Good morning, it's Paul here.

I updated yesterday's report with a few more sections later in the day. To see the full report, please click here. It includes my comments on;

K3 Business Technology (LON:KBT) - profit warning (looks nasty)

Accrol Group (LON:ACRL) - in line trading update

Zytronic (LON:ZYT) - decent interim results & outlook

Interquest (LON:ITQ) - lowball bid from management - company now in play

Koovs (LON:KOOV) - RNS saying no reason why share price is falling (other than that the company needs to raise more funding)

On to today, I've included in the header the companies which I intend reporting on.

Patisserie Holdings (LON:CAKE)

Share price: 333p (up 4.1% today)

No. shares: 100.0m

Market cap: £333.0m

(at the time of writing, I hold a long position in this share)

Interim results - for the 6 months ended 31 Mar 2017.

This group's main operations are the chain of "Patisserie Valerie" cake & tea/coffee shops. It's a roll out share - i.e. the company is expanding (opening around 20 new sites each year) funded from its own cashflow.

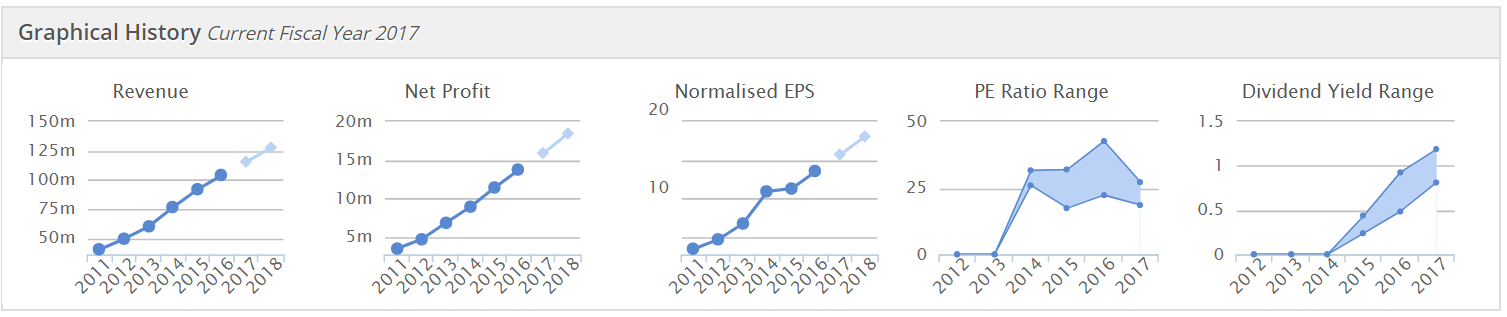

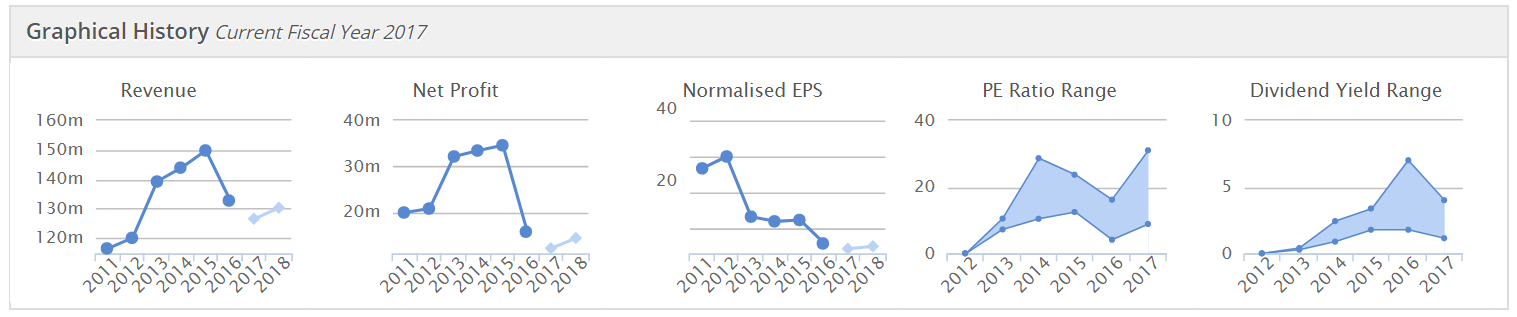

If you look at the Stockopedia historical graphs, you can see why this is one of my favourite shares - with revenue & profits growing in diagonal lines - steady, predictable growth. With no debt.

