Good morning!

Thanks for all the positive feedback on yesterday's article, I'm glad people found it interesting.

Graham's having a day off today, so just one report. I intend covering the following;

Next & B&M trading updates - yes, I know they're large caps, but the idea is to get a feel for how retailer bellweathers have done over Xmas. This has read-across to smaller retailer shares - note how M&S, Debenhams & French Connection are all down c.5% this morning, in sympathy with Next's lacklustre Xmas trading.

Staffline (LON:STAF) - in line trading update

Accrol Group (LON:ACRL) - interims to 31 Oct 2016

Spectra Systems (LON:SPSY) - positive trading update

Cambria Automobiles (LON:CAMB) - AGM trading update, in line with expectations.

Large cap retailers

.

John Lewis Partnership

EDIT - Sorry, I dropped a massive clanger here, and accidentally did a write-up on last year's results, thinking they were this year's! Huge apologies for that. I would blame having a cold, but apparently I did the same mistake last year. Rather embarrassing, sorry.

Anyway, there's no point in having an incorrect section in here, so I've deleted it.

Next (LON:NXT)

Basically, it's not as good as expected, so the shares are down, and have pulled down other retailers too. The prior year comparatives were soft, so growth was expected, but failed to materialise.

Special divis make this a nice income stock, and it's certainly coming back into buying range for me. Although I wonder whether Next may struggle to maintain its sector-leading net profit margin?

It's remarkable to find such a high quality business on a PER of below 10, but where's the growth going to come from? It seems that Next is likely to only, at best, stand still in terms of future profitability, maybe? Hence the low rating.

The market is really only interested in online retailers at the moment, or growing, smaller retailers. Although I wonder if the pricing gap between growth & value retailers may now be getting too wide?

B&M

Very strong UK LFL sales growth of 7.2%, from this pound shop chain. Although 1.1% of that was an extra day's sales, so LFL was really 6.1%, still outstandingly good.

Staffline (LON:STAF)

Share price: 856p (up 1.3% today)

No. shares: 27.7m

Market cap: £237.1m

(at the time of writing, I hold a long position in this share)

Trading update - I was worried that a profit warning might be on the way here, due to seemingly unrelenting selling pressure in the market, and a lowly valuation.

However, I need not have worried, as the company has continued its excellent multi-year track record;

The Board is pleased to report that the Group expects to deliver full year results in line with market expectations.

Profit is split roughly evenly between the 2 divisions, both of which seem to be trading well;

Demand in the Staffing business has remained strong through the second half and the division has once again achieved excellent growth in the number of OnSites this year.

PeoplePlus, the Employability, Skills and Justice Division, has also made good progress, becoming the top performer in Work Programme contracts as well as benefiting from its focus on improved margins.

I recently interviewed the CEO of Staffline, Andy Hogarth. He sounded a little downbeat, but that's probably because he had a heavy cold.

There are some short term issues over the timing of Govt contract renewals, which is reflected in cautious broker forecasts.

My opinion - the company has an outstanding track record of identifying new business areas, and executing them well. For that reason I'm happy to look through any short term uncertainty.

The valuation looks very modest to me. I think worries about its E.European workforce disappearing are misplaced.

Results meeting for private investors - this was a great success last results time, so the company is once again putting on a presentation for private investors on results day. Details are below;

A presentation for private and retail investors will also be held on Wednesday 25 January 2017, starting at 12.00pm at the offices of Buchanan, 107 Cheapside, EC2V 6DN.

Admittance is strictly limited to those who register their attendance in advance of the event. To register for the event, please contact Buchanan on 020 7466 5000 or staffline@buchanan.uk.com.

I encourage more companies to put on presentations for private investors. It's extremely helpful in giving us access to good companies & management. Last year there was a light buffet, of mainly sandwiches & wraps, plus a small selection of soft drinks, and some cakes/cholcolates.

Accrol Group (LON:ACRL)

Share price: 126p (down 0.4% today)

No. shares: 93.0m

Market cap: £117.2m

Interim results, 6 months to 31 Oct 2016 - this is a low-priced loo roll (and similar tissue products) manufacturer, based in the UK, which floated on AIM in Jun 2016. I reviewed its admission document in my report here on 8 Nov 2016. My conclusion then was that there were too many risks for this share to interest me.

These interim results don't look particularly great to me.

Revenue up 8.8% to £63.9m for the 6 months

Adjusted EBITDA up only 1.5% to £7.1m

So clearly margins are already under pressure. However, what worries me is that adverse forex movements have only been deferred, through hedging;

Our current hedging position in both US$ and Euro together with agreed paper prices until April 2017, lead us to remain confident in the outlook for the full year.

So the current year looks fine, but what happens after that?

If exchange rates continue at current levels then the soft tissue industry, along with many other sectors, will need to increase prices to recover the rise in raw material costs.

That could prove tricky, as trying to raise prices for customers like Lidl & other discounters is probably likely to be hard work. It may end up with Accrol suffering margin compression, maybe?

Valuation - this share is rated at 11 times forecast earnings for this year. Given that it might struggle to meet, let alone exceed that profit next year, I can't see much attraction here for investors.

Balance sheet - NAV is £54.5m, which drops to NTAV of £23.8m, once we get rid of intangibles.

There is some debt, but it doesn't look excessive at £19.9m.

Dividends - a maiden interim divi of 2p has been announced. The company "remains committed" to a 4p final divi.

