Good morning! It's Paul here.

Both Graham and myself are busy preparing for various talks we're doing at the UK Investor Show this Saturday. I'm nervous, but excited, about the main stage slot I'm doing - I'll be interviewing Nigel Wray and veteran fund manager Paul Mumford.

Also, I (perhaps foolishly!) agreed to myself being interviewed by Tom Winnifrith. So I feel a bit like a lamb to the slaughter!

I think he wants to beat me up about Trakm8 Holdings (LON:TRAK) - although of course my bullish view on that stock in early to mid 2016 turned neutral/bearish once the company began issuing more negative updates in later 2016. I think it's probably over the worst now, and personally I went back into TRAK recently, in the 65p placing. The company has had a few mishaps, but it's got good & growing recurring revenues. So once the delays & problems associated with new product launches have been resolved, it might conceivably get back on track, who knows?

So I need to spend this afternoon, and most of tomorrow, getting up to speed with the facts, which I can hurl back at Mr Winnifrith. I'm trying to visualise myself as Margaret Thatcher, at the dispatch box. With Tom W being Neil Kinnock, or even better, Michael Foot, floundering in my wake, sinking under the weight of facts & figures being thrown at them!

Treatt (LON:TET)

Share price: 369p (up 3.4% today, at 10:48)

No. shares: 51.8m

Market cap: £191.1m

(at the time of writing, I hold a long position in this share)

Trading update - for H1, the 6 months ending tomorrow, 31 Mar 2017.

You might recall that this food & drink ingredients company issued a very strong update on 23 Feb 2017, which I reported on here. That report is worth revisiting, as I also included a couple of useful links to audio/video content which readers had found & passed on to me. On the back of all that positive information, I added this company to my personal portfolio.

What's interesting, is that companies which release very positive trading updates often continue rising in price in the days/weeks/months after the initial surge in price. Mark Minervini mentions this in one of the many nuggets of gold in his book, How To Trade Like a Stock Market Wizard - which has been my favourite book I've read this year, so far. I think he calls it post-announcement drift, or something like that. So his contention is that, even though it means paying more for good companies, when they issue positive news, that is very often just the beginning of a bigger move upwards. I think he's absolutely right about that.

The reverse is also true - i.e. stocks which put out bad news, often continue falling. This was a key finding in the marvellous work done in Stockopedia's ebook, The Profit Warning Survival Guide.

Sure enough, Treatt has risen about another 20% in the last month, after the initial 20% jump in price on the morning of 23 Feb 2017. You can see this on the chart below.

Better, still there's another positive announcement today, key points saying;

- Strong trading has continued

- Strong dollar is boosting profits

- H1 revenues up 25%, of which 10% is due to favourable forex movements (excellent that they quantify this split, all companies should do this)

- Order book has increased by a material amount

- Net debt up by £3.6m to £12.0m at 31 Mar 2017, cf. a year earlier

- Seasonality - H1 sees cash outflows, H2 cash inflows.

- Expects to exceed its revised expectations for the full year ending 30 Sep 2017.

So forecasts are going up again, barely a month after they were last increased. So this company is clearly on a roll. A certain amount of caution is needed with companies that are making big forex gains (Bioventix (LON:BVXP) was another one recently that is getting a big boost from sterling's weakness, although it was less clear than Treatt about the precise benefit). The trouble is that such forex gains are a one-off boost to growth. So if we extrapolate out similar growth rates in future years, that would be a mistake. The forex gains could even reverse in future periods, who knows? So a degree of care is needed when forecasting.

Valuation - I've seen one broker forecast that has risen 10% today, and it seems likely to me that Treatt could be heading for 20p+ EPS this year perhaps? If that's correct, then the PER is about 18.5 currently. That's not expensive for a company demonstrating strong organic growth.

My opinion - this is one of my favourite long term growth companies. I was a bit late to the party, only buying in recently. This brings the headache of whether it's right to buy a stock after it's already risen a lot. In my view, where there is concrete news which justifies a big rise in price, and the outlook is very positive, then sometimes it can be worth taking the bull by the horns and buying a stock after a big rise has already happened.

In this case, I reckon the current year PER is still under 20, which looks reasonable for a growth company. As Minervini points out, his historical analysis shows that most multibagger shares are actually on a PER of 30 or more before the big move upwards starts. So if you screen out anything with a high PER, you are excluding the biggest future potential winners from your portfolio - which sounds a pretty dumb thing to do.