Remember that the net profit figures shown on Stockopedia are post-tax. So you can ascertain by comparing graph 2 (net profit) with graph 1 (revenues) just how strong (and consistently good) the net profit margin is at this company.

Profit growth is all well and good, but if the company is constantly issuing new shares to finance growth, then the benefit to EPS can be small. Not so in this case - as you can see from graph 3, with terrific EPS growth over the last 6 years.

Graph 4 shows us that the stock has never really been cheap - hardly surprising, given how well it's performing. So I would tend to see a PER of about 20 as being (in historic terms) about as cheap as we're likely to be able to buy the shares.

Finally graph 5 shows the emergence of divis. Clearly the yield is still very low, but the trend is upwards. Remember also that the company is using much of its cashflow to finance expansion - opening 20 new stores each year, at a reasonable cost of about £400k per site. Therefore, once the company reaches maturity, and stops expanding, it will have scope to pay out very much larger future divis.

It's amazing how much information can be quickly gleaned from these 5 little graphs.

Anyway, back to the interim figures, which look good to me. A few numbers;

Revenues up 11.0% to £55.5m

Pre-tax profit up 15.7% to £9.7m - note the exceptionally high profit margin of 17.5% - this is key to a successful roll-out, as it should mean that new stores are highly profitable, hence giving a very good return on capex.

Diluted EPS up 19.2% to 7.88p. It's always worth checking the tax charge, if the % change in EPS is different from the % change in profit before tax (and also worth checking if new shares have been issued). In this case, the P&L tax charge seems to have dropped from 20.3% in H1 last year, to 18.1% in H1 this year. So that flatters EPS somewhat.

Outlook - sounds fine to me;

Performance in the six weeks after the period end has been good with a strong Easter period. We are on track with our roll-out programme and have some exciting new locations for the remainder of the year. We continue to react positively to changes in the market place and I am confident we are well positioned to deliver another period of good growth in the second half of the year.

I would have preferred a specific confirmation of trading in line with market expectations. However, having seen several broker notes this morning, there doesn't seem to be a problem. The brokers confirmed that trading is in line, and that forecasts might even be raised later this year.

Balance sheet - this is superb, with no debt, and cash of £16.2m, up from £8.9m a year ago, despite having opened about 20 new sites in the last year.

The beauty of such a strong balance sheet, is not only that the company could sail through any economic downturn unperturbed. It's also that there is scope to make acquisitions. This is hinted at in the narrative, and mentioned by brokers.

So in effect, there is additional earnings to be added on, at no dilution to shareholders in future. That should be factored into the valuation, in my view.

Cashflow - a really clean cashflow statement, showing just what a quality business this is. It's too big for me to reproduce here, but it's well worth looking at the cashflow statement. That shows a business generating pots of cash, which is then used to finance its expansion capex, pay divis, and there's money left over to add to the cash pile. Really terrific.

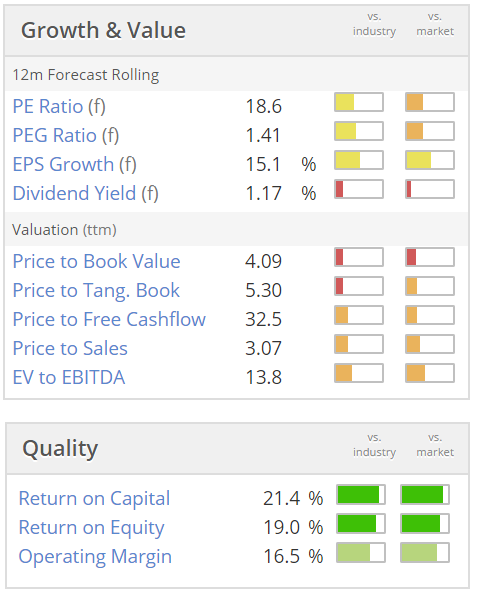

Valuation - I don't think this valuation looks stretched at all, for such a credible growth company. A high quality, self-funding roll-out, with net cash, on a PER under 20 actually looks rather attractive to me;

Stock Rank - I'm surprised the StockRank is not higher. 66 implies it's a good, but not great company (I disagree on that point!). Note that the value score is very low, but there's an ultra high quality score.

