Good morning!

Digital Barriers (LON:DGB)

This is a heavily loss-making provider of advanced surveillance technologies. Preliminary results for the year ended 31 Mar 2014 have been published this morning. As you can see from the two year chart, the periodic lurches down are when the company disappoints in trading statements and results:

This is the big problem with loss-making growth companies - nobody really knows how to value them, since there are no profits that you can apply a PER to, in the conventional way. So the entire valuation rests on expectations of future profits, which is little more than guesswork.

Company management teams, aided and abetted by the whole City machine of brokers, PR people, etc, plus the perma-bull muppets on bulletin boards, relentlessly talk up company expectations (sell notes are very rare, and dissenting voices are chased away!). Therefore when hard facts come through at results time, this very often throws a bucket of cold water over inflated share prices, as investors realise that things are nowhere near as positive as they had been encouraged to think.

This is why I try to avoid loss-making growth stocks. Or if I do succumb to temptation, then it's usually either something that is completely off the radar of other investors, or something that has been a serial disappointer - already has a bombed out share price, everyone hates it, but it has enough cash in the bank, and the first signs of commercial success are peeping through. That's the convergence of factors which is most likely to lead to success, in my opinion. Every now and then it can lead to spectacular success too - I've had lots of multibaggers using this approach, but also quite a few failures too, so we're very much talking about the high risk end of the market here.

Sorry, I've rambled off the point. Back to Digital Barriers. Group revenes actually fell - usually a very bad sign for a growth company in my experience, from £23.3m to £19.0m. Although they've found a way of showing growth, by labelling some products as "core", which has created a growth rate of 18% for that category. Nice work - someone deserves a bonus for coming up with that idea!

The company made a hefty adjusted loss of £12m, with exceptionals & other one-offs worsening it to a loss of £15.1m. That's a big problem, because with gross profit of £8.7m, the company would have to more than double sales just to reach breakeven - quite a tall order for a company that is reporting declining sales against last year.

Although the company did embark on a cost-cutting programme last year, which has reduced overheads by £3m. From the divisional analysis, it seems to me that central overheads are way too high, at £ 10m. That should be cut by about three quarters, in my opinion, to start to make these numbers look like a viable growth platform. So as things stand, I think the company needs to deliver a serious uplift in sales, and fairly soon. If that doesn't happen, then more restructuring (hence more exceptional costs) are likely, I reckon.

The cash position looks fine for at least the next year anyway - there was £14.2m cash on the Balance Sheet at 31 Mar 2014, which was raised in an £18m follow on Placing. Cash burn last year was over £9m, although with overhead cuts that should reduce somewhat this year.

I am told that management have been successful in previous ventures, and talk a good story here, so that's presumably why the market cap is so high, at £76m (based on a 118p share price). I wouldn't go near it at anything above about 25p, because to my mind that sort of valuation (£16m mkt cap) would better balance risk:reward from an investor's perspective, given that it is heavily loss-making, and is reporting declining sales. But each to their own. Bulls must like the products & the management, and think the company will perform better in the future, which it might do, who knows?

Scapa (LON:SCPA)

It's an international tapes & adhesives group.

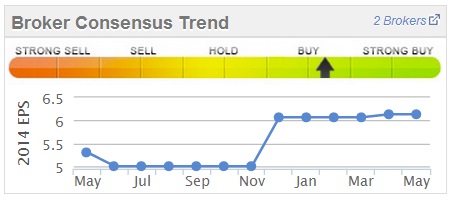

I last looked at Scapa here on publication of their interim results on 26 Nov 2013. At the time I felt the shares looked fully valued, at 92p, because that equated to a PER of 18.4, based on expectations of 5.0p EPS for the year ended 31 Mar 2014.

However, since then expectations have risen, with broker consensus expecting just over 6p EPS, and the actual results today showing adjusted EPS of 7.2p (up 31% on prior year).

So this is a good example of where a company out-performing against broker forecasts can go from looking expensive to looking quite good value, even with a further rise in share price.

