Good morning! It's Paul here.

I've got to be out of my hotel room by noon, so will rattle off as much as I can. Then I'll try to find a cafe that does an all-day breakfast, and has WiFi, to write a bit more.

I added some more to yesterday's report last night, which now covers: Revolution Bars, Johnston Press, Be Heard, Entu, and Walker Greenbank. Here is the link, if you wish to see that completed report.

Purplebricks (LON:PURP)

(at the time of writing, I hold a long position in this share)

This ludicrously highly valued online estate agent often plunges in share price. These have been excellent buying opportunities. So it's a share which I monitor, and tend to buy these sharp dips. The same thing has happened in recent days, with a particularly sharp sell-off yesterday. So I rang my broker to buy some more. I could hear talking in the background, and my broker then made me aware that apparently PURP was about to be exposed for some kind of malpractice on the BBC's Watchdog programme. So I cut my buy order in half. That's a good example of how a traditional telephone broker can add value, by pointing out things I may not have spotted.

My feeling is that TV exposes tend to only have a passing impact on share prices, unless something really terrible is going on. As regards estate agents, most of us probably have a very low opinion of the entire sector. So I really don't see it as a particular problem that PURP has managed to upset some customers along the way. What do people expect, if they're only paying a fraction of the normal price for a service?

As it turned out, the Watchdog programme was fine. PURP seems to have breached advertising rules, forcing it to pull some adverts. Hardly the crime of the century. Their claims were broadly correct anyway, they just fell foul over some details. Furthermore, the undercover filming of 5 PURP agents threw up remarkably little dirt. I think filming any 5 estate agents undercover would throw up plenty of embarrassing things.

The CEO of PURP turned up at the Watchdog studios, and faced the music. He got some good points across, but I think should have been more contrite, and more relaxed. He comes across as very anxious in interviews & presentations. So some media training could be useful there, I think. It doesn't do much good if you come across as anxious & shifty, when you're trying to restore faith in a company!

Overall then, it struck me as a storm in a teacup. It might even help the company, as it profiles PURP as a major player in the sector? Or maybe I'm biased, because I own the shares?

EDIT: I've only just noticed that PURP has issued a statement today, re the BBC attempted hatchet job yesterday. Also, I've spoken to my broker, and he said that he's read 3 broker notes today which all concluded that the BBC attack contained nothing of substance.

Next (LON:NXT)

(at the time of writing, I hold a long position in this share)

It's been a smashing start to the the day, for me. I mentioned in a report here recently that I'd bought back into Next. The reason was the bombed-out valuation, and better than expected Q2 retail sales figures from the ONS. This led me to believe that the High Street might be performing better than the stock market expects?

Next is such a quality business. A lot of its sales are now online (around half, or not far off half anyway). Its international operations are doing well, and expanding. Even the problem area of UK retail remains highly profitable. Importantly, Next has managed its store estate well, and is unencumbered by long leases, plus has hardly any loss-making shops.

Reports of the death of the High Street seem very exaggerated to me. In medium to large towns & cities, the shopping areas are still thriving. Internet won't kill off clothing retail, because to many women especially, clothes shopping is a leisure activity. Trying garments on, to ensure they fit well, is a key advantage that the High Street has over online.

Lease terms are key. What we'll see, as online hoovers up further market share, is that High Street rents will come down. That's already happening. Next said, earlier this year, that rents on new sites are being achieved at just 5% of revenues (as opposed to 7% on existing stores). Expect that figure to get even lower. Hence, I see falling rents as being a positive, offsetting effect on retailers, helping to reduce the impact of cost increases in other areas (e.g. staff). I wonder also how long it will be before staffing levels are reduced by the use of robots in-store?

Therefore, my view is that the best High Street retailers should adapt & survive. As regards Next, its update today is reassuring. This has triggered a 7.6% rise in share price this morning, to 4318p.

Next gives wonderful guidance to the market, and today its profit expectations remain unchanged, at between £680-740m. So it's still a fantastically profitable, and cash generative business.

