Good morning/afternoon!

I'm running a bit late today, so please refresh this page, as I'm adding to the article throughout the afternoon. I've been dog-sitting for friends in London over the weekend, and there have been a few accidents, so I'm now expert at carpet cleaning!

Dialight (LON:DIA)

Share price: 488p (down 11% today)

No. shares: 32.5m

Market cap: £158.6m

Interim results to 30 Jun 2015 - this industrial LED lighting company warned on profits on 10 Jun 2015 - which I reported on here. In that update the company said 2015 profits would be significantly below market expectations, but didn't quantify how much. I concluded at the time that Dialight seemed "a can of worms, with possibly more bad news to come out", which looks to have been a sensible conclusion.

Results today look bad. Key points:

- Turnover for H1 rose 14% to £86m

- Underlying operating profit collapsed - down 74% to only £1.7m

- Underlying EPS only 5.4p

- Interim dividend has been passed

- Moved from net cash into net debt, of £8.0m

Balance Sheet - overall this is still strong, but the main item which has consumed cash, and caused the move into net debt, seems to be a big increase in inventories, up £12m compared with a year ago, but up £4.1m in the last 6 months.

Significantly rising inventories is a red flag, so would need looking into, as it could be a precursor to a write-off of obsolete stock at the year end perhaps?

A useful check is to see what the stock turn is like. In this case, cost of sales from the P&L for the 6 months was £61.1m, so I would expect there to be no more than say 2 months' sales in stock, so about £20m, and hopefully less. However in this case, stock is much higher, at £36.5m. So that is certainly a concern.

Given that there is a new CEO conducting a strategic review (results to be announced in Oct 2015), then there has to be a heightened risk of him doing a "kitchen sink" job, and make a big provision against slow moving stock perhaps?

The net debt positions doesn't look to be a problem - the company says it has headroom on its banking covenants, and in any case I imagine the bank would be fairly relaxed, given the overall balance sheet strength, so I'm not worried over net debt, at the moment.

Operational problems - so why have profits dropped so much? Problems with the oil & gas sector are mentioned, but also internal problems:

The Group has previously reported during H1 2015 that it was incurring a number of operational inefficiencies at our principal plant in Mexico. We have also identified issues with platform product design, design for manufacturing and global commodity management. A team has been selected from the best operations resource within the Group to relocate to Mexico to remedy the issues identified.

This is a worry, because surely these problems are fairly basic issues when running a company? Therefore I can only conclude these issues are down to poor management, which might take a while to sort out.

Outlook - there are various positive remarks in the narrative about the opportunities available, etc, but the most specific remarks sound rather mixed to me:

There is an increase in the number of new sales opportunities in our H2 2015 pipeline, however there is uncertainty remaining on the timing of projects. We are not anticipating any recovery from the oil and gas sector in the balance of the year. The focus for the sales teams will be on our other target vertical markets. Operational issues remain in the Group, although a number of actions have begun to remedy them.

Dialight has a very strong brand, notably in the US market that has been built on products that stand apart from the competition and there is still an immense global market opportunity.

Therefore it sounds to me as if there could possibly be one more profit warning left to come, later this year perhaps? That's just a hunch.

Valuation - Broker forecast consensus of 31.5p EPS for 2015 looks pie in the sky, given that H1 was only 5.4p, so it would require a heroic improvement in H2 to achieve that. Although H2 historically has been stronger than H1.

So I imagine 2015 forecasts are likely to come down again, possibly quite a lot? I wouldn't want to hang my hat on anything more than say 10-15p full year EPS.

So how do you value the company? It's difficult, as it depends entirely on whether, and how much, you think the company can recover in future. This might be a one-off bad year, with improved performance to come next year & thereafter perhaps? Or this lower level of profitability could be the new normal? We don't really know at this stage. Therefore valuing the company involves quite a bit of guesswork - not something that appeals to me, and I would always err on the side of caution.

My opinion - the share price still looks too high to me. Also with divis now gone for the time being (they say divi policy will be decided in the strategic review), it's less attractive to tuck away and await recovery.

