Good morning! Just a quick reminder (as lots of regulars read these reports) that it's the monthly Mello Beckenham investor evening tonight. I'll be attending tonight, and might give myself a night off, and have my first drink of 2015! Well, 18 days abstinence isn't bad. Their draught Peroni is just too good.

Portmeirion (LON:PMP)

Share price: 887.5p

No. shares: 10.7m

Market Cap: £95.0m

Trading update - the outcome of 2014 was never really in much doubt, as previous updates have been bullish. However, it's still reassuring to read the usual "in line with market expectations" statement today from this up-market ceramics manufacturer.

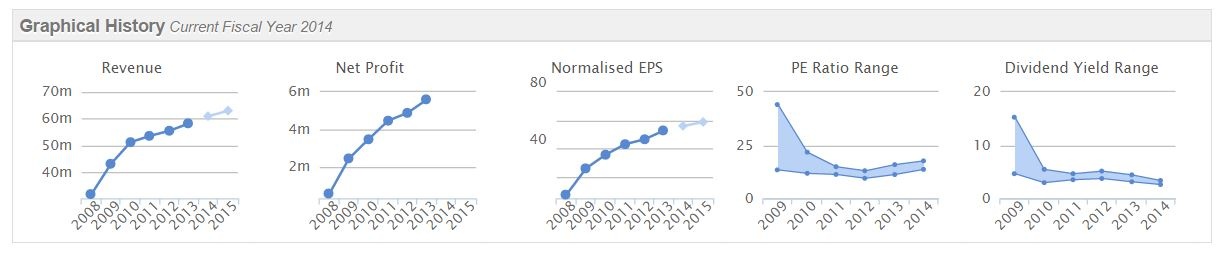

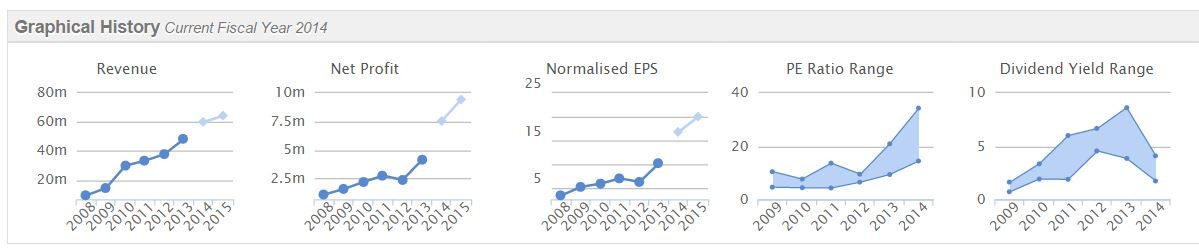

Revenue is said to be "over £61m" for calendar 2014, c.5% up on last year, and the sixth consecutive year of record sales. Profits and divis have followed a similar upward trajectory, as you can see from the Stockopedia graphic below;

That's what it's all about - nice steady, dependable organic growth.

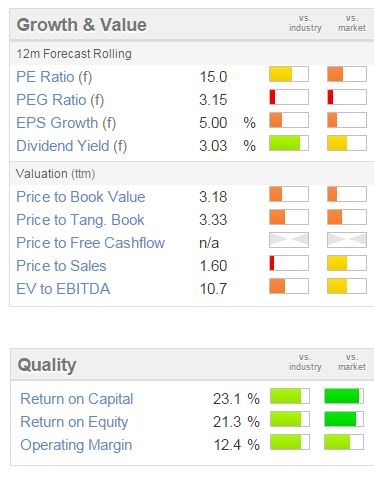

Valuation - as you can see from the usual graphics below, the fwd PER is medium at 15.0, and the dividend is a useful 3.0%. However, bear in mind that this is a high quality business - note that all three quality scores are high. So the valuation metrics seem reasonable to me.

It also has a very strong balance sheet, so financial stability is thrown in for free. The company has net cash, and bought the freehold for its HQ site last year - a very positive point in my opinion, as I love freehold property on companies' books.

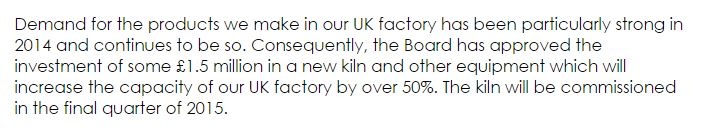

Growth - the market does not seem to have reacted yet to this interesting section in today's report, indicating a substantial increase in manufacturing capacity is being implemented in 2015. This surely augurs well for continued organic growth.