Just for fun, I've compared the market caps and profitability of Next, with Asos and BooHoo. You might be surprised to hear that (based on Stockopedia net [i.e. after tax] profit forecasts for the current year), Next is forecast to make 6.2 times the profit of Asos & BooHoo combined! (£581.2m vs £94m). Yet on valuation, Next is worth £5.9bn, versus Asos + BooHoo combined valuation of £7.6bn.

As regards divis, Asos & BooHoo pay out nothing. Whereas Next is paying a divi yield (including quarterly specials) of about 8%.

Now I realise of course that Asos & BooHoo are highly prized due to their strong growth, and being glamour, internet stocks. However, the market is seemingly overlooking the fact that Next is also a very successful online retailer, with a bunch of highly profitable stores too. On a PER of 10. How does that make sense?

Right, on to some small caps!

Gattaca (LON:GATC)

Share price: 277p (down 8.6% today)

No. shares: 31.6m

Market cap: £87.5m

(at the time of writing, I hold a long position in this share)

Trading update - this company describes itself nice & clearly as;

The UK's leading specialist engineering & technology recruitment business.

It updates us today on trading for the year ended 31 Jul 2017. I'm impressed that the company can give an update Just 3 days after the end of its financial year. This indicates that the finance team are on top of things.

The Board expects profits to be broadly in-line with market expectations.

So, slightly below market expectations then.

The company provides some tables showing the split of revenues between sectors, and type (i.e. temp & perm). These seem to show a slightly improving trend in H2, but still down on last year.

Outlook comments don't fill me with confidence either;

"The UK continues to be our biggest market by some margin and, while we have seen some recovery following the initial uncertainty caused by the outcome of the EU referendum, continuing political uncertainty and its impact on business confidence is unlikely to lead to an increase in customer demand and candidate availability in the near and medium term.

Although it then goes on to say that its specialism in engineering and technology should help mitigate overall economic weakness, and concludes;

This strong position in Engineering and Technology markets, particularly where they converge, allied to our rapidly growing international business puts us in a robust position for the future."

Rather mixed messages, then, which is a little confusing.

A lot more detail is given, which I won't dig into.

Net debt - has risen to £41m, due to an acquisition, dividends paid, and a slight deterioration in debtor days.

Valuation - Stockopedia shows 34.7p as the analysts consensus for EPS. If we knock that back to say 34p, which I would say is broadly in line, then at 277p per share, the PER is 8.1 - in the bargain basement. Mind you, that doesn't look quite so cheap when you adjust for net debt.

Dividends are extremely generous, with this share yielding about 8%. A similar yield to Next. Usually an 8% yield is the market telling us that it thinks the divis are unsustainable at that level. However, with both Next and Gattaca, I reckon that could be wrong. Both look able to continue paying out at that level. Providing trading doesn't deteriorate, anyway.

My opinion - a somewhat lacklustre trading update, which is reflected in a depressed share price.

I must admit to be close to losing patience with this share. However, on balance I'll probably continue to hold for the excellent divis. Plus I think this is a fundamentally sound company. There could also, at some point, be consolidation in the sector, who knows?

Hopefully the company can improve performance in future. Big UK infrastructure projects have been flagged by the company again today as providing potential upside.

Portmeirion (LON:PMP)

Share price: 965p (up 1.8% today)

No. shares: 10.8m

Market cap: £104.2m

(at the time of writing, I hold a long position in this share)

Half-year report - for the 6 months ended 30 Jun 2017.

This is a UK-based group of companies specialising mainly in decorative pottery, crockery, and other similar homewares. It acquired a candle business, Wax Lyrical, in 2016. This business has contributed 6 months trading in H1 this year, but only 2 months in H1 last year, which has flattered the overall revenue growth of 16%. Organic revenue growth in the core business was only up 3% in H1 (in constant currency, this is down 2%).

This group has a heavy H2 weighting, so its H1 results are not particularly interesting. The outlooks statement probably matters more than the figures.

H1 profit before tax is up 18% to £1.6m

Outlook - the company sounds confident;

...we remain confident for meeting expectations of the full year given the revenue and profit reported for the first half year.

Balance sheet - looks solid to me. Of particular note is the net debt has fallen sharply, to only £1.7m. That seems to have been flattered somewhat by favourable working capital movements (inventories & debtors have fallen), which could possibly reverse in H2.

