Good morning,

This is the last report before the long weekend, so I hope everyone enjoys the break.

Paul is updating us on Gattaca, and I'm writing the rest of the comments.

By the way - Paul updated yesterday's report so that it now includes Norcros (LON:NXR), £D4T4 and Comptoir (LON:COM). This includes a really detailed analysis of some issues arising from a close reading of the footnotes at Comptoir, with Paul providing his own "adjusted adjusted figures"! You can read it at this link.

Regards

Graham

PZ Cussons (LON:PZC)

Share price: 327p (-0.7%)

No. shares: 428.7m

Market cap: £1,402m

These shares have recovered a little since I covered them at the interim report in January.

At the time, I noted that currency depreciation in Nigeria and ongoing exceptional costs were a frustrating drag on results. But I also suggested that it was a company which deserved the benefit of the doubt, after several decades of success.

Today's update tells us that performance to April 12th has been in line with expectations, including cash generation.

As reminder, PZ Cussons is a mid-sized house of brands which includes Carex, Imperial Leather, St. Tropez, Charles Worthington and many others.

Reading through the company's regional news, there are good signs in terms of product launches and range extensions, including a complete relaunch of Imperial Leather.

And the troublesome Nigerian market may be showing signs of improvement:

In Nigeria, there has been some improvement in liquidity in both the interbank and secondary markets although exchange rates in the secondary market continue to be volatile.

There's a shortage of foreign currency in Nigeria due to the gap between official interbank exchange rates and the rates used in the black and secondary markets, causing major disruptions to business. But PZC says all its business units there have traded "relatively well" during the most recent period.

Outlook sounds ok:

Further margin improvement initiatives are underway to mitigate ongoing raw material and exchange rate volatility.

The outlook for the financial year ending 31 May remains in line with expectations.

The Group's balance sheet remains strong and well placed to pursue new opportunities as they arise.

My opinion

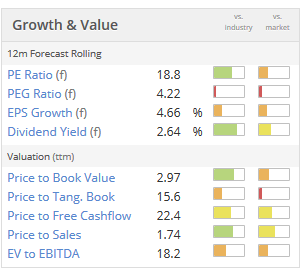

Unfortunately the shares are still quite richly valued, leaving a modest dividend yield at the current price.

However, that yield is well covered by earnings and the debt load looks manageable at £191 million.

For the patient investor, this stock is the sort that can hopefully be tucked away for a few more decades.

SRT Marine Systems (LON:SRT)

Share price: 42p (+13%)

No. shares: 127.6m

Market cap: £54m

This has been accused by some of being a "jam tomorrow" type of stock, but some jam has finally arrived:

Subject to audit, for the year ended 31 March 2017 the Company expects to report revenue of £11 million, which is ahead of last year and profit before tax of £1.2 million which is significantly ahead of market expectations. As at the year end, gross cash balances were £1.7 million.

Wow! This will be the best result since at least 2013.

CEO comment is upbeat:

Notably, in addition to those projects under contract and recently signed, we have also seen excellent progress with a number of our validated sales pipeline opportunities moving closer to contract and thus revenues and I look forward to updating the market in due course when they convert.

My opinion

It seems as if investors have had plenty of false dawns with this stock, but as a reader ("Kalkanite") points out in the comments below, there have been some fairly huge contract announcements here. This includes a contract announced just over a year which is worth "up to €90 million" in revenues over a three year period, providing a maritime domain management system for an Asian country.

I do have a couple of reservations about this stock. My primary concern is that it seems highly lumpy (contract-driven) in terms of sales, making forecasts difficult.

The wording in that contract of "up to" a certain sales figure makes me wonder if it will actually convert into a much lower sales figure over the three years, especially since one year has passed already?

One other small thing is that I noticed that weak AIS (automatic identification system) transceiver sales in the US last year were blamed on the lack of enforcement of regulations requiring the use of this technology. Does this imply that the shipping industry itself does not have a strong desire to use these devices?

All that having been said, it seems like this is closer than ever to breaking out into meaningful profitability - which it needs to do, given the >£50 million market cap. It seems to me that the market is already pricing in a decent chunk of the promised success, so rightly or wrongly I would be cautious about investing at this level.

