Good afternoon!

Apologies, but I'm running late today, so am slowly updating this article, and will continue doing so this afternoon/evening.

In the meantime, I was burning the midnight oil last night, reporting on 6 more companies' results, so 9 in total. Therefore, here is the full report from yesterday.

Today I have looked at results & trading updates from;

Xaar (LON:XAR)

James Cropper (LON:CRPR)

Eckoh (LON:ECK) (major contract win)

Quixant (LON:QXT)

Cello (LON:CLL)

eg Solutions (LON:EGS)

Cloudbuy (LON:CBUY)

Van Elle Holdings (LON:VANL)

Xaar (LON:XAR)

Share price: 335p (down 7.1% today)

No. shares: 77.7m

Market cap: £260.3m

Final results - for the year ended 31 Dec 2016.

This company makes innovative inkjet printheads, for commercial use. The core issue here is that the company has been heavily reliant on one sector - namely print heads for ceramic tile printing, where demand comes from China. Competition has been increasing, so this area is under pressure. Therefore the challenge for Xaar is to develop new products, and indeed it is spending a lot on R&D, and has some very interesting new products in the pipeline.

In the meantime though, results are not exactly sparkling. A few points;

Revenues rose by 2.9% to £96.2m, but this was after including £6.7m from an acquisition of a company called EPS, which is included in the P&L figures from 1 Jul 2016. Strip that out, and organic revenues fell by 4.3%

Adjusted operating profit margin is still strong, at 20% (2015: 22%). Although note that the company changed its accounting policies a while back to be much more aggressive about capitalising development spend. Contrary to what some people seem to think, there is plenty of leeway here to interpret accounting standards, so companies which aggressively capitalise development spend have usually chosen to do so.

Diluted adjusted EPS fell from 24.5p in 2015 to 21.2p in 2016. That gives a PER of 15.8. That may seem good value for a tech company, but earnings are falling. So the key issue is whether this level of earnings is sustainable?

Balance sheet - very strong indeed. Note that net cash has fallen, but is still very healthy indeed at £49.3m (2015: £69.7m).

Dividends - increased slightly to 10p for the year, so a yield of 3.0% - not bad.

Outlook - the company has set a target for growth;

We remain focused on our long-term opportunity, the conversion of well-established analogue manufacturing techniques to digital inkjet solutions. Our vision is to grow annual revenues to £220 million by 2020.

I think it's a mistake to publish such targets. It creates a rod for management's backs, and it could end up with them chasing poor quality acquisitions in order to meet the target. Or investors will be disappointed if growth fails to match the target. Plus for bulls of the stock, this doesn't look a terribly exciting rate of growth over the next 3 years. People want to see explosive growth from tech stocks.

It goes on to say;

Looking nearer term, our achievements in 2016 on a number of fronts position us well for growth.

Whilst our strengthened product portfolio expands our market opportunities, execution risks remain. The expected growth of new product revenues over the course of 2017 reduces our visibility for the current year, with revenues expected to be more second half weighted than usual.

Our objective is simple, to take the necessary steps in terms of product developments, partnerships and financial performance to reach our 2020 target.

Oh dear, the dreaded H2-weighting thing. That's often an early sign of a potential profit warning down the line, and probably weak interim results. None of the above fills me with confidence.

My opinion - the new products being developed do sound exciting. Plus the company has a big R&D budget, and considerable expertise/reputation in the sector. In the meantime, its legacy products are still generating decent profits, which is effectively funding the R&D.

So who knows what the future holds? The upside case could come from any future blockbuster products. My main worry is that the cash cow of ceramic tile print heads seems to be dwindling, so if that revenue/profit isn't replaced, then the company & its share price might dwindle.

Overall, I don't have the expertise to make a guess on the outcome, so this goes into the "too difficult to value" tray.

Having said that, I'll keep it on my watch list, and follow the future trading updates, for early signs of new products taking off. It could be one to go back into in future, if decent growth looks set to return. Personally, I don't like guessing on these things. I'd rather pay more, once there's improved newsflow, than gamble on things when the newsflow is hesitant.

James Cropper (LON:CRPR)

Share price: 1410p (up 6.4% today)

No. shares: 9.5m

Market cap: £134.0m

Trading update - for the 52 weeks to 1 April 2017.

This sounds good;

During the year James Cropper experienced healthy sales growth across both the Paper and Technical Fibre Products businesses. The impact of foreign exchange movements has also been favourable to our export business.

Accordingly, the Board expects the results for the year ending 1 April 2017 to be moderately ahead of its previous expectations. Additional modest gains may also be realised from the capitalisation of development costs in its 3DP division, the treatment of which is currently under consideration.

The outlook for next year remains encouraging with growth expected across all three businesses.