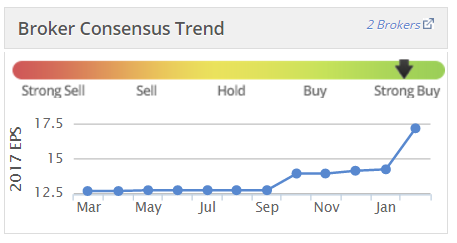

I'm not saying we should pay high PERs willy-nilly. However, in carefully selected cases, it can be worth doing, as strongly growing companies can rapidly grow into an apparently high valuation. Also, brokers are often far too cautious in their forecasts for growth companies. So that can result in a series of big rises to broker forecasts, as Treatt demonstrates in the chart below - and remember this chart doesn't yet include the latest upgrades that will be triggered by today's update:

My opinion - as is already fairly obvious, I like this share, and hold it personally as a conviction position, intended as a long-term hold.

I see this as a growth at reasonable price (GARP) share, which is in that lovely position of seeing repeated upgrades to forecasts.

The only negative for me, is that plans for major capex, which a reader kindly flagged up last time I reported on the company. This could involve some dilution, and a big increase in net debt. Although given that the market cap is nearly £200m, and the growth is proving very good, then I imagine the company would be able to easily finance a (say) £20m placing, combined with a similar sized bank loan. That would only mean 10% dilution, which is nothing really.

The upside from the capex is that the company would then have capacity to greatly expand production & therefore sales.

Overall, I think this looks a very interesting company. Is there a lot of immediate upside on the share price? Probably not, but I could imagine it reaching 400p fairly easily, and then maybe pause to consolidate, or even correct a little, who knows? So it's maybe not of interest to people with a shorter term mindset. As a long term proposition though, I think this looks very interesting indeed. I reckon this is likely to be a much bigger & more profitable company in say 5 years' time.

AO World (LON:AO.)

Share price: 142p (up 3% today, at 12:44)

No. shares: 421.1m before placing, +37.7m placing shares = 458.8m after placing

Market cap: 651.5m

Placing, and trading update - I'm surprised that AO has decided to do a fundraising. It mentions cash constraints, and funding for expansion;

The capital raising will allow us to suitably capitalise the business to support our continued growth and increasing scale, provide flexibility to react to market opportunities and changes, and strengthen our balance sheet for our supplier partners. This will provide improved flexibility to take the right commercial and investment decisions for the growth of the business, with fewer financial constraints.

I can see why more cash would be helpful - after all, AO operates in a very low margin sector, selling electrical items online, with much competition. Therefore, having the cash to negotiate cash deals, and prompt payment discounts with suppliers, would eke out a little more margin.

The dilution isn't bad - it's only a 9% increase in the share count. The price of 132.5p isn't too bad - the share has been trading around 137-142p in recent days, so the placing is a bit of discount, but not horrendous.

Trading update - for the year ending 31 Mar 2017. Personally I think this is poor, but the market seems to have accepted it without any problems - the share price is up today. The main bit says;

Full year trading for FY2017 is expected to be in line with our range of expectations, with Group revenue expected to be c.£700m, up c.17% year-on-year.

Our existing Adjusted EBITDA guidance range is tightened to £-2.4 to £0m and Group cash as at 31 March 2017 is expected to be at least £27m.

Top line growth of 17% is fairly good, but not enough to justify a super-premium rating, in my view.

As regards EBITDA, they're saying that the company might scrape to breakeven, but more likely will be slightly loss-making. A company that can't get into profit on £700m turnover doesn't have a very good business model, if you ask me!

There again, Amazon & others are hugely disrupting many markets by deliberately operating at breakeven - which you could argue is anti-competitive, since the intention is clearly to drive others out of business, thus enabling them to ultimately jack up prices once they've obliterated the competition. I'm surprised that regulators have not taken aim at Amazon, yet.

Valuation - so that leaves AO World in a very difficult position. I can't really see how this company is likely to ever get much further than being a box-shifter that just about squeezes out a breakeven, or modestly profitable result. So why on earth is this company valued at £651m?

European expansion doesn't really seem to be setting things alight either. Whilst the % growth rates look good from low levels, the ambition doesn't sound very exciting to me;

In our Europe business, we are on track to achieve a positive Adjusted EBITDA run-rate* and revenue run-rate* of c.€250m by FY2021 (in existing territories of Germany and Netherlands) with operational leverage, which is expected to be generated largely from warehousing and delivery, weighted largely to the latter period. We expect limited further capex to realise plans in existing territories.