Gattaca (LON:GATC)

Share price: 270p (down 9.5%, at 09:27)

No. shares: 31.2m

Market cap: £84.2m

(at the time of writing, I [Paul] hold a long position in this company)

This section was written by Paul Scott

Trading update (profit warning) – funnily enough, I was only looking at the StockReport for this share yesterday, and wondering if I should buy some more. Thankfully I didn’t. The reason being that a forward PER of 7.2, and a dividend yield of 7.8% is the market clearly signalling that something is probably wrong.

In bear markets, it’s not unusual to see a dividend yield exceed the PER, but in a bull market it’s rare – and usually a sign of trouble ahead. Last time I saw that, was with Fairpoint (LON:FRP) – which of course turned out to be a complete disaster.

GTC isn’t in the same category as Fairpoint though. The profit warning today from GATC isn’t disastrous, and arguably was already factored into the share price beforehand.

With profit warnings, there’s no one-size-fits-all response that will always be right. Sometimes it’s best to sell immediately, sometimes it isn’t.

For me, it’s a straightforward choice.- If I think the profit warning is something that is a temporary, and fixable problem, then I hold, or buy more.

- Or, if I feel that the profit warning is the thin end of the wedge, with something serious going wrong, then I will ditch my shares immediately, and move on.

That’s what is supposed to happen anyway! (but is not always what actually does happen). So this is a memo to self, as well as to everyone else.

Smaller companies have more frequent slip-ups than larger companies, so profit warnings are just an occupational hazard for small cap investors. Hence not getting emotional about them, and instead having a clear strategy & plan of action is very important.

Good smaller companies have profit warnings sometimes too. That can sometimes be a good entry point, if you’re able to sort the wheat from the chaff.

Profit warning – so what’s gone wrong then?

“The Board has reviewed its outlook for the remainder of the year to 31 July 2017 and now believes that profits for the year will be approximately 10-15% below its prior expectations.”

This is explained by several factors, although the commentary today really doesn’t tie in with the in line trading update for H1 announced in February, which I reported on here. In that previous update, the company described its H1 performance as “solid”, and confirmed full year results would be in line with expectations. That’s what I reported on at the time, and based on this reassurance from management, concluded that the shares looked cheap at 290p.

So it’s galling to read today’s update, which now seems to be presenting H1 (6 months to 31 Jan 2017) in a more negative light;

“As previously announced on 2 February 2017, performance in the first half of the year reflects the tougher UK trading conditions post the Brexit vote. The softening in NFI in the first half was driven by near term uncertainty which led to elongated hiring decisions and some projects being delayed; however the medium-term outlook in our sectors remains positive with some signs of a return of confidence in recent weeks.”

Therefore I’m rather annoyed that management seem to have given a rose-tinted view of things in the previous update in Feb 2017.

Other issues revealed today are: Central overheads have over-run, for various reasons – although these sound temporary & fixable (my key criteria for assessing the seriousness of a profit warning).

Outlook comments sound encouraging, including;

“We are particularly confident that the headcount investments which we have made in our overseas businesses will lead to accelerated growth next year.

With the integration of Networkers now complete, we intend to consolidate our central cost base, whilst maintaining the structure and support we have built and to convert the sales opportunities we see into growth over the next few years.”

Valuation – forecasts for this year are likely to come down to c. 30-33p adjusted EPS. Therefore at 270p currently, the share price implies a PER between about 8-9, which seems reasonable.

Dividends – no mention is made today, but with the yield now approaching 10%, I suspect we might have to prepare for the divi being reduced somewhat, perhaps?

My opinion (Paul) – obviously this is a disappointing announcement, but it’s not a disaster.

Management credibility has taken a knock though – I’ll definitely be more sceptical when reading future updates from this company.

I like the business model here though. This is a focussed staffing group, specialising in engineers & technology sectors – both good growth areas.

I’ve no idea what the share price is likely to do in the short term, as that depends on the vagaries of the market. If an Institution decides to start dumping in the (illiquid) market, then the price could get trashed, who knows? So far though, today’s muted share price fall of about 10% suggests that existing holders have not been particularly spooked by this fairly mild profit warning.

Personally I’m happy to hold, and watch to see what the price does. If anyone trashes the share price with clumsy selling, then I’d pick up some more. It’s a decent, cash generative company, paying big divis, so that seems quite attractive to me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.