy onerous leases the board expects to increase revenues, profits and to generate cash next year.

So some potentially interesting stuff in there, but given the high levels of debt, and weak current profitability, I wouldn't be prepared to pay a valuation of anywhere near the current £21.3m market cap. It doesn't appeal to me at all.

Anpario (LON:ANP)

Share price: 258p

No. shares: 19.9m

Market Cap: £51.3m

I last reviewed this natural animal feeds company here on 24 Jun 2014, when it published an "on track to meet market profit expectations" update. It also indicated that the strong pound was blunting sales growth. I questioned the high valuation, with the shares on a forward PER of 20.

Interim results today seem to have come in slightly better than expected. Revenue is up 2% to £13.1m, and operating profit marginally up at £1.6m for the six months. So a good operating profit margin there of 12%, but the growth looks pretty anemic for a company on a growth rating.

Outlook - I'm struggling to match the upbeat tone of the outlook statement with the figures being reported. The company says;

We are confident of maintaining the momentum of the first six months performance and expect the Group to meet market expectations for the year ended 31 December 2014. The healthy cash balance and continuing cash generative nature of the business leave Anpario well positioned to finance further organic growth. In addition, the Group is also able to consider making selective investments and earnings enhancing acquisitions, should suitable opportunities arise. These factors, combined with the strong trading position, will drive progress and continue to enhance the value of Anpario for all its stakeholders.

So the all-important meeting market expectations line is there, which is good. More on that below.

I'm not so keen on the idea of acquisitions - that makes me worry that there might only be limited organic growth potential? After all, if rapid organic growth was in the pipeline, then management being distracted by acquisitions is the last thing you want at a small company.

Balance Sheet - Anpario sails through my testing here. It has no debt, net cash of £5.7m (that's material, at 11% of the market cap), and a very healthy working capital position. No pension deficit or other "funnies", so all good.

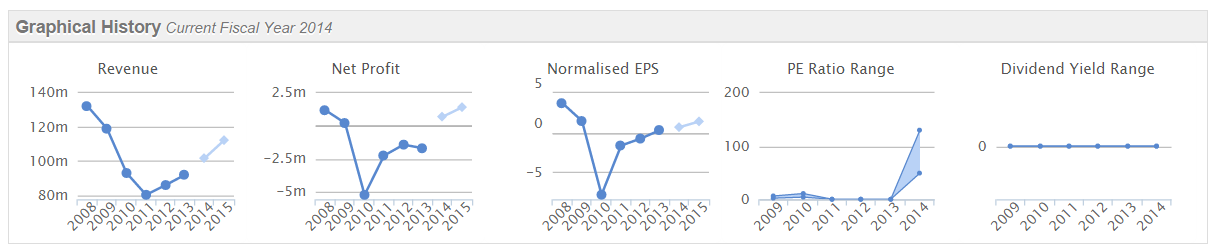

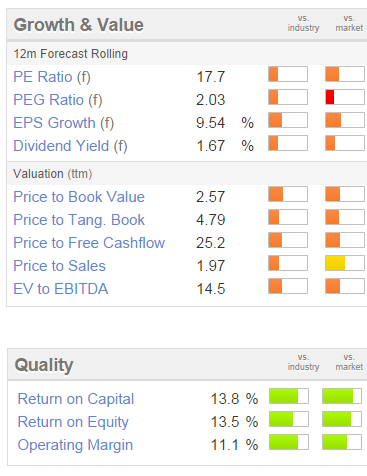

Valuation - As previously, this is where it stops working for me. The company is slightly cheaper than last time, on a current year PER of 19, and blending in next year's comes out at a PER of 17.7. That's still too rich for me, even after adjusting out the net cash. If earnings growth was more rapid, then I'd be fine with a rich rating, but earnings growth hasn't been very good at all.

My opinion - Remember that I'm only reviewing the numbers, I'm not making a judgement on the company's future potential. I think this is a share where bulls have researched the company's activities, and concluded that it has a bright future, hence they are prepared to pay a rather toppy price for it.

The quality rankings above are good, and the balance sheet is good. However, on current forecasts (confirmed today) the rating still looks too high to me - a high PER, a PEG of 2.0 is not good. So the company either needs to get cheaper, or accelerate its earnings growth.

Looking at the two year chart below, it seems to me that the bull run from Sep 2013 got a bit out of hand, and that maybe a bit more froth still needs to come off the share price?

For these reasons I won't be taking it any further at the moment.