Trouble is, it's so difficult to predict which companies are likely to outperform against forecast. Sometimes you can spot tell-tale signs in the wording of trading updates, or pick up general chat from the industry about particular companies that look as if they are on a roll. However, it's really all about backing good management, and hoping that they deliver. So sometimes you'll get it right, and sometimes will be wrong.

The problem also is that management who present well at meetings, can be terrible managers, and vice versa. So it's not about hearing a slick presentation, it's more about whether management can rattle off relevant facts & figures in the Q&A part of a presentation, to demonstrate that they have a really tight hands-on grip of their business. I much prefer hands-on, hard-working managers, to great talkers & ideas people - who often turn out to be good at raising, and spending money, but hopeless at building a good business.

My main reservations with Scapa concern the capital-intensive nature of its activities - having factories & lots of equipment, as there will always be an ongoing capex requirement with this type of business. Secondly, it has a big pension fund deficit, so that would need more research.

There are various outlook comments dotted throughout the results, and it sounds as if their healthcare division has the best outlook perhaps? Nothing jumps out as terribly positive though, with a non-specific but mildly positive overall outlook statement;

Over the past year we have continued to strengthen our business by successfully delivering against our strategic goals and priorities, which have driven organic growth and improved business performance and shareholder value. While we are currently early in the new financial year, we expect the momentum to continue and the Group remains well positioned to make further progress.

Given that it's only two months into the current financial year, perhaps a vague outlook statement is to be expected. If they rise to say 8-10p adjusted EPS this year, then at 113p the shares would look quite interesting.

Dividends are negligible, at sub 1% yield, and the Balance Sheet looks fine apart from the pension deficit. There are bank facilities available for acquisitions. One would also need to check whether the growth just reported is organic, or due to acquisitions, as the former is clearly much better than the latter.

Overall, it looks potentially interesting, but not enough to make me want to delve any deeper. Hopefully reader(s) might like to follow up on this stock idea, and report back if you think it's any good?

Torotrak (LON:TRK)

Another year goes by, with Torotrak releasing another set of crap figures. It amazes me how they keep finding people to put money into it, to keep it going, a bit like perennial loser Earthport (LON:EPO). But they do.

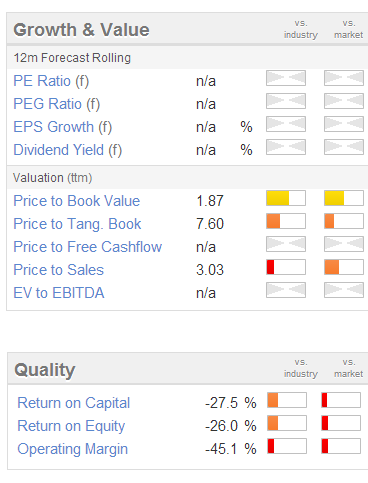

For the year ended 31 Mar 2014 Torotrak reported turnover of £3.5m, and a £4m operating loss before amortisation & exceptionals, or £4.8m loss including those items.

It raised more cash in the year, and had £14.9m on the Balance Sheet at the year end, so it might take them say 2-3 years to burn through that?

The original project here was a revolutionary gearbox, which they have been trying to commericalise since the 1990s. TRK was spun out of BTG at the height of the TMT boom in 2000 for an insane £400m market cap, and has had its own Listing since then. It's possibly the ultimate story stock, always on the cusp of great things, but never quite getting there. Some product is being sold under licence, to Allison Transmission, but clearly not in commercially viable quantities.

In my view it's a tacit admission of failure when Listed companies bolt on some other technology as a second activity, when the original technology has failed to deliver. Corac has done the same thing. I think it's probably more about ensuring that everyone's jobs are safe, not just at Torotrak or Corac, but also the fund managers who made a bad investment in the first place, and now need a new & more sexy story to justify supporting another fundraising. That's puts off the day of reckoning, and eliminates career risk for a couple of years, by which time they will probably have moved on. Maybe I'm being too cynical, but this kind of stuff does happen.

It would be nice to see them eventually crack their target markets commercially, but after 15 years trying, I'm glad it's not my money they are spending. The market cap is around £62m at 21.5p per share. One word - why?!

There is nothing specific in the outlook statement.

I'll leave it there for today. Back again tomorrow morning!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.