Good morning! It's Paul here.

There are only 4 companies reporting today which are of interest to me, so I'll handle that on my own. Graham's having the day off.

I intend reporting today on;

Norcros (LON:NXR) - in line trading update, and upbeat commentary

D4T4 (LON:D4T4) - trading update - positive (ahead of expectations), and confident outlook

Comptoir (LON:COM) - recently floated small chain of restaurants. First full year results as listed company.

(sorry, I didn't get round to looking at Carrs)

Norcros (LON:NXR)

Share price: 168p (up 10.5% today)

No. shares: 61.3m

Market cap: £103.0m

Trading update - for the year ended 31 Mar 2017.

A refreshingly simple description of the group in today's update;

...the market leading supplier of innovative branded showers, taps, bathroom accessories, tiles and adhesives...

Trading looks solid;

Group underlying operating profit1 for the year is expected to be in line with the Board's expectations reflecting a robust performance and demonstrating the Group's resilience.

It always pays to check the footnote, which in this case says;

1 Underlying operating profit excludes IAS 19R administrative expenses, acquisition related costs and exceptional operating items

The pension fund administrative expenses are non-trading costs, but I dispute whether they should be ignored. After all, the pension fund isn't going away any time soon, so these are costs the company must bear, and for many years to come.

Acquisition-related costs and exceptional items are OK to adjust out, providing they're not used as "soft codes" to absorb a multitude of other costs, which can happen at some companies. I'm not suggesting anything of that sort goes on at Norcros, it's more a general point.

I've mentioned it before, but a new CEO of a different company once told me how he asked what the profit for the year was likely to be. His FD replied, "Whatever you want it to be - exceptionals will take up the strain!" So we should always question the underlying & exceptional adjustments.

Overall, I'm happy with the accounting at Norcros, which seems fairly sensible.

Other points from today's update;

UK division performed much better in H2 (LFL sales +8.3% in H2, versus -5.0% in H1 - that's a good turnaround)

Acquisitions doing well (crucial, as the group is growing by acquisition)

UK tile business is being restructured, resulting in a £2.3m exceptional charge. However, payback on these cost cuts is expected to be within 12 months - clearly positive for the company (if not the 90 employees losing their jobs)

South African business continuing to trade well. Strangely, many investors dislike Norcros because a material part of the business is in S.Africa, yet this has actually been trading well for some time. Perhaps people worry about the political risks?

Net debt - reduced from £32.5m a year ago to £24.0m. Good cash generation in H2. Looks positive to me, considering the group has been spending on acquisitions - yet debt still looks reasonable.

Pension deficit - the only mention today is to say it is;

"a well managed pension situation"

Directorspeak - sounds fairly upbeat - doing well in challenging markets.

Valuation - this share has looked really cheap for quite a while now.

Stockopedia shows the broker consensus as being 25.6p for 3/2017, and 27.7p for 3/2018. At the current share price of 168p, that gives PER of 6.6, and 6.1 respectively - which looks an extremely pessimistic valuation to me.

Dividends - nothing is said in today's update, so I assume the 7.49p forecast divis for 3/2017 still stands. That represents a yield of 4.5% - a pretty good return, and likely to continue growing, unless a recession intervenes are suppresses demand.

My opinion - I'm very tempted to buy back in, as this company seems to be faring well, and looks dirt cheap. However, it's looked dirt cheap for a long time, as investors seem to have various worries about the large pension fund, and potential issues with S.Africa. There's also the issue of forex impact - as most product is manufactured in China, so will be subject to cost price inflation. That isn't mentioned in today's update.

The other problem with this share, is that the shareholder register is a bit of a revolving door. People seem to buy the share because it's cheap. Then nothing much happens, and eventually they get bored, and sell out. So there seems to be unrelenting downward drift on the share price after good news. As you can see from the chart, it's not really gone anywhere in the last 4 years. Just up & down, resulting in a generally sideways movement.

The trouble is, in a bull market, I think people want more excitement, and a clearer up-trend. I suppose somebody might come along and bid for Norcros, but the big pension fund could well be an impediment to that perhaps?

Overall - it's a really tricky one. The business is doing well, and looks dirt cheap. However, what's likely to change, given that there seems a permanent flow of stale bulls trying to sell their shares after every rally?

