Good morning!

Apologies for the formatting problems today, a gremlin crept in somewhere. I've corrected the whole article manually, and it's just gone haywire again, so am giving up for the day now. EDIT: Ed has rescued it since, thanks Ed!

On The Beach (LON:OTB)

Results y/e 30 Sep 2015 - this company is an online travel agent, serving mainly the UK market, offering short haul beach holidays in Europe, and N.Africa, their website is here. The Prospectus says that OTB has 17% market share of the UK packaged holiday market, with its largest competitors being TUI and Thomas Cook.

The company's shares were floated by Numis on the UK main market on 28 Sep 2015 in a placing at 184p per share.

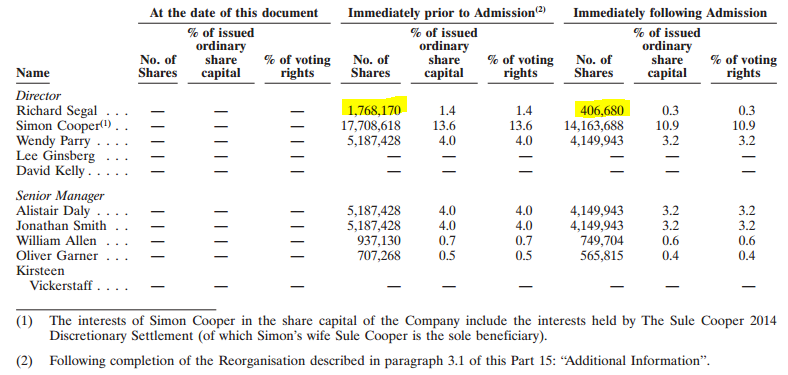

Unfortunately, the net proceeds of the placing, £90.2m, went mainly (£83.8m) to selling shareholders, the bulk of which was a Private Equity firm called Inflexion. Management also top-sliced their holdings as set out in this table from the Prospectus:

Note that the Chairman cashed in most of his chips (highlighted above). The other Director sales appear to be more reasonable, and personally I don't have a problem with Directors top-slicing their personal shareholdings in an IPO. The founder CEO, Simon Cooper, still holds 10.9% of the company, which all the other Directors combined also holding 10.9%, so 21.8% in total held by Directors - that seems to me about the optimum level - plenty of skin in the game, but not outright control.

The company received £6.4m proceeds from the placing, although this seems to have been raised to mainly cover fees of the IPO. Can you believe that Inflexion had the temerity to charge the company a £903k "exit fee" as part of the IPO process?!

Not only this, but Inflexion boast on their own website that they made a 3.6x return on their investment in OTB, in just 23 months of ownership. Normally, I wouldn't touch any recent issue where the proceeds raised went to pay off a Private Equity owner, as the track record of such floats has been so disastrous. PE is a scourge in my view, and they often leave behind all sorts of problems, dress up a company for sale, over-price it, and the hapless buyers of those shares are often left bitterly disappointed a year or two later, when the shares have crashed after all the problems surfaced.

Therefore, as with all PE exit floats, I am eyeing OTB with extreme scepticism. It's rather annoying therefore that the numbers released today are actually rather good, and the valuation seems not unreasonable.

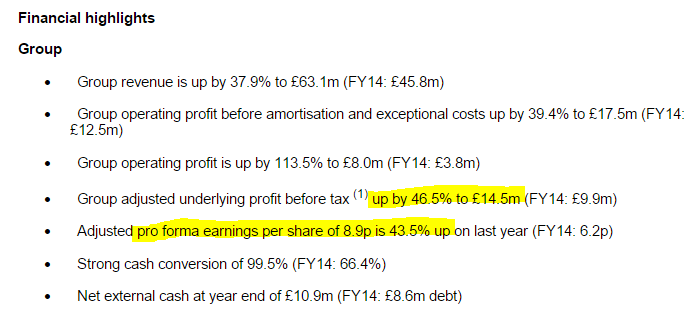

Results - it's a proper business, with genuine, and growing profits - I can't see any particular nasties in the accounts. Here are the highlights from today's results statement:

The adjustments to profits look reasonable - mainly stripping out the impact of the high debt structure normally associated with tax avoidance by PE shareholders.

With the shares currently at 180p, and adjusted proforma EPS of 8.9p, the PER is 20.2, which actually isn't outrageous by any means for a growing, profitable internet company. This seems to have come in ahead of broker forecast of 8.4p.

Growth - as it already claims to have 17% market share, in a highly competitive sector, then it's difficult to see how much more growth the company can achieve from the UK market. Maybe this is why Inflexion wanted to sell down their stake (although they still hold 37.1% of the company).

