Good morning! It's Paul here. I'll be doing today's report.

In the meantime, I covered loads more companies in yesterday's report, in the evening. I appreciate this isn't ideal for readers, but sometimes there's just so much going on during market hours that I can't concentrate properly on report writing.

So yesterday's report had a big section on Crawshaws (I quite like the deal with 2 Sisters, and have bought some stock personally). Other companies covered are results & trading updates from: Proactis, WANDisco, RedstoneConnect, HML Holdings, Reach4Entertainment, and Dillistone.

Today, I hope to cover;

Servoca (LON:SVCA) - trading update

Richoux (LON:RIC) - poor results & impending fundraising

Styles and Wood (LON:STY) - final results

Synectics (LON:SNX) - AGM statement

Harvey Nash (LON:HVN) - Preliminary results

Character (LON:CCT) - Interim results

IMImobile (LON:IMO) - trading update

So that will keep me busy for the rest of the day.

Servoca (LON:SVCA)

Share price: 27.25p (up 23.9% today)

No. shares: 123.7m

Market cap: £33.7m

Trading update - this staffing company has a year end of 30 Sep 2017, so it's reporting on H1 performance today.

Things seem to be going well;

We are pleased to report that following a positive start to the year, results for the first six months are ahead of internal expectations and significantly ahead of the corresponding period last year.

Outlook comments for H2 also sound positive;

The Group's diversified business mix has delivered a resilient performance and this gives the Board confidence as we enter the second half.

Valuation - it's the usual struggle to find broker research, but there's a FinnCap note on Research Tree from Dec 2016, which forecasts 2.4p adjusted EPS for this year. The Stockopedia consensus figure is in a similar ballpark, at 2.36p.

FinnCap said this morning that they're leaving forecasts unchanged. That's surprising, as the RNS suggests the company is out-performing. So personally I'd be inclined to base my valuation on maybe 2.5p or 2.6p EPS for this year?

That means, even after a big rise today, the valuation is probably just over 10 times this year's forecast earnings. That's probably about right - small cap staffing companies are all pretty cheap at the moment.

My opinion - there's been a good progression in profitability here since 2012.

Divis are only small - there are much better yields available elsewhere in the sector.

Note that the company is doing share buybacks - which enhances EPS, but won't help market liquidity.

The last balance sheet looks OK - no concerns there.

Overall, it looks a fairly sound, profitable company. The price looks about right to me.

Richoux (LON:RIC)

Share price: 19.5p (down 29.1% today)

No. shares: 99.6m

Market cap: £19.4m

(for the avoidance of doubt, I no longer hold any shares in this)

Final results - for the 52 weeks to 25 Dec 2016.

Five months later, we find out how the company performed in 2016. That's a ridiculously slow reporting cycle, and could be seen as showing contempt for shareholders.

The figures published today are audited (which takes time to do). However, I think we need more consistency in how companies report. Some companies put out preliminary results, on a faster timetable (which is best practice). Whilst others, such as this one, have a yawning gap whilst they prepare the figures & get them audited. A tiny company like this has very simple accounts, it should be a doddle to prepare them, if the finance department is well-organised.

This is a rag-bag of restaurant formats, which has needed a good sort out for years. Jonathan Kaye has come in to breath new life into it, and got a very generous share options package too.

The trouble is that casual dining is a tough sector, where there's over-capacity. Also, I'm starting to think that the Kayes might be a one-trick pony - growing pasta/pizza formats galore. All very similar. The trouble is that everyone else has latched onto the fact that the gross margins are huge on pizza/pasta. So there's a considerable proliferation of these copycat chains.

In fairness though, Mr Kaye hasn't had much time yet to sort out Richoux. There could also be an element of kitchen-sinking in these figures, perhaps?

Some numbers;

Revenue £13.3m (up 2.2% on prior year)

Profitability - it's swung from a £731k operating profit (pre-impairments, etc) in 2015, to a £729k loss in 2016 - clearly a poor result

Impairments - are substantial this year, at £5.0m. This follows a £0.5m charge last year. This might be seen as non-cash, but it's real money from prior periods that's gone down the drain. In other words, the fit-out costs (capex) of the bulk of the estate, was wasted money.