D4t4 Solutions (LON: D4T4)

Share price: 154.5p (up 14.3% today)

No. shares: 38.0m

Market cap: £58.7m

Trading update - for the year ended 31 Mar 2017.

Looking back at my previous notes, I reported here on 30 Nov 2016 when the company announced good interim figures. Although I struggled to understand what the company actually does.

There's a short update note out today from FinnCap (which is available to subscribers on Research Tree) which helps clarify things somewhat. It seems that the company does IT project work on data analysis, which is lower margin. However the more interesting part of the business seems to be the strongly growing (up 43%), and higher margin software sales (called Celebrus).

A few points from today's update;

Revenue for 3/2017 is expected to be c.£17.7m. This looks well below consensus forecast of £20.1m, and is down on prior year too.

Higher margins (due to sales mix improving as mentioned above) means that profit is expected to be ahead of current market expectations. Very good.

FinnCap has helpfully quantified this, saying it expects £4.1m PBT for y/e 3/2017, up slightly from its previous estimate of £4.0m.

In (adjusted) EPS terms, this means 9.9p for 3/2017 - so a current PER of 15.6

Cash generation has been strong, with a y/end net cash of £5.1m, being more than double the forecast closing balance

Divis - the company today reiterates its policy of paying progressive divis. The yield is c.1.6% - not huge, but worth having

Outlook comments sound mostly positive, and confident about the pipeline, order book, renewed confidence of US clients, etc;

In summary, the business enters the new financial year in robust shape and we are encouraged by the opportunities and outlook for the business in the coming year.

As a result, we remain confident that we can achieve the current management expectations for the financial year 2017/2018.

My opinion - this looks an interesting share, and reasonably priced - providing the solid performance continues. It seems to be performing well, delivering strong profit margins & good cash generation. The balance sheet looks alright, and there's a small but growing divi.

I like it. Definitely the type of thing that warrants a closer look.

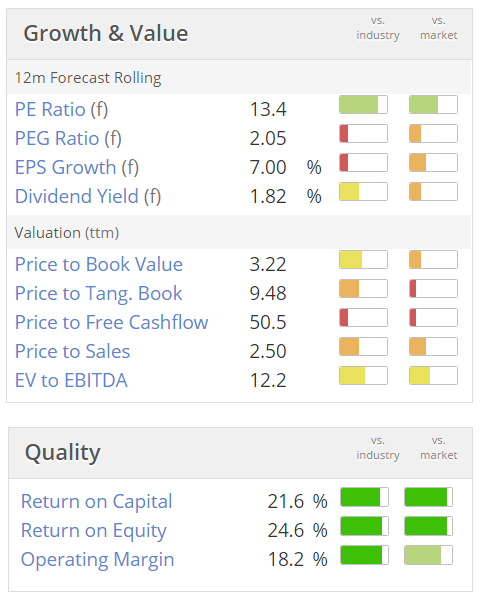

Note also the excellent quality scores on the Stockopedia graphics below.

Comptoir (LON:COM)

Share price: 45p (down 11.8% today)

No. shares: 96.0m

Market cap: £43.2m

Preliminary results - for the year ended 31 Dec 2016 - it's getting late to be reporting 2016 figures, so I'm not impressed with the timeliness of this report. At a company this size, they should be able to get the figures out in about 6 weeks - I was doing that 20 years ago for a chain with over 100 shops, when computer systems were much more primitive. So there really aren't any excuses these days.

About the company - I've not written about this company before, so here's a snapshot.

- Recent floated (June 2016) on AIM, at 50p per share, by Cenkos

- IPO raised £7.3m (net of fees) in fresh funding, plus placed 16m existing shares for selling shareholders

- Middle Eastern (Lebanese) themed restaurants - the main brand being "Comptoir Libanais", with most sites currently being in London (22 sites at 31 Dec 2016)

- Company website is here. Investor website here.

- Jonathan Kaye is a NED (the Kaye family seem to pop up at many listed restaurant groups, at some stage or other!) - and invested £4m in the IPO

- The founder's previous restaurant companies went bust (CVAs) in Apr 2010

- Note that Restaurant (LON:RTN) operates 2 airport sites under a franchise agreement. There are plans for further overseas franchising, e.g. Middle Eastern airports

- Food preparation is done at a London-based central production unit (CPU) - freehold acquired with IPO proceeds

- Shareholdings are very concentrated - the founder, Tony Kitous owns 52.1%, another Director called Chaker Hanna (great name!) owns 14.6%. Plus the Kaye holding (mentioned above). So this share is likely to be very illiquid. Also Directors arguably have too much control.

