Good morning! Preliminary results from Solid State (LON:SSP) have been issued for the year ended 31 Mar 2013. This share has been on my watch list for a while, and I last mentioned them on 2 May 2013, concluding that it looked potentially interesting.

Solid State shares have more than 10-bagged in the last 4 years, and the company continues to trade well. At 225p per share the market cap is £15.6m.

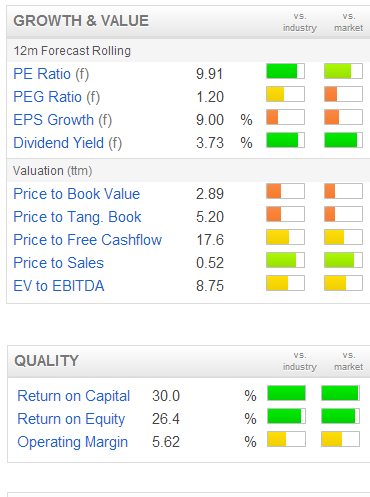

As you can see from the Stockopedia excerpt from the StockReport on the right, Solid State scores highly on forecast PE Ratio, and on Dividend Yield, with strong green bars in both cases indicating a high ranking in both its industry (the left hand bar) and the whole market (right hand bar).

Note also that a new feature has been added this week so that if you roll your mouse over these bars in the StockReport, a box giving more details pops up - I like it! (that feature won't work on the picture on the right).

Their results today look good, with turnover up 22% to £31.5m, profit before tax & exceptionals up 17% to £1.87m, and EPS up 12% to 21.8p.

They are acquisitive, so some of that growth might have come from companies bought during the year. This is important, as I've been caught out before over-paying for growth that I assumed was organic, but turned out to be from acquisitions. The difference being of course that an acquisition just bolts on growth on a one-off basis, hence does not justify a higher PE rating once you have included the acquired company's profits in the E bit of the PER calculations.

They seem to have come in slightly ahead of broker consensus EPS (forecast was 21.1p, against 21.8p achieved), putting them on a PER of 10.3. That looks fairly good value to me, although with a bit of debt, and the order book flat against last year, it's difficult to see there being much upside from here in the short term. Maybe 10-20% upside, which doesn't excite me in terms of risk/reward.

Solid State have raised their dividend by 10% to 8p, which is in line with broker consensus forecast dividend.This breaks down as 2.75p interim dividend paid on 28 Jan 2013, and a final dividend of 5.25p to be paid on 2 Sep 2013 (ex-divi date is 7 Aug 2013). So a quite good dividend yield of 3.6%.

Five year chart below shows just how well the shares have done, long-term:

I have also quickly reviewed their Balance Sheet, and it looks fine, with current assets of £11.3m being 136% of current liabilities of £8.3m. There are negligible long-term creditors, so that's a pretty sound financial position. They seemed to have net debt of £2.3m at the 31 Mar 2013 year-end, and spent £900k on an acquisition post year-end.

(Edit: thank you to Bobdouglas, who pointed out an error here. The £2.3m net debt figure is now correct)

Overall, looking at the numbers it seems OK, and reasonably priced. However, to persuade me to buy the shares, I'd want to understand their products & markets better, to build a picture in my mind about how future profitability is likely to pan out. After all, that's essentially what investing is all about - forecasting the future, using the past as a guide.

(Edit: thank you also to deucetoace who points out in the comments below that they had a large one-off order last year, which won't be repeated this year, so that is likely to hold back growth this year).

Profits Warnings

Both SDL and Andor Technology have warned on profits today, and their shares are down on the day 33% and 19% respectively.

I last reviewed Andor Technology (LON:AND) on 10 Dec 2012 here, and concluded that it looked potentially interesting, but wasn't especially cheap at 395p per share. It's also a Mark Slater share, although as I reported here, his Funds have reduced their stake in it, and there were question marks over why growth was stalling.

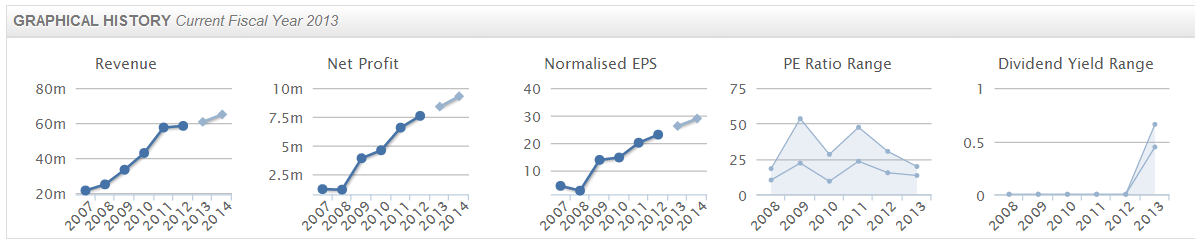

Andor make specialised scientific digital cameras. As you can see from the StockReport graphical history below (which is incredibly useful for quickly absorbing a lot of key trend information), the track record here is very good:

Although given today's profits warning, the lighter coloured forecast figures in the above graphs are likely to be revised down. So has it now gone ex-growth, or is even in decline?

