Good morning!

EDIT: apologies, I'm running late today, and just lost two whole sections I'd written but not saved, arrgghh!! So have to recreate that again from scratch.

Quite a nasty day today - I see the FTSE 100 Index (FTSE:UKX) is starting with a 5 again, at the time of writing. It's always worthwhile checking what the other indices are doing, because the FTSE100 is a false comparison for many investors, due to its excessive weighting in resources stocks.

Sure enough, whilst the FTSE100 is down 2.1% today, the Small Caps Index (I use SMXX) is only down 0.5%, and the AIM All Share Index (AXX) is down 0.7%. So whilst the large indices might look bearish, the smaller companies end of the market is doing alright. In particular, look at this comparison of the three indices over the last 6 months, to see the striking under-performance of the resources-laden FTSE100 (the lower, dark blue line), compared with Small Caps and AIM:

I've no idea what these indices will do in future, but so far anyway, small caps have had little more than a modest correction after a good bull run.

I remain of the view that consumer-related shares are the best area to be in, so I'm generally trying to keep my focus away from industrial or resource-related companies.

Volkswagen

This is a huge scandal - off the scale - VW has admitted that some of its cars are fitted with a software cheat which recognises when the car is having its emissions checked, and then makes adjustments to improve its emissions temporarily.

Its shares have gone into freefall, down 19% today, at the time of writing. This got me thinking - surely VW won't be the only company to have done this? Are they uniquely devious? I find that difficult to believe. Maybe other companies have been up to the same trick?

So I'm wondering if this might be a good time to whack on a basket of shorts on car maker shares, as there could be more stuff to come out of the metalwork possibly?

Boohoo.Com (LON:BOO)

Share price: 30.5p (down 1% today)

No. shares: 1,123.1m shares

Market cap: £342.5m

(at the time of writing, I hold a long position in this share)

Shorting attack - some readers may have noticed that Tom Winnifrith has decided to sink his bear teeth into online fashion retailer, BooHoo. I am rather cross about this, as it's my biggest conviction long position in the market at the moment, and I think the company's fundamentals are superb, and the shares are a reasonably priced GARP stock.

Also I wasn't too happy about Tom blowing a hole in mine & friends' portfolios, as the share price has dropped about 10% since he began publishing negative comments. So I sprang to the defence of the company last night, and wrote a rather rambling reply to Tom's article, and much to my surprise see that he has re-published my comment as a standalone article on ShareProphets. I wasn't aware he was going to do that, but have no objection. Also, kudos to Tom for encouraging bull-bear debate, which I also think is important.

This is worth expanding on actually. I welcome civilised bull-bear debate, indeed I like to think about the bear case on every stock before I consider the bull case. There are plenty of occasions where bears have saved me money by pointing out serious flaws in companies that I had invested in ( Tungsten (LON:TUNG) springs to mind), and by listening to them, thinking about their arguments, and then recognising that they are right and I was wrong, then selling my shares, a bad situation has been salvaged, and a disastrous situation avoided.

So I have engaged with Tom, and rebutted his arguments very easily actually - as there was nothing of substance at all in his attack. In particular he seems to have got it into his head that BOO makes super-normal profit margins, citing its 60% gross margin. However, a 60% gross margin is normal in fashion retail, and translates typically into a 0-10% net profit margin, due to the high fixed costs.

Some people mistakenly think that online fashion retailing is hugely profitable, but actually it isn't. The high fixed costs of a chain of retail outlets are instead swapped for the huge marketing spending needed to drive customers to your website. Plus the cost of a busy website, and a gigantic warehouse. So actually, the net margins from online fashion retail are suprisingly modest - e.g. the most most successful UK player in this sector, ASOS (LON:ASC) only achieves a net profit margin of about 4%, which is pretty lousy actually!

Mind you, Asos sells mostly branded goods, so the maker & brand owner are taking out profit margins before the stock gets to Asos. BOO has a superior business model, in that it sources products direct from the factories, and they are all own-branded (i.e. "BooHoo") product. So it collects in multiple margins - mainly the biggest one, the retailing margin, but also the wholesaler margin, thus giving it strong gross margins, despite offering customers extremely low selling prices.

