Good morning,

For Paul's report today covering Revolution Bars (LON:RBG) and £G4M, click here.

For yesterday's report, click here. Yesterday's report includes all of the following:

- Churchill China (LON:CHH)

- Indigovision (LON:IND)

- Staffline (LON:STAF)

- Interquest (LON:ITQ)

- Bloomsbury Publishing (LON:BMY)

- Mothercare (LON:MTC)

And now for the contents of this report:

Just Eat (LON:JE.)

- Share price: 611p (+3.3%)

- No. shares: 679m

- Market cap: £4,150m

JustEat/Hungryhouse merger referred for in-depth investigation

I could talk at considerable length about the economic reasoning behind this, but in straight investment terms this RNS confirms that Just Eat shareholders will probably have to wait for several more months for this investigation to conclude.

The Competition and Markets Authority (CMA) has found that Just Eat and Hungryhouse "are close competitors because of the similariy of their service and their broad geographical coverage".

Apparently, Just Eat has not offered ways of addressing the CMA's concerns (I wonder if it made an attempt to do so, or if it decided there was no point?), and so a CMA panel will have until November to reach a decision.

As investors, we benefit by finding companies which have a long-term competitive advantage. One of the ways of addressing competition in the short-term is to merge. It doesn't prevent new entrants from appearing at a later stage, but it can shore up the competitive position for the time being. And takeover deals can represent a win for the owners of the target companies, too, who are happy to cash out.

So it's frustrating that this deal is being delayed. I'm continuing to sit on the sidelines, but would love to see a clear buying opportunity open up in these shares.

Johnston Press (LON:JPR)

- Share price: 15.625p (+6%)

- No. shares: 106m

- Market cap: £16.5m

Trading for the full year (to December 2017) is still expected to be in line with expectations.

And these numbers cover the period to the end of April 2017:

Total revenues for the period, including the i, were up 0.2%; excluding the i, total revenues were down 12%

Digital advertising revenues (excluding classified) were up 10%; including classifieds, digital revenues were up 3%

Checking back, I see that the acquisition of the i newspaper was completed on 11 April 2016, so the 0.2% revenue growth number mentioned above is not really relevant to anything.

Revenues from continuing operations for the whole of 2016 fell by 6% (adjusted) or 8% (statutory), so today's 12% like-for-like reduction doesn't offer much optimism of a turnaround to me. With the shares price up, I guess investors must be focusing on the 4% sales growth number at the i?

A note of caution is included, which is really just a confirmation of an ongoing secular trend:

The Board notes that trading conditions for regional newspapers in the UK remain challenging and, while encouraged by improving trends across the Group, the management team continues to take actions to manage its costs tightly.

The main event, the AGM, is on Monday, and with activist Crystal Amber now owning more than 20% of the shares, some speculation on the message boards suggests that change might be afoot in terms of Board structure/deal strategy.

From the annual results in March, I see that net debt is at £204 million, versus an operating profit (excluding impairments and write-downs) of £21 million.

£220 million in Senior Secured notes are coming due in June 2019, so the company probably needs to come up with a refinancing solution now, in good time, rather than letting things drift and ending up in a situation which is out of its control.

There are some serious negotiations required here to reconcile the various interested parties, and I don't think this is investable without some sort of special insight into how the negotiations might play out. The position of current equity holders could be very seriously reduced, and from the outside looking in, it's anyone's guess as to how much it could be reduced by.

Future (LON:FUTR)

- Share price: 206p (+14%)

- No. shares: 36.6 million

- Market cap: £75 million

Thanks to andrea for requesting this, as I might otherwise have missed it.

Future is a media business with a large collection of magazine titles, an e-commerce division and an events business.

It owns PCgamer, techradar, Total Film, SFX and over a hundred other titles based on interests and hobbies (tech, games, music, film, science, etc.)

After a bunch of profit warnings in recent years, it now appears to be functioning well again, from a financial point of view.

