Hi there!

Today's Part 1 by Paul includes:

- Revolution Bars (LON:RBG)

- Elegant Hotels (LON:EHG)

- MySale (LON:MYSL)

- Vertu Motors (LON:VTU)

- DX (Group) (LON:DX.)

In this report, I am planning to cover:

- Empresaria (LON:EMR)

- Costain (LON:COST)

- International Personal Finance (LON:IPF)

Cheers,

Graham

Empresaria (LON:EMR)

Share price: 148p (+4%)

No. shares: 49m

Market cap: £72m

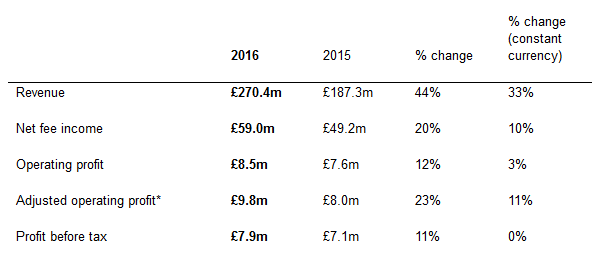

Really solid results here:

I covered this at the year-end trading statement (see 24/1 SCVR) and the 23% gain in adjusted profit before tax which was forecast then has indeed materialised.

Temporary recruitment reaches 60% of net fee income, up from 55%, in line with strategy to emphasis this more predictable source of income. Good news.

Ex-UK income also increases as a percentage of total net fee income, up to 68% (from 63%). As has been mentioned before about this stock, it offers plenty of international diversification.

Final Dividend increases to 1.15p from 1p.

Outlook

Reasonable outlook statement:

We are confident that 2017 will be another year of profit growth with the Group benefiting from the potential within its existing brands and also the investments made in 2016 contributing for a full year.

,My opinion

I still like this share, I think it's at a reasonable price and it's hard to find much fault with the company.

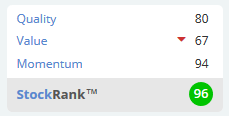

The StockRank remains at a very healthy level:

Arguably, recruitment companies should always trade at a discount to the market as a whole.

On peer comparison, a simple forward PE test shows that Empresaria at 10x is ranking mid-way between smaller player Harvey Nash (LON:HVN) at 7x and the much larger rival SThree (LON:STHR) at 14x. Given the scale of SThree, it would be reasonable to expect Empresaria to trade at a relative discount.

The other thing I'd note is that the constant-currency results were quite muted without the impact of a weaker pound sterling, so it's hard to think of this as a growth stock even if revenue is set to grow further thanks to the full-year impact of some acquisitions.

Overall, it's a good company and an interesting offering.

Costain (LON:COST)

Share price: 399p (+2.5%)

No. shares: 104.3m

Market cap: £416m

(See coverage of 5/1 Trading Update)

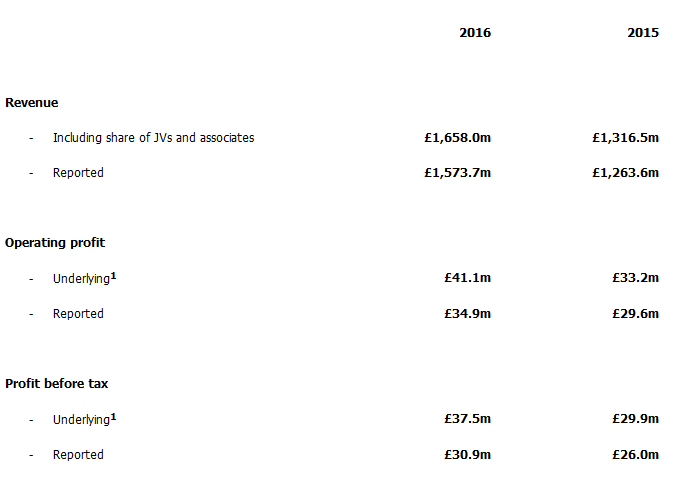

An excellent performance for the full year, with revenue up 26% and underlying operating profit up 24% to £41 million.

Actual, reported PBT rose to £30.9 million.

Net Cash rises to £140 million from £108 million - but this is not to be taken too seriously, since the statement acknowledges that it is due to the timing of receipts.

In the "cash flow" paragraph, we learn that the average month-end net cash balance in 2016 was in fact £69 million, down from £104 million in 2015. Lots of working capital gets tied up in projects at a company like Costain.

So it would be unreasonable to try to do an "Enterprise Value" calculation, or any other kind of calculation, using the £140 million figure mentioned above. A big chunk of the cash was usually tied up in projects, and is likely to get used up in projects again (until the next large set of invoices gets paid).

