Good morning! Friday's SCVR wasn't one of my best, so feeling a little guilty, I set aside a couple of hours to write a bonus article over the weekend - namely Part 2 of my series of articles reporting on the London Value Investor Conference in May 2014. So here it is - an article covering a speech from Charles Heenan of Kennox.

I've also set up a dedicated website for my Brighton investor group, following last week's successful evening, so anyone interested might like to peruse & bookmark the link. Good old WordPress - it makes setting up new websites such a pleasure, and it's remarkably easy too.

I don't know where to start with this morning's announcements, there are loads of them, so it's going to be a busy morning! The Aldi Colombian is kicking in (coffee!!), so let's crack on!

Getech (LON:GTC)

This is an odd situation - the company warned on profits a couple of times, most recently on 10 Jun 2014. However the very next day, it announced a major $2m contract win, together with an indication that further contract wins were in the pipeline.

Management credibility is returning rapidly in my view, as today they have announced a further $600k contract win, all of which is being recognised in the current financial year (ending 31 Jul 2014). So I am coming round to the view that this company is fundamentally sound, but that they just have an inherently lumpy sales profile (small company, but large contracts with uncertain timing). There's nothing they can do about that, so shareholders will just have to either get used to volatility in the newsflow, and hence share price, or sell up and move on.

I like buying sound companies after a series of temporary disappointments, as especially in a generally rather pricey market, that can be the best way to get bargains. The difficulty is sorting out good companies with temporary problems, from bad companies that are in decline.

These shares look potentially good value in my opinion, although we won't really have the full picture until results for the year ending 31 Jul 2014 are released. I hope the company improves on the 3-months it took to report the figures last time. I note that they issued "Final Results" last year on 29 Oct 2013, which presumably means they have been audited. Personally I would much rather see preliminary results (pre-audit) much sooner after the year end (4-6 weeks should be do-able for a small company). The faster the reporting, the better the financial controls, so this is an important issue.

Director Buys

When should Director buys be taken notice of, and when shouldn't they? This is partly an art, as well as a science. Personally I try to look for the motive behind the purchase. If it's a co-ordinated set of buys by several Directors, especially over multiple days, then it's usually being done for PR reasons, to prop up a falling share price. Especially if those buys are small in relation to the Directors' salary/wealth/existing shareholding, then such buying can actually be a bearish signal, particularly where a company has a reputation for over-promoting its own share price.

The best type of Director buys are where a Director of a small company spends a 6-figure sum on buying shares, and it's a meaningful amount of money relative to their overall personal wealth, which 6-figures will nearly always be for smaller companies.

Such buys carry even more weight when a company is not prone to promoting its share price.

The other key factor to consider is how shrewd the Director making the purchases is. If the Director is a flamboyant type, then their purchases will usually be done for the wrong reasons - to prop up the share price. However, if the Director concerned is a hard-headed, often dour entrepreneur, with a reputation for getting things right, then a large purchase of shares by them is one of the best bull signals you can get.

Porta Communications (LON:PTCM)

The reason I mention the above, is because I'm trying to decide what signal should be drawn from the significant Director buying at Porta Comms this morning. It's a small, but rapidly growing PR group, headed up by very experienced management.

It's been announced that the CEO, David Wright, has spent £30k buying shares at 11p, and the shrewd Bob Morton (Chairman) has spent £105k buying shares at a keener price of 10.5p.

That equates to the CEO increasing his shareholding by 11%, and the Chairman increasing his by 3.1%, and certainly in the case of Morton, he's a very wealthy man, so this purchase is not hugely significant in terms of their overall wealth.

That said, it's a £6-figure vote of confidence, in a £25m market cap company (at Fri night's closing price of 10.75p), from shrewd Directors, so it gets a firm thumbs up from me. The market has also given it a thumbs up, with the shares up to 11.5p this morning.

Despite my critical comments about this company's presentation of its numbers a few days ago, I still think it looks a very interesting growth company that could be a good slow-burner in my portfolio. So it's one where I am anticipating waiting perhaps 1-2 years for a possibly quite large re-rating, if management execute well.

It's a volatile share, which tends to move up & down in waves, as you can see from the two year chart below. From a chart perspective, this clearly looks a good time to buy, assuming that the same sort of patterns continue. You have to remember that the chart only measures investor sentiment in the short term. It's the fundamentals that will determine the long term price. That's why so many shares move in unison, as investor sentiment goes across the whole market. People think they've found a brilliant share because it shoots up in a bull market, but more often than not they've just caught a rising tide that is lifting all boats.