For more details, the AIM Admission Document is here, and is a fairly straightforward one, so it's a good one to peruse, if you're not used to reading these documents (a lot of it can be ignored, or skimmed over - there are usually only a few key sections worth reading in detail).

I always try to read the Admission Document before buying into recently floated companies, as there can be all sorts of useful background in there which the company doesn't want to, but is obliged to mention.

2016 results - right, on to the figures. Key points;

Revenue up 21% to £21.5m, due to considerable expansion in site numbers - 6 new sites opened, and 3 acquired (i.e. existing restaurants which were bought)

Adjusted EBITDA up only 7% to £2.7m (2015: £2.5m) - so where are the economies of scale? Surely EBITDA should be rising by at least the % increase in revenue? This is well below.

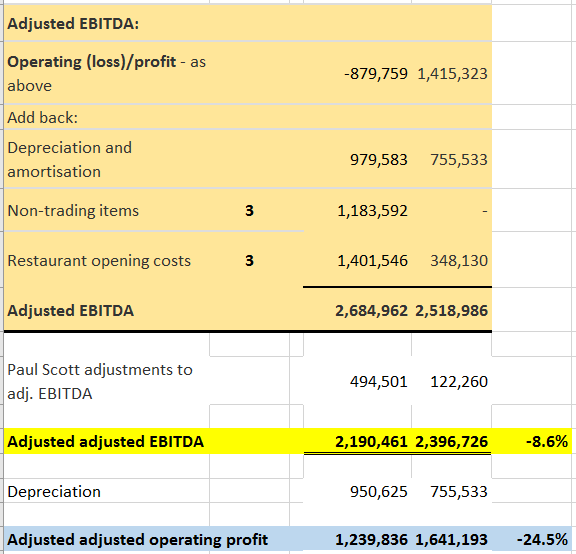

I challenge the adjusted EBITDA figure here, as it looks inflated to me. A footnote says;

*Adjusted EBITDA is calculated excluding the impact of £1.2m (2015 - Nil) non-trading costs and £1.4m opening costs

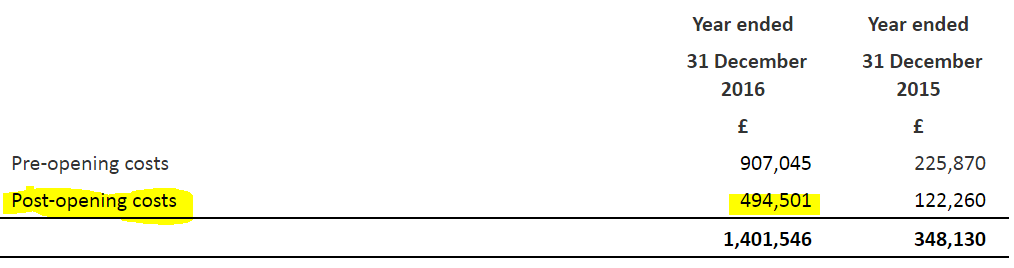

The opening costs figure looks far too high for me, given that only 6 new sites were opened, so I've done a bit more digging. Sure enough, there's a problem. This is (part of) what the company says today about opening costs;

For these reasons, it takes us a few months after opening a new restaurant to bring our wage costs fully into line with our model and for this reason our policy in respect of Opening costs is to include not only the costs of overheads (rent, rates, insurance) and wage costs up to the date of opening, but we also include an element of wages, training and marketing costs incurred over the first three months of trading only so that the level of costs included in the site profit & loss account are "normalised".

We believe this approach is both appropriate for our offering and is consistent with the policy we have always applied. We also feel it is appropriate for our stage of development.

I think this approach is inappropriate, and frankly just taking the mickey. It's abusing the whole concept of separating out pre-opening costs. The point is, that once the doors open for trading, the full P&L performance should hit the company's accounts. You can't start "normalising" trading costs, that's outrageous.

Note 3 shows this breakdown of the opening costs. I think the £494.5k element should certainly be deducted, and put back into normal trading costs.