The way I read that, they're expecting losses in Europe to continue until close to 2021. Scraping into the black by 2021 makes me question why they decided to expand into Europe in the first place?

My opinion - I just don't see the attraction here. I think AO chose the wrong sector to build its business - characterised by very low margins, and numerous competitors, which are already operating on the internet. So what exactly is AO disrupting? Not a lot really. They seem to be focused on offering better service. That's fine where there are fat margins, to finance better service. Trouble is, that isn't the case here. So it means more costs, with inadequate margin to finance them.

I suppose the upside case is that, over time, AO may become the consumer favourite choice for electrical items, and some people may not bother comparing prices online, if they value a particularly charming & pleasant delivery driver, who also wheels in the washing machine & connects up the hoses. Personally, I would just do a search, and go with the cheapest company, and tolerate a grumpy delivery driver, since I'm only going to experience him for a few minutes of my life.

eCommerce companies are an area of particular focus for me. In my view AO World is one of the least attractive, in terms of what you get for your money. The shares look significantly over-priced to me. I prefer eCommerce companies which focus on a higher margin niche, my current favourite being Gear4Music (in which I have a long position). Margins there are not great, but they're a lot better than AO World. Also, G4M is achieving scale where it can introduce its own brand, higher margin products.

The other interesting point to consider with eCommerce companies, is that in the current growth phase, they're all spending a lot of money on marketing. However, as the businesses mature, and growth rates moderate, then they should be able to economise on marketing spend. That should then lead to higher margins, or "turning on the profit engine" as some analysts call it.

This has been in evidence at Boohoo.Com (LON:BOO) - they took a decision a while ago to reduce marketing spend as a percentage of revenue, and instead lower selling prices for customers. That strategy has worked very well - dialling in a lower gross profit margin (deliberately) by lowering prices, and compensating by lowering marketing spend, has overall boosted growth and the net profit margin.

So I feel that we could see eCommerce companies begin to improve their net margins in future years, if they achieve scale, and high brand awareness. This then enables them to talk directly to customers (via email, for example), rather than spending a fortune on TV adverts, etc.

An interesting sector, but I've yet to see anything from AO which justifies the sky-high valuation, for a company that's really not making any money yet. It's difficult to see where future profits are likely to come from, in such a competitive sector. Also the top line growth isn't enough to excite investors for much longer, in my view. So I could see this share correcting to perhaps half the current price, at some point. Even that might be still generous?

Time is short now, so a few quick comments;

Carr's (LON:CARR) - share price is down 17.6% today to 124p, so looks like a profit warning.

Trading update - here's the main bit, which is clearly negative;

As a result of challenges to mitigating the impacts of a previously announced delay to a significant contract in the UK Manufacturing business, together with a slower than anticipated recovery in USA cattle prices impacting our feed block performance in that region, the Group's performance for the current financial year is anticipated to be significantly below the Board's existing expectations.

Additional comments say they are mitigating the impact of contract delays by cost-cutting, and winning other, new business. However, it's not enough to offset the problems elsewhere.

Medium term outlook sounds more encouraging, which is possibly what helped moderate the share price fall today (as a normal profit warning tends to knock off 30% from a share price, typically);

In the medium term, the engineering division continues to operate in a recovering nuclear market, with some significant contract wins in the last 18 months, and management has identified further potentially material opportunities in adjacent markets of defence, new nuclear and aerospace.

My opinion - I've never understood the attraction of this share. It's low margin, and as is clear from today's update, is also subject to the vagaries of contract win timing. There was a nice special dividend a while back, but apart from that I can't see anything much to get excited about here. Maybe the future will be more rosy, with the contract wins & opportunities mentioned in today's update? But that's not really something I want to punt on.

Crimson Tide (LON:TIDE) (at the time of writing, I hold a long position in this share) - disgracefully, I cant remember why I bought this one. It's a real minnow software company. Results are out today, and contain some interesting-sounding commentary - with some big clients, in various sectors.

Profits have improved, but are still small, at £352k. The company says it is increasing overheads, in order to drive expansion.

My opinion - small & speculative, but looks potentially interesting, as a bit of a punt, I reckon. It has a track record of being very modestly profitable, and not needing to issue many new shares, which is always useful for more speculative things.

Do any readers have a view on this company? It's just a small position, at the speculative end of my portfolio, so not something I've really done much work on. Think I bought it because a couple of shrewd friends had researched it, and reckoned it has a promising future. Sorry to be so vague.

Right, I have to stop there. See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.