Outlook

Crucially, the outlook remains positive:

Our major customers are committed to spending billions of pounds to improve people's lives by enhancing the UK's energy, water and transportation infrastructures... Costain is well-positioned to take advantage of the opportunities that lie immediately ahead and this, combined with the good visibility we have over the medium-term, reinforces our confidence for the future.

As confirmed at the year-end trading statement, the forward order book is still at the record level of £3.9 billion.

Over 90% of the order book consists of repeat orders - it's great to achieve that sort of risk reduction/reliability in a cyclical industry like this.

Dividend is increased so that the total dividend is up 15% for the year.

Note that Costain has to match dividends with contributions to its pension deficit, which has more than doubled to £73.5 million thanks to lower interest rates.

That deficit is still manageable but is big enough to affect the value of the equity - Costain has to make annual payments of around £10 million, rising with inflation, until 2031.

My opinion

Taking those pension payments into account and also taking the conservative point of view that the reported numbers are more reliable than the underlying numbers, I'm actually growing increasingly sceptical of the investment case here.

Earnings will continue to be volatile of course, but £31m million in PBT was just earned and this was a record result for the company. £10 million in cash then needs to be sent to the pension fund. After tax, that doesn't leave all that much in terms of retained earnings available for capex and dividends.

With the order book flat year-on-year, and even with the attractions of repeat business, I am starting to struggle to see how the >£400 million market cap be justified. Any thoughts?

International Personal Finance (LON:IPF)

Share price: 163p (-10%)

No. shares: 222.5m

Market cap: £363m

This alternative lender was formerly in the FTSE-250 but has suffered regulatory misfortune in recent years.

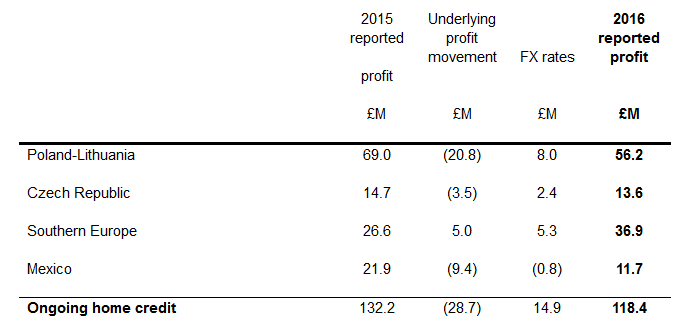

To try to get a grip on the seriousness of what IPF is facing, here's the segmental PBT for Home Credit, IPF's largest division:

As an alternative lender - dealing with customers not served by the banking system - IPF suffers from heavy impairments, which were 26.8% of revenue in 2016 (up from 25.6%).

It makes up for the heavy impairments through high interest rates and non-interest charges, but these are in the crossfires of regulators, particularly in Poland, where it trades as Provident Polska (and you can see above that Poland-Lithuania is the largest IPF market).

The effects of new "total cost of credit" rules in Poland are the primary reason for the £20.8 million underlying reduction in profitability seen above.

As would be expected, IPF has attempted a mitigation strategy which involves making longer-term and larger loans at lower interest rates. It has also reduced its lending to the highest-risk customers.

That mitigation strategy appears to have worked quite well for 2016, but there are even more serious obstacles potentially coming up later in 2017. The Polish Ministry of Justice has proposed to reduce the cap on non-interest charges:

The level of the current cap is: (i) a flat level of 25% of the loan value; and (ii) an additional cap of 30% per annum. The combined total of the flat 25% and the time-dependent 30% p.a. may not, in any event, exceed 100% of the loan value. Under the proposal, the flat level cap would be reduced to 10% of the loan value and the additional cap per annum would be reduced to 10%. The combined total of the flat 10% and the time-dependent 10% p.a. would not be able to exceed 75% of the loan value.

My opinion

The original cap reduced profitability in Poland for 2016 by around 30%. So what would this do - would it eliminate profitability completely? I think that's an open question. Hopefully there would be some further mitigation strategies which would enable IPF to continue profitably in Poland for the long-term. But in the short-term the outlook is undeniably bleak.

Excluding the Polish Home Credit contribution, IPF achieved PBT of £36.4 in these results.

So if we assumed that segment could sustain itself at breakeven, the current market cap is not expensive at all (10x PBT).

The balance sheet is still strong, with current assets of £1.023 billion and total liabilities of £784 million, so that there are net current assets of c. £240 million (2/3 of the market cap).The final dividend has been maintained.

On balance then, there is an interesting risk:reward proposition here. The big risks are that the Poland segment suffers some kind of disorderly breakup, or that the other countries it operates in launch similar rules.

I don't know how to quantify the risk of that happening so I certainly can't say that IPF is a sleep-sound stock, but I do think it's worthy of consideration.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.