I'm a bit sceptical whether that 6% yield on the 100p IPO price is sustainable, if something were to go wrong with trading. It's a cash outlay of around £5.5m p.a., and that looks a tall order to me.

So dividend seekers might want to look more closely at whether that level of payout was a sweetener to get the IPO away, or whether it can really be maintained long term? If future divis are cut, for whatever reason, then it would be accompanied with a big drop in share price - as we saw with another high yielding Zeus float, Entu (UK) (LON:ENTU) .

My opinion - this looks a risky share to me. Movements in forex & paper prices could easily trigger a profit warning.

The IPO was a mechanism for large shareholders to sell. So personally I wouldn't want to be on the other side of that trade. It's not for me.

Spectra Systems (LON:SPSY)

Share price: 34.5p (up 35.3% today)

No. shares: 45.3m

Market cap: £15.6m

Trading update - this is one of the oddest companies on AIM (and that's saying something!). Based in the USA, it performs erratically in terms of revenues & profits, with no clear trend either way.

Be that as it may, 2016 seems to have been a good year;

...today announces that it expects its profits for the year ended 31 December 2016 to significantly exceed market expectations. Revenue is also expected to be ahead of market expectations.

Looking back at the interims, they're unremarkable, with a $430k loss on turnover of $4.8m.

Note that the balance sheet with this company is cash-rich. It's been sitting on a big cash pile since 2011, which strikes me as a comfort blanket for management. Therefore I would apply quite a discount to the cash, when valuing the company, as it appears they're not likely to do anything useful with it.

My opinion - for me, this share is too illiquid, and long-term performance has been lamentable really. Perhaps it's just a lifestyle business for management & staff?

That said, if the improvement in performance in 2016 is sustainable, then the shares might be worth a fresh look?

Cambria Automobiles (LON:CAMB)

Share price: 61p (up 0.8% today)

No. shares: 100.0m

Market cap: £61.0m

AGM trading update - as mentioned in yesterday's report, my view is that the market has oversold car dealership shares. So it's pleasing to read a report from Cambria that seems supportive of my view. This is not a share I currently hold, but probably should buy some - as I like the company, management, and valuation.

The company has a 31 August year end, so today's update covers the 3 months to 30 Nov 2016;

The Group has maintained its momentum from the strong results delivered in the last financial year and its trading performance in the first three months of the current financial year has been ahead of the corresponding period in 2015/16, both on a total and like-for-like basis.

What is remarkable, is that new car sales were down heavily (down 9.4% on a LFL basis) in the 3 months. However, this has not impacted profits because margins improved. So clearly the manufacturers are supporting dealers. Also, crucially new car sales are not actually the main profit driver at car dealerships any more.

After a strong September trading period, the Group did see some pressure on new car margins in October and on new car volumes in November. New vehicle unit sales for the first quarter were down 0.7% (like-for-like down 9.4%), but gross profit per retail unit improved in the Group's like-for-like businesses.

Used vehicle sales are key to profits, and are doing well;

Used vehicle sales continued to perform well, with unit sales 3.6% (like-for-like 2.5%) ahead of the same period in the prior year and gross profit per unit continuing to increase. This performance has again enhanced the profit from the used car segment of the business.

The other key profit generator is aftersales (servicing, repairs & warranty work, I suppose), which is also doing alright;

The Group's aftersales operations increased revenue by 13.1% (like-for-like up 2.9%), with profitability up by 6% year on year (like-for-like down 1.5%, impacted partly by a fire in October at the Welwyn Garden City Jaguar and Aston Martin workshop).

Mind you, if new car sales drop for a sustained period, then that's bound to have a gradual impact on aftersales.

Outlook comments - a bit cautious, but crucially still in line with expectations for the full year;

The Board continues to believe that there may be some pressure on new car volumes and margins in 2017 as a result of the uncertainty in the economy and the foreign exchange volatility witnessed over the past few months.

However, the Board also believes that the Group's robust balance sheet and proven management team ensure it remains well placed to take advantage of any opportunities that may arise.

The Group's trading performance in the first quarter means that it is trading in line with market expectations for the full year.

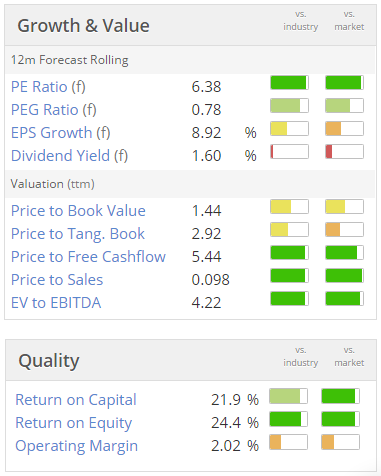

Valuation - as with other smaller car dealership chains, it looks great value to me;

My opinion - the car market has changed radically, with new cars far more affordable than they were historically. Also, most private buyers now use personal leases, which are very affordable indeed. So I reckon the higher levels of new car sales we've seen in recent years could hold up better than some expect.

The dealerships make most of their profit from aftersales and used car sales, so seem reasonably well insulated.

Of course things could get worse, so if you're very negative on the economy in general, then it's probably best to avoid this sector. However, if like me, you're a bit cautious, but reckon things will probably be OK, then the low valuations in this sector right now could be presenting a decent entry price.

All done! See you in the morning.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.