Good morning! I caught up with yesterday's SCVR yesterday evening, so here is the link if you haven't already seen it. Apologies for the outage on Mon & earlier on Tue. So I thought we'd get today's report in early. That reminds me of the joke about America being late for two world wars, so they've decided to be really prompt for the next one!

Topps Tiles (LON:TPT)

Share price: 123p

No. shares: 193.6m

Market Cap: £238.1m

Trading update - this covers the half year to 28 Mar 2015, since the company's next year end is 27 Sep 2015. It only mentions sales, but says nothing about profitability, or trading versus market expectations, so a bit thin on detail.

The top line figure is good though. Sales are up 6.4% to £104m for H1, and LFL* store sales are up an impressive 5.2% - all the more impressive since the 2014 comparative was itself very strong, being 10.2% up on 2013. So very good progress on sales, no doubt about that.

* LFL = like for like - i.e. removing the impact of new stores, and store closures.

Outlook - the company mentions short term uncertainty due to the General Election, but that rising levels of disposable income should help boost home improvement spending. I wonder if there might also be a backlog effect, from people having delayed replacing things like flooring until their personal situation improves?

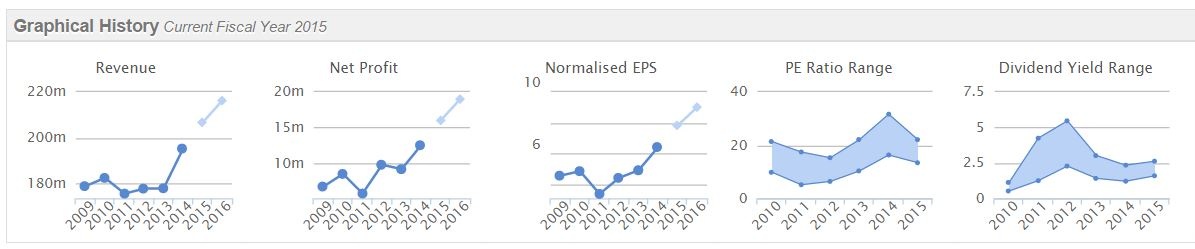

My opinion - I did buy into Topps a while back, when they were around 90p, but banked my profit at about 115p, when it looked fully valued. The broker forecasts already factor in a considerable increase in earnings, and note from the graphic below that broker forecasts have actually been falling over the last year. That seems a little odd to me.

The light blue lines on the first 3 charts below are obviously broker consensus forecasts, so you can see expectations are already fairly ambitious. There could be more upside for the shares, but the key question really is how much is already baked into the share price?

Note the steady decline in broker forecasts for the company over the last year;

I wonder if this means the company is experiencing strong sales, but might be under some margin pressure? Or that sales increases are being driven by increased marketing spend perhaps? It's worth checking out anyway, as usually when strong sales are reported, broker forecasts go up, not come down!

Overall though it looks a good company, that is continuing to trade well, so I could see a bit more upside on the shares, but not enough to tempt me back in.

Plexus Holdings (LON:POS)

(at the time of writing I hold a long position in this share)

Contract win - an intriguing announcement today from this maker of innovative well head equipment. The shares have suffered like all companies in oil services. Today's statement flags a contract win to use their technology for shutting down ageing (and uneconomic?) oil wells. The company says;

My opinion - I bought a few of these shares at slightly below the current price, after reading some interesting research on the company, suggesting that it has very impressive technology. The rating is high, at 23.5 forecast earnings, but this looks a very high quality business, with strong margins and growth.

Maybe with a new market opening up for shutting down oil wells, the impact of the low oil price may not now be as bad as the market feared? This RNS could possibly provide a catalyst for a partial recovery in the share price maybe?

It's much more pricey than I would normally pay for any company, but high margins and good growth, with something unique in product terms, can be an attractive proposition.