Working capital is plentiful, with an excellent current ratio of 2.95.

Although there are some longer term creditors, namely £6.6m pension deficit, and £5.9m of bank debt (which is included within the £1.7m net debt figure above).

Overall, it's a very safe, solid balance sheet, so no concerns there.

With a £20m, largely unused bank facility, the company potentially has firepower to do more acquisitions. That could provide some upside potentially. The Wax Lyrical acquisition has gone well, so I think management here are a safe pair of hands. I know Dick Steele, the Chairman from old, and he's a very solid, decent chap.

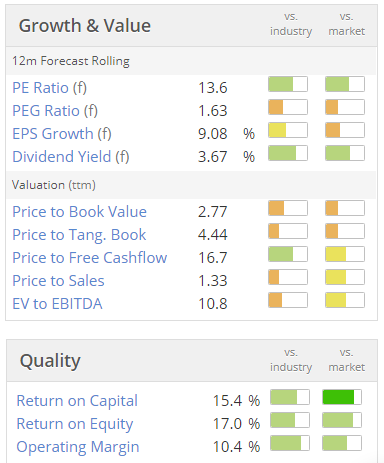

Valuation - this looks good value to me, for a business with valuable brands;

My opinion - I really like it, and have topped up today. I'm considering buying more still, but the stock is very illiquid, so am holding fire for now. The trouble is, you have to take a nasty hit from the bid/offer spread with this share, and if you need to sell in a hurry, then you'll be carried out on a stretcher. That needs to be taken into account, hence why I don't think this would ever become a large long position for me.

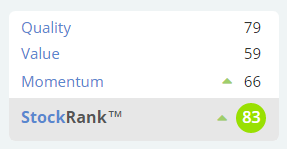

Stockopedia likes it - a strong StockRank;

Within StockRank Styles, it's classified positively as a "Super Stock"

I'm hopeful of a takeover bid from America. The "Christmas Tree" range of pottery is a best seller for PMP, in the USA, where it's something of an iconic range. So to my mind, it's probably only a matter of time before a US acquirer realises that PMP is only modestly rated, and pounces on it. There's nothing in the valuation for the brand values, which I think is wrong. So a takeover on a PER of say 20, implies about 50% upside on the current share price, if that scenario plays out.

In the meantime, we get reasonable divis to keep us amused, and the company has a track record of nice growth. So this looks a good each-way bet, in my view.

Communisis (LON:CMS)

Share price: 47.5p (up 2.2% today)

No. shares: 209.4m

Market cap: £99.5m

Interim results - for the 6 months to 30 Jun 2017.

This is a reader request. This is a marketing group, which seems to have a wide range of activities, as shown on its website here. I've never really understood what the company's main activities or profit drivers are. It doesn't help that the divisional analysis splits its activities between "brand deployment", and "customer experience". What on earth does that mean? I seem to recall that a lot of its activities are print-based - direct marketing, or junk mail as most of us would call it.

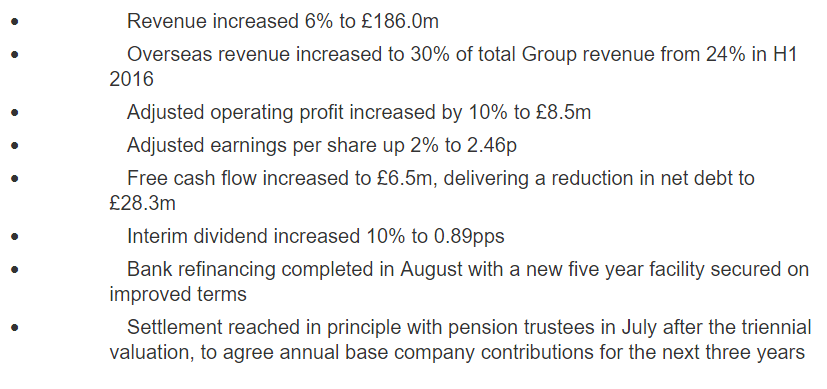

The financial highlights look fairly solid - see below. Remember these are only 6 month figures;

Outlook - unless I've missed it, there doesn't seem to be an outlook section with today's results commentary. However, the CEO comments include what sounds like the group is performing in line with full year expectations;

Trading expectations for 2017 are unchanged.