Personally I'd only be interested in taking a risk on this company if the PER was in bargain basement territory, which it really isn't at the moment. My worry is that the company might be facing more lasting problems, with increased competition & hence pricing pressure, which is alluded to in the narrative.

So it's not for me at this level. If the share price were to halve from here, then I'd take a closer look. The 2-year chart is showing an unrelenting down trend, of anaemic recoveries interrupted with profit warnings. It doesn't sound to me as if the company is out of the woods yet, based on today's announcement. What do you think? Comments in the comments below please.

EDIT: I see Dialight (LON:DIA) shares have dropped further, now down 16% on the day at 460p. They've got further to fall too, in my view.

MYSL

Share price: 46p (up 15% today)

No. shares: 150.6m

Market cap: £69.3m

(at the time of writing, I hold a long position in this share)

There are 3 announcements today from this company, as follows:

Chairman appointed - Iain McDonald (stated to be a former top ranked retail & e-commerce analyst) takes up the Non-Exec Chairman role.

Director buy - the Non-Exec Chairman (above) has spent £27k buying shares at 44.9p. Interesting, but not a significant amount of money. I see Director trades increasingly as red herrings these days (unless serious amounts of money are involved), since they are so often just done for show.

(Note that the CEO of MySale spent £3m buying stock at 80p, eight days after a previous profit warning, which clearly wasn't a very smart move.)

More interesting is the new Chairman's share options package (unusual for a Non-Exec to get any share options), which certainly gives him a big incentive to help push the share price up substantially, as then some big in-the-money options will vest, as follows;

Alongside his appointment, the Company has today granted Iain McDonald 3,000,000 options over the ordinary share capital of the Group each with an exercise price of 53p (the "Options"). 1,000,000 Options will vest when the Group's share price reaches £1.50, a further 1,500,000 shall vest when the Group's share price reaches £2.26 and a further 500,000 shall vest when the Company's share price reaches £2.75.

Trading update - it looks as if the company's previously poor performance is starting to turn around;

In the year under review Group revenue grew by 5% to approximately A$235 million [PS: about £110m] and for the second half of FY2015 EBITDA was breakeven. As previously announced, following the challenging first half to the financial year, the Group took action to improve Gross Profit margins, and a reorganisation to reduce fixed costs. As a result the Group has seen momentum build during the second half which resulted in the Group returning to underlying EBITDA profitability in the fourth quarter. During the second half, management has increased the proportion of own-buy activity and investment into inventory to improve brand selection and increase gross profit margin.

That's quite a good turnaround, as looking back at the last interim results, it looked a bit of a basket case, making an underlying EBITDA loss of AUS$11.4m (about £5.4m) in H1, so to get to a run rate of breakeven/small profit in Q4 looks quite good - although seasonality might play a part in that - most sales are made in Aus/N.Zealand.

Balance sheet - this was strong at the last interims, and the company today says it has A$40m cash. This is well down from 6 months ago, but they say that is due to buying in more stock (previously it took in surplus stock on a sale or return basis).

Outlook - this sounds quite positive;

The Group anticipates that the positive momentum of the second half FY2015 shall continue into the current financial year with increasing revenues, improving gross profit margins and careful control of costs delivering an expected return to EBITDA profitability in the coming year.

My opinion - this company has, so far, been a big disappointment for shareholders. Performance has been poor (little growth, and increasing losses), and it was far from clear that the company had a viable business model at all.

I think today's update changes things. Sure, it's not properly profitable yet (hence them mentioning EBITDA), but it has plenty of cash, and seems to have a much better strategy now, to keep a lid on costs, and improve margins by buying in stock, rather than taking in the dog-ends from other fashion retailers.

This very much chimes with my experience in the sector - my former employer in the 1990s, called Pilot, opened a handful of factory outlet shops, which were initially a disaster, because they were just clearing dead stock, often at below cost price. I remember being horrified at the losses when doing the management accounts.

