Update: Paul is covering a lot of stocks in a Part 1 report at this link.

Paul is covering:

- Tracsis (LON:TRCS)

- Tasty (LON:TAST)

- Severfield (LON:SFR)

- Card Factory (LON:CARD)

- T Clarke (LON:CTO)

- Hostelworld (LON:HSW)

- Fairpoint (LON:FRP)

In this report, I am covering:

- Cloudcall (LON:CALL)

- Premier Technical Services (LON:PTSG)

- Inland Homes (LON:INL)

- Gfinity (LON:GFIN)

- S&U (LON:SUS)

And will see how I'm doing when they are all done. So please refresh through the afternoon (I will update the header of this as stocks are added).

Cloudcall (LON:CALL)

Share price: 102.5p (-0.5%)

No. shares: 20.1m

Market cap: £21m

Highlights:

- Group revenues up 47% to £4.9m, 85% of which is recurring

- Recurring revenues up 63% compared to 2015

- US revenues grew 160% to £1.3m (2015: £0.5m) underpinned by Bullhorn relationship

- Gross profit up 50% to £3.8m (2015: £2.5m)

- Operating loss before non-recurring items decreased to (£3.7m) (2015: (£4.5m))

Transition to profit is said to be "clearly visible".

Outlook comment from CEO:

"The encouraging revenue growth since the year-end combined with the strong January and February sales provides a solid base for the year and gives me considerable confidence in our ability to deliver in 2017. I am also increasingly confident that the Group's plans for the coming year will enable it to continue towards its objective of reaching break-even."

User numbers are up from 11,800 to 16,200 and the trend does appear to be one of accelerating growth.

Scrolling down to the separate outlook statement from the Chairman, his wording in relation to profitability is that "the pathway to EBITDA breakeven is now clearly within our sights".

In terms of product development, mobile apps and SMS/IM services will be added soon (the core product is a cloud-based telephone system).

Net cash is £2.3 million (£3.2 million cash minus £0.9 million debt which is currently due to mature in 2018).

My opinion

The after-tax loss was £3 million, slightly worse than the £2.9 million loss in the prior year, and there was £2.4 million in net cash absorbed from operations (but there were also some development costs capitalised, and interest to be paid on the loan).

The company says that cash burn is set to reduce as it approaches breakeven, so it looks conceivable that more equity will not need to be raised. But bear in mind that the total cash burn in 2016 was closer to £2.7 million.

Personally, I'm allergic to situations where dilution is possible. For those who are willing to take the chance, I could see this being fairly tight - it will depend on continued sales momentum, of course, and also on whether the bank is willing to extend and enlarge the borrowing facility (at 8.7% above base rate).

At the current stage, I think I'd rather be the lender than the equity investor!

Premier Technical Services (LON:PTSG)

Share price: 107p (+3%)

No. shares: 89.3m

Market cap: £96m

The underlying organic growth rate is 20%, but acquisitions have bumped up results quite a bit:

· Group revenue up 52% to £39.2m (2015: £25.8m)

· Gross profit up 45% to £20.3m (2015: £14.0m)

· Adjusted operating profit* increased 49% to £7.9m (2015: £5.3m)

· Adjusted profit before tax** up 49% to £7.5m (2015: £5.0m)

The acquisitions continued after year-end with the addition of Nimbus Lightning Protection (to become part of PTSG's Electrical Services Division).

It's an impressive group entity. It says that it now serves over 150,000 buildings and has upgraded its objective: whereas it originally set out to become "the UK's leading provider of niche specialist services" (to facilities management, property and construction sectors), it is now seeking "sector dominance" in chosen areas of operation.

Outlook

It continues to actively explore for acquisitions, and is upbeat on trading:

2016 was a successful year in terms of the delivery of strong, profitable organic growth and the Board is pleased to note that 2017 has started very well with continuing sales growth and new record levels of orders in hand held across the Group. We remain both confident of our prospects and enthusiastic about the future.

My opinion

The major point of contention looks to be the adjusting items, which turn a statutory profit of £2.3 million into adjust profits of £6.7 million.

There were adjusting items of £3.7 million last year, too.

The adjusting items include £1.9 million (pre-tax) in share options - this is really just another way of paying salaries and bonuses.

There's also the deferred consideration in relation to acquisitions, and amortisation of acquired intangibles.

So it's the typical story of an acquisitive group, with complications in the accounts, and it's up to investors to decide whether the combined entities will be worth more than the sum of their parts (and whether the synergies will be worth all of the frictional costs in creating the group).

Reflecting the strategy, the company is in negative net tangible assets in the balance sheet.