My opinion - this for me is my ultimate sleep soundly stock. It doesn't deliver nasty surprises - mainly because a lot of the products have very reliable, predictable sales patterns. Management seem strong, and the valuation is still reasonable. Plus there is good organic growth. I feel this share should be on a premium rating, so there's the chance for the PER to rise, as well as continued increases in earnings. All its main markets (USA, UK and S.Korea) are growing.

Note from the two year chart how pullbacks are relatively modest with this share, which suggests to me that there is probably latent demand for the shares, with buyers hoovering up loose stock on each dip. That augurs well for possible continued rises.

The valuation doesn't look at all stretched yet either, in my opinion, so I'm happy to tuck it away and forget it for another six months, as a happy holder. I'd be surprised if the shares are not in the 1000-1200p range by the end of 2015.

Sprue Aegis (LON:SPRP)

Share price: 326p

No. shares: 45.5m

Market Cap: £148.3m

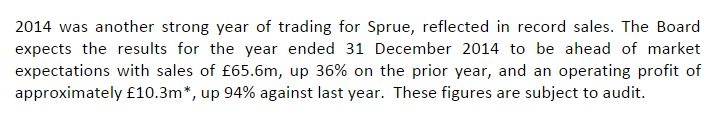

Trading update - there's an excellent trading update today from this smoke alarms company, the key part says;

(the asterisk refers to this £10.3m figure being pre-exceptional, which is fine as the exceptionals are £0.7m and relate mainly to the move from ISDX to AIM, which is clearly a bona fide exceptional cost)

Sprue has demonstrated very strong growth, with super historical charts;

Checking their last accounts, there was no finance charge on the P&L (in fact there was a small finance credit) therefore I think operating profit referred to above in today's trading update should be the same as profit before tax.

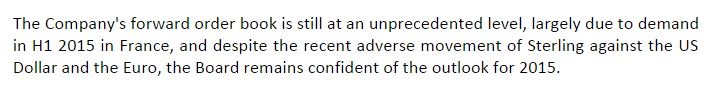

Valuation - I estimate that 2014 EPS is looking to come in around 21.8p, which is a long way ahead of broker consensus of 16.8p. So why haven't the shares shot up this morning?

At 326p per share, the PER on 2014 earnings is about 15.0 - assuming my estimate of 21.8p EPS is accurate. To my mind that rating is probably about right, given that there must be some impact from surging French demand, which may not be sustainable at this level.

French demand - the issue seems to be that the market is discounting the fact that a lot of the growth is coming from legislation in France (effective Mar 2015) requiring that each house has at least one smoke alarm, where apparently the existing installation base is very low. Therefore this is likely to be driving a spike in demand, which is not likely to be sustained, once these devices are fitted in French homes.

I suppose it depends on how compliant the French are with the new law, and how assertive the authorities are in policing it? So I've no idea whether this is causing a big, short term spike, or whether there will be a longer term wave of installation? That's a key point to determine whether profits are sustainable at this level, or could go higher, or lower.

Outlook - besides French demand surging, other points noted are that UK retail demand fell ("slightly softer sales"), gross margin rose but was offset by adverse exchange rate movements.

The company sounds confident for 2015, but again France is mentioned as a key factor;

There is more detail in today's announcements about new product development, which all sounds encouraging.

My opinion - this looks an excellent company, and the shares have done very well, but the key issue is to establish what its long term sustainable profitability is likely to be, and not to get carried away with outstanding figures for 2014, which at least in part have been driven by demand in France, ahead of the new law.

It's worth noting that Sprue has a smashing balance sheet, with net cash, and pays decent divis, of around 3.1% forecast yield, so all positive there.

Overall, I like it, but for me any purchase would have to hinge on getting comfort about the sustainability of the 2014 level of profits.

Thorntons (LON:THT)

Share price: 81.2p

No. shares: 68.6m

Market Cap: £55.7m

Checking the archive, I reported on Thorntons 7 times in 2014, and was generally negative, due to erratic trading, low margins, and a balance sheet with too much debt and a pension deficit. My last report was on the profit warning on 23 Dec 2014, where I still wasn't interested in dabbling in these shares despite them falling from 120p to 91p on the day. It's worth about 50p per share to me, tops.

Trading update - covering the 14 weeks to 10 Jan 2015 is issued this morning. It's mixed. The shops delivered a strong LFL sales performance - up 5.0% for the quarter, which is very good in my view. pre-Xmas was particularly strong, with a +7.8% LFL performance in the 4 weeks to 24 Dec 2014.

