Good afternoon!

I ended up writing quite a long report late yesterday evening, which is here, covering the following companies' results or trading updates;

Cdialogues (LON:CDOG)

Idox (LON:IDOX)

InternetQ (LON:INTQ)

Lavendon (LON:LVD)

Mobile Streams (LON:MOS)

Blinkx (LON:BLNX)

In future, I will endeavour to only go out on the lash at weekends, and not on school nights! So apologies again for yesterday's delayed service.

UK Mail (LON:UKM)

Share price: 327p (down 10% today)

No. shares: 54.9m

Market cap: £179.5m

Interim results to 30 Sep 2015 - I've not looked at this company before, so am not fully up to speed on it, so this is just an initial impression. These H1 figures look poor, but given the shares are only down 10% today, this must have been previously flagged to the market.

Indeed, looking at the chart, 7 Aug 2015 is the date when the share price began to tank, and sure enough there was a trading update on that day. The crux of that profit warning on 7 Aug 2015, which was a "materially below current market expectations" one, i.e. nasty, is that teething problems had been encountered with the move to a new, fully automated depot in Coventry.

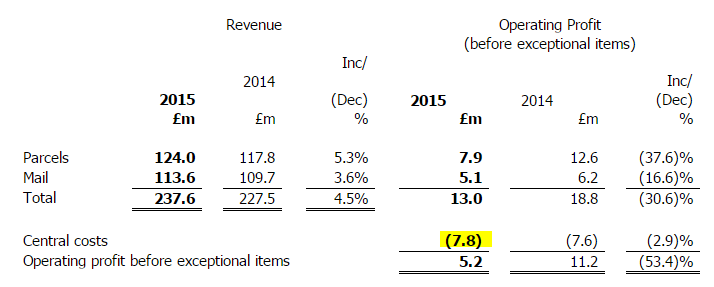

Today's interim results continue that theme, and the hit to profits is really rather bad, as the table below shows. They lost about a third of their operating profit, but due to what seem to be high central costs, this had a much larger impact on the bottom line - operational gearing working in reverse.

Therefore, the apparently strong operating margins mentioned in the narrative, are not really a very fair representation of performance, given that such a large lump of costs are classified as central costs.

In this type of situation, it's difficult to know how much of the drop in profits really is down to the temporary factors that management focus on, and how much is underlying deterioration in performance that will continue even after temporary problems are fixed. This is such a highly competitive sector. We say City Link go bust, and then a horrendous drop in shares on DX (Group) (LON:DX.) in recent days, after its profit warning.

This sector looks a minefield to me - combining many of the worst characteristics, which investors should avoid as much as possible - low margins, heavy capex necessary to stay competitive, lots of competition, and (with mail) falling volumes due to email substitution. Add to that, a national shortage of HGV drivers, with large pay rises being necessary to attract and retain them - as noted in DX's recent profit warning.

So really, all logistics companies look like bargepole (or even shorting opportunities), given the sector-wide difficulties. Unless the price is so bombed out, that all the bad news is in the price already (possibly the case with DX, which I bought recently, but time will tell on that).

Hence a strong balance sheet is essential in this space, as weaker players must surely end up going bust, sooner or later? Talking of which;

Balance Sheet - here are my usual 3, simple tests;

NTAV is positive? PASS - this looks alright, at £50.9m

Current Ratio over 1.2? FAIL - the current ratio is weak, at 0.81, although note that most of the bank debt is included in current liabilities, which skews the numbers. Given that long term liabilities are modest, at only £8.2m, then I can live with the current ratio being rather weak. So this test failing, is not necessarily a deal-breaker for me.

Net debt reasonable? PASS - the company does of course rely on the support of the bank, but total net debt of £12.7m is actually quite modest, for the size and profitabillity of the business overall. Although I need to check what further capex is budgeted for, as debt might continue rising perhaps? Note that a further £10.3m in compensation relating to HS2 will be received in Dec 2015, which is very material to the cash/debt position, and clearly a positive.

Dividends - given the drop in profits, the big divi yield was clearly unsustainable. Management have reduced it today, saying it is being "rebased" to 5.5p (from 7.3p last H1). That's actually quite a modest drop in the divi, but it will be interesting to see what they do with the final divi.

The narrative talks about dividend cover, rather than the absolute level of dividends, which is an important distinction, as it gives them wiggle room to cut the divi further, if earnings continue to tank;

We would expect to return to prior levels of dividend cover in due course as our earnings grow.

Outlook - rather disappointing, as expectations for 2016 are being trimmed;

As a result, our expectations for the current year remain in line with previous guidance, but our expectations for the next financial year have softened slightly.

Whilst this is disappointing, the strategic rationale for the transformation we are undertaking is as compelling as ever, and we are confident both of our ability to restore our parcels business to previous levels of profitability and to build from there. The medium term operational and financial benefits will place us amongst the most efficient and competitive operators in our market.