International growth could be the catalyst for the share price rising strongly, but there seems little sign of much ambition in that regard, from the Prospectus, which I had skim-read this morning, sad git that I am!

Apart from the UK, so far the company has only entered the Swedish market, and it mentions two other small markets ("Norway and/or Denmark"). That seems very unambitious, for a company that has done very well in the UK. The trouble with entering new markets is the cost - as local staff will be needed, who understand each market properly, speak the language etc, then there would be heavy losses up-front, due to marketing spend, to get the brand known.

As AO World (LON:AO.) are finding, it's expensive, and difficult to gain traction in overseas markets, as people just think & act differently in different countries, so what works in the UK may well not work in other countries

Balance sheet - not great, but travel companies have favourable working capital flows (because customers pay up-front, and suppliers can be paid later), so the -£500k NTAV deficit at this company doesn't particularly concern me. There is no debt, instead trade creditors are funding the business effectively.

Cashflow - this is distorted, due to the transactions with the PE former owner, which are one-offs. Note that £2.0m of costs were capitalised into intangibles - not excessive, but just something to be aware of.

Outlook - it sounds as if the company is coping well with disruption to travel from terrorism, etc.

Since the beginning of the new financial year, On the Beach has continued to perform strongly and I remain optimistic about the future. I believe the foundations we have put in place for direct contracting, personalisation and internationalisation, combined with our strengthening brand awareness, continue to offer significant growth opportunities.

Our continuing investment into talent means we are well placed to increase the pace at which we innovate and thereby further differentiate our market-leading customer proposition and our growing scale means that we continue to leverage operational efficiencies, increasing our profits as a percentage of revenue.

The start of FY16 has been marred by the terrible events in Egypt and in Paris and our thoughts are with all of those affected. We have worked hard to ensure that all On the Beach customers in Sharm el Sheikh were repatriated in an orderly fashion and those that were due to travel to the Red Sea prior to Christmas have been offered alternative holidays. As an OTA we have no commitments to flight or hotel capacity and are well positioned to react quickly to changes in consumer demand. We have enjoyed a strong start to the new financial year and performance is in line with the Board's expectations. I remain confident for the year ahead as we focus on our strategic objectives while investing to deliver long-term, sustainable returns for our shareholders. We will be providing a further trading update on the 5 February 2016.

Valuation - if the company is able to achieve broker consensus of 12.1p this year, then at 180p the shares would look good value, with a PER of 14.9.

Dividends - none at the moment, but the company intends starting divis from the current year (ending 30 Sep 2016), so likely to be paid in late 2016 or early 2017. The profits and cashflow suggest to me that it has the capacity to pay potentially decent divis in future. Although I suspect that funding international growth might absorb most of the future cashflows, perhaps?

My opinion - I wanted to dislike this share, and pick holes in it, because it's a PE exit type of of float. However, the figures look rather good, and the valuation seems reasonable to me, so I actually quite like it, and would consider a purchase.

The big problem with PE floats, is that things are often not as good as they seem, and some kind of bombshell drops typically 6-18 months after the float, and you think to yourself, ah that's why they sold.

In this case though, I'm really tempted to buy a few. It's impressive that the company has carved out a big market share in such a competitive market. They now look big enough to be able to spend the big bucks on marketing that are necessary to stay ahead in this space.

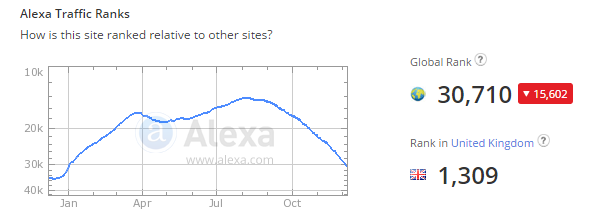

The good thing with companies which operate wholly or largely from a website, is that you can track the web traffic though a tool called Alexa.com . This is the chart for OTB (below). The steep fall in traffic rankings over recent months is (I imagine) just seasonal, as the main peak season will be over the summer. Although my concern is that the current position isn't much improved from this time last year - which suggests that perhaps growth is slowing? That needs more investigation.

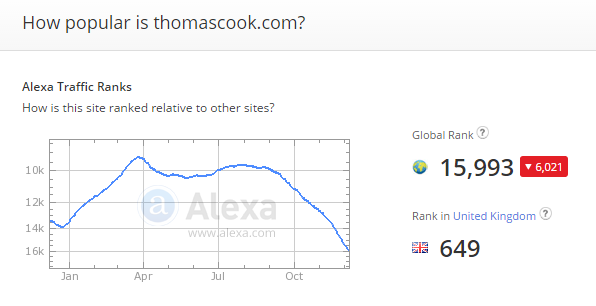

Mind you, having a quick look at the equivalent Alexa chart for ThomasCook.co.uk it is clearly inferior, so that gives me some comfort that OTB appears to be out-performing in terms of year-on-year growth, although note that the ThomasCook website is much higher ranked, at 649th most popular UK website, as against OTB's rank of 1,309 most popular UK website.

