Good morning! It's Paul here.

Remarkably buoyant market conditions continue. I really don't know what to make of it. So many smaller company shares are going through the roof at the moment. It feels too good to be true, but I really don't know whether I should be running my winners, top-slicing, or moving into cash?

I'm struggling to remember any similar time, in my investing career (c. 20 years) where mine (and other peoples') portfolios seem to go up almost every day, for weeks & months on end. Personally I've hardly top-sliced anything. I'm letting the winners run. Providing companies keep putting out sufficiently positive newsflow to justify an aggressive valuation, then in a bull market arguably one should just go with the flow.

It's going to end in tears at some point, we just don't know when!

Anyway, there's loads for me to get through today, so here goes.

K3 Business Technology (LON:KBT)

Share price: 154p (down 38.3% today)

No. shares: 36.0m

Market cap: £55.4m

Trading update (profit warning) - bad luck to shareholders here.

This company seems to be a software reseller (mainly Microsoft products), describing itself as;

K3, which provides mission critical software, cloud solutions and managed services to the retail, manufacturing and distribution sectors...

It's a significant profit miss today;

As previously reported, half year results were impacted by Enterprise contract slippages and, although the Company has seen some major deals close, certain large Enterprise contracts have not been secured as expected.

As a result, despite the high seasonality inherent in Q4 trading, the Board now believes that the results for the year to 30 June 2017 will be significantly below current market expectations...

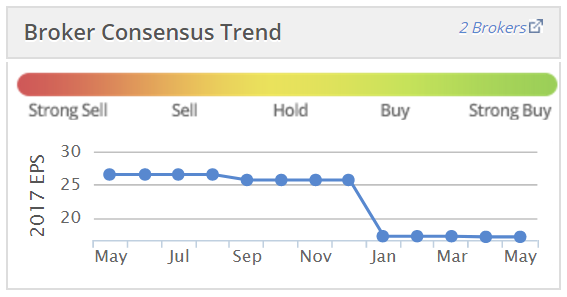

As you can see from my favourite Stockopedia graphic below, this is the second profit warning this year;

Broker forecasts - I haven't yet seen any revised forecasts, taking into account today's profit warning. FinnCap said that it's suspending its forecasts for now, until there is more clarity after the year end (30 Jun 2017).

Therefore, for now, we're in the realm of complete guesswork as to how bad this profit warning is likely to be. My hunch is that we could be looking at something like 10p EPS? That's just a guess though.

The company goes on to sweeten the pill somewhat, saying this;

Nonetheless, the Group's operations elsewhere are seeing encouraging progress and healthy cashflows. Furthermore, the Company has secured pilot customers for its new cloud-based modular technologies which will generate opportunities for both new and existing customers.

So it doesn't sound like a complete wipe-out.

Review - I don't like the sound of this - the word "review" is usually a sign of more pain to come;

Given trading conditions and the Group's performance to date, the Board has started a review of the Company's resources with the intention of refocusing the growth strategy around the cash generating business units and the large installed customer base. A further update on this will be provided in due course.

That sounds like redundancies & exceptional charges are in the pipeline.

Balance sheet - I've flagged up many times before that this group doesn't have a good balance sheet. It's stuffed full of intangibles - mostly goodwill (of £50.0m at 31 Dec 2016), plus another £27.2m of other intangible assets.

So the NAV of £70.4m reduces down to negative NTAV of -£6.8m.

Personally I tend to usually avoid any share where NTAV is negative. The only exceptions being where the company is highly cash generative, which this isn't.

The c.£17m bank debt at 31 Dec 2016 could become a problem if banking covenants are breached. So holders really need to check out the position re covenants. That £17m is the gross debt. It was partially offset by £4.5m in cash.

Given the size of the company, the bank debt doesn't look particularly alarming, but I'm never comfortable with bank debt at companies which are seeing deteriorating trading.

My opinion - no change really, as I've never rated this share.

My report here on 10 Jan 2017 on K3's earlier profit warning concluded that the share was unattractive.

Graham reported here on 27 Mar 2017 on its underwhelming interim results, deciding that the share was in the "too difficult" tray.

The news today looks worrying. This seems to be a situation where bad news is dribbling out piecemeal. If I owned this stock, I'd have probably sold on the opening bell today. With considerable uncertainty over performance, I can't see any appeal to holding this share.

I suppose some upside could come from the renewed focus on making IT systems more resilient, following recent high profile hacking issues.

Accrol Group (LON:ACRL)

Share price: 155p (down 2.5% today)

No. shares: 93.0m

Market cap: £144.2m

Trading update - this company makes loo rolls & other tissue products, selling to discount retailers mainly.