My opinion - this is a tricky one, as it's not a business I've looked at before. After the share price collapse at DX, I'm not inclined to go anywhere near this sector right now, it's far too high risk, since pressure on earnings is such that more profit warnings are almost certain from this sector.

Despite the share price having fallen a lot already, I this one could have further to fall. Operational problems, combined with intense competitive pricing pressure, and costs rising (especially drivers wages) make this such a difficult area, it's just best avoided (or even shorted) in my view.

As we saw with DX, a high dividend yield and low PER can be a value trap, once earnings collapse. This share is essentially a punt on whether UKM can restore previous levels of profitability. That's not a bet I want to take.

Eckoh (LON:ECK)

Share price: 47.2p (up 1.7% today)

No. shares: 223.3m

Market cap: £105.4m

Interim results - this share appears to be making the transition from being valued on fundamentals, to being valued on hopes of considerable future growth.

The figures reported today simply don't compute, to my mind, with a valuation now above £100m. Growth seems quite pedestrian, if anything, for such a highly valued stock. This is happening with quite a few fashionable growth stocks, so it's a general market thing, which could easily reverse.

H1 turnover only rose 10.3% to £8.6m, and adjusted operating profit rose 43.6% to £1.5m. It's important to note though that adjusted profit excludes share-based remuneration, which is material to the numbers. In H1 this year for example, the share-based payments charge was £343k, or just over 23% of adjusted profits. This wasn't a one-off either, as in the last full year, share-based payments (to Directors & staff presumably) was £939k, nearly 28% of adjusted profit.

Outlook - the forward-looking comments dangle some carrots about future growth in front of the eyes of investors who want to view this as a superstock, and who are happy to pay up-front for future growth;

Moving into the second half of the year, with market sentiment assisting the acquisition of new customers, and positive reactions for our new tokenisation proposition, we would expect our strong trend of growth to continue. The acquisition of PSS will enable us to grow more quickly in the US market where we remain confident that the size of the business can, in time, outstrip that of the UK and we will look carefully at the opportunity to move more meaningfully into the Australian market where PSS already has a presence.

With our high levels of recurring revenue from the existing client base, significant new business pipeline both in the UK and the US, and new opportunities to sell through PSS, we believe that Eckoh has an excellent platform on which to continue to build an exciting, fast-growing, business.

In line with our acquisition strategy, we will also continue to evaluate other acquisition opportunities where they may complement our product base or accelerate geographic expansion. As we look ahead, therefore, the Board remains very confident in Eckoh's future prospects and we continue to trade in line with market expectations for the year.

My opinion - it looks an OK business, growing modestly. This stock has been around for years, and I held shares in it a long time ago, but it just trundled along, never gaining any real tractions. It's gained a bit of traction now, but the market seems to have gone nuts over it.

I can't see how the current valuation stacks up, but maybe there is stronger growth potential in the pipeline? It's valued at a current year PER of about 34 times, and when you adjust the accounts to expense share option remuneration, you'd be looking at a considerably higher PER, well into the 40s I reckon. Does that make sense? Possibly, but it's certainly not obvious from the figures released today.

The market is starting to sell off very highly rated small caps this week, so personally I'm steering clear of opening any new positions for growth stocks, and am reviewing my portfolio to bank profits on things that have detached from reality in terms from valuation (although I rarely go into that sort of area anyway).

SCS (LON:SCS)

A very quick comment, as I have to catch a train back to Hove shortly. I'm impressed with today's trading update, which says;

"The Board is pleased to report that ScS Group continues to trade in line with expectations and has had a good start to the current financial year. Like for like order intake (including House of Fraser) has progressed as expected, and for the 16 weeks ended 14 November 2015 is up 7.9%, a pleasing performance against particularly strong comparatives during Autumn.

...We continue to look forward to the year ahead and beyond with confidence. A further update will be provided at the time of the pre-close statement which will be made in February 2016."

That's a very good LFL sales increase, which should feed through to better profits.

My opinion - I remember how quickly this stock unravelled in the financial crisis back in 2008, it went from good profits, to going bust, quite quickly. Therefore, with wafer thin profit margins today, I'm concerned that the same thing could happen again when the next recession strikes.

So it's not for me. The big divi yield on offer can obscure the reality that this is not a good quality business, in my view. That's what the market is telling you - a 9.3% dividend yield is the market telling you that this is not a sustainable payout.

In the short term though, the company appears to be trading well, so there might be further upside on the shares, for those investors who don't really think about the economic cycle.

Right, I've run out of time. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, I have a long position in DX., and no short positions.

A fund management company with which I am associated may also hold positions in companies mentioned.

NB. These reports are my personal opinions only, which are subject to change without notice, and are never financial advice or recommendations. DYOR is what it's all about here!)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.