In terms of the intriguing new StockRank Styles classifications, CAKE is reported as;

Note that the green colouring on "High Flyer" indicates that this is one of the successful investing styles. More info on the StockRank Styles is here. Remember these are computer generated, and back-tested, but not infallible.

My opinion - you may have guessed by now that I like these figures! This company really is a class act. Luke Johnson owns 38.6% of the company, so I'm very happy to be riding on the coat tails of this very experienced & highly regarded entrepreneur.

Hospitality is cooling as a sector at the moment. This is due to problems with rising costs, and over-capacity. Several companies in the sector have reported a decline in profits, and slowing or halting expansion plans.

As always, the best companies sail through troubled waters, taking the problems in their stride. That's exactly what's happening here. Cost pressures have been mitigated, it's just a really well-run business, with an excellent format.

I like the comments about expansion overseas now being considered.

Eventually, I reckon this company is likely to be sold, for a decent premium. This is alluded to by several brokers today.

EDIT: Many thanks to one of our star members, Bestace, who has flagged up a results presentation on CAKE's website. Well worth a read - it's here.

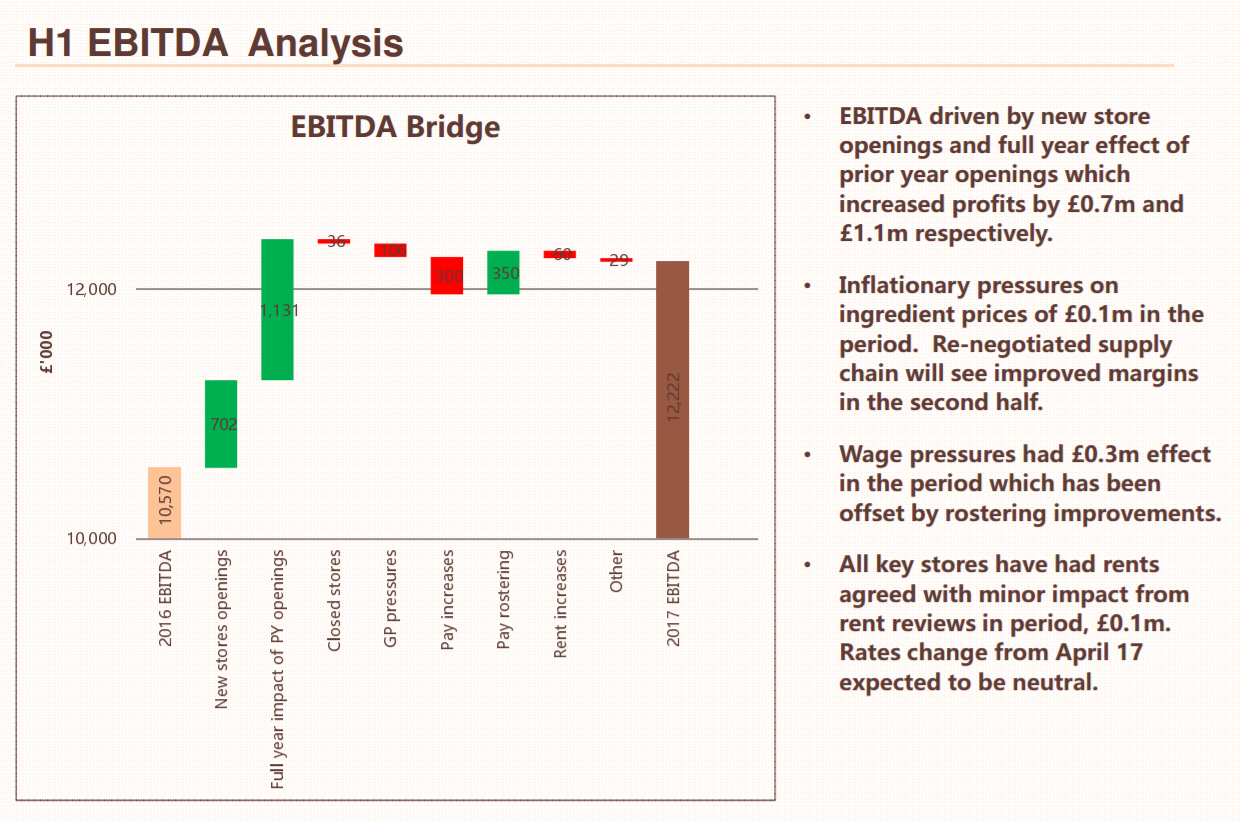

Slide 7 is particularly interesting, as Bestace points out below. It's an EBITDA bridge, showing the factors which moved EBITDA from last year's figure, to this year's. Here it is:

EDIT 2: I forgot to mention, another nugget of gold in the CAKE results presentation - the payback period on new sites is just 23 months! That is astonishing. Payback period is a key measure which helps you determine whether a roll-out is any good. Anything under 3 years is excellent. Under 2 years is awesome.