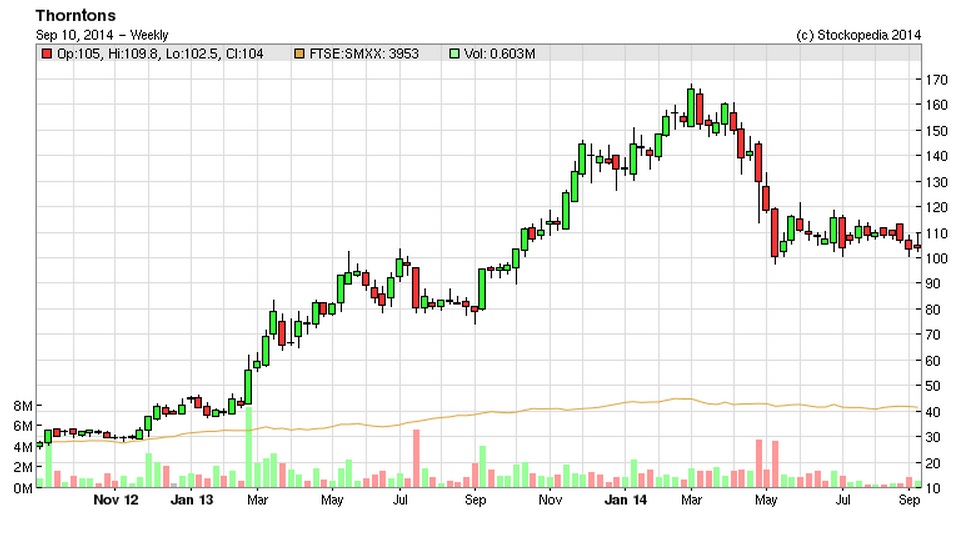

Thorntons (LON:THT)

Share price: 103.5p

No. shares: 68.6m

Market Cap: £71.0m

I'm a little surprised these shares haven't risen today, on full year results (to 28 Jun 2014) that look quite decent at first glance. The shares are down 1.5p to 103.5p at the time of writing.

Profitability - Pre-exceptional operating profit rose from £7.5m to £10.0m, a rise of 33.5%. Finance costs of £2.5m (which I think will be a mixture of bank interest, and notional interest relating to the pension fund) took profit before tax down to £7.5m, up 60.3% against last year. So not a bad performance. Although note that the operating margin is fairly weak at 4.5% of turnover (of £222.4m).

One of the factors driving profit up must have been continued closure of loss-making stores, as the business continues to shift away from retail, and more towards supplying supermarkets, etc. It's working, but I don't see any great profit potential there - more likely they will be squeezed harder & harder by a supermarket sector that is under increasing structural strain from discounters, and therefore has no choice to bleed its suppliers dry.

EPS - at 7.8p basic EPS seems to have come in slightly ahead of forecast of 7.7p, so that's fine. The PER is therefore 13.3. That's high enough in my view, in light of;

Pension deficit - still a big issue. The deficit on the Balance Sheet has risen from £22.7m to £27.7m, and this requires overpayments of £2.75m p.a. - very much a material amount, so this needs to be factored into valuing the shares. It's a common mistake to ignore pension deficits, especially as interest rates seem likely to remain low for a long time to come.

Balance Sheet - the company remains far too heavily reliant upon bank debt, in my opinion. Net debt was £32.9m at 28 Jun 2014. Although note there is asset backing, from freehold property. Bear in mind that debt carries interest payments, so that's a drag on profitability.

Dividends - These were stopped in 2010/11, and there is no dividend announced today. The company is keeping this under review. It mentions financial performance, and lack of distributable reserves, as impediments to paying a dividend. Not good is it?

Outlook - This doesn't sound particularly bullish to me;

Over the coming three years we will deliver sales growth in addition to achieving further improvement in EBIT margin. We anticipate further growth in our UK Commercial channel during the first half of the current financial year. However, we expect this to be at a more modest level as a result of strong prior year comparatives, the continually changing marketplace and a marked reduction in the first quarter. We are confident that we can maintain our positive profit growth for the full year in line with market expectations driven by strong annual sales growth in our UK Commercial channel.

Slightly mixed messages in there I think.

My opinion - I remain concerned about the weak Bal Sheet, especially excessive bank debt, and a nasty pension deficit. There's no divi, and the tone of today's announcement seems to suggest to me that the company might struggle to get much further in terms of profitability. If they do achieve current year forecasts, at 10.6p EPS, then the PER is just under 10, which considering how much debt & pension deficit the company has, looks a sensible (or even too high) valuation.

There's loads more narrative with today's results, which I'm not going to plough through, as the figures are not attractive enough to make me want to buy the shares, or investigate further.

As a trading punt it could have another move up - the chart looks as if it's bottomed out, and people might start buying the share if it starts a move up? Difficult to tell, as the chart might also be pointing to an imminent plunge below 100p? Who knows, I'm not a chartist, and they're rarely worth listening to anyway - I've never seen one who can predict moves up or down with more than 50:50 accuracy! So what's the point?!

However, on fundamentals, it's priced about right, or a tad too high, in my opinion, so I won't be buying any.

I've run out of steam today, so will leave it there.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in ZYT, and no short positions.

A fund management company to which Paul provides research ideas also has a long position in ZYT).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.