However, the buyers then hit on the idea of supplementing dead stock with specially bought-in ranges, which were still bargains for the customers, but had a much better gross profit margin. The impact was astonishing - suddenly the biggest loss-making shop became the most profitable shop (out of about 100) in the whole chain. Not only was the margin much better, but the more appealing bought-in stock ranges also drew in far more repeat customers too. So a double bonanza of much higher sales, at much higher margins.

It sounds to me as if MySale have come to exactly the same conclusion, and are already benefiting from this effect. For this reason, I think this share is now potentially interesting, as a GARP share (growth at reasonable price).

Strengthening the Board, and dangling some lucrative options in front of the new Chairman is a potential catalyst. Remember that Philip Green (retailing mogul extraordinaire!) owns 22.1% of the company (through Shelton Capital), and Mike Ashley (sportswear retailing mogul!) owns 4.8% through Sports Direct. So whilst no guarantee of success, having those guys behind you will certainly be a deep pool of experience & I imagine ear-bashing for the CEO by telephone, if the strategy isn't right.

It's clearly still a very speculative share, but the signs are starting to appear that it might actually get somewhere, in my view. So since the valuation is cheap for an internet retailer, and it has cash in the bank, then I think this could be an interesting, albeit speculative, recovery stock.

There's an article in today's Evening Standard which gives a bit more info, and suggests that Green & Ashley have been helping guide the strategy back to something more commercially viable.

Take a look at this chart - yet another IPO that went disastrously wrong. Makes you wonder why anyone buys IPO shares, since the failure rate is unbelievably high. Memo to brokers - if you keep floating over-priced junk, then sooner or later you won't have any buyers.

XP Power (LON:XPP)

Share price: 1599p (down 0.2% today)

No. shares: 19.0m

Market cap: £303.8m

Interim results to 30 Jun 2015 - key points;

- Revenues up 7.4% to £53.9m for the 6 months

- Operating margin fell 90 bps to 23.6%

- Hence profit before tax only rose 3.3% to £12.6m

- EPS fell 0.8% to 50.1p, due to higher tax charge cf last year

- Interim divi up 2p to 27p

- Order intake up 11%

- Acquisition of 51% of S.Korean company

Outlook - sounds positive, although I don't see any comment on profits vs market expectations:

While the global economic outlook remains uncertain and exchange rates are volatile, following a strong first half, the second half of the year has started well and we are encouraged by our record order intake and strong backlog. This gives us confidence that we should be able to continue to grow revenues in the second half of 2015 as designs won in 2014 and prior years enter their production phase.

Balance sheet - looks very solid, no problems here at all. They have scope to do more acquisitions, which is mentioned several times in the narrative, so more earnings growth is likely from bolt-on acquisitions, which could drive the share price higher.

Dividends - there has been a very good progression of divis over the last few years, and the yield is good, currently about 4.2%.

StockRank - very high at 96.

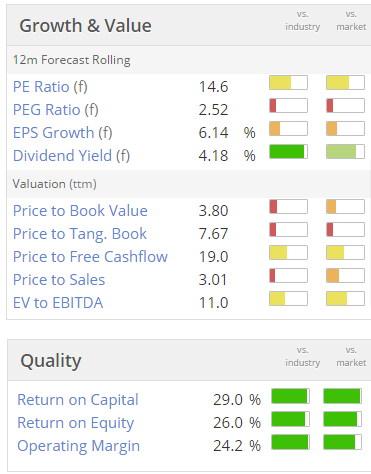

Valuation - looks reasonable to me - this looks like a QARP (quality at reasonable price) company;

My opinion - the figures look good here. Now the $64k dollar question is what the future holds? I note that earnings growth has been somewhat pedestrian in the most recent few years. Also those juicy profit margins could come under pressure from competitors perhaps?