IMImobile (LON:IMO)

Share price: 152.5p

No.shares: 48.1m (per Stockopedia, but NB see bolded section below)

Market cap: £73.4m

Update on share options & B shares - regulars here might recall that we had an interesting discussion about the very high level of dilution from share options at this company. I had originally missed this important point in my report of 3 Dec 2015 mentioning the company's interim results. Reader(s) flagged up the share options issue in the comment section.

I followed up on this point with a bit more detailed research published the next day, in my report of 4 Dec 2015.

The company then got in touch via advisers, saying that the CEO would like to respond with an explanation. I'm always receptive to companies that wish to engage, and put their side of the story, or clarify factual matters.

The company has emailed me a detailed explanation, which I reproduce below in full, and of course unedited (apart from me adding bolding to the key paragraph);

Dear Paul,

Further to the concerns highlighted recently regarding possible share dilution at IMImobile, I’m keen to explain the situation in more detail.

Please see below a breakdown of the options and potential impact on issued share capital, with the reconciliation between the 22.5m under option and the 19.7m in the accounts. The number in the note to the accounts reflects the dilutive impact of the options after taking into account the difference between the exercise price and average market price during the year.

An explanation of the 19.7m that has a dilutive impact is as follows –

Total number of options (m) Total dilutive impact (m) Vested (m) Unvested (m) Founder shareholding 11.3 11.3 N/A N/A Sub- total 11.3 11.3 Flowering 3.0 2.8 1.4 1.4 2014 Unapproved 6.4 4.9 2.4 2.5 CSOP 1.0 0.1 0.1 0.1 Rollover 0.8 0.6 0.4 0.2 Sub- total 11.2 8.4 4.3 4.1 Total 22.5 19.7 4.3 4.1

A) Founder Shareholdings - 11.3m

As you point out in your commentary there are B shares that are owned by the founders of the business and current directors - Vishwanath Alluri and SS Bhat - these allow them to exchange their subsidiary holdings (which they have held since foundation of the company) for a direct holding in the listed company. This structure was established on listing and was necessary because of tax and foreign holding considerations, the structure is detailed in the Admission document. The shares under this arrangement should be considered as good as issued and the options will actually be exercised as and when the founders wish to sell any of their holding. The value of the founder shareholdings using the prevailing share price should be aggregated with those listed on AIM to obtain a meaningful valuation of the company’s share capital.

B) Management and employee incentives – 8.4m

These options largely reflect shares under option schemes issued to senior managers and c450 employees in the group when the Company transitioned from a private venture capital owned company to a publicly listed business. The schemes were established with the venture capital shareholders at the time to provide a long term incentive and retention mechanism over 4 years, details of the schemes are fully disclosed in the Admission document. A further relevant breakdown is that of the 8.4m, 4.3m are vested and 4.1m will vest over the next three years and that this additional vesting is subject to certain financial performance criteria and employees remaining within the company. In arriving at today's valuation and "effective" issued capital I would include the vested shares as these are in the money.

Therefore the “effective” issued share capital today would be 63.6m shares (48.0m in issue + 11.3m founder shareholdings + 4.3m vested options). Shareholders should expect an additional dilution of 4.1m shares (6.5%) over the next three years under existing schemes.

There is also commentary on the number of share schemes in the notes to the accounts. This reflects the usage of certain UK tax driven share ownership schemes for UK employees and managers (CSOP and Flowering shares), a general scheme for mainly non-UK employees (Unapproved) and a rollover of an option scheme put in place in 2011 in what was the Indian holding company (Rollover). The other schemes in the note Plan A and B were cancelled pre-IPO and are disclosed for prior year comparison only.

I hope this helps explains the situation and I'm happy to talk you through any of this in more detail. I follow your blog and appreciate the thorough analysis you do and would love also to take you through our business whenever you have time.

warm regards

J.

My opinion - firstly, many thanks to the CEO for going to the trouble to explain things in such detail. Armed with these facts, the key issue is obviously to use the correct number of shares in issue to value the company.

The section I bolded above clarifies this, and suggests we should be using 63.6m as the effective number of shares in issue, with a further dilution of 6.5% possible. Providing investors use this number of shares in their calculations, then it is possible to make a judgement on whether the shares offer good value or not.

See you tomorrow.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.