The idea that it would be easy to replicate a successful online retailer like BOO is extremely naive in my view. There may be few barriers to entry, but there are huge barriers to achieving scale & profitability, which is precisely why so few have managed it, despite many trying.

Also bear in mind that the existing High Street fashion retailers nearly all have transactional websites too. So this is a very crowded space. There's little room for new entrants, and the net margins are too tight to attract many new entrants.

BOO results are out a week today - 29 Sept, so in my view this ill-conceived shorting attack is presenting a nice buying opportunity ahead of what are likely to be good results - both Investec, Peel Hunt, and quality tip-sheet SCSW have put out notes recently which seem to have been given a steer by the company that it is trading well.

Tom reckons he's got hold of some dirt on the company - some confidential documents which show the company in a poor light apparently. I'm in two minds about this - whilst any wrongdoing should be exposed, I don't agree with confidential company documents being made public unless there is some public interest aspect to it. I expect every company in the land has stuff on their email servers that they wouldn't like to be made public!

Having worked in the sector myself for 8 years, I know that the rag trade is a place where some people do push the boundaries shall we say - e.g. they will substitute cheaper zips, or lower the quality of the product below what was specified, if they think they can get away with it. So the onus is on each company to check everything carefully, and only do business with people that you know are trustworthy. That's especially true when you're buying from overseas.

Anyway, as things stand right now, the bear case has zero credibility in my view, so let's see what the interim figures look like next week, and let the numbers do the talking!

However, I do hope that people in bulletin board land will take note that this is the correct way to hold a bull-bear discussion - civilised, and discussing the facts & figures, not personalities or perceived track records of the people involved, or descending into personal abuse against the person raising the bear case. Once people become abusive, it just shows that they've lost the argument in my view. Which is why I heavily toned down my original reply to Tom last night!

I can understand why people might attack the valuation of Ocado (LON:OCDO) or ASOS (LON:ASC) which are still way too high. Yet why anyone would attack the only reasonably-priced company in the sector, which also makes the best net profit margin, is quite beyond me! Still, that's what makes a market. There's no way I'm going to be scared into selling my shares (a key modus operandi of shorters remember - shaking out the loose holders using fear as a tactic!), on such a flimsy (non-existent really) bear case.

Obviously DYOR though, and if anyone agrees with the bear arguments, then please feel free to air your views in the comments below. I won't bite your head off! Bull-bear discussion is useful & improves decision-making, in my opinion. Shutting it down is folly, which is why I rarely engage with rampaging bulls on bulletin boards these days, other than when I fancy some sport, poking them with a stick, late on a Saturday night!

Regenersis (LON:RGS)

Share price: 148.5p (up 3.8% today)

No. shares: 79.0m

Market cap: £117.3m

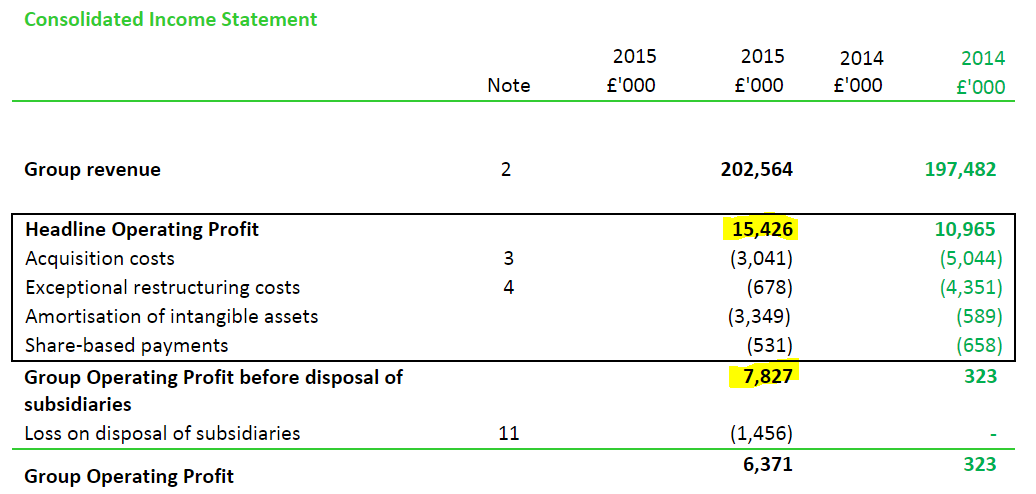

Results year ended 30 Jun 2015 - the figures here are always overly-complicated, which is basically done in order to paint a rosier picture than would be the case on standard published profits. The company has invented its own definition of profit, called HOP (Headline Operating Profit), which excludes loads of stuff, e.g.;

As you can see the adjustments going up from Group Operating Profit to HOP, are highly material - increasing the reported profit by more than double for 2015, and by a factor of 34 times for 2014.