Provisions - there is also a £511k charge for "reorganisation costs", and a £420k onerous lease charge.

The overall loss before tax is a whopping £6.7m, so very much a kitchen sink set of accounts.

Balance sheet - actually isn't bad. The company still has £3.9m in cash, and no debt.

Outlook/ current trading - doesn't sound very good;

Like many restaurant groups in the casual dining sector, trading in the first quarter of this year has been difficult.

In addition, during this period trading in some of our restaurants was interrupted whilst we converted or refurbished them. The impact of temporary closures will continue during the second quarter.

Whilst our new Richoux and Friendly Phil's restaurants have only been trading for a brief period, the early signs from them are encouraging.

The Friendly Phil's format seems to be a refresh of the existing Dean's Diners format.

Fundraising - within the outlook section, the company gives advance notice that it intends to raise more cash. That's pretty toxic for the share price, although of course that means the investors concerned get a bigger slice of the cake. Everyone else gets diluted. So I hope there will be an Open Offer, if any fundraising is done at a discount;

The cost of converting or refurbishing restaurants and of closing underperforming restaurants, the reduction of income due to temporary closures and the current trading climate have led the Board to conclude that it will need to approach shareholders for further funds in due course.

The Board has had informal discussions with a number of the Company's key stakeholders, who have indicated that it would be their intention to support such a fund raising.

I don't have any doubts that the funds will be raised. I am worried about the price though, which could be punitive for existing shareholders that are not able to participate in a fundraising.

Illiquidity - for that reason, I've ditched my shares in Richoux today. What a performance that was! The trouble with tiny, illiquid shares like this, is that you can't sell when you want to. So even though there was a 20p Bid price on the screen, there was nobody actually offering to buy in any size at that level.

This is a problem with most micro caps. What people don't realise, is that the quoted market prices are often an illusion. Often there are no real buyers at all, at the market price. So to exit my position, my broker had to negotiate a haircut - in the end I had to accept 17.5p as my exit price - that's a 12.5% haircut on an already bombed out share price. Painful, but thankfully it was only a small position, so no serious damage done.

The reason I am mentioning this, is a memo to self more than anything - namely that almost every time I get involved in tiny, ililquid shares such as this, it ends badly. Then to add insult to injury, you can't get out - unless you're prepared to take a hefty haircut.

Risk:reward is absolutely terrible with micro caps, unless you spot something really special - and the occasional gem does occur. I think there has to be massive upside potential, to justify parking money in a share that is so illiquid, it can be impossible to exit from. That's fine if you take a Nigel Wray approach - just write off the money if it goes wrong, otherwise hold forever. Those of us with considerably smaller portfolios than him don't have that luxury!

My opinion - longer term, I still think Richoux has great potential. Its main brand could & should have been a serious competitor to Patisserie Holdings (LON:CAKE) (in which I hold a long position). Although, as today's results make clear, it's going to take quite some time to sort out the existing problems.

There's more dilution coming for existing holders too. Also, I have my doubts about whether the Kaye approach of doing copycat Italian pizza/pasta chains has any more mileage in it? Newer operators like Franco Manca (owned by Fulham Shore (LON:FUL) - in which I have a long position) are doing it better, and have fresh ideas.

Comparing another troubled Kaye chain, Tasty (LON:TAST) (in which I have a long position) and Richoux (LON:RIC) , it strikes me that TAST is the much better investment of the two (although neither are much cop really) . TAST is struggling, but it's still profitable, and doesn't need to raise cash. Whereas RIC is now loss-making, and needs to raise cash. So I've unceremoniously ditched them.

Air Partner (LON:AIR)

Share price: 112.3p (down 4.9% today)

No. shares: 52.2m

Market cap: £58.6m

Preliminary results - for the year ended 31 Jan 2017.

I wasn't planning on looking at these results, but several readers requested it, so here goes. Just re-reading my notes from 15 months ago, when I concluded that this share looked quite interesting, with a big dividend yield, and a StockRank of 99 at the time.

The share price was 388p then, so adjusting for the 1 for 5 share split in Jan 2017, that's 77.6p in new money. Therefore we've seen a 45% share price rise in 15 months - not bad. Although we're in a roaring bull market, so most things are going up.

