Good morning!

Hornby (LON:HRN)

Share price: 64p

No. shares: 39.16m

Market Cap: £25.1m

This models company has been having trouble for a while now, due to messing up its supply chain when they moved production offshore. I was very scathing about it last time, perhaps too much so, but it looks as if the company is beginning to recover, and there might be turnaround potential in the shares.

Trading update (IMS) - issued today, it covers the period since the last year end, on 31 Mar 2014. On sales they say;

The sales performance of the Group in the period up to the end of July has been in line with Company expectations and slightly ahead of the corresponding period last year. Recent sales of Airfix and Corgi have been encouraging, the former driven by the launch of the '1/24 Hawker Typhoon MKB1' to great acclaim. Management of aged stock has been a priority in the period and good progress has been made across the brands.

I haven't bolded the bit about in line with company expectations, because the above only refers to sales, whereas it's profit that matters most. I'm somewhat concerned by the comment about aged stock, which suggests there might be further write-downs of stock in the pipeline perhaps?

On supply chain problems, it sounds like they are making progress, but are not out of the woods yet;

There continues to be significant focus on the production processes for Hornby and Scalextric product from our supplier partners in Asia. We are working with an increased number of factories in our network and improving the capability of vendors and therefore, whilst we still foresee challenges in ongoing production, we remain confident that supplies of key products will improve over time.

Hmmm, that doesn't sound particularly encouraging. Translation - we're still in a bit of a mess!

A new MD for Asia has been appointed, with good supply chain experience. Let's hope he can sort things out.

Net Debt - has risen to £10.7m at end July 2014 (£7.4m a year earlier) which is of some concern. Looking back to the last set of results, the company has banking facilities available until Dec 2015. Banks don't like lending money to loss-making companies, so I'm nervous about this.

So whilst the risk of the bank pulling the plug completely might be low (at the moment), don't be surprised if the company tries to do a fundraising at some point, which of course will dilute existing shareholders, resulting in the PER rising (since earnings will be divided into a larger number of shares, hence EPS will go down sharply).

If trading is poor, and/or the bank plays hardball & insists on an equity fundraising, then it might be necessary to do a deeply discounted equity fundraising, destroying value for existing shareholders. I don't know how likely these possibilities are, but they are a significant risk here, which puts me off investing. I don't like investing in heavily indebted companies at all for these reasons - it introduces far too much risk.

Chart - below is the 5-year chart. As you can see, it's seriously lagged the small caps index since early 2012, missing out on the big bull run completely, indeed it's gone down. However, the chart suggests that if they get back on track (geddit?!!), then maybe a share price of 120-160p might be possible? It all depends on rebuilding profitability though, and that's a big ask.

Outlook - this sounds fairly encouraging;

The pre-Christmas period will be an important factor in the overall result of the current financial year. We have a strong range of products and initial indicators of both listings and orders are encouraging. On time delivery of our product will continue to be a significant factor in performance and we are working closely with key suppliers to achieve the required volumes. With the correct volumes in play we are satisfied that our trading outlook is in line with market expectations. In the longer-term we remain confident in the strength of our brands and the opportunity to improve performance and grow profitability.

Which brings me on to;

Valuation - Stockopedia shows a bounce back from last year's losses to a positive EPS of 2.8p this year, and 3.9p next year. With the shares currently at 64p, that puts them on a high PER of 22.9 times this year's forecasts. However this is a turnaround year, so the PER is pretty meaningless, as it should go a lot higher in future if the turnaround continues, due to the effect of operational gearing.

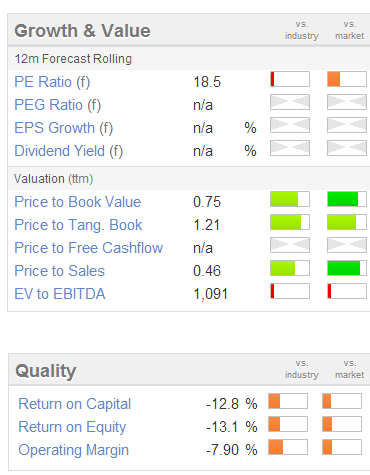

As you can see from the Stockopedia graphic on the right, it scores very badly on most measures, has no dividend, and is flagged as a resoundingly poor quality business. However, that might change if they get their supply chain sorted out.

