Good morning,

In case anyone missed it, Paul has heroically covered a large bunch of stocks I didn't get around to yesterday, in a Part 2 report.

It's available at this link. Stocks covered: XLM, LAKE, MUR, KLBT, AVO, PRSM.

Paul is also writing a Part 2 report today, covering LOOP, TAP, KOOB and STAF. It's available here.

Kromek (LON:KMK)

Share price: 21p (+6%)

No. shares: 153m

Market cap: £32m

Firm Placing and Open Offer to Raise up to £21 million

This very large fundraising (vs. the market cap) comes as something of a surprise to me - bigger than I would have expected.

The company had £3.8 million in cash and some spare capacity in a borrowing facility, at the date of its interims (last October). When this was reported, I said the company could potentially get to profitability before raising fresh funds - but the risk of a further dilution was enough to keep me away.

100 million new shares are conditionally being placed at 20p, and a further 5 million will be available through the open offer (if the proposals are accepted).

Admirably, the placing is taking place at no discount to the middle market price of yesterday evening.

Rationale

An interesting rationale - it needs financial strength to boost its perception among its customers, apparently. Cash reserves are needed "to provide comfort to third parties".

The Directors believe that a perceived lack of balance sheet strength has, at times, weakened the Group's position when negotiating contracts with OEM and government bodies. Whilst these organisations are increasingly interested in pursuing CZT as a new technology, when the Group has historically engaged in commercial discussions with these organisations concerns have been expressed about the financial strength of the Group and its ability to supply significant quantities of CZT detectors over an extended period of time. The Directors believe these concerns have delayed or prevented the Group from entering into significant supply contracts with potential new and existing customers.

Use of proceeds

£17 million for the balance sheet strength required as above, and £3 million for general purposes.

Current Trading

in line with expectations.

My opinion

I think this is great news for the company, and it's nice that shareholders have been so supportive, but is there value at the current share price? At the current share price, the market cap would rise to £54 million based on the new share count.

And it wouldn't make any sense to work on an enterprise value basis (subtracting the cash value from the market cap), since the whole point of this fundraising is that the cash is needed inside the company.

The company is targeting EBITDA breakeven in the year to April 2018.

Way too speculative for me at this share price.

WH Smith (LON:SMWH)

Share price: 1575p (+6.5%)

No. shares: 112m

Market cap: £1,765m

Another mid-cap, but as readers will be aware, I do like to climb out of the swamp of small-caps sometimes!

This is another share I have a bit of history with. I like the company very much.

Some people reckoned it had the potential to be just another undifferentiated victim of a fickle consumer, but they under-estimated the power of its niche - particularly in the Travel segment. Consumers still want bottled water and magazines in train stations and airports, and it doesn't look like that is going to change any time soon.

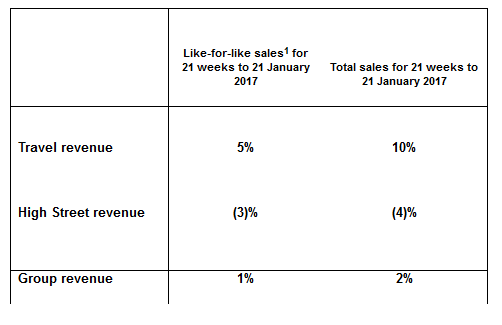

Today's update for the 21 weeks is as follows:

Profit Guidance: "As a result of the performance in Travel we expect Group profit growth for the year to be slightly ahead of plan."

One reason why the High Street has failed to achieve 2015/2016 sales is"the annualisation of last year's strong sales of 'colour therapy' titles" - remember when everyone was buying colouring books for adults?

My opinion

The company has relentlessly improved its margins over the years even as sales have flat-lined, it has growth opportunities in international travel stores, and is embedded in the high street via its partnership with the Post Office. A great stock to buy and hold, in my opinion.

Restaurant (LON:RTN)

Share price: 307p (-11%)

No. shares: 201m

Market cap: £617m

The struggle continues at the Restaurant Group. Results for the period ending 1 January are expected "in line", but some weak commentary on Q4 and the outlook have seen the shares slipping.

Total turnover increased by 3.7%* versus the prior year, to £710.7m, with 53 week like-for-like sales down 3.9%. In the period the Group closed 37 sites and opened 24 sites.

Recent trading continues to be challenging, with 2016 quarter four like-for-like sales down 5.9%, driven by underperformance across our Leisure brands.

The proposition at Frankie & Benny's is going to experience substantial change, as expected, and other brand offerings are also under review.

The company thinks H1 will be difficult, but H2 might benefit from company initiatives.

This paragraph is a serious test for investors' confidence. Nothing revelatory, but it's a bleak series of headwinds:

During 2017, the Group will also face well documented external cost pressures from the increases in the National Living Wage, the National Minimum Wage, the Apprenticeship Levy, the revaluation of business rates, higher energy taxes and increased purchasing costs due to the combined effects of a devalued pound, and commodity inflation.

My opinion: I have a little bit of spare capacity in my portfolio, and am tempted to do something I don't normally do - take a small starter position in this stock.

My source suggests that the market is expecting pre-tax, pre-exceptional profit of c. £77 million this year. Debt is low and I have the impression that the brands are still well-liked (although I must try to quantify this, if possible).

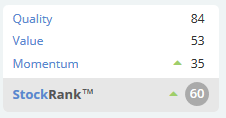

The Stockrank is only 60, as it is held back in particular by a weak Momentum score. That's been caused by a considerable period of negative news flow, with only temporary periods of reprieve along the way, and it would be a brave investor who would bet that this sequence of negative flow was now at an end. But perhaps on a longer timeframe, the shares are now attractive?

That's about it from me today. Thanks for reading!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.