I think the accounting looks very aggressive, such that HOP is almost certainly over-stating what I would consider reasonable. Take the £3,041k classified as "Acquisition costs" - following it through to note 3, which says;

Acquisition costs relate to the M&A activity within the year, with the most significant relating to the acquisition of SafeIT and additional investments in Xcaliber and Blancco sales offices.

To my mind, opening new sales offices for a company that you recently acquired, is not a cost of acquisition. It's a normal operating cost, post acquisition. So that figure looks inflated (to boost HOP).

There are more restructuring costs, although nowhere near as much as last year. We don't really know what costs have gone into that figure. It could just be a soft code, to dump other costs into, who knows?

The amortisation of intangible costs of £3,349k - no breakdown is given, so I can't tell if this only related to goodwill, or whether it relates to costs which are being capitalised into intangible assets in order to boost profits. The cashflow statement shows £4,749k was freshly capitalised in the year under "Purchase and development of intangible assets", so that looks to be a material cost which is by-passing the P&L.

Overall, I don't buy this HOP figure - it looks like creative accounting to me, it's too aggressive, and not something I would rely on as a genuine profit measure on which to value the business.

Balance sheet - looks OK.

Writing off intangibles gives NTAV of £12.5m.

Current ratio - reasonably OK at 1.30, but note that trade creditors seems quite high, so might include some deferred income (which reflects cash paid up front by customers).

Cash of £12.1m outweighs bank debt of £4.4m. Although note there is also a bit in contingent consideration liabilities, totalling £5.7m. Overall this looks OK to me, as it's still in a net cash position after including contingent consideration + bank debt.

Dividends - looking useful now, with total divis for the year of 5.0p (up 25%), yielding 3.4%

Strategic update - this is the most interesting part of the announcement. Reading between the lines, it seems to me that the existing strategy hasn't really worked, so they're going to try something else.

Hence what they are calling the "Aftermarket Services" division, which seems to be a collection of low margin electronics repair businesses in various countries, might now be sold.

Any such sale would reposition the Group as a pure-play software business and enable a significant distribution of cash to shareholders.

I wonder how much they might be able to sell it for? I doubt such a business would attract a high valuation, but the intention seems to be to achieve a higher stock market rating for the other part of the group, the software bit, which is mainly the data erasure company it bought last year called Blancco. Note that this acquisition was funded through a £100m Placing at 345p per share - the current share price is down 57% from that, in just 18 months.

I'm amazed that they managed to get that Placing away in Mar 2014, given that Matthew Peacock had just trousered £17.5m by selling 5.8m shares at 300p a couple of months earlier, in Jan 2014. It pays to follow the big Director buys & sells with this lot!

Anyway, the software division looks high margin, and could be an interesting growth area.

My opinion - a friend who knows management here told me that they are "Clever financial engineers, but useless managers!". So I put them in the same category as management at Vislink (LON:VLK) - another similarity being that both sets of management have perfected the art of removing large amounts of money from the companies for themselves - see this fascinating expose of how this has been done at Regenersis.

So it's very much a case of swimming with sharks I think - great care has to be taken, but it can be an exhilarating ride if you know when to get out! (which is easy, just run for the exit when Matthew Peacock sells a large tranche, as it'll be downhill from then on).

So is Regenersis about to get interesting again? Quite possibly. It looks like it's being prepared for a re-birth, morphing into a high margin software group, which will then be promoted heavily at investor events no doubt, with the new story being more exciting than the last one, getting the share price up nice & high so that the Institutions can be persuaded to do a big placing for more acquisitions. So it could be an interesting ride for private investors too, depending on how much they manage to sell the legacy business for.