In terms of the sector, facilities management is highly competitive and doesn't strike me as a sector with a lot of operational gearing, so PTSG really does need to prove that it has a competitive advantage in niche, specialist services in order to justify a significant earnings multiple.

Inland Homes (LON:INL)

Share price: 60.5p (-3%)

No. shares: 203.6m

Market cap: £123m

This brownfield regeneration specialist and house-builder issues news of decent NAV growth, up to 87.05p from 80.64p on an EPRA basis (including the valuation surplus on trading properties and the dilutive impact of share options).

Clearly that means there is a significant discount baked into the current share price, but perhaps a discount is appropriate given the company's small size - it sold 101 homes during the period.

There are plenty of factors beyond the company's control and I would probably be one of those erring on the side of scepticism when it comes to the sustainability of current house pries in the South of England.

EPRA NAV of 87.05p is composed of the following: NAV of 55.26p, plus unrealised value of 31.42p (plus one other small tax adjustment).

If you include tax on the value uplift, EPRA NAV is 81.08p.

So in effect, the share price is giving Inland credit for about 20% of the unrealised value within recent projects.

Outlook

An excerpt from the outlook statement:

Our record land bank at the period end of 7,151 plots is a healthy combination of owned and joint ventured consented and unconsented land and we are confident that our specialist and proven planning capabilities will deliver a record number of consented plots during 2017.

The business has both a strong pipeline of land and a growing development programme, which will only accelerate as our in-house capabilities mature and, as such, we believe we are well placed to deliver shareholder value.

Leverage

Total assets of £256 million are financed by £118 million of equity and £138 million of liabilities, including about £70 million of loans.

My opinion

It looks perfectly reasonable to price this at a significant discount, given the leverage involved and the relatively small size of the company. Investors should get rewarded well for taking these risks, and that means a lower share price (and a higher dividend yield!)

For now, the yield is still quite low, at about 2.3%. I would be tempted to invest here if it reached an above-average yield (assuming leverage also at comfortable levels).

Gfinity (LON:GFIN)

Share price: 16.375p (-0.8%)

No. shares: 157.4m

Market cap: £26m

My first time looking at this company which is in the business of organising video game tournaments (yes, really!).

It is still very small, and loss-making, and on the basis of the headline numbers I'm actually quite amazed the market cap is in excess of our usual £10 million cut-off point.

I have no objection to investing in events businesses generally (for example, I'm a big fan of ITE (LON:ITE), which has a Quality Rank of 74).

But Gfinity is still in its infancy and has everything to prove.

The plan is that live gaming events will generate ticket sales, sponsorship and merchandising income.

Net cash

It made a £1.7 million loss in the latest H1 period (versus a £3 million loss in the prior financial year), and raised £3.6 million of equity, leaving it with a closing balance of £2.7 million. Shares outstanding almost doubled due to the fundraise.

Outlook

It sounds like the company is doing well (excluding financial results!).

This has been a strong period for Gfinity, during which time we have continued to establish ourselves as a leading eSports business with an excellent reputation, further illustrated by the quality and range of partners signed up in the latter half of 2016. We are experiencing significant ongoing growth of the eSports market and an increasing in commercial activity in the sector, leaving Gfinity very well positioned as the only independent and publicly listed eSports company in Europe.

My opinion: I could be wrong, but I see a lot more dilution in store.

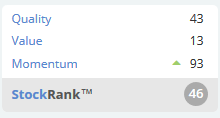

S&U (LON:SUS)

Share price: 2121p (+1.3%)

No. shares: 12m

Market cap: £255m

Excellent numbers from this niche finance provider:

- Profit before taxation from continuing operations up 29% at £25.2m (2016: £19.5m)

- Basic earnings per share from continuing operations up 28% at 170.7p (2016: 133.6p)

- Revenues up 34% at £60.5m (2016: £45.2m)

- Proposed final dividend up 6p to 39p (2016: 33p); total dividend in respect of the year increased to 91p (2016: 76p)

Reflecting the very strong conditions in the car market, S&U's motor business saw a 32% increase in the number of new agreements (over 20,000). This business offers car loans to customers with a history of credit problems.

Separately, a new bridging finance arm is being piloted. This will make 8-10 months loans against commercial and residential property.

My opinion

Well-run alternative lenders are some of my favourite investments (e.g. H & T (LON:HAT), where I have a long position).

Impairments at S&U have increased slightly to 20% of revenue but this still looks firmly within an acceptable range.

The balance sheet is strong too, with £140 million in equity supporting £195 million in total assets (nearly all of which is customer loans).

The dividend yield is forecast at 5% (trailing at 4.3%), increasing the attraction. So this is certainly a stock I'll be keeping on my watchlist for a potential purchase.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.