The main activity of this company is aircraft broking, e.g. private jets for sports teams, HNW individuals, business people, etc. This generates 90% of the profit. There is another, consultancy division, which looks early stage - a distraction maybe?

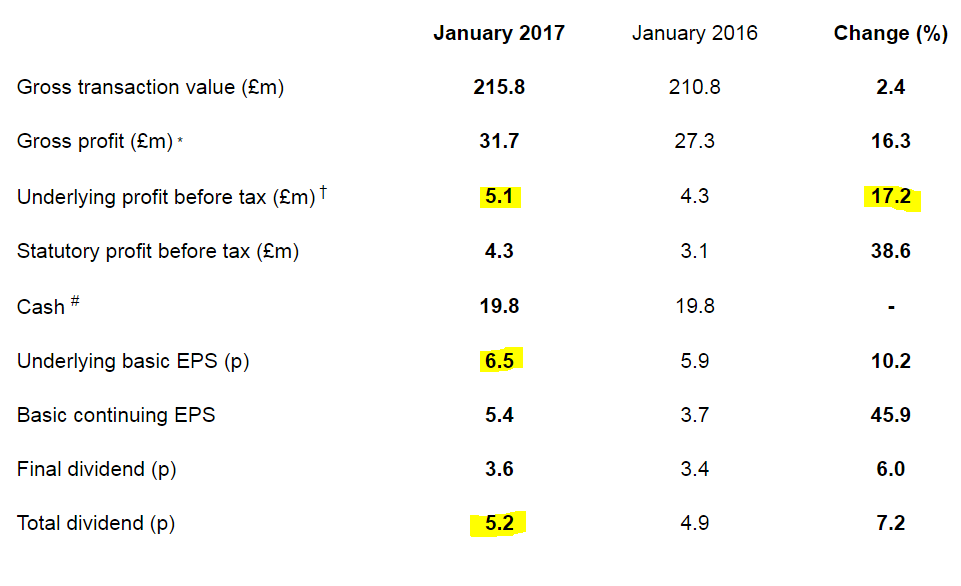

The highlights section shows a good increase in profitability. This looks to have come mainly from improved margins, rather than top line growth:

Underlying EPS of 6.5p seems to be below consensus expectations of c.7.5p. I've done some digging, and the difference is down to a one-off higher tax charge in 2017/17. Stripping out that one-off impact, the results are actually in line with expectations. So that's fine.

Dividends are a particular feature here - the company pays out most of its earnings in divis. The 5.2p divis for 2016/17 represent a fairly attractive yield of 4.6%.

Balance sheet - this looks unusual, since the company receives substantial cash deposits up-front from its JetCard scheme. This is important, because of the £19.8m cash, £15.9m is actually money that belongs to customers using the JetCard. Since the company also says in the narrative that it intends moving this cash into segregated accounts, to reassure customers, then it's essential to ignore the JetCard cash when valuing the shares.

Therefore, I would adjust the balance sheet by removing £15.9m cash. The other side of the double entry is to reduce deferred income by £15.9m too. So basically, the enterprise value figure will be wrong, and needs to be manually adjusted in this way.

Overall though, the balance sheet looks OK to me.

Outlook - sounds alright, but not exciting;

Trading has commenced in line with the Board's expectations and this, together with the pipeline of work for the next quarter, means that we begin the 2017/2018 financial year with a degree of optimism

Valuation - forecasts for the new financial year are unchanged at £6.4m normalised profit before tax.

Although a somewhat higher tax charge is expected this year too, so EPS has been trimmed from 8.7p to 8.1p by one broker today.

That gives a PER of 13.9, which looks about right to me.

My opinion - it looks OK. We have to remember that this sector is very cyclical, so both profits and share price are clobbered when the economy turns down. For that reason, it's the sort of thing to ditch as soon as storm clouds are seen on the economic horizon.

In the meantime though, I can see the attraction of a nice yield, and what appears to be a well-run business. I like the chatty narrative with today's results too - the company seems focused on delivering customer service, and repeat business, which seems very sensible.