Balance sheet - this is where I've had issues in the past with this company, hence have never bought any shares in it.

NAV is £130.7m. However, the balance sheet is dominated by intangible assets of £186.1m, which personally I always write down to nil. Doing so results in negative NTAV of £-55.4m. I wouldn't usually invest in any company with negative NTAV, unless it was highly profitable and growing strongly, which this isn't.

Working capital isn't good. Current assets are £122.2m. Current liabilities are £158.0m, which gives a current ratio of 0.77, which is poor. I generally would like to see a current ratio of at least 1.2 for this type of business, and would only be comfortable above 1.5. However, note that nearly all the bank debt is shown within current liabilities, so this does make the working capital position look worse than it probably is in reality.

Note that long term creditors includes a pension deficit of £42.0m.

A funding agreement has been reached with the pension fund trustees, which doesn't look particularly onerous. Although this is a drain on cashflow, and consumes money that could otherwise be used to pay higher divis;

Deficit repair contributions to the Scheme will be £2.55m, increasing in line with dividend increases, or 3% if higher, plus rental payments which remain unchanged at £1.15m through the Central Asset Reserve arrangement

I'm not overly concerned about the pension deficit here. However, it does affect the share price valuation, so needs to be taken into account.

Bank debt seems under control. I particularly like the disclosure below of average net debt, which gives a better view of reality. As opposed to year end figures, which are often distorted;

Net debt reduced by £2.1m since 31 December 2016 to £28.3m, and ended £6.6m lower than at the corresponding point in the prior year. This reflects bank debt of £25.9m, representing 37% of the Group's facilities.

Bank debt at the period end was 0.85 times EBITDA for the twelve months to June 2017 and average bank debt during the period was £45.2m, 1.48 times EBITDA. Covenants remain well covered.

That seems alright. I'd prefer it if the group didn't have debt, but it doesn't look onerous.

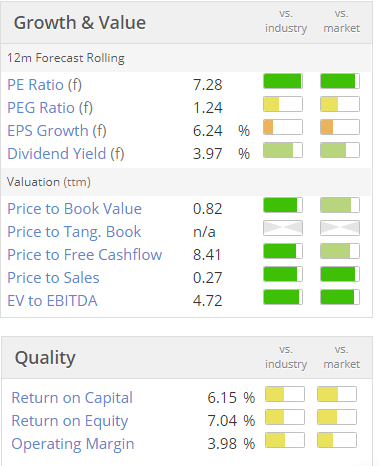

Valuation - this share looks strikingly cheap on the usual Stockopedia valuation graphics - in particular, a very low PER, and a reasonably good divi yield;

However, bear in mind that there's a fair bit of debt and pension deficit (another form of debt).

So the market cap is £99.5m, average net debt is £45.2m, plus the pension deficit is £42m, so you can see that the Enterprise Value (calculated on the basis of including the pension deficit, which is the most prudent approach is £186.7 - that's not far off double the market cap.

So the PER would actually be in the low to mid teens, if you were to adjust the figures to be cash & debt neutral. That's probably about the right price.

My opinion - this looks a solid performance from the company in H1, and a decent full year outlook. However, I think the apparently very cheap PER is justified, because of the net debt, and pension deficit. Therefore, I've come to the conclusion that it looks priced about right.

As you can see from the 2 year chart below, this share has tended to meander up & down, with an overall sideways direction. In a bull market, investors are chasing more exciting growth stocks. So my worry would be that this share could just continue going nowhere, as investors rotate in & out, getting bored after a while. You tend to see that in bull markets - investors often eschew shares which fail to set the pulses racing, or are seen as a bit old fashioned, or even in long term decline (which print-based communications probably are). I know CMS does digital stuff too, but Google & Facebook seem to be hoovering up such a high proportion of digital marketing, I'm not sure how much there is left for others?

Overall, it doesn't float my boat I'm afraid. We have to remember that putting money into shares that don't really go anywhere comes with an opportunity cost - i.e. we could have been making money elsewhere on something better.

Right, that's me done for today.

Our Graham will be looking after us all tomorrow. I'll chip in, if anything particularly interests me.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.