I think opening costs, and also reporting of LFL sales, are areas where accounting standards need to intervene, and standardise the way these things are done. Left to their own devices, companies just begin expanding & abusing any areas where there is wiggle room.

It's sometimes helpful to create a simple spreadsheet in situations like this. I've done this below;

The beige coloured section is straight out of today's announcement, immediately below the P&L statement. I have then made one adjustment below, to add back the post-opening pre-opening costs!

As you can see, this one perfectly reasonable adjustment results in EBITDA actually being down 8.6% vs prior year, and operating profit being 24.5% below prior year - clearly a poor result. What's the point in doing a roll out, if your EBITDA, and your profits actually fall?

Educating the local population - the reason for falling profits is very clear - the public don't get it, and need to be "educated" into the delights of Lebanese cuisine;

While Lebanese food is growing in popularity, it is not familiar to all our potential customers and for this reason we have to educate the local population and our sales tend to build towards maturity over a number of years rather than maturing after several months.

This is a red flag to me. I like Lebanese food, but I'm not sure at all that this format is likely to work outside of London. Therefore, I think there's a major doubt about whether this format will scale up to a national roll out.

On balance, I'd say it's unlikely, so this chain seems most likely to remain a small, London-based chain. That makes it probably a poor investment proposition, in my view.

Cashflow - the IPO proceeds are gone now, on new sites, and buying the freehold to the CPU. That presents a problem - how will the company fund further expansion?

Note also that the "cash from operations" seemed to dry up in 2016 - dropping from £2.5m in 2015, to only £370k in 2016.

Impairment of assets - when a roll out is starting to go wrong, you often seen "impairment of assets" start to appear as exceptional items. This is where a site or sites have become loss-making, and the fixed assets then have to be written off.

We saw this recently occur at Tasty (LON:TAST) too (in which I hold a long position), and it's a bad sign. It shows that something is going wrong - either across the whole company, or at individual sites. It can also be a sign that management are making bad (and expensive) decisions in choosing the wrong sites for new openings - i.e. they're signing leases on bad/over-rented sites.

Slowing down expansion - sure enough, the company is now slowing down its expansion plans, adding conviction to my view that things are not going well at this company.

Plans are now to open 4 new sites in 2017, and 4 more in 2018. That's not very exciting. Given that we already know that new sites trade relatively poorly to begin with, I have to ask the question why they're opening any new sites at all?

There are so many good restaurant chains expanding at the moment, there is a real risk of over-capacity. Sure, this chain is different, but the customers don't seem to find it particularly appealing (at first, anyway).

Outlook & current trading - wobbly in Jan & Feb, but sounds like it's improving;

As set out in the Chairman's statement trading in the first two months of the year was below expectations, however we saw a marked improvement in March and we anticipate strong sales in April, particularly over the Easter holiday period.

Sales at the new restaurants are gradually building towards the levels anticipated at maturity and the Company is putting in place a number of marketing initiatives, including a new menu, ahead of the critical summer trading period to promote sales at both existing and new restaurants. The Company is also heavily focused on cost control.

The Directors believe the Group's current Comptoir Libanais restaurant estate has significant potential for organic growth which will continue to provide attractive returns for shareholders.

My opinion - as you've probably guessed, I find this an unconvincing roll out.

It's not generating enough cash to do a proper roll out, and I think management maybe need to completely re-think the format, and the strategy. Will British consumers outside of London really find a Middle Eastern looking & themed chain appealing? I doubt it very much personally.

People tend to like what they're familiar with - e.g. Italian, Spanish, Greek, etc - places they go on holiday and enjoy themselves. Whereas when you think of the Middle East, you just think mainly about wars & bombings. That's a pity, as the food looks lovely, but I think it'll be a tough sell to many UK customers outside London.

Maybe a fusion-type menu might be better, such as is being done by another chain called Leon, which has some M.Eastern influences, but is presented in a more appealing way?

There are so many good roll outs underway at the moment, mostly well-funded private companies. For this reason, I need very high returns on new site openings, to convince me that a roll out is worth investing in. That is not the case with this company. The poor performance from new site openings is a big red flag, as the complete opposite should be the case at this type of company. So personally I shall just watch with interest, but am not at all interested in investing in this company.

All done for today. See you in the morning.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.