Foxtons (LON:FOXT)

Share price: 103.25p (down 2.6% today)

No. shares: 275.1m

Market cap: £284.0m

(at the time of writing, I have a small short position on this share)

Q1 trading update - this is the premium-priced estate agent, focused on London & some surrounding areas.

It says Q1 was in line with expectations, but note the sharp declines in sales commissions;

During the first quarter Foxtons performance has been in line with the Board's expectations.

Group revenue was £28.7m compared to £38.4m in the first quarter last year and £26.4m in the fourth quarter of 2016. This quarterly performance is set against the record sales volumes in the first quarter last year when a number of transactions were brought forward ahead of the stamp duty surcharge on buy-to-let investments and second homes.

Our first quarter revenues comprised property sales commissions of £11.1m (2016: £20.0m), lettings revenues of £15.5m (2016: £15.8m), and mortgage broking fees of £2.1m (2016: £2.6m).

The London property market has slowed considerably, especially at the top end, where punitive Stamp Duty changes are probably more of an issue than Brexit. Another issue might be unrealistic pricing. The Evening Standard this week had an article on a property in a desirable area, where the asking price had been reduced from £40m to £30m. It was a fairly large property, but was semi-detached!! Who in their right mind would pay £30m for a semi?! Ridiculous.

The other problem with top end London property, is that some vulgar neighbour could make your life hell by the latest craze of excavating gigantic basements - causing noise & massive disruption to everyone around them. Who would want that, after just buying your £30m semi?!

Back to Foxtons. It confirms today that it has no debt;

Foxtons holds a net cash position with no debt.

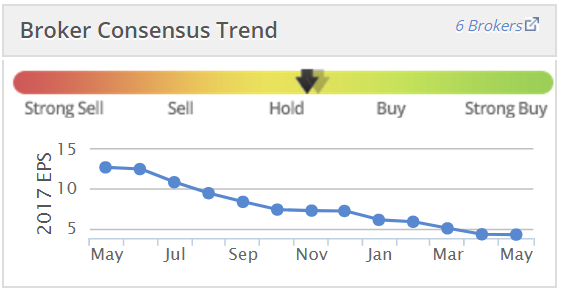

Look how profitability has collapsed from the boom years of 2013-2015;

The markdowns in broker forecasts over the last 12 months have been striking;

Valuation - on current figures, the forecast PER for 2017 is about 25 times. Clearly that looks expensive, but this is a particularly bad year - and companies often look expensive on a PER basis, in a year where earnings are poor.

So the question really is, are earnings going to improve? It's difficult to see any catalyst at the moment for that to happen.

My opinion - I wonder what impact the online estate agents (market leader Purplebricks (LON:PURP) - in which I hold a long position) might have?

Foxtons charges eye-wateringly high fees in London, that look commercially unsustainable to me. Hence one of the reasons I put a small short on this share. Reputationally, Foxtons are not highly regarded either - in fact Londoners I've spoken to seem to constantly complain about them.

Altitude (LON:ALT)

Share price: 65.5p (down 2.2% today)

No. shares: 46.4m

Market cap: £30.4m

(at the time of writing, I have a long position in this share)

Preliminary results - for the year ended 31 Dec 2016. So very late figures, which readers will know is something that particularly rattles my cage.

This company has a tiny exhibitions & publishing business, which is barely worth mentioning. Although it does generate a modest profit. The exciting bit is a new venture, which is being pursued in the USA, called Channl. This is a software portal, which connects distributors of promotional goods (e.g. branded pens, mugs, rucksacks, etc) with the end customer and the factory.

The interesting thing is that Channl enables distributors to create many thousands of individual websites for each potential customer, with 3D viewing products mocked up with the client's logo. So it replaces, and is better than, catalogues. The customer can order online, if they like the products. The idea is that Altitude sits in the middle, and takes a cut of the revenues.

