There’s no better way to close out for Christmas than with a review of the year. We can admire the stocks that doubled, rue the ones that halved, and regret just how close we came to buying that one stock that could have made all the difference.

So let’s repeat what we did this time last year, and dig into the data, look at the winners and losers across the StockRank spectrum, and cut ourselves a bit of slack. Investing is joy, regret and farce rolled into one. A tragedy and a comedy - with the endless promise that next year, just maybe, we’ll do a little better.

The backdrop - a stronger market than it felt

2025 seemed like a good year - but it didn’t feel like that for everyone.

At the time of writing, the FTSE 100 Index (FTSE:UKX) has risen around 16% year to date, with the FTSE All Share Index (FTSE:ASX) close behind. But small caps have lagged badly.

The FTSE Smallcap Index (FTSE:SMC) rose just 