However, the commercial division (supplying supermarkets & others) has seen poor trading, with sales down 10.3%. The two divisions are roughly the same size in turnover terms. Thorntons says that it experienced "challenges with specific grocers" - which to my mind is code for them being squeezed extremely hard on price & therefore margins by increasingly desperate supermarket chains, which are engaged in a battle to the death - with their suppliers being the people who are going to take the pain, whether they like it or not.

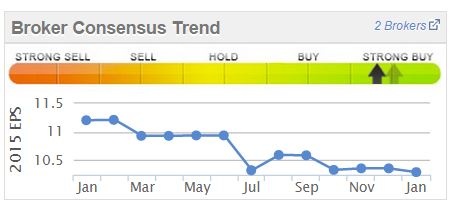

Valuation - this is tricky, as unless I've missed it, I can't see anything in today's statement relating to profitability. Current broker estimates are for 10.3p EPS this year. Is that do-able? I would have thought the risk is of more downgrades, following the pattern of the last year:

The weak balance sheet is another factor to take into account when valuing this share. I went through this issue in detail on day of the last annual results, here. The pension deficit requires overpayments of £2.75m p.a., which is a large chunk of their profits. It's not clear to me how the bank debt will ever be repaid. Although there is freehold property within fixed assets, which helps keep banks happy, since it's rock solid security on loans.

There are not likely to be divis of any significance for a while, perhaps ever, in my view either (divis stopped in 2011), despite management making noises about reinstating a divi - I don't see how they can take such a risk with this balance sheet, as it would be reckless.

My opinion - I still don't like it. The strategy is questionable now too. The company has made a great song & dance of transforming itself into an FMCG company, instead of just a retailer, but it's actually now the retail bit that is doing well, and the FMCG bit that is under pressure!

There's very little profit, and over a third of forecast profit will be sucked into the pension fund in over-payments which are likely to go on for years, especially if interest rates don't rise significantly.

I think there are probably better opportunities out there than this. Although the brand is still fairly desirable, and the last time someone put a box of Thorntons in front of my family, we emptied the box in about 10 minutes (it was a 2-layer box too!!), with approving "ummm"s coming from everyone!

Pressure Technologies (LON:PRES)

Share price: 275p

No. shares: 14.4m

Market Cap: £39.6m

This engineering group mainly supplies the oil & gas sector, so as you would expect the shares have dropped. The speed & severity of the fall is astonishing though, and I am wondering if this might be a good potential recovery stock, for when the oil price recovers?

Property acquisition - today the company announces that it has bought the freehold land & buildings used by its core business, Chesterfield Special Cylinders, for £3.36m.

That doesn't sound like something a company in trouble would do. Looking at their last balance sheet (dated 27 Sep 2014) it looks strong to me. Net current assets are £18.0m, nearly half the market cap, which includes net cash of £5.9m, plenty to cover the purchase of this freehold property. The current ratio is a very healthy 2.01, and negligible long term debt.

My opinion - this is looking interesting in my view. It's a given that the newsflow is likely to be negative for a while, maybe all of 2015 and into 2016, as customers cut both capex & operational spending, which is bound to impact this company considerably. However, with the shares already marked down savagely, I wonder if the bad news is already in the price?

Who can tell, it's educated guesswork really when a sector is in such a state of flux as oil & gas is right now. Arguably you could say that all small cap investing is educated guesswork, as so many things happen which are unplanned at smaller companies.

It's nice to be able to buy at 275p today, when the company raised £10.7m in fresh cash for an acquisition at 575p per share in Mar 2014. Who knows what will happen next, but I suspect these shares may not be too far from the bottom, possibly? It just depends how the market will react when the inevitable forecast downgrades & profit warnings flow through. Maybe it's better to wait, in the hope of getting a better bargain later this year?

A few quick comments now, as time is running out;

Finsbury Food (LON:FIF)

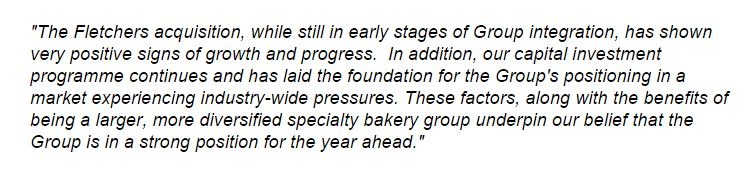

A trading update today reads positively, although no mention is directly made of performance against market expectations, which is a rather annoying omission. Instead a rather more fuzzy outlook statement is given;

Organic sales growth was 5.6%, and an acquisition has further boosted total sales growth in the six months to 27 Dec 2014 to 24%. Mention is made of consumer markets being "challenging". Cost cutting and efficiency gains through capex have negated cost inflation, so that operating margins have improved.