I know very little about this company, as it's not one I've ever really looked into in any great detail.

Broker forecast - one broker has increased its EPS forecasts today, to 48.6p for the year ending imminently. So that means a PER of 29.0. That seems a pretty aggressive rating.

For the new year, ending 03/2018, the broker forecast has been upped by 6% to 58.0p. That translates into a still-high PER of 24.3.

So why is this stock on a big rating? It seems to be due to expectations of increased earnings from new products, called 3DP. This has not been included in current forecasts, so investors are clearly anticipating forecast-busting results in future.

I don't really get into that kind of thing in these reports, which are just a review of the numbers. It's your job to decide what the future holds for companies you invest in.

Balance sheet - I had a quick look at the last balance sheet. It's OK, but note a fairly hefty pension deficit, which would need to be factored into the valuation.

My opinion - a good update, which is reflected in a rich valuation. So the key issue to consider is whether you think the new products & growth justify the high valuation. I don't have a view on that.

Eckoh (LON:ECK) - I don't usually comment on contract win announcements, but this one caught my eye as it's entitled: Largest ever US secure payments contract win. It's for $3.7m spread over 5 years, so not that amazing after all. Although a table is given, showing that contract wins in the US are building nicely.

Eckoh put out a profit warning, which I reported on here in Sep 2016. At 38.5p the share price hasn't recovered much in the last 6 months. Although the contract wins announced today sound encouraging, the company has not indicated that it's trading ahead of expectations.

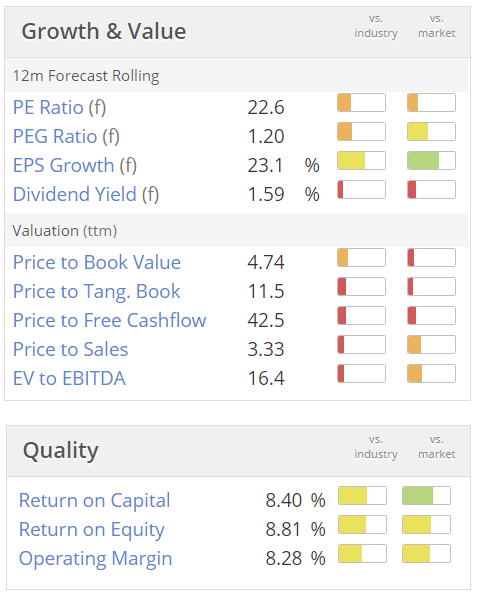

Therefore based on the existing forecasts, it doesn't look a particular bargain;

So overall, I can't see anything much to get excited about here.

Softcat (LON:SCT)

Share price: 368p (up 6.0% today)

No. shares: 197.6m

Market cap: £727.2m

Interim results - for the 6 months to 31 Jan 2017.

I wouldn't normally cover this, as it's a bit big for my remit here, but several readers asked me to in the comments below, so I might as well write about something that people want to read about.

This company is "a leading UK provider of IT infrastructure products & services".

A few key figures from today's half year results;

Revenue up 28.9% to £378.5m (it looks as if the growth is organic, I can't see any mention of acquisitions)

Adjusted operating profit is only up 9.4%, to £21.4m, so they've been doing more, but lower margin work

Adjusted diluted EPS is up 6.1% to 8.7p

Outlook - confident of meeting full year expectations

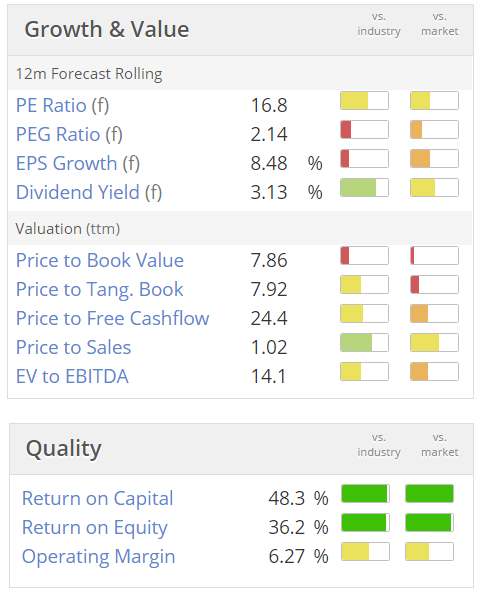

Valuation - after today's share price rise, the current year PER looks to be just over 17. Here are the valuation metrics as of last night;

I'm not convinced that fairly pedestrian EPS growth of about 6% justifies a PER of 17.

Balance sheet - quite an unusual balance sheet, with very little in fixed assets, and no long term creditors. So it's really just working capital, and that looks OK - the current ratio is 1.44

Current assets includes £46.6m in cash. There's no debt. So nothing to worry about there.