Management has been making big claims for this product. If these claims turn into reality, then the upside potential here looks remarkable. The only problem is that there's not any hard information on actual results so far.

The trouble with today's announcements, is that it's more jam tomorrow, and no firm evidence that this project is going to be a commercial success. So I'm a bit of a nervous shareholder. I've got no idea if it's going to work or not, this one is a bit of a punt.

There's not really any point in dwelling on the 2016 numbers, but for the sake of completeness, the key figures are;

Revenues £4.3m (down 4.7%)

Operating profit before amortisation charges & a few other small bits & bobs of £565k (up 94% on prior year). So at least it's not massively loss-making, as this type of jam tomorrow share usually is.

Balance sheet - is weak. Trade payables look stretched, at £1.75m, although there was £741k in net cash at 31 Dec 2016.

Placing - also announced today, this has fixed the cash position. FinnCap has raised £2.5m in fresh cash at 60p. Also, they placed 2.025m existing shares, held by a major shareholder, Keith Willis. So the cash position & balance sheet should look OK after this placing, which is not highly dilutive, so it's fine.

My opinion - I wouldn't normally go near anything like this. However, a friend with a good track record on small caps, has spent a long time researching it, and he reckons it's the real deal. So almost as good as being told by a bloke down the pub, I hear you scoff!

Time will tell whether this was an inspired stock pick, or a complete dud. I've only put in an amount I can afford to lose, which is usually wise with jam tomorrow shares. If there is any game-changing news, then I'll report back to you. For the moment though, this can only be considered a complete punt.

I think the pressure is now on management to deliver, rather than talking up the potential.

Zotefoams (LON:ZTF)

Share price: 311.5p (up 7.4% today)

No. shares: 44.4m

Market cap: £138.3m

Trading update - covering Q1, ended 31 Mar 2017.

The company calls itself a world leader in cellular materials technology. In language I understand, I'd say they mainly make foam for things like car seats.

A few key points from today's update;

- Revenues up 28% in Q1 vs Q1 last year - in line with management expectations.

- Some forex gains, so at constant currency growth was 16%

- Additional production capacity of c.20% is expected to come online around end of Q3.

Outlook - why can't they say that profits are in line with expectations or not? Instead we get this waffle;

While it is still early in the year, and we are mindful of the less stable political and macroeconomic environment, we continue to expect 2017 to be another year of progress and remain confident about the long-term prospects of the business."

To me, that sounds a little hesitant. However, the market has lapped it up, with the shares up 7.4% today. Also, since they said earlier in the RNS that revenues were in line, I suppose we can probably assume that profit was in line too. It's a lot easier when things are spelled out more clearly.

Valuation - brokers are forecasting 15.3p EPS for 2017 (PER of 20.4), and 17.9p for 2018 (PER of 17.4), so the shares look priced about right to me.

Shareholders get a dividend yield of about 2%

My opinion - it looks fairly good. Probably the main downside for me, is that it's so capital intensive, with lots of fixed assets needed to manufacture its products.

I seem to recall there was talk of some blockbuster new product a couple of years ago, so that might be worth having a dig around for. Overall, I'd say this company might be worth doing a bit more work on - growth has been good in recent years, with more in the pipeline. The valuation seems fairly sensible, providing nothing goes wrong.

Ideagen (LON:IDEA)

Share price: 95p (up 1.1% today)

No. shares: 198.1m

Market cap: £188.2m

Trading update - for the year ended 30 Apr 2017.

This is an acquisitive software group, specialising in supplying software to highly regulated industries (e.g. healthcare, financials, etc).

Here are the main points summarised;

- Results should be in line with market expectations.

- Trading robust across all key verticals.

- Organic revenues growth was 10%

- Four acquisitions made in the year.

- Revenues £27.1m, adjusted EBITDA of £7.8m expected, both up 24% on prior year.

- Transition to SaaS is going well.

- Cash generation "extremely strong".

- Net cash at 30 Apr 2017 of £4.2m (significantly ahead of market forecasts)

- Positive outlook comments, confident about current year & beyond.

That all sound very encouraging. I suppose the question is, how much has been anticipated by the big rise in share price of late?

The forward PER is 22.4, which looks a fairly full price to me. There again, performance seems to justify the share price almost doubling in recent months. Well done to holders!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.