All in all it sounds quite good. My friend Edward Roskill gave an excellent and quite detailed explanation of the investing appeal of Finsbury Foods in an audiocast with me in Oct 2014, for anyone interested who hasn't already heard it, the link is here.

Valuation looks very reasonable - a fwd PER of only 7.2, and a 4.5% dividend yield. Plus a StockRank score of an impressive 97. Although one should bear in mind that a food manufacturer is not going to be on a premium rating, but there might be scope for this to go somewhat higher perhaps?

Communisis (LON:CMS)

Trading in 2014 was in line with the Board's expectations, which one assumes will be similar to market expectations.

Net debt is reported at £36m at year end.

No outlook statement is given.

My opinion - The shares look reasonable value, on a PER and divi yield basis, but the PER should be low, because the company has a very weak balance sheet - with heavily negative net tangible assets, and too much debt.

A lot of investors just ignore balance sheets though, so maybe there will be buyers for the shares anyway? I wouldn't want to be holding this stock when the next Recession is looming - as it's cyclical in nature, and the weak/indebted balance sheet would probably trigger a nasty fall in share price in those circumstances.

Brady (LON:BRY)

This software company for the energy sector traders, has issued a bullish trading update today.

For 2014 they traded in line with expectations. Cash is "significantly ahead of expectations", and 15 new contracts were won.

The valuation looks about right to me at 83p per share.

Conviviality Retail (LON:CVR)

H1 results (to 26 Oct 2014) are out today, with a Xmas trading update.

The H1 results are flat against last year, at the operating profit level. The operating margin is small, at just 1.8%.

The balance sheet is middling, but only has about £11m in net tangible assets. The trade creditors seem to finance the business, rather than the bank, which is nice, as trade creditors don't charge interest or arrangement fees!

Xmas trading is described as being in line with expectations. LFL sales growth was only 1.2%, which is probably only just enough to cover cost inflation.

My opinion - this is a low quality business, with a fat divi yield as the main hook to interest investors. That said, I prefer their franchised business model to an own store business model. So it's really a glorified wholesaler to largely independent retailers.

It doesn't appeal to me.

Beale (LON:BAE)

Things were never going to end well at this moribund department store minnow. The 29.7% shareholder, Panther Securities has bid for the whole of Beale, but at a substantial discount to the market price. It's very rare for such a situation to arise, but basically Panther has Beales in a financial headlock due to providing it with loan financing, and also being the landlord of 11 of its shops!

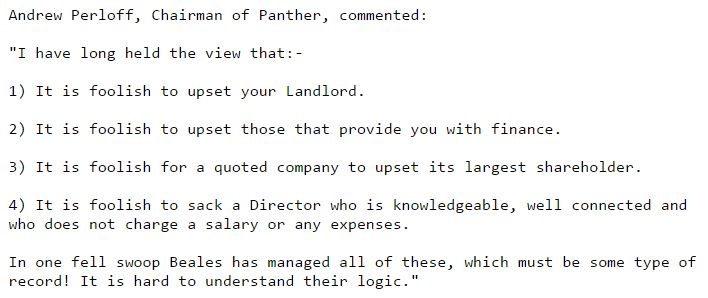

There was a bizarre, and tetchy/menacing RNS from Panther in Jul 2014 where it made clear its displeasure with Beale removing Panther's representative on the board. Andrew Perloff, Chairman of Panther, commented in that RNS;

Clearly their patience has run out, and I don't blame them. It looks as if Beale management were over-playing their hand, indeed being foolish.

Panther has called time, and today launches a formal bid for Beale at a 48% discount - just 6p per share.

My opinion - I think Panther are being generous offering 6p per share. You'd have to be pretty daft to buy shares in this old, tired retailer with terrible finances. One look at the accounts makes it abundantly clear that this was a zombie company, where the equity really only has token value for control.

I would imagine it will be restructured, possibly as a pre-pack, in private hands. They would be better off turning the stores into giant Primarks I think.

Alliance Pharma (LON:APH)

Profit for 2014 are reported as in line with market expectations.

Net debt came down to £21.1m at year end.

It is evalutating a number of acquisition opportunities, and has £24m of spare bank facilities available.

My opinion - this stock never really goes anywhere, so there must be lots of stale bulls in it. Hence I suspect any rise in share price would probably be limited in scope and duration.

It looks priced about right for a fairly dull investment.

Centaur Media (LON:CAU)

There's an in line trading update here for 2014. The tone sounds positive, and unusually the company indicates today that 2015 is expected to be ahead of current market expectations. Looks potentially interesting. The divis are good here too.

Phew! I've definitely earned a Peroni or two after this mammoth report!

Back in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in PMP and PRES, and no short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.