Good morning! There's a lot of red on my screen today, what with another nasty profit warning from Tesco (LON:TSCO). Also, ASOS (LON:ASC) looks to have gone ex-growth internationally, with a weak Q3 trading update this morning, which makes its sky-high rating look all the more inappropriate.

Also, I wonder how long the even more crazy rating at AO World (LON:AO.) can continue to defy gravity and logic? It just amazes me the way the market repeatedly takes growth companies up to such silly over-priced levels, when it's so obvious that sooner or later they crash back down to earth. Who buys things at such stretched prices, and why? How come they have any money left?!!

Anyway, let's have a look at some small caps.

Zytronic (LON:ZYT)

Share price: 295p (up 11p this morning)

No. shares: 15.2m

Market Cap: £44.8m

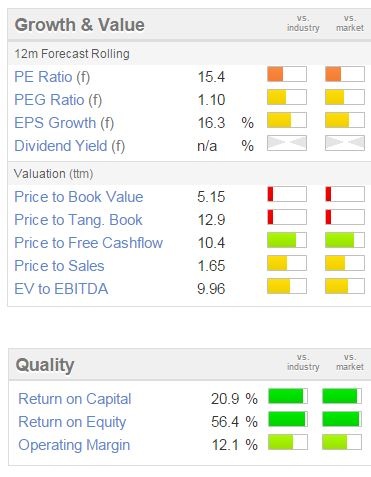

I last did a detailed review of Zytronic, a UK maker of bespoke touch-screens, after its positive trading statement on 10 Sep 2014. My guess then was that the company might be heading for about 18p EPS for the full year to 30 Sep 2014. My conclusion was that the shares looked good value at 246p.

Preliminary results for the year ended 30 Sep 2014 are out this morning, and look excellent to me. The company has out-performed the increased market expectations, by delivering basic EPS of 19.6p, a whopping 77% increase on last year - which was admittedly a bad year, when the company ran into some problems with essentially a temporary gap opening up in the order book (if I understood it correctly).

Particularly striking is a much improved gross margin, which is up from 28.4% last year to 36.6% this time. Turnover hasn't risen that much, up 9% to £18.9m, so this is still a small business, but has strong pricing power - it made a pre-tax profit of £3.3m, and generated an even more impressive £4.2m in operating cashflow.

Balance Sheet - is terrific, and is a great pleasure to read. Current assets of £14.0m represents a remarkable 5.1 times current liabilities. There's £7.8m in net cash included within that too, or just over 51p per share in net cash. So 17.4% of the share price is the company's own bank balance, which gives a very nice buffer in valuation terms, and you can sleep very soundly owning this share - even if they have a bad year, the divis aren't under any threat, nor is the company's solvency.

Dividends - the total divis have been increased from 9.1p last year to 10.0p this year, so that's a healthy yield of about 3.4%, twice covered.

Outlook - sounds OK - the company says that both sales and order book are up on last year, at this early stage of the new financial year.

My opinion - it's great to see the company firmly back on track, after a difficult year in 2013. In my view smaller companies are much more prone to profit warnings than larger companies, as they are often heavily dependent on a few key customers and contracts. So with this type of company, every now and then a gap appears in the order book, and a profit warning is issued. That doesn't suddenly make it a bad company, yet that is how the market often reacts. Such situations can be good buying opportunities in my view, providing nothing is fundamentally broken at the company in terms of its market position, etc.

It doesn't always work, but in this case it has done. I can't see any reason to sell the shares now that things are back on track. Strip out the cash, and the valuation is still actually quite reasonable. It pays nice divis too, so I shall continue to hold this one for the foreseeable future.

As you can see from the two year chart, it's now fully recovered from the profit warning in May 2013;

Pressure Technologies (LON:PRES)

Share price: 500p (down 62p today)

No. shares: 14.4m

Market Cap: £72.0m

Preliminary results for the year ended 27 Sep 2014 are published this morning. The figures look terrific - revenue up 57% to £54.0m, and underlying operating profit up 138% to £7.8m. Wow!

So with results that good, why are the shares down? That seems to be down to the wobbly-sounding outlook. Although the order book was up 14% at year end, the company indicates that a reduction in sales is expected for their cylinders supplied to the deep water oil & gas market. Nor suprising, considering the rapid & huge fall in the price of oil recently.

I don't know this business well enough to gauge how important that particular activity is to the group results as a whole. Ah, I've just found a section in the results that gives a breakdown - and 73% of group turnover for 2014 was from the oil & gas sector. Oh dear, that's not good - the company says today;

The general air of uncertainty in the oil & gas sector has resulted in major development projects being postponed, or re-engineered to reduce costs.

My opinion - I can't see any way to value this company, as its markets are too uncertain for me (not being a sector that I know anything about). I would imagine that the risk of a profit warning is probably now very high, given the collapse in the price of oil recently, which is the main sector that PRES serves. I'll watch from the sidelines.

As you can see from the chart below, the share price now seems to be in freefall, so catching the bottom would be difficult.

IMImobile (LON:IMO)

Interim results for the six months to 30 Sep 2014 are out today, and look fairly solid to me. Adjusted profit is up 29% to £2.3m. The balance sheet is strong, although bear in mind that cash is flattered since £10m was spent on an acquisition just after the period end.

I like this company - I met the CEO in the summer, and was very impressed with both him, and the company, so it's been on my watchlist since. It's a software company in the telecoms sector, providing software for major companies which optimises their emails & texts to customers, and various other things connected with mobile phone operators. The client list is very impressive - blue chips.

I can't see any accounting funnies, which is good. I particularly like that this company expenses all development spending, which is the most conservative accounting treatment.

I spoke to the CEO again today, and it seems to me that this could be an interesting growth company - although it's not a sector I understand particularly, and my slight concern is that things move fast in this sector, with products/services having a fairly short shelf-life, until something new is developed by the competition.

The company today says it is trading in line with expectations, so that makes the valuation look about right probably, in my view. The shares have held up well since the IPO in Jun 2014. This looks an interesting company, and worthy of further research.

Ensor Holdings (LON:ESR)

Interim results to 30 Sep 2014 look impressive - with operating profit up 98% to £1.3m. The company seems to be on a roll - it makes building products.

Its balance sheet looks fine, although there is a small pension deficit.

The shares look reasonably good value, if the strong trading in H1 continues.

So this seems another share that is worthy of some further research.

Regards, Paul.

(of the companies mentioned today, Paul has long position(s) in ZYT, and no short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.