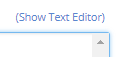

When it comes to technology investments, timing is everything.

Investing in the right idea at the wrong time can do serious damage to your wealth. Satellite telecommunications provider Inmarsat undoubtedly falls into the good idea category, but is now the right time to buy?

Having taken a closer look at the numbers, my view is that despite a strong run, Inmarsat could yet deliver further gains for shareholders.

Speed advantage

Inmarsat was originally founded by the International Maritime Organization in 1979 to enable ships to remain in permanent contact with land while at sea.

Today, the firm is essentially a satellite mobile network operator. Inmarsat provides mobile voice and broadband services to the aviation industry, maritime sector and to organisations, including the US military, which operate in remote areas where no other coverage is available.

The firm’s maritime division is still its largest, accounting for $595.6m (49%) of revenue and more than half the firm’s profits in 2014. However, while the maritime division is likely to remain a valuable cash cow for the firm, its fastest-growing division is aviation.

In addition to in-flight safety, telemetry and navigation services, passenger use of mobile broadband and voice services is rising fast. Inmarsat’s aviation revenue rose by 37.7% to $101.1m last year. The division’s EBITDA margin of 86.3% made aviation the firm’s most profitable business, too.

Inmarsat is in the final stages of launching its 5th generation satellite broadband service, Global Xpress. Customers will be able to enjoy speeds of up to 50Mbps, anywhere in the air, on land or at sea. That’s better than most home broadband and should be a big draw for airlines, I’d imagine.

The firm expects this new service to deliver $500m of additional revenue by its fifth birthday. I think that this next generation network could be the catalyst needed to unlock a new round of growth for Inmarsat.

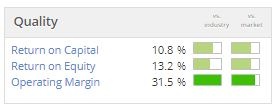

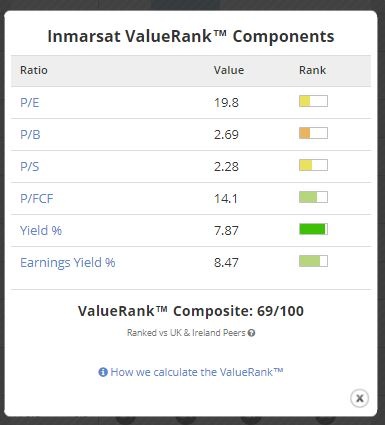

Quality - Good company at a fair price?

For anyone who can remember when international direct dialling was new and a 56k modem was fast, Inmarsat’s services are deeply impressive. As you’d expect, they don’t come cheap.

For anyone who can remember when international direct dialling was new and a 56k modem was fast, Inmarsat’s services are deeply impressive. As you’d expect, they don’t come cheap.

