As a value investor, I find it very hard to buy fully-valued successful companies, even when they seem very likely to deliver further gains. It’s a problem Ed discussed recently in his article about High Flyers such as Domino’s Pizza. Domino’s has never really been cheap, but has 14-bagged over 11 years. Am I missing out by avoiding such stocks?

Well perhaps. But I think it’s important to have a reasonable level of conviction when buying shares. That means investing based on a set of criteria you feel comfortable with, such as value and quality. It’s hard to hold on to a stock through market corrections if you never really wanted to buy it in the first place.

By way of a compromise, I’ve been screening for shares which appear to offer attractive quality, a reasonable valuation and evidence of decent momentum.

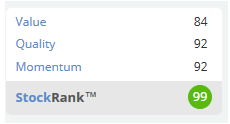

Luckily, Stockopedia makes it easy to track down stocks that fit a given profile. A blog post from earlier this year, Towards a taxonomy of stock market winners, makes it clear that the kind of company I’m looking for is a Super Stock. A company that continues to outperform without looking overly expensive.

Does NWF fit the bill?

This week’s choice is AIM-listed NWF, which describes itself as The Feed, Food and Fuel Group. It’s not exactly rock ‘n’ roll, but it is a consistent high performer that’s been in business since 1871, and ticks all the boxes as a potential super stock:

NWF shares have risen by 78% over the last three years, during which shareholders have also enjoyed 15.3p per share in dividends. That gives a total return of 94% in three years, making NWF a conspicuous outlier in the battered FTSE Oil & Gas sector.

The firm’s business has three core divisions, Boughey Distribution, NWF Agriculture and NWF Fuels. Respectively, these handle grocery, animal feed and fuel distribution. Although I’m not an expert on the company’s business, I can immediately see two likely structural advantages.

Firstly, a business like this can grow by generating efficiencies of scale and perhaps consolidating smaller businesses. Secondly, NWF has the potential to become a ‘sticky’ supplier to its customers, by providing a combination of price and service without which it would be hard to manage.

The first advantage…