The company updates us today on its year ended 30 Apr 2017;

The Company has had a strong year of growth in its first year as a publicly listed business following its successful IPO on AIM in June 2016, and is pleased to announce that it has performed in line with market expectations despite some challenging macro-economic factors.

Further details are given about new manufacturing & storage facilities, thus increasing production capacity (although it's not stated by how much).

The CEO comments are brief, but soothing.

"We are pleased to announce that, despite a less favourable macro-economic environment, we have performed in line with expectations in our maiden year as a publicly-listed business.

We have continued to make progress with our growth plans, extending our relationships with both new and existing customers and investing in our infrastructure for the future.

Valuation - the valuation looks about right to me. A business like this is not likely to ever command a premium valuation, so a forward PER of 10.6 looks sensible;

Dividends - there doesn't seem to be any forecast dividend data picked up by Thomson Reuters (Stockopedia's data supplier).

However, the prospectus indicated a planned 6% dividend yield, based on the float price of 100p per share. With the share having since risen to 155p, that translates into a 3.9% yield. So pretty good, assuming that the planned divis happen.

My opinion - I reviewed the prospectus here on 8 Nov 2016, and found lots in it that repelled me.

Specifically, why did the previous shareholders want to cash in a lot of their chips? They couldn't have been particularly optimistic about the future, or why sell?

Forex movements could cause problems, as could input cost volatility.

Customers - are highly concentrated. Yet as we know, the discount retailers aren't known for their generosity towards suppliers. So there is risk here.

A horrible management incentive scheme, that gives away 12% of the share price upside above 130p to management! That's pretty awful, in my view.

Overall then, it's not for me.

Zytronic (LON:ZYT)

Share price: 472p (up 6.2% today)

No. shares: 15.9m

Market cap: £75.0m

Interim results - for the 6 months ended 31 Mar 2017.

Zytronic is a UK-based specialist manufacturer of touch sensors - e.g. bespoke touch-sensitive screens for things like cashpoints, vending & gaming machines.

These are decent figures. Here are a few key numbers for H1;

Revenues up 14.1% to £11.3m

Profit before tax up 38.9% to £2.5m

Basic EPS up 44% to 13.8p

There seems to be a bias towards H2 for profitability, so the company looks set to do around 30p EPS for this year.

Broker consensus is 28.6p EPS for this year, giving a PER of 16.5 - which looks reasonably priced.

Very strong balance sheet, with £12.5m in net cash - so expect a special dividend in the not-too-distant future.

Current trading sounds positive;

"The second half of the year has started well and is in line with expectations and on this basis we expect to make further progress in creating value for shareholders."

Dividend yield is about 4.0%, with scope to pay out more, due to cash pile.

StockRank of 88 is excellent.

My opinion - this is a long-standing favourite of mine. I don't currently hold any stock personally, as I was happy to bank a gain, and recycle the money into faster-growing companies.

Also, last time I reported on it, a reader pointed out the risk factors in the company's Annual Report. This indicated a heavy reliance on a small number of customers. Therefore, there is the ever-present risk of a gap appearing in the order book. That happened a few years ago (in 2013), and it knocked the share price for six.

Since then though, the company has performed well. It's a high net profit margin business, with a very sound balance sheet, paying decent divis. The price certainly doesn't look expensive, even after a very recent run.

A couple of interesting announcements later in the day;

£ITQ

(at the time of writing, I hold a long position in this share)

An announcement has been issued by a newly created company called Chisbridge Ltd. This company has been formed by the Chairman, CEO & CFO of Interquest.

Chisbridge is;

"evaluating making an offer for InterQuest at 42p per share in cash with a full loan note alternative"

This is clearly a derisory offer, and it puts the company in play. So hopefully other bidder(s) may now appear, and offer a more sensible price for the company. I wonder whether that might be the intention of this initial offer?

Just 29 minutes later, the independent Directors of InterQuest issued another RNS, in response, rejecting the approach, saying this;

The Independent Directors, who are being advised by Panmure Gordon, have unanimously concluded that they would be unable to recommend the Proposed Offer to InterQuest shareholders on the basis that it would materially undervalue the Company and its prospects.

So I wonder what happens now? The share price has risen to 46.5p, or 10.7% above the derisory 42p possible bid. So the market is clearly now expecting other bidder(s) to enter the fray at a higher price.

It will be interesting to see how this pans out.

Koovs (LON:KOOV)

Statement re share price - the company says it knows of no specific reason why its share price has been falling. I do - possibly because the company is a massively loss-making load of junk?

The company says it continues to see year-on-year growth, but the last sentence reiterates this company's ongoing problem;

The Company will look to raise additional capital during the course of the year to continue to deliver its growth plans.

They need to keep finding mugs optimists to refill the coffers, as it continues to burn through large amounts of cash in operating losses.

This is a very high risk share, and I think its business model remains a long way from success.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.