There's a massive debtor book (£151.7m), but by my rough calculations, debtor days (including VAT) is bang on 60 days - which is normal.

My opinion - it looks OK. The valuation looks fairly full, given pedestrian EPS growth.

Personally I'd probably be tempted to bank the nice 25% rise that's happened in the last 3 months. Although it depends whether you think the company might out-perform in future, in which case it could be worth holding onto. That's your call!

Quixant (LON:QXT)

Share price: 382.5p (up 4.8% today)

No. shares: 65.4m

Market cap: £250.2m

Final results - for the year ended 31 Dec 2016.

This company makes computer gaming systems.

Key points;

Revenue growth very strong, up 116% to $90.4m - however, most of the increase came from an acquisition, of Densitron.

Adjusted profit before tax - rose 23% to $11.1m, plus $2.7m from Densitron, totalling $13.8m (up 50%)

Adjusted fully diluted EPS of 16.6 US cents = 13.3p, giving a PER of 28.8 - seems an aggressive valuation.

Dividend of 2p (2015: 1.5p), yielding only 0.5%

Outlook comments - perhaps explain why the stock is rated on a high PER - people are anticipating strong future growth;

The outlook for the Group remains extremely positive. The Gaming division continues to offer considerable growth opportunities both from the expansion of its market share in the core gaming platform business and through the new opportunity created in the gaming monitor market.

The Densitron division is healthy and profitable and offers potential for growth in several important vertical markets through a more focused and co-ordinated global approach.

I am therefore confident in the Group's ability to continue to deliver strong growth in 2017 and beyond.

Sounds pretty good.

Balance sheet - looks fine to me. There's a bit of debt, $8.9m, but that's almost exactly offset by $8.9m in cash. Working capital overall looks healthy - a current ratio of 2.04 is strong.

So no issues that I can see.

My opinion - it looks pricey, but seems to have a positive outlook. The shares have almost doubled since Jul 2016, so I wonder if it's maybe due a breather, or a pullback at this level?

A few quickies to round off with;

Cello (LON:CLL) - 2016 results look fairly ordinary. A few points;

- Revenue up 5.4% to £165.3m

- Headline basic EPS flat at 8.7p

- See note 10 for the numerous & large adjustments to profit, which makes me sceptical about the headline figure.

- Dividend increased nicely - up 18.9% to 3.4p

- Good start to 2017 & confident expectations will be met.

- Balance sheet at year end was a bit weak, but people businesses don't really need much capital. Also, please note...

- Did a £15m placing after the year end, at 97p. This will have usefully strengthened the balance sheet, as only $5.25m of it was required for an acquisition.

My opinion - looks worthy of consideration, as fwd PER of 13.6 seems reasonable.

eg Solutions (LON:EGS) - accounts for year ended 31 Jan 2017 are out today, for this back office optimisation software company.

The company has been trumpeting improved performance in trading updates, but the end result is rather underwhelming;

Revenue up only 8% to £8.2m

Adjusted profit before tax of only £0.3m

Most of the turnover came in H2, as the H1 results were awful (revenue of just £2.5m, and an adj loss before tax of £1.3m)

My opinion - tricky one this. There have been many false dawns with this company, and shareholders only put money in, whilst management are notorious for taking lots of money out.

On the other hand, it does seem to have some momentum now, and the contract wins in the last year do look quite impressive for such a small company. So who knows? Maybe its time has finally come?

Cloudbuy (LON:CBUY) - oh dear, yet another set ofdismal figures from this serial disappointer.

Revenue for 2016 was unchanged, at £1.7m, and it generated a £4.3m loss before tax.

The balance sheet's a train wreck, with the company being propped up with loans from a wealthy individual Roberto Sella, who (goodness knows why?) got involved some time ago.

I've never seen any sign that there is a viable business here. So the equity is worth nothing, in my view.

Van Elle Holdings (LON:VANL) - this is a new one to me. It's an engineering contractor, which floated on AIM in Oct 2016. It's put out a profit warning today - that's such bad form. The cause is some contract delays in Q4.

It doesn't sound disastrous - revenues for y/e 30 Apr 2017 are now expected to be 5% below previous estimates, at £93m.

It says that cash generation remains strong, and it intends declaring a final dividend in line with what was envisaged at IPO time.

Contracting businesses like this don't interest me. Too many of them slip up in some way, and to do so 6 months after IPO is pretty lame. So not for me. Mind you, looking at its last interim results, the profit margins do look pretty good, so maybe it might be worth a closer look at some point?

Phew, another marathon completed. Sorry they're mostly being written in the evenings, I've gone semi-nocturnal, and it's easier to concentrate when the market is shut, I get more done this way, albeit a little later.

See you in the morning.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.