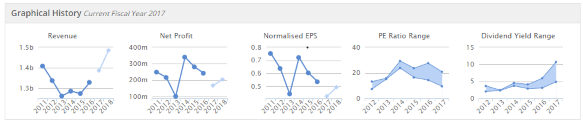

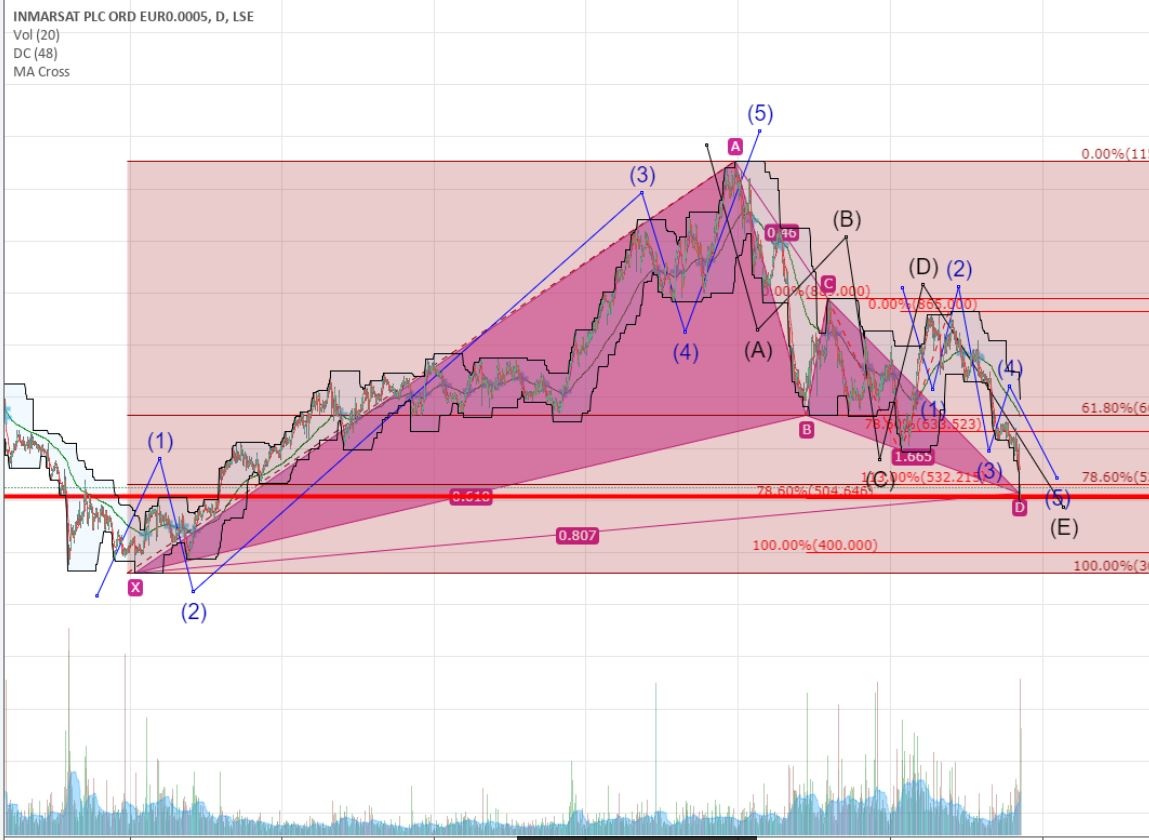

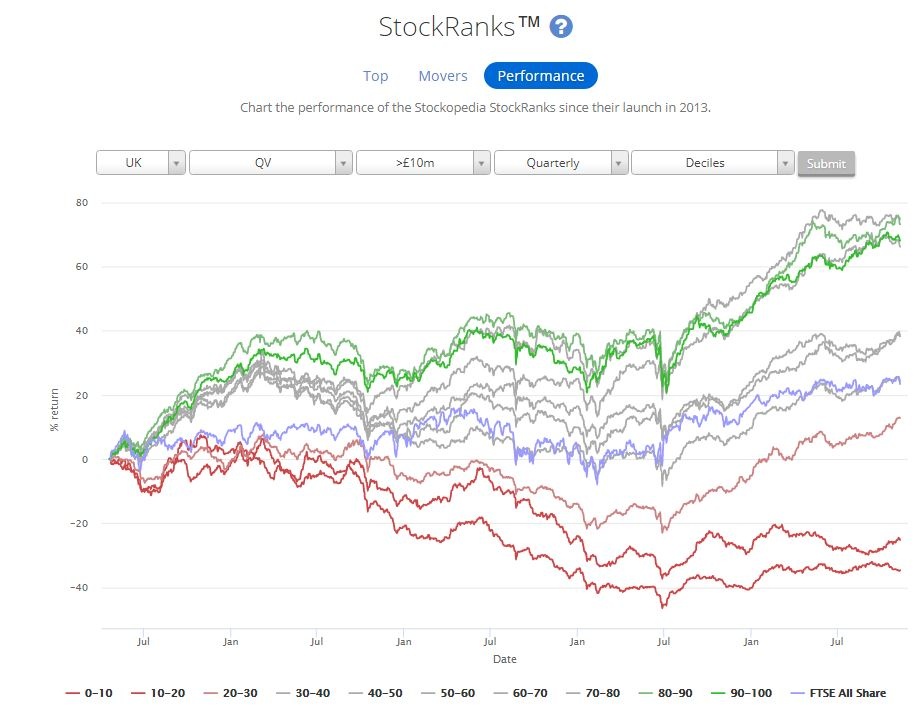

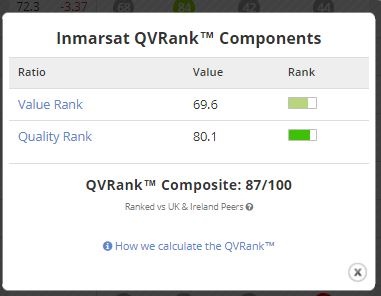

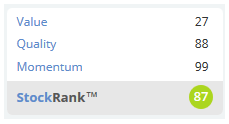

Inmarsat’s StockRank of 87 is the result of high QualityRank (88) and MomentumRank (99). These high ranks in tandem with a low ValueRank (27) make this the classic profile of a