Good morning! No amusing Radio 4 stories today, as I woke up one minute before the clock/radio was due to go off - isn't it surprising how often that happens, we obviously have some sort of internal clock (mine works intermittently only!). Apologies for not getting round to finishing off yesterday's report on my return from London, by the time I got to look at it, it was 10pm, and I was just too tired to process any more numbers. Will try to revisit Hyder Services profit warning later in the week.

Hargreaves Services (LON:HSP)

This is a company that cropped up on my radar last year, and they are holding another analysts' lunch today in London, which I've been invited to, so will report back my findings. The last one was very interesting, as it touched on all sorts of issues surrounding coal - HSP is the UK's largest coal distributor, and also has some surface mining interests too.

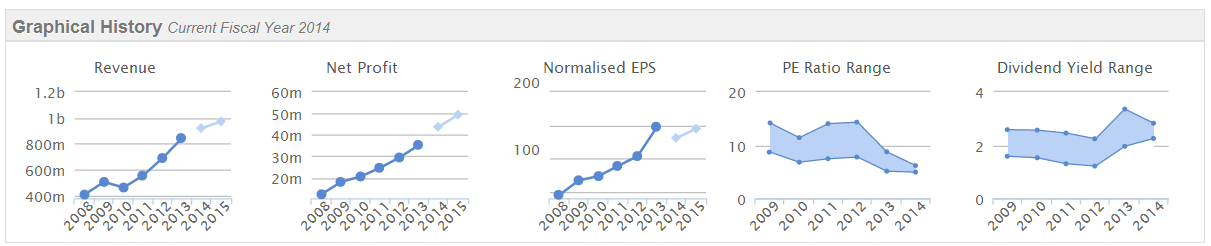

Rather than repeating the background, let me refer you to my previous reports which outlined the investing case here on 24 Sep 2013, and reported on their positive trading update here on 16 Dec 2013. My feeling is that this is a much mistunderstood company, and various problems have obscured a remarkably good track record of increasing profit in recent years;

The headline figures for the six months ended 30 Nov 2013 look really good - turnover is up 28% to £460.5m, underlying diluted EPS is up 7.4% to 65.0p, which is lower than the 25.1% increase in underlying operating profit, which suggests a higher tax charge this year. The interim dividend has been increased by a healthy 27.5% to 8.8p, which is consistent with what the company said last time I met them, in that the intention is to raise dividends by about 50% from last year's level, over the next couple of years.

Net debt is £95.2m, which is quite material in relation to the £280m market cap (at 850p per share), however I tend to disregard debt where it is matched by freehold property. There is considerable hidden property value within HSP, although I can't put a figure on that, but there will at some point be upside from surplus freehold property assets, and we're talking quite big sites.

I will read the results in more detail on the train to London later this morning, so I'm fully briefed for the lunch with HSP's Directors. For now though, on a quick skim, it all looks good. The PER is low - they confirm confidence of achieving full year expectations, which is for 131.3p EPS, therefore the stock is on a low current year PER of only 6.5.

The reason these shares are so cheap is because nobody really knows what the future holds for coal. It is coming under attack from the EU and our Govt, with five coal-fired power stations closing at the end of 2015 I think, due to failure to meet new emissions standards. Meanwhile the Chinese and Indians build multiple new coal-fired power stations every month, so the action taken here doesn't overall make any significant difference to global pollution or warming. So stock up on candles, as we could be heading for blackouts in the not too distant future perhaps?!

However, the section entitled "future for coal in the UK" in today's results is pretty unsettling, in terms of the investing case for these shares. Top marks to the company for honesty, but I'm not inclined to buy their shares after reading this;

Future for Coal in the UK

At the time of our preliminary results in September 2013, we commented on our view for future coal demand in the UK. Our view has not changed in the intervening period. It is inevitable and necessary that unabated coal generation is reduced and eventually eliminated in the UK, however, there remains significant uncertainty concerning the time period over which this is likely to happen. Initiatives such as investment in renewables, changes in coal and gas prices and investment in new nuclear capacity may all hasten the demise of coal. On the other hand, concerns over the cost of energy in the short term, as well as over the long term price and security of gas supplies, and delays in investment in alternative capacity, all point to a slower decline. We remain of the view that despite current Energy Policy, coal will continue to have a significant role to play in the UK's transition from fossil fuel based generation to renewable generation for many years to come.

It's very difficult buying into a declining macro trend, as there will never be any impetus to put the shares on a high rating. Looks at Trinity Mirror (LON:TNI), which got as low as a PER of just 1 in the summer of 2012! Despite being hugely cash generative, to the extent that it would repay all its own debt within three years. The shares have since 8-bagged mind you, but it does make me nervous about seeing HSP as a bargain on a PER of 6.5, when it is also in a declining (but less cash generative) sector than newspapers.

There is a small pension deficit of £3.1m shown on the Balance Sheet, which has come down from £5.5m last year. The Balance Sheet overall looks fine to me - with £278.2m current assets, and £126m current liabilities that's a very healthy 221% working capital ratio. There is another £116m in long term liabilities, most of which (£102.5m) is bank debt, which might seem a lot, but doesn't concern me because the company has large freehold property holdings, which are likely to be worth considerably more than book value. Therefore that provides security against bank borrowings, which should therefore be considered safe, in my opinion.

In summary therefore, the attractions here are the low PER, and the growing dividend stream, plus upside from property development. The downside is that they are in a structurally declining sector, so it will never be on a high rating, and will eventually either have to reinvent itself, or wither away - not a great place to start for an investment. However, everything has a price.