It's how the fundamentals play out in the long run that will sort the winners from the losers. So that means cashflow, dividends, and sustainable growth, which are all that matter once the speculative froth has been blown away.

Zotefoams (LON:ZTF)

My last comments on this company were on 19 May, where I thought it looks a good company, but expensive at 272p per share (a PER of 22 at the time). The shares have come off nearly 14% (similar to the decline in small cap indices in the last few months) since then to 235p.

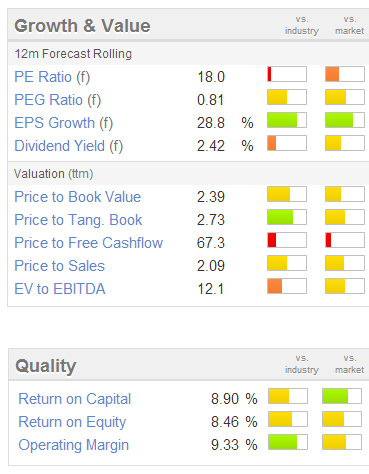

As you can see from the usual Stockopedia valuation graphics, Zotefoams shares are not cheap.

The earnings growth is high at 28.8%, but that represents mostly a bounce back from a poor year last year.

A trading update today details performance in its various divisions, which sound encouraging.

A £1.2m exceptional charge is being taken for writing off fixed assets on a production line that is being turned into a development line. That's non-cash, so not an issue.

Foreign currency movements have made raw materials costs lower, but impacted on selling prices to a larger extent.

Overall though the conclusion sounds like they are probably trading at or near to market expectations, with this comment;

Overall the Board remains confident of a satisfactory outcome for the year and continued progress in the future.

I don't know enough about the company, its products & markets to be able to predict how it might perform in future. Although at this price, I'd say that holders must presumably be expecting it to out-perform against broker forecasts.

The growth potential seems to be coming from new products, so that is probably the area to focus on when researching this company.

Plastics Capital (LON:PLA)

I've skimmed over the accounts published this morning by Plastics Capital, for the year ended 31 Mar 2014.

To my mind the valuation all hinges on whether you're prepared to accept their adjustments to EPS or not. There's a big difference between basic EPS at just 3.2p, and adjusted EPS at 11.1p.

In my view the 11.1p adjusted EPS figure has been heavily buffed up, to look as shiny as possible. It's fine to strip out the amortisation of goodwill. Looking at note 3 to today's accounts, the exceptional costs of £840k relating to acquisition & legal fees seems very high. Also £242k this year, and £210k last year of costs are within exceptionals and called "Redundancy/recruitment costs" - which are a normal part of running a business, so personally I would add these back. "Company set up costs" of £160k this year, and £64k are more costs treated as exceptional - but again, it's difficult to call something exceptional if it happened last year and this year!

A further £260k of bank refinancing costs are treated as exceptional, but I would regard as normal. It's the write off of previously incurred but capitalised bank arrangement fees. That's not exceptional in my view.

Net debt reduced a little to £7.2m (from £8.4m), but bear in mind that £2.7m of fresh equity was raised during the year to fund a small acquisition. The narrative states they want to do more acquisitions, so that will almost certainly involve the issue of more equity. Therefore I am sure management will be keen to keep the share price up, so that dilution is kept to a minimum!

They have proved adept at making good acquisitions in the past, and providing new equity is not issued at too deep a discount in Placings, then things might be OK.

Capex was heavy in the last year too at £1.9m, although that should support future growth.

The dividend has been raised a very generous 50%, to 3.0p, so the yield is starting to get into reasonable territory.

The outlook sounds reasonable;

Trading for the first quarter of FY2015 continues in line with management's expectations and there are indications that trading conditions will improve over the coming months. The pipeline of new business remains strong and converting them into sales during the year is a major priority. We believe existing business will at least continue at similar levels to FY2014 and we will continue to develop our activities in China, to make the most out of the recent investment there.

Overall, I quite like this company, but think the shares are probably priced about right, or slightly on the warm side perhaps at 134p. The PER may look lowish, but once you adjust for net debt and pare back some of the exceptionals, it's not really cheap after all. Growth looks fairly lacklustre at the moment too, so I can't see a good reason to chase these shares up to a higher valuation.

That's all for today. Thank you for reading, and as always your comments in the comments below are very welcome. If you think I've got something wrong, or missed some important detail, then do please flag it up.

See you tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in GTC and PTCM, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.