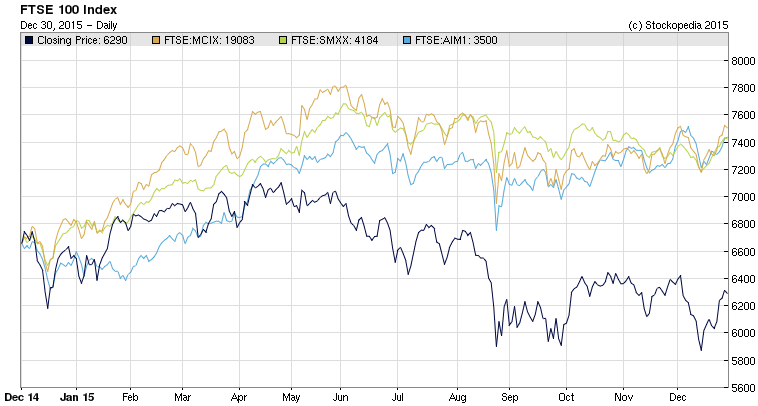

2015 turned out to be a year of very mixed fortunes for UK investors. A sluggish performance by the blue chip FTSE 100 index - down by around 4.5% - told a tale of depressed commodity sectors and sliding prices at giants like Pearson, Standard Chartered and Rolls-Royce. Small and mid-cap indices did better but they weren’t immune from the occasional accounting scandal, alleged fraud and disastrous IPO. But there were great gains to be had in the right parts of the market. Here’s a quick look back at some of the winners and losers in stocks and approaches in 2015.

Winners

Successful IPOs: Fever-Tree Drinks

Known for its high-end tonics and mixers, Fever-Tree Drinks floated on the Alternative Investment Market in November 2014. But the success has been the price gain through 2015 - rising by a staggering 244%. What makes that all the more remarkable is that Fever-Tree was one of a number of ‘dreaded’ private equity-instigated floatations. Often heavily indebted and sold a frothy prices, this type of IPO has been a disaster on many occasions (see HSS Hire below). But Fever-Tree has so far flourished as a public company. Private equity backer LDC, sold its remaining 10% stake in July and what now looks like a knockdown price. Fever-Tree currently has a Stockopedia ValueRank of just 1 out of 100, suggesting that its price could now be stretched. Yet its Quality and Momentum Ranks are in the top tier of the market. That gives Fever-Tree the profile of a classic High Flyer - but any slip ups in the growth trend could send the momentum crashing.

Small-caps shone

From an index perspective, the general trend showed that small and mid-cap stocks were the place to be in 2015. The FTSE 100 laboured under the weight of its bias towards oil and gas and mining giants. But the AIM 100, FTSE SmallCap and FTSE 250 are all on course to end the year in positive territory, with the FTSE 250 up by around 8%.

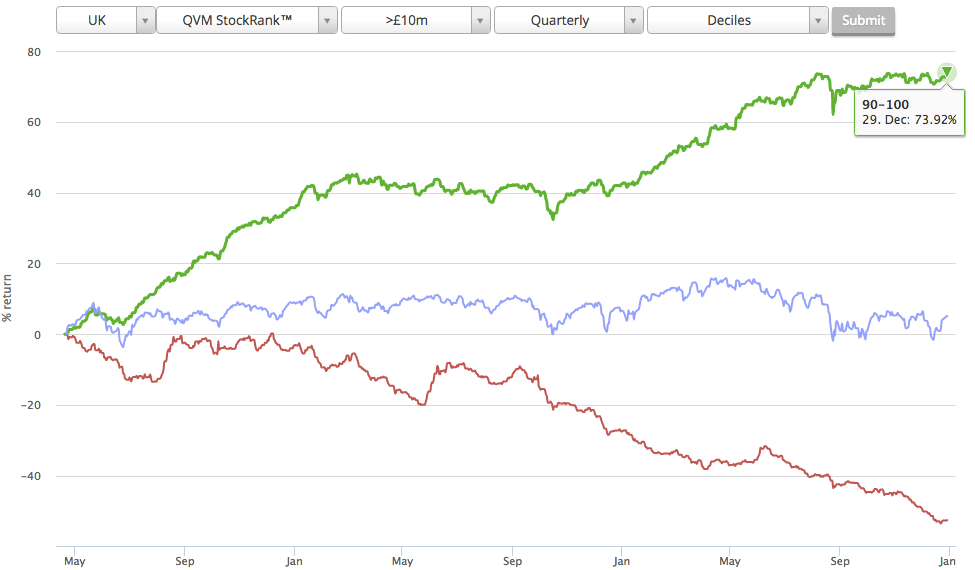

Factor investing outperformed

At the close of 2015, the highest ranked 10% of stocks based on Stockopedia’s factor investing inspired StockRanks hit a new high. This quarterly rebalanced portfolio of stocks with the strongest blend of Quality, Value and Momentum has now produced a 74%…