Good morning,

It's the last day of H1, which means that some companies are producing results today because they have to (if their calendar year-end is December).

Better companies tend to have their results known long in advance of deadline, and it puts investors at a disadvantage when they have to wait so long to see what is happening, so this is a red flag. It's not that any company which does this is uninvestable - it's just something which should spark extra caution!

Onto a few updates:

Game Digital (LON:GMD)

- Share price: 23.6p (-28%)

- No. of shares: 170.9 million

- Market cap: £40 million

I last covered this games and console retailer at the interim results in March, when the share price was 42p (for context, it IPO'd at 200p in 2014).

Value destruction in terms of the share price has therefore been immense and investors are now again pricing in financial distress. It last went into administration in 2012.

Consumer demand for Nintendo Switch has been, and remains, very strong, however the level of supply to the UK market has been lower than expected. These lower levels, combined with continued softness in our core Xbox and PlayStation markets, have impacted sales.

The Group still expects to deliver positive Group GTV2 growth in the secondhalf of approximately 5-6%, however this is below our previous expectation. As a result, we now expect Adjusted EBITDA for the full year to be substantially below previous expectations.

You don't need a particularly long memory to know that when things go bad at GAME, they go really bad.

But since already halving its UK stores from the peak, and disposing of nearly all the international operations, it seemed to have a much better chance of sticking around for a decent period of time in its current incarnation.

The harsh share price reaction today may also be related to this paragraph:

Significant efforts are being made on reducing fixed and variable costs across the Group's UK retail footprint, where we have over 220 lease events to manage by the end of 2018.

That sounds very complicated but the average UK lease length is just 1.2 years, so it's not a surprise that there would be so many lease "events" over the next 18 months.

I'm intrigued as to whether this could be a value opportunity. Perhaps the worst leases can be allowed to expire without the exceptional costs being too large. And remember that net cash in January was £69 million, with no bank borrowings.

So perhaps the risk of financial distress in the short-term is actually very low?

That could make this an interesting trade. Whether you'd really want to hold it for the long-term, though, is another matter. Long-term, the store estate might still be much too large, and it's hard to believe that it can achieve sustainable profitability, given its track record.

The gaming industry as a whole has actually been very strong over the last few years, so GAME can't blame the underlying industry fundamentals. It's just that the industry is a difficult one for bricks-and-mortar retailers, that's all.

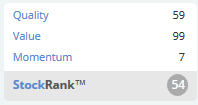

Stockopedia computers think that the value available here is excellent, which I disagree with, but they also point out that it is Speculative and Contrarian.

Trinity Mirror (LON:TNI)

- Share price: 99.1p (+4%)

- No. of shares: 277.5 million

- Market Cap: £275 million

Another speculative and contrarian stock is this publishing group.

Perhaps even more so than with GAME, you can make a great argument for buying this share in the short-term. The problem is: do you really want to hold it for the long-term, as like-for-like print sales continue their perpetual decline?

Today's update is in line with expectations.

Group revenue is expected to fall by 9% on a like for like** basis over the period.

Publishing revenue is expected to fall by 10%, with print declining by 12% partially offset by digital which grew by 5%.

The phone hacking provision is increased again, by another £7.5 million. Over 80% of claims are settled, and while the remaining ones are likely to be larger and more complicated, you'd think that the provisions should be getting close to the accurate number now!

CEO comment is simple enough:

"The trading environment for print in the first half remained volatile but we remain on course to meet our expectations for the year. I anticipate that the second half will show improving revenue momentum as we benefit from initiatives implemented during the first half of the year."

My opinion

With lots of high valuations out there at the moment, I'd actually be more inclined to choose this share rather than a lot of the high flyers!

It's buying back its own shares and is on a tiny PE ratio of only about 3x. The much-discussed pension deficit would be reduced by a third if the discount rate was increased by just 0.5%. And financial debt is manageable at just £30 million, last seen.

Given how much investors have embraced risk over the past years, the valuation here is now looking rather harsh to me.

You do need a view on the long-term future of print publishing, however, and where the trough might be (if it exists). My views aren't fully formed on that point yet. Indeed, I put this share in the "too difficult" basket last time I covered it here. But it seems worth looking into.

Fastjet (LON:FJET)

- Share price: 19p (+15%)

- No. of shares: 336 million

- Market cap: £64 million

A rare day of relief for shareholders in this low-cost African airline.

The Company has made steady progress in implementing stabilisation efforts, including inter alia, a re-fleeting process, relocation of its headquarters from London to Johannesburg and a right-sizing of its operations in Zimbabwe and Tanzania. These steps are having the desired effect and accordingly fastjet aims to achieve a cashflow break-even position for the final quarter of 2017.That would be a great achievement at last!

A very important change implemented by the new fastjet CEO is to engage with a flight operator called Solenta. It has given Solenta a 28% shareholding in exchange for Solenta providing wet leases on a number of aircraft (i.e. Solenta provides the aircraft, crew, maintenance and insurance).

So fastjet has outsourced many of its activities to a third party, that party being given a huge chunk of fastjet shares in return. It's less ambitious to outsource these activities, but it's also quite a bit safer.

By October, when it hopes to have reached cash break-even, it plans to operate four aircraft, two in Zimbabwe and two in Tanzania, with half of them on Solenta wet-leases

With a smaller fleet and with half of the flight crews and maintenance having been outsourced, it should indeed be much easier to get to breakeven.

What could such a business be worth? There is still so much to prove in terms of getting the load factors which would generate a decent level of profitability, and when you buy airline shares you don't really expect it to have outsourced most of its activities.

I'd also remind investors that at the final results announcement a month ago, it said it would have to raise additional funding over the next year if any of the following variances in assumptions occurred:

Load factors not met by 5%; or

· Fare prices decrease by 2% year on year; or

· Fuel prices increase by 15% with no recovery in ticket prices, or

· Foreign exchange rate depreciation of Tanzanian shilling by 13% against the US dollar.

While today's announcement improves the likelihood that it could avoid diluting shareholders again, it remains, in my opinion, extremely speculative.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.