Overall then, it looks quite a nice company, probably fairly priced. Personally I don't feel any particular urge to buy any shares in it, as this is not a sector which interests me, and it's too cyclical.

Styles and Wood (LON:STY)

Share price: 411p (down 4.4% today)

No. shares: 8.7m

Market cap: £35.8m

Results for year ended 31 Dec 2016 - very slow reporting from this company.

This group calls itself a "integrated property services, and project delivery specialist" - surely they can come up with something a bit simpler & more readily understandable than that?

The figures look pretty good, with underlying profit before tax up 26.5% to £4.1m.

Underlying basic EPS is up 11.3% to 41.4p, so that puts it on a PER of 9.9, which is probably about right for this type of business - a low margin contractor.

Broker consensus for 2017 is 50.9p EPS, which would bring the PER down to about 8 - which I wouldn't say is particularly cheap. These type of businesses should be on a single digit PER, because they're so prone to things going wrong on contracts, and becoming loss-making and sometimes going bust in recessions.

Balance sheet - The company was in a right mess financially a while back, but a clever restructuring, combined with better trading, has sorted things out pretty well. That said, the balance sheet is still weak.

NAV is only £3.4m (but positive for the first time since 2007, the company proudly points out).

Take off the intangibles though, and NTAV is negative at -£5.0m.

A weak balance sheet means no dividends of course. So it does matter.

Outlook comments sound fairly confident. It does amuse me how companies with weak balance sheets often claim to have a strong balance sheet, as we see here;

"The Group goes into 2017 in good shape, with a healthy forward order book, strong balance sheet and an unrelenting focus on delivering a truly integrated property services solution to our customers. We have a solid platform to deliver sustainable growth and look to the year ahead with confidence."

My opinion - well done to everyone who spotted the opportunity on the restructuring a while back.

I'm not sure how much upside there is from now on though? Maybe some, if things continue going well, but is it likely to be a multibagger from here? Probably not. There's also the ever-present risk of profits being decimated by one or more bad contracts.

Personally I don't touch low margin contracting businesses any more - there's too much risk, for not enough reward. That said, there can be good (if risky) money made on turnarounds such as this one in 2015-2016.

Quick comments now, as I'm almost out of time;

Synectics (LON:SNX) - today's AGM statement is reassuring. The first 4 months (Dec- Mar inclusive) have been "in line with the Board's expectations". I also like this comment on the full year outlook;

Based on the Group's current healthy order book and pipeline of anticipated new business, the Board's expectations for results for the full year remain in line with market forecasts."

Overall, it looks an OK business, nothing special. The valuation seems about right to me.

Harvey Nash (LON:HVN) - results for y/e 31 Jan 2017 don't look too good - adj EPS fell from 9.73p last year, to 8.86p this year. That's despite forex translation benefit from its overseas operations.

It has a gigantic debtor book, and does mention bad debts in some countries, so that's a risk which concerns me.

Cashflow looks good, and it pays a generous divi.

Outlook comments are quite good;

With the benefits from the actions taken, we are confident of driving profitable growth in the year to January 2018, whilst remaining flexible in response to changes in market conditions. The current financial year has started well, with performance marginally ahead of expectations.

My opinion - I don't recall having ever researched this share in any depth. It might be worth a closer look, as the valuation seems modest. There's lots of green on the StockReport, and a StockRank of 96, which are positive factors.

Character (LON:CCT) - half year figures to 28 Feb 2017 look somewhat underwhelming - adj EPS is down about 14%.

Outlook comments say they are "on target to achieve current market expectations" for the current year (ending 31 Aug 2017).

Balance sheet - looks good, with plenty of cash.

New products - there's some interesting commentary about expanding popular ranges of toys.

My opinion - I've held this share before, and think it's looking good value again. I might revisit it when time permits. Based on a very quick review of the numbers today, I think it could be worth a closer look.

IMImobile (LON:IMO) - an interesting company, with good management, in my view.

Today's update is for the year ended 31 Mar 2017. Things have gone well;

Group trading slightly ahead of market expectations with strong trading momentum and organic growth in all regions and business units

There's a lot more detail in the announcement, which I don't have time to go into now.

All done for today!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.