The statement today from Andor indicates that H1 results (to 31 Mar 2013) will be in line with expectations, but they are warning on H2, following on from a semi-warning on 3 April. Interestingly, it's yet another situation where a company said they expected the year to be H2 weighted, and then fail to deliver the uplift in H2. I've noticed this a lot lately, so in my view when companies warn of deferred orders, and say they expect to recoup in H2, then it's best to just sell out, as there is a much greater likelihood of a follow-on profits warning within a few months. Unless there is a specific reason to expect H2 to recover (e.g. new product launches), then it's best to play it safe I think. The bad news rarely comes out in one go, but tends to come piecemeal in my experience.

The warning is fairly specific, in that Andor say full year sales are likely to be £4m down on last year, so that implies a fall from £58m to £54m in turnover. So it's not a horrendous miss, but with operational gearing that could mean a sharp fall in profits from the £7.5m recorded last year.

So with rather incomplete information & outlook, it's now very difficult to value. At today's 294p, and with 31.6m shares in issue, the market cap (after today's sharp fall) is £92.9m. On the positive side they indicate that net cash has risen to £21m and is "available for investment", either through internal R&D or acquisitions. So that is 23% of the market cap being net cash, which provides a nice buffer.

Is the business worth £71.9m ex-cash though? At this stage I just don't know, because it could be a business that's now in decline (in which case the market cap should be much lower), or it could be a possible recovery situation? I would need to see the latest broker notes before being able to take this idea any further. Potentially interesting, but I need more information.

SDL (LON:SDL) is a share that's not been covered here before, as it was a mid cap, but is rapidly becoming a small cap. Their shares are down 34% to 256p today, so with 80.2m shares in issue, that gives a market cap of £205m. Could this be a falling knife to avoid, or a bargain to catch? I've lost lots of money in the past catching falling knives in the small cap space, so tend to avoid doing it now, unless the situation is really compelling.

Although we are in a bull market now, and shares are therefore more likely to bounce strongly after an initial fall. Remember that at the open there are often forced sellers at any price (e.g. spread betters who are stopped out), so you can sometimes grab a quick bargain - if you can correctly time the point (usually between 8 - 9 a.m.) when the forced sellers are out, and the same people are scrambling to buy back!

I secured a bargain earlier this week with Clean Air Power (LON:CAP), managing to grab some on the spike down to 6p, which are already showing a 37% profit, not bad in a few days. Doesn't always work of course, in fact frequently it fails!

Going back to SDL (LON:SDL), what do they do? It seems to have a variety of activities, related to language translation, and customer experience management solutions, whatever that means!

It's quite big, with turnover of £269.3m and profit before tax of £27.4m for the year ended 31 Dec 2012. Adjusted EPS fell 11% to 34p that year.

Interestingly, they bought Alterian for £70m in Jan 2012, a share I remember from the past.

Today's statement says that H1 performance (it's a calendar year) has "remained below management expectations". Helpfully they give a forecast for the current year of £15-20m for profit before tax & amortisation (versus £35.5m achieved last year).

Incidentally, why is it that some companies insist that "we can't give forecasts", and then other companies do publish forecasts, as in this case with SDL? Which is correct, do any readers know what the rules are? It would clearly be much better if all companies followed the route taken by SDL, in specifically stating what their profit forecast is for the current year. That would remove a lot of the uncertainty from profits warnings, which is one of the reason that the market sometimes over-reacts.

It's such a big drop on last year's performance, roughly halving of profit before tax & amortisation, that I don't really know where to start in how to value this company. As with Andor above, if you think that trading will recover then the shares could be cheap. I don't have any information to make an informed judgment on that, so cannot value the company I'm afraid. Will report back if & when more information becomes available.

I'll sign off here, as am off into London to see management of an interesting small cap company.

See you from 8 a.m. tomorrow morning, as usual.

A quick reminder, here is my landing page on Stockopedia, which you can bookmark if you wish, to get straight to my daily report & the archive (there is a handy box where you can search by company ticker). Also there is a link to sign up for the 11 a.m. daily email of this report, so you never miss one.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in CAP, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.