I'll report back more after today's analyst lunch with the company.

McBride (LON:MCB)

Shares in this maker of household & personal care products have eased down 1% to 104p this morning on publication of their interim results to 31 Dec 2013. I last reported on this company here briefly on 9 Jan 2014, when it issued a trading update stating that underlying operating profit for the 6M to 31 Dec 2013 would be around £ 10 m, with an improvement expected in H2 (i.e. Jan-Jun 2014). So this might be a recovery situation possibly?

The actual results today seem to be in line with that trading update a month ago, as you would expect. Revenue is up slightly, at £380.3m, and adjusted operating profit is down 10.5% to £10.2m. Note that their operating profit margin is low, at 2.7%, indicating a competitive, and price sensitive marketplace.

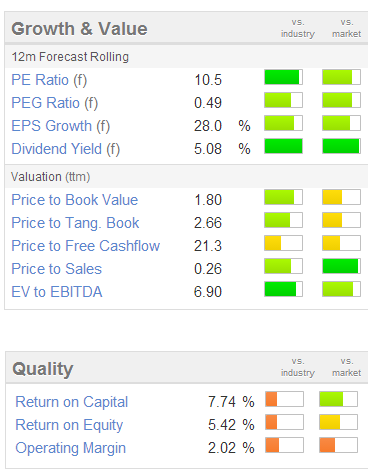

Whilst the Stockopedia valuation graphics (left) look attractive, the fly in the ointment with McBride is that there is too much debt (for my liking), reported at net debt of £84.8m at 31 Dec 2013.

Whilst the Stockopedia valuation graphics (left) look attractive, the fly in the ointment with McBride is that there is too much debt (for my liking), reported at net debt of £84.8m at 31 Dec 2013.

That net debt seems a lot compared with profits, but is more reasonable when compared with EBITDA, at 1.9 times. Banks normally feel comfortable below 1.5 times, so it's a little stretched perhaps?

McBride has a big depreciation charge, as it's a capital-intensive business, with a lot of plant. So if you look at EBITDA, a case can be constructed for seeing it as cheap, perhaps? I'm not convinced though. After all, that plant all needs replacing as it wears out, so the depreciation charge should just be mirroring that process.

To paraphrase Warren Buffett, EBITDA ignores depreciation, but capex is not paid for by the tooth fairy, so focussing on EBITDA is to ignore a major cost.

The pension deficit went up to £28.8m, although pension deficits are manageable, and much lower risk than bank debt - because in practice the pension fund will not pull down the business (it has happened, but is extremely rare), whereas an unhappy Bank might pull the plug (although there has been an artificially extremely low incidence of Banks withdrawing funding of Listed companies in the last few years - something that I feel is lulling many investors into a false sense of security about the dangers of high bank debt).

Often when companies declare in the narrative to their results that they have a strong Balance Sheet, you find that actually they don't. That is the case here (in my opinion), with net tangible assets of only £63m, which is not a lot for the size of company. Also, their current assets of £232.5m is only 96% of current liabilities, and a further £102.2m of long term liabilities exist. So that is not a strong Balance Sheet, sorry. It's a reasonably OK Balance Sheet, providing the providers of debt remain friendly. To my mind a strong Balance Sheet is a company that doesn't have any debt at all.

Their outlook statement points towards improved trading, but lacks conviction the way it reads to me;

Trading since the end of December and our outlook for the year remain as indicated in our January trading statement. We continue to expect an improvement in performance in our second half given the extent of new product launches in the pipeline and cost saving initiatives underway. The scale of this improvement remains dependent on the extent of branded promotional activity and demand in the UK retail sector.

Overall, with too much bank debt, low margins, and an uncertain outlook, risk/reward doesn't look particularly favourable to me. The shares might do well if trading does improve in H2, but I wouldn't be surprised if they warn on profit again in April or May. So it's not for me.

The chart looks as if it's trying to find a bottom, so maybe chartists will start buying soon? Maybe one for traders to consider? Look how it has underperformed the FTSE SMALL CAP INDEX XIT (FTSE:SMXX) though (sorry I can't change the colour of thickness of the comparison line, I know it's difficult for some people to read, but the format appears to be fixed).

dotDigital (LON:DOTD)

Interim results from this email marketing software company look good, although I note that the profit before tax for continuing operations is not rising very fast, at £2.2m (compared with £2.0m last year H1, and £4.0m FY ending 30 Jun 2013. That might possibly be because of revenue investment in growing the business?

I like this company, and think it's a good growth story, but question the longevity of email as a marketing tool - personally I find myself overloaded with emails, and can't wait to unsubscribe from email lists that I end up on from companies that are trying to sell me stuff all the time.

Also the valuation looks a bit warm now - at £85m market cap, for half year earnings of £1.8m, so that's 23 times the current run rate. The outlook statement sounds good;

Based on the strong performance at the half year to 31 December 2013 and the forward pipeline, the Board remains confident of achieving both revenue and profit expectations for 2014 and of delivering long term shareholder value.

Good growth companies are expensive at the moment, which is fine as long as they continue growing. I've missed the boat on this one, and am not going to revisit it after such a big rise in price & valuation. Good luck to holders though, it's a good company I think, the price is just too high for me now;

Right, got to dash for this train up to London.

See you tomorrow, when I shall report back on Hargreaves Services (LON:HSP) after today's lunch with their Directors.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.