Good morning!

I had a second wind yesterday, and added some new sections to yesterday's report in the evening, covering: Avesco (AVS), Best of the Best (BOTB), and McBride (MCB). So if you haven't seen those sections, then this link to yesterday's full report is a good place to start.

The main indices seem to be stabilising after the recent sharp sell-off, although everyone seems terribly nervous still. Although personally I am enjoying the buying opportunities, and see a correction as healthy. Even though the economic data is softer in the US, that doesn't automatically mean that we're heading into oblivion again.

With most of the retail sector having reported now, it seems as if things weren't as bad as feared, generally speaking. As always, it's all about execution, so good companies trade reasonably well, even in difficult conditions.

SBRY / HOME

(at the time of writing, I hold a long position in HOME)

J Sainsbury (LON:SBRY) seems motivated to push ahead with its possible bid for Home Retail (LON:HOME). Sainsbury has published this document on its website setting out the rationale for the deal. Having read this, I feel it's far too light on the numbers. It's all very well coming out with management buzzwords, and generalised waffle, but if I were a SBRY shareholder, I'd want some hard figures to justify the deal.

As a retailing man myself, I can entirely see the logic for the deal, it makes complete sense. Especially considering that Argos branches are already within some larger Sainsburys stores - so the trials have worked, thus proving up the concept of store combinations.

Plus SBRY knows Homebase inside-out, as it used to own it. Going forwards, retailing is all about multi-channel. So the winners will be not only the best at operating physical stores, but will also have the best IT and logistics, to satisfy customer demand in store, by home delivery, and click & collect. HOME adds expertise in some key elements of that which SBRY is currently lacking.

With cost synergies, and letting go of some of the Argos estate, and putting them into larger Sainsburys stores, it's entirely feasible that SBRY could drive profits at HOME up from c.£150-200m to perhaps £300m+. That would be a fantastic outcome for SBRY shareholders, given that the EV of the acquisition price could be as low as £400m (given that most of the consideration will actually just be giving back HOME shareholders their own money from HOME's balance sheet!).

Sports Direct (LON:SPD)

(at the time of writing, I hold a long position in this share)

Continuing the retail theme (and please note that I stray outside of small caps in these reports, into larger companies sometimes, but only for the retailing sector, as that's my sector specialism), there's an intriguing announcement today.

Strategic US investments - Mike Ashley has a history of buying stakes in other retailers through Sports Direct, in which he is the majority shareholder, so has complete control.

Today Sports direct announces that it has taken stakes in two US sportswear companies, using Contracts for Difference (CFDs) - a leveraged instrument that mimics owning the shares in terms of financial risk:reward, without having to stump up the full cost of actually buying the shares.

11.52% stake in Iconix Brand Inc (NSQ:ICON) - underlying value c.£19.3m (based on market cap of £167.8m) - note that I am working in sterling, having converted from dollars.

A quick review of the Stockopedia page for NSQ shows that it is very highly geared, with an EV of £1.19bn, so over £1bn in net debt. Also note that it achieves an operating profit margin of 47.7%, amazingly high. This fits with the company's activities - it owns brands, and licences them to manufacturers. The Stockopedia profile summary gives a synopsis, from which it becomes very obvious why SPD has taken an interest in it;

So clearly this deal is all about trying to gain access to the brands which Iconix owns. I hope he doesn't go for a takeover, as that would mean assuming a large amount of debt.

2.34% stake in Dick's Sporting Goods Inc (NYQ:DKS) - this is a US sportswear retailer, with c.$7bn turnover, and a reasonable operating profit margin which is around the 8% of turnover level. Stockopedia shows it is rated on a fwd PER of 10.6, which seems fairly reasonable. The shares have been sliding since Apr 2015, when they peaked at nearly $60, to around $35 at present.

The market cap of Dick's is c. £2.8bn, which is the same ballpark as SPD's market cap of around £2.5bn. SPD's 2.34% stake has an underlying value of £65.5m, so it's a meaningful exposure by SPD, and looks an interesting investment. I might follow them and take a long position in Dick's, once I've researched it, as it looks quite good value at first glance.