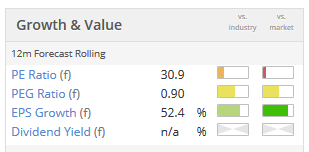

Some of the highlights I've picked out from the results:

Media division revenue up 23% to £16.2m (2016: £13.2m)

Magazine division revenue up 45% to £24.7m (2016: £17.0m), driven by the acquisition of Imagine Publishing and strong UK performance in subscriptions

Adjusted operating profit increased by 375% to £3.8m (2016: £0.8m), more than the £2.8m achieved in the full year FY16

Adjusted operating cash inflow of £6.2m (2016: £2.6m) with cash conversion of 129%

The increase in magazine division revenue is primarily due to the acquisition mentioned above, but there is underlying growth even excluding its effects.

The outlook is positive, with H2 trading "expected to be slightly ahead of the Board's expectations."

Some of the growth numbers in the statement are superb, e.g. 18% growth in the group's online audience to 53 million, audience growth at techradar of 29%, and organic revenue growth at PCgamer.com of 81%.

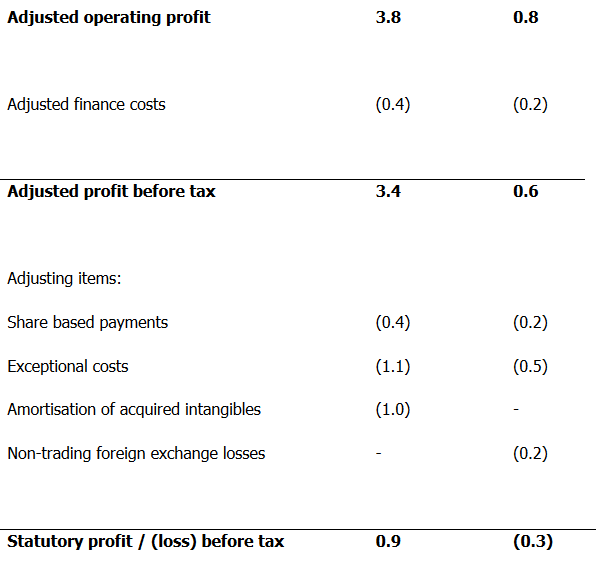

The adjusted profit numbers are reconciled against the statutory numbers as follows:

There is a leap of faith required here - not a huge one, but a leap of faith nonetheless.

The adjusting items are all real, the question is whether we trust them not to be repeated (exceptional restructuring and redundancy costs), or at least to be unimportant (the amortisation of price paid for acquired intangible assets).

I'm leaning toward the view in this case that the adjusting items do deserve to be added back in, to get a view of the company's future earning power (with the exception of share based payments, which should never be added back). So I could optimistically agree that adjusted PBT for the six-month period was close to £3 million.

Note that it is carrying £10 million in gross financial liabilities, which i would add to the market cap to treat it on an enterprise value basis.

There are also significant trade payables but these are mostly in the form of deferrals and accrued income - customers paying an advance for the company's content, basically. So that's not something I'd worry about in terms of solvency.

Overall, then, it seems a reasonable proposition at a £75 million valuation. If growth trends continue, and the adjusting items start to drop out, that could easily seem cheap in a few years.

Safestore Holdings (LON:SAFE)

- Share price: 437p (+3%)

- No. shares: 209 million

- Market Cap: 913 million

I don't particularly want to talk about Safestore Holdings (LON:SAFE), but just to highlight this as a marker for where we are economically.

Five years ago, Safestore Holdings (LON:SAFE) issued USD bonds at rates of 5.8% (7-year bond) and 6.7% (12-year bond).

Fast forward to today and they are being replaced with:

- EUR 7-year note at 1.6%

- EUR 10-year note at 2%

- GBP 12-year note at 2.9%

If these were rates on government paper, they would be quite unattractive in my book.

But they aren't government paper, they're notes on mid-cap equity!

Granted that Safestore Holdings (LON:SAFE) is a much more solid company than most, the paltry interest rates on offer help to demonstrate that the bond market is not somewhere you can go for an attractive return (by historic standards).

These low interest rates have created a false environment where the hunt for yield has forced many investors further up the risk spectrum than they would otherwise be, in the hunt for yield, and I don't know if it can last forever.

As mentioned previously, I'm not someone who wants to try to time the market or jump into cash out of fear, but I'm increasingly satisfied with my strategy to allow cash to passively build up in my portfolio for the time being.

This strategy works best for me, in terms of striking a balance between maintaining my existing investments and my heavy long-term equity exposure, while also accumulating some buying power in the event of a correction. Everyone has their own time horizon and risk tolerance, and a different strategy might work for you.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.