Overall though, it ticks a lot of my boxes, and is certainly worthy of doing more research, to better understand the markets and products which it sells.Fevertree Drinks (LON:FEVR)

Share price: 368p

No. shares: 115.2m

Market cap: £423.9m

Interim results to 30 Jun 2015 - this is the premium mixer drinks (mainly tonic water & ginger ale) company which floated in Nov 2014, and has seen its share price rise steadily since.

The company intrigues me, as what they've done - in creating their own niche for premium mixers - is very clever. I did an initial write-up about the company recently here on 8 Jul 2015, and afterwards I had a read through the company's admission document. Very interesting reading it makes too. We had an interesting discussion about the company in the comments section on that day, so that's also worth revisiting.

The bull case is basically that the product is very good, and that bars/restaurants are not likely to stock multiple premium mixers. Instead they will just stock Fever Tree, so it could become a land grab for a new niche.

I might have tried this product in a G&T at the Savoy a few months ago, but to be honest I couldn't really tell any difference, but we'd had quite a few by that stage of the evening, for a friend's birthday party. One of my friends - who likes designer bags, and gucci shoes, that type - was raving about Fever Tree. So it definitely appeals to a trendy, affluent and perhaps rather narcissistic/vain type of person. Personally I think paying more for the mixer than you pay for the shot, is bonkers, but there we go.

The bear case is that at £423.9m, the market cap is too high, and that the product might not grow as fast as expected, and could attract copycat competition, thus squeezing margins, and clipping the rapid growth rate.

I'm not sure which is right, but am leaning more towards the bear case, than the bull case at the moment.

Revenue - as expected in the recent trading update, which said that H1 turnover would be "approximately £24m". It's actually come in at £24.1m, so good to have a little extra. That's a fantastic 62% organic growth rate in the top line.

Although I note that the run rate per six months is slowing considerably (although there could be some seasonality involved), i.e.

H1 2014: £14.9m

H2 2014: £19.8m (sequential growth of 32.9%)

H1 2015: £24.1m (sequential growth of 21.7%)

So the sequential growth rate appears to be slowing. Or, as I say, it might be because maybe H2 is seasonally stronger?

Adjusted EBITDA - normally I would say that this measure is bogus, but actually in this case it looks fine - because there is only a minimal depreciation charge, the amortisation charge can be safely ignored, and interest charges will soon be gone since the company now holds net cash and can hence pay off the residual debt (assuming no punitive early settlement charges).

£7.2m adjusted EBITDA is therefore very impressive - a stonking, super-normal profit margin of 29.9%. The big question mark of course, is whether that profit margin can be maintained, against competitive pressures in future?

If you take off a notional say 20% Corp Tax, and divide by 115.2m shares in issue, then that arrives at EPS of about 5p for the six months, which is slightly ahead of the 4.44 diluted EPS figure that the company reports today.

Valuation - broker forecast (raised in Jul 2015) is for 9.1p for the full year 2015. That looks conservative to me - growing this fast, I would expect H2 to be better than H1.

The 2016 broker forecast of 10.4p also looks conservative to me, so providing nothing goes wrong, I'd expect to see those figures upgraded to maybe 10-12p this year, and who knows next year - maybe 15p? At 368p that would put the company on a current year PER of about 33, and 2016 PER of about 24 - which actually doesn't look insane, for a fast growing company that has created a new niche, and is growing strongly, internationally.

My opinion - this is a tricky one. With my value hat on, I'd say it's way too expensive. But with my growth hat on, I can see that if the bull case is watertight (i.e. no competition gains traction), and growth continues apace, then the shares could end up being a good bet.

So it's a straightforward bet on whether you think the growth and margins are sustainable. As someone mentioned in the comments section, there is also the possibility that a major drinks group might pounce, and take it over. Then drastically scale-up operations within its existing factories & distribution network.

Overall, I can see merit in both the bull and bear cases, so will say I'm pretty much neutral on this share.

Right, I'll sign off for the day. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in MYSL, and no short positions. A fund management company with which Paul is associated may also hold positions in companies referred to.

NB. Please note these reports are just Paul's personal opinions, and are not share recommendations or financial advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.