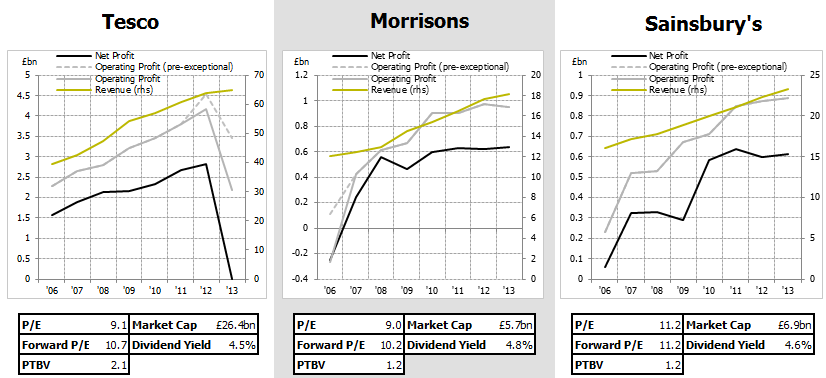

I like the supermarkets. I like the supermarkets because they're the best example I can think of of capitalism in action. They're relentlessly profit driven machines in constant competition; they expand everywhere there are consumers and they compete for said consumers on, more than any other sector I can think of, price. They represent, to me, the ultimate embodiment of the 'vote with your money' mentality. Anyway, before I get all misty eyed and reverential (as an economist (of sorts) you don't tend to find many industries which act anything like the textbooks say they should), I just wanted to share a couple of stats I put together. The supermarkets are all trading at quite depressed prices historically at the moment, and my gut feeling was that they were undervalued. Here are a few figures, then:

Headline metrics

Unsurprisingly, the supermarkets all trade at fairly similar multiples of their earnings. They tend to be fairly correlated in share price movements; while there is always an outperformer in the sector, it's still a group of companies which are fairly exposed to the macroeconomic environment. We talk about company performance being correlated to 'consumer spending', but when so much of consumer spending is made up by these 3 companies and their Walmartian sister, ASDA - about 25%, at a guess - correlation gains significantly more meaning. Here's the share price of the 3 companies over the last year:

The real divergence, of course, coming in the last few weeks. Probably the best metric to look at when comparing across the three is like-for-like sales, excluding petrol; Tesco are down 2.4% on this metric, Morrisons down 5.6% (!), and Sainsbury's up a rather creditable 0.2%. The impact of that is fairly obvious from the graph, though note that the colours might be slightly confusing (Tesco isn't blue - blame Google Finance!).

Valuation

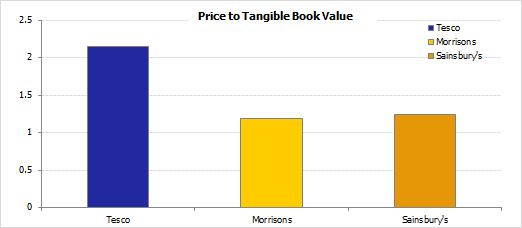

While they trade at similar multiples on an earnings front, the difference is fairly obvious on an assets one:

Tesco trades at a premium to both other supermarkets in assets terms - and it's quite substantial, too. When we see a similar earnings valuation but diverging asset valuations, it tells us one clear thing about the companies in question - returns on equity aren't uniform. There are three factors to returns on…

.png)