Shoe Zone (LON:SHOE)

Share price: 187.5p (up 12.6% today)

No. shares: 50.0m

Market cap: £93.8m

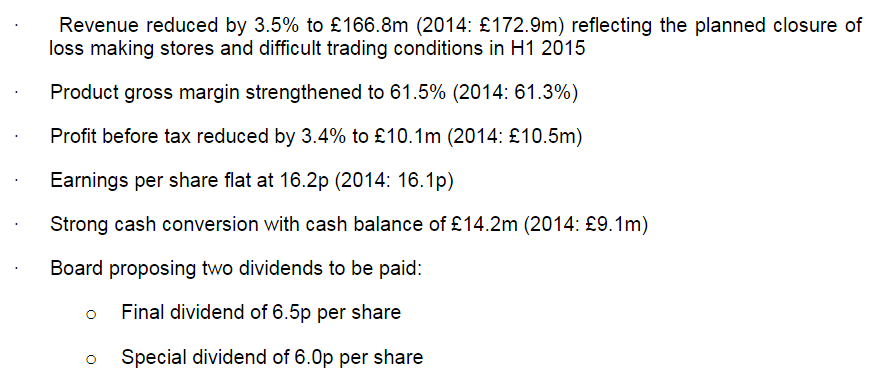

Results, 52wks ended 3 Oct 2015 - the highlights are self-explanatory;

That's a very good gross margin - which is important because retailers need strong margins to make enough profit to cover all the fixed costs of High St sites.

Although profit was slightly down, EPS was slightly up, due to a reduced tax charge.

Balance sheet - looks great. Working capital is very healthy, with a current ratio of 2.02. There is no debt, and the company has net cash of £14.2m, a very healthy position. Note that there is a £5.2m pension deficit.

Cashflow - this a strongly cash generative business - note operating cashflow is consistent with last year, at £14.2m (£14.8m LY). Also, the shopfits are done on the cheap, so there's not a great deal of capex, although that might increase in future as larger shop units are to be tried out.

Dividends - given that this business is a cash machine, it's paying out not only a 6p final divi, but a 6.5p special divi on top. Very nice!

Outlook - a bit mixed. Trading in Q1 (Oct-Dec 2015) sounds like it has not been too good, but no figures are given;

Shoe Zone's trading in the first quarter of the year has been challenging, amid the well documented high street trading conditions for clothing and footwear retailers. Despite this we have continued to make progress against our strategic objectives. Our stock position is well controlled and we have achieved strong gross margins choosing not to discount stock before Christmas as is usual for our business. We anticipate the full year effect of our new merchandise director will continue to improve our stock and cash position.

...The falling oil price is already having a positive impact on the cost of logistics and should also impact the price of raw materials thereby improving gross margins for the remainder of the year.

So it sounds as if sales might struggle this year, but margins should do well - offsetting influences. I am perturbed by the downbeat Q1 comments, as this could be lining the company up for a profit warning later this year perhaps? Although as we saw with the profit warning last time, it wasn't a disastrous one.

My opinion - overall then, not a bad set of results in the circumstances, and the spike down in price in recent days looks to have been spurious.

The great news today on divis looks to have been the prevailing influence on the share price today. Also, the commentary says that any cash balances over £11m will be paid out in special divis, so this share could be a nice cash machine for investors in the longer term too.

I'm not sure there is much upside on the actual share price from here, but it looks worth holding just for the future dividend stream, if you can live with the share price volatility.

Regenersis (LON:RGS)

Share price: 182p (up 3.4% today)

No. shares: 79.0m

Market cap: £143.8m

Trading update - this group has a 30 Jun year end, so is reporting today on H1 to 31 Dec 2015. It says;

The Group's performance in the first half of the current financial year was strong compared to the prior year and in line with expectations.

The Software business significantly increased sales, in line with the market's expectation for the full year, whilst also maintaining its operating profit margin. The Aftermarket Services businesses performed in line with expectations.

That sounds straightforward.

Outlook - the background is that the group is being rejigged - what used to be the main business, a collection of low margin electronics repair companies, is to be sold off. The new group will focus on data deletion software.

We are updated today;

As a result of the strategic review process announced in September 2015, the board has received several indicative offers for the Aftermarket Services division. Although there can be no assurances, this process remains on plan and has moved onto its next stage within the expected time frame.

