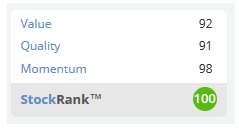

How can a company that’s only been listed for six months be the highest-ranked stock on Stockopedia, with a StockRank of 100?

It’s a question I’ve been asking myself as I’ve watched shares in Indivior climb by 57%.

I know that there’s plenty of statistical evidence to suggest that spin-offs tend to outperform the market. I also know that Indivior appears to have the winning characteristics of a super stock, with high value, quality and momentum ranks.

Yet with such a limited track record, can investors have confidence in Indivior’s future?

The Indivior story

Indivior was the name given to the Reckitt Benckiser Pharmaceuticals business, which demerged from its FTSE 100 parent Reckitt Benckiser at the end of 2014.

Reckitt’s view was that the pharma business was no longer a good fit with its consumer goods focus and that “the potential risks and rewards of Indivior” would be better understood as a standalone business.

One of the risks Reckitt’s board might have been referring to is the possibility that Indivior is a business in decline. Indivior’s only significant product is Suboxone. This is a treatment based on the drug buprenorphine, which is used to treat opioid addiction, including for heroin addicts.

Although it’s sold in Europe, Suboxone's main market is the US, where it has a dominant share of the market. Reckitt’s decision to spinoff Indivior coincided with the approval of four generic competitors to Suboxone in the US.

This competition is eroding Indivior’s profits and its market share, which has fallen from 64% to 59% over the last year.

What it’s not doing, however, is reducing volumes. Indivior appears to be benefiting from President Obama’s flagship legislation, the Affordable Care Act. According to the firm, this has been a significant factor in driving demand growth in the US market. Despite Suboxone’ loss of market share, volumes rose by “low double digits” during the first quarter of this year.

A value play?

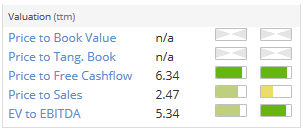

There’s no doubt that Indivior looked cheap at the time of its demerger. Even at today’s share price, Indivior trades on just 7.2 times trailing twelve month (TTM) earnings and only 6.3 times trailing free cash flow.

These impressive ratios…