Pittards (LON:PTD)

Share price: 103.5p (down 20% today)

No. shares: 10.1m

Market cap: £10.5m

Interim results to 30 Jun 2015 - these have gone down like a lead balloon, with the shares off by 20% today. It's not one I currently hold, as luckily I chucked it out on a period portfolio tidy up a while back, to get rid of low conviction stuff.

The company did a Placing & Open Offer in May 2015, to raise up to £5.8m before expenses, at 120p per share, which was to part-finance the purchase of its freehold premises in Yeovil, and for general working capital purposes. Pittards is a maker of leather goods, such as gloves.

- Revenue in H1 was down 10.3% to £15.6m

- Margins improved from 19% to 22%, due to favourable forex movements

- Profit before tax was £555k (up 72%, but on a small base number of £322k)

- Diluted EPS for H1 rose 38.7% to 4.26p.

Overall then, the P&L looks half decent, compared with last year anyway. So why have the shares tanked today? It's because of this:

Outlook - oh dear, this all sounds rather depressing;

The current order book is below our expectations and reflects the lower level of demand that has become evident during July and August. This trend was confirmed at the major international trade fairs attended recently, where it was clear that activity levels in the leather industry are currently depressed and likely to remain so in the medium term.

As a result of the factors explained above, sales and profits in the second half are expected to be below market expectations.

Looking further forward, a number of new opportunities are starting to appear and these could begin to have an impact in the second half of 2016.

We are in the process of reviewing our strategy for the next three years to validate, and, where appropriate, reset our priorities. Consequently, we anticipate continuing to make substantial investments in people and training, during 2016, in order to facilitate the delivery of our strategic priorities to meet our customers' evolving needs and deliver superior shareholder value in the longer term.

So that's a double whammy - poor outlook for sales & profits, and having to absorb "substantial investments" to meet customer needs. Given that the starting point was not a very profitable company, I wonder whether it will be making any profit at all in future?

Balance sheet - this looks solid, but extremely inefficient - just look at the level of inventories, at £18.4m. That compares with £12.2m cost of sales on the P&L for H1. So in other words, it's carrying about 9 months' worth of sales in stock. That looks crackers to me! Perhaps it is necessary for some kind of ageing processes for the leather, but I don't really care - it's just a highly inefficient use of capital. The company's paying interest on its debt to fund those inventories, so it comes at a cost to shareholders to be this inefficient.

Net tangible assets are £23.6m, and it looks like that will be generating a negligible return for the time being.

My opinion - I think shareholders need to shake things up here. This company clearly needs a huge sort out - or just shut it down & return the capital to shareholders maybe? What's the point in keeping all that capital tied up, for no return?

New management are needed, in my view, with a new strategy to take the company forwards, selling higher margin products, and to drastically reduce levels of stock, and thereby clear the bank debt. I won't be revisiting this share unless & until there's a more convincing strategy to make some money & pay divis - it doesn't appear to have paid anything to shareholders in the last six years, so what's the point in the company existing, other than to provide work for its employees and Directors.

However, the big discount to NTAV is likely to attract value investors, so the downside from here may not be that bad, who knows? The Stockrank is very high at 93, but I imagine that will fall as reduced broker forecasts feed into the data, so it's not something to rely on.

Previously I had hoped that the former Burberry Director might make a difference here, and who knows that might yet happen in the future, but for now it looks a very uninteresting share I'm afraid. Good thing they got that Placing away before market conditions turned down, eh?! A happy coincidence for the company I'm sure. Not so happy for shareholders who put in the new money though.

Sorry I didn't get a chance to look at the following, am just making a note so we can circle back to them if time permits in future;

Porta Communications (LON:PTCM) - complicated figures as usual, but looks like there is an underlying improvement. The jury is still out on this one, but it's the c.£1m spent by Directors, especially Bob Morton, that suggests to me the company has good long term prospects.

Minds + Machines (LON:MMX)

Cenkos Securities (LON:CNKS)

Swallowfield (LON:SWL)

I wanted to look at these three, but ran out of time/energy, sorry.

See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in BOO and PTCM, and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are just Paul's personal opinions, nothing more. So please DYOR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.