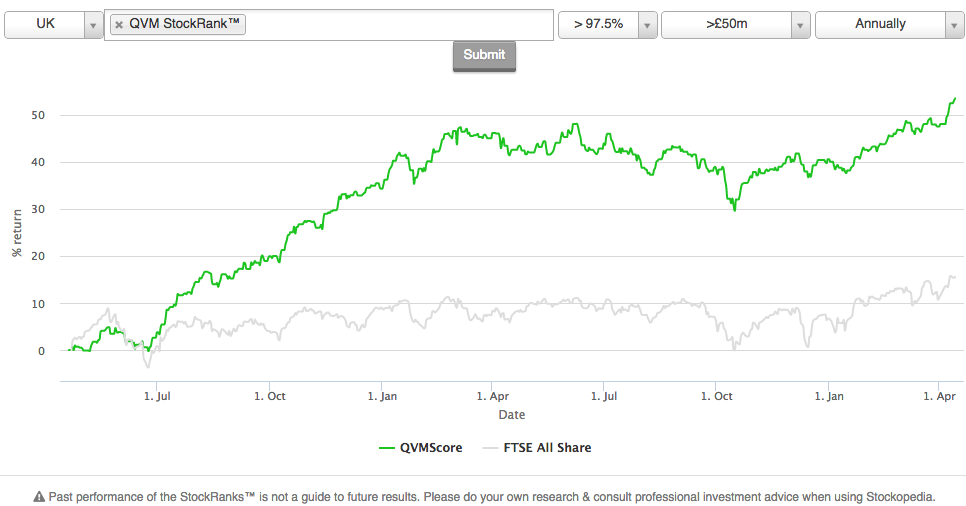

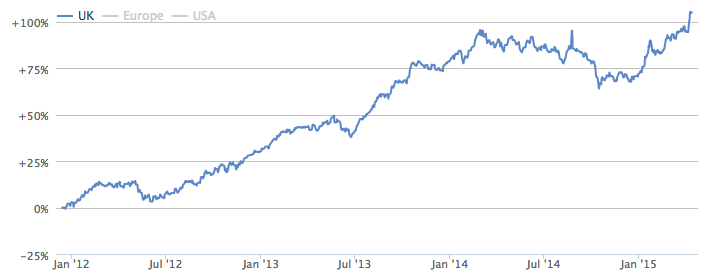

I have just noted that the Stockopedia Screen of Screens (SoS) has now generated a 100% return since 2012 inception. It's trucked along for the last 3 years at a 24% compound annual growth rate. It's too short a timeframe to draw conclusions, but it's clearly a phenomenal record to date for what has been a fully diversified 25 stock portfolio throughout.

What has been particularly fascinating about this performance is how the Screen of Screens has outperformed the majority of the Guru Screens which contribute to its selections. It currently ranks 15th out of 65 screens since inception, beating 75% of them. For those that don't already know, the Screen of Screens selects stocks that qualify for the most Guru Screens on Stockopedia, and this blended approach across quality, growth, value and momentum appears to have worked well.

Due to the nature of the Guru Screen collection on Stockopedia - where there are more value strategies than momentum strategies - the Screen of Screens is structurally weighted more heavily towards value than growth or momentum. Given there are quite a few Ben Graham Bargain screens in the collection some of the candidate stocks can often raise a few eyebrows.

Where the strategy has been unsuccessful is in its selection of the more dodgy bargain stocks like Naibu - which made this farcical news announcement in February before delisting - but it's also been brave in picking other controversial bargains like Quindell which turned a profit of 150% in just 3 months for the strategy in the first quarter of 2015.

But mostly the Screen of Screens diversifies quite broadly across different classifications of good, cheap and improving stocks - from momentum stocks like Just Eat through to high quality yielders like Next. The screen has an average StockRank of 87 which shows exposure to the same factors that drive the outperformance of the StockRanks.

Although I don't personally use the SoS as my own investment strategy (I'm a StockRanks zealot these days), I do love to see the stocks I buy qualify for at least a couple of guru screens on their StockReports. I was born into stock market investment through the use of stock screens, and they'll always be a key part of my own personal toolkit.

If you've been using the Screen of…