As the number of shares in issue has remained virtually static in the last 5 years, then it is valid to look back at previous EPS before the supply chain problems appeared. In 2009-2010 the company was making around 10-12p EPS, so if it gets back to that sort of performance (quite a tall order!) and the market gives it a PER of say 10-12, then we're looking at a share price range of 100-144p. That compares favourably with the present price of 64p.

However, I would not want to pay anywhere near that price range up-front, whilst there is still considerable uncertainty over whether the recovery can get to anywhere near the historic level of profitability.

My opinion - Therefore whilst I think there could be some recovery potential here, the share price is already anticipating that, and in my opinion risk:reward doesn't look attractive at this price. There seems a fairly high likelihood of there being more bad news at some point - I think this has potentially got another profit warning in it, so that combined with the high levels of bank debt & potential stock write-off, rules it out for me.

I think there are more convincing, and less risky turnaround opportunities available elsewhere, so I won't be getting involved with this one.

Castings (LON:CGS)

Share price: 459p

No. shares: 43.63m

Market Cap: £200.3m

Profit warning - About £20m has been wiped off the market cap this morning (as usual, I have manually adjusted the market cap figures above to the current share price), as this Midlands, UK based engineering company has put out a profit warning at its AGM, saying;

Following the statement in the chairman's report in June it is disappointing to report that sales up to the end of July are below our expectations. We are also experiencing operational issues due to the change of work mix. Management are addressing the issues and it is hoped, with a forecast of an increasing order book, the situation will improve during the remainder of the financial year.

This doesn't come as a great surprise, since the company had previously flagged the uncertain outlook, which I reported on here on 15 Nov 2013, and again here on 19 Feb 2014. So given the company's own (refreshingly frank) previous statement that it's "impossible to reliably predict" demand, the shares cannot be valued on a PER much above about 10 in my view.

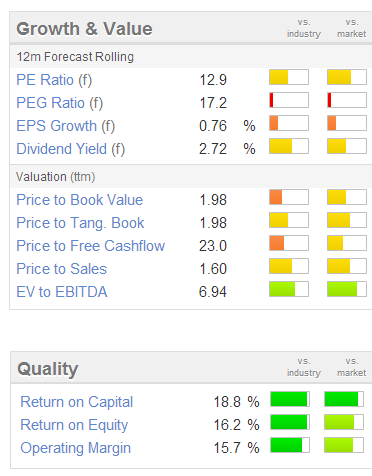

That's a pity, as it's a very nice, high quality company, as the Stockopedia graphics show;

Valuation - The above graphics show a PER of 12.9, based on last night's (higher) share price. However, the drop in forecast earnings I am guessing will approximate to the drop in share price today, so the forward PER shown above is probably still about right.

The company also has an excellent Balance sheet, although I note that the company paid £3.9m into the pension fund, despite it reporting a surplus. So the usual issue of conflicting accounting & actuarial valuations on pension schemes.

The difficulty is that the company has not quantified what the profit shortfall so far this year actually is. So it has moved the shares into the "impossible to value" bracket, until there is clarity on where earnings are likely to be this year. If we take a fairly gloomy view, and assume that EPS will drop back from last year's (y/e 31 Mar 2014) 39.1p to the 33.6p achieved the year before, then at 459p the shares would be on a current year PER of 13.7. That's a bit too high for me, even after today's fall, given the uncertainty.

My opinion - I like this company, and at some point would like to buy in. However, the price has to be right, and for me it's not cheap enough to justify a purchase (yet). Also I'd need to better understand their competitive position, the markets they operate in, etc. As a UK-based manufacturer, the company must be experiencing headwinds from forex, as so many other companies are seeing their profits hit hard from the strong pound.

So it's going on my watch list, but I'd need another significant drop in share price before being tempted to buy.

I don't really understand why the stock market ignored the very clear warnings from the company over the last year that the outlook for demand was uncertain. I might wait for the next set of interims (due in mid Nov) before taking this share idea any further.

Nothing else of interest caught my eye today, apart from;

H & T (LON:HAT) - This pawnbrokers interim results today look poor, with profit before tax down to £2m (from £4.6m) for the six months. The company reaffirms full year forecasts, which are already well down on last year. So it's on 14.2 times PER for the current year forecasts. The Balance Sheet looks OK. I don't invest in companies that exploit the poor, so it's not one I would take any further.

I'll try to get the first draft published a bit earlier tomorrow, it's been like wading through syrup since I got home - so many distractions & emails to deal with, etc.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.