My opinion - this share is impossible to value at the moment, as we don't know what the likely sales proceeds are for the legacy business. I'm unsure how to value the software business too, so really this share is just a punt at the moment, until the figures become clearer.

I'm wary of management, and the way they present the accounts (too many adjustments), so won't be investing.

Xaar (LON:XAR)

Share price: 488p (up 8.2% today)

No. shares: 77.5m

Market cap: £378.2m

Scheduled trading update - I like the use of the word "scheduled", which reinforces that it's probably not a profit warning! It looks as if the company has managed the downturn in revenue well, maintaining a strong operating margin through cost-cutting;

In line with the Board's expectations, Xaar expects to report total revenue for 2015 of approximately £93.5 million. Since the last trading statement on 4 November 2015 sales have performed in line with expectations, with revenue growth in packaging being offset by the anticipated softening in demand in ceramic tile printing in China.

As a result of improved operating efficiency at both the Sweden and Huntingdon manufacturing sites Xaar expects to report an adjusted operating margin for 2015 of approximately 20%.

The Group remains in a strong financial position with net cash at 31 December 2015 of £70 million (30 June 2015 - £59 million).

My opinion - the big problem that Xaar has been grappling with in recent years, is declining demand from China for its ceramic tile printhead. This has been the mainstay of the business.

I certainly wouldn't want to invest right now in any company which is hugely dependent on sales to China, would you? Worse still, it's sales into just one specific niche, in one country, and the country that is probably the most worrisome of all major economies.

True, Xaar has other interesting things in the pipeline, but to my mind the market cap is much too elevated given the risks. That said, if the company can make a commercial breakthrough into other sectors, and it tends to see waves of adoption of its innovative printheads, then who knows what the future holds?

Risk:reward looks unattractive to me, right now. Although my judgement may be clouded by my having been scalded on the shares in 2014. I often see that trait in other investors - they refuse to accept that a company is a good investment, if they have previously lost money on the shares. Maybe I'm doing that here, subconsciously?

Stanley Gibbons (LON:SGI)

Share price: 59.5p (down 13.1% today)

No. shares: 47.1m

Market cap: £28.0m

Share price movement - this sounds odd;

The Directors note the recent movement in the Company's share price and would like to update on current intentions for funding the business.

In response to a number of unsolicited enquiries from shareholders and other investors, the Board is considering a number of fundraising alternatives to reinforce the working capital position prior to the year ended 31 March 2016. However, whilst an equity fundraising is one option potentially available to the Board, the discount to the Group's net asset value at which any such fundraising would likely be priced could make it a relatively unattractive route to alternatives under consideration. The Directors will update the market on the progress of these considerations in due course.

Let me translate this for you. We're in a financial mess, and are looking at various ways to raise money. Equity financing is available, but on lousy terms, so we're trying to see if anyone will lend us money instead. The bank are not keen on extending the overdraft.

Whilst the balance sheet looks apparently strong, the big unknown is what the last reported £54.9m of inventories are actually worth in reality. Given that stamps have no intrinsic value, they're just tiny pieces of old paper, they're only worth what someone is actually prepared to pay for them. That could be a fraction of book value, for all we know.

My opinion - it looks high risk to me. I think there could be a huge writedown of inventories to realisable value, and in a fire sale that could be a fraction of book value. If they had to write off say two thirds of book value on inventories, then current assets would be a £36.6m hit, and would take current assets down to £41.1m. Total liabilities are £45.3m, so that would put the company in a precarious position, with net tangible assets of barely above nil, once you add in the £6.1m property, plant & equipment.

OK, a two thirds write off on inventories is a savage cut, but I wouldn't be surprised to see that kind of figure happen to shift inventories which are not now in such demand as they were when Chinese buyers were bidding up prices.

Overall, I think this could be a value trap, and is best avoided, so am putting it on my Bargepole List - admittedly closing the stable door after the horse has bolted. At the very least, the valuation is now too uncertain in my view, and with financing issues now rearing up, it's not one I shall be revisiting, until there is more clarity.

All done for today!

Regards, Paul.

(of the companies mentioned today, I have long positions as noted above, and no short positions.

NB. These articles are my personal opinions only, which are subject to change without notice.

Please always DYOR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.