Johnston Press (LON:JPR)

Final results - for the 53 weeks ended 3 Jan 2015. Having had a quick review of these results, I remain of my longstanding view that the equity is worth nil. Even after a large fundraising to pay down some of the debt, the company still has a seemingly insurmountable debt burden - net debt was £194.2m at 3 Jan 2015.

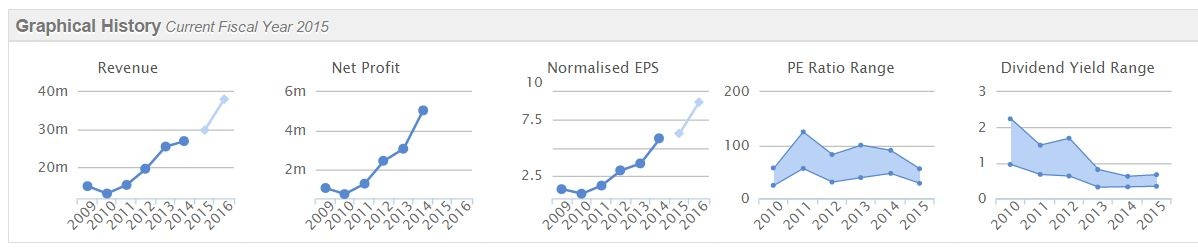

Underlying operating profit has been squeezed up to a very high margin - £55.5m profit on turnover of £265.9m, that's a remarkable 20.9% margin. This is the bizarre thing about this, and Trinity Mirror (LON:TNI) in that everyone knows they are dying businesses, but they're churning out astonishingly high profit margins in the short term. It can't last though, as circulation is relentlessly declining, as indeed are ad revenues. So it's all about stripping out costs & managing decline.

It's true that the interest cost will reduce in future, due to lower rates charged on reduced borrowings, so that helps. However, there will still be some capex, plus tax to pay, and the pension deficit is set to absorb cash payments of;

- £6.5m in 2015

- £10.0m in 2016

- increasing by 3% until

- final payment of £12.7m in 2024

Overall then I suspect it might well look fairly tight as to whether the company can reduce debt fast enough to leave anything for shareholders at the end of it. Say the newspapers take 10 years to wither away until they have to all be shut down? Over that time, will the company generate enough free cashflow to service the pension deficit, and repay £194.2m in net debt? Who knows, but that's the key calculation that shareholders need to work out. Also there is some value in the property estate, which is being rationalised already.

There are no divis either, so overall I think this is a waste of time, with little potential upside from the £180m market cap, in my opinion.

Eclectic Bar (LON:BAR)

Interim results - it comes as no surprise to see this share as the biggest faller of the day, down 34% to 61p. The company makes lots of adjustments, and rattles on a about EBITDA, but bottom line is, it doesn't make any money.

Current trading is poor, and it looks as if students in particularly have fundamentally changed their behaviour, and are not venturing out to nightclubs midweek so much, presumably because they're skint?

Maybe this group will see a benefit from the increased disposable incomes mentioned by Topps Tiles above? I wouldn't write it off completely, as the market cap is down only about £8m now, at 62p per share.

The balance sheet worries me though - a current ratio of 0.76 looks very weak, and I note £3.3m of "other financial liabilities" in long term creditors.

It just looks a very weak proposition in my view - tough trading, no real profits, and a weak balance sheet. Judging by poor performance since floating, It certainly looks as if the vendors who floated this sold the stock market a pup.

Moss Bros (LON:MOSB)

Preliminary results - I can't fathom why this share is anywhere near as high priced as this. Basic EPS was up about 10% to 4.02p, so at 107.2p the PER is a staggering 26.7 times.

Bulls say, ah but the cash pile is large. It is, but the company is spending it on store refits, and financing high divis that are not covered by earnings. So the divi yield is not sustainable at 5.2%, and note that net cash fell from £28.3m to £19.6m in the year.

In my view a price of 60p per share would be quite generous, so at over a quid, it remains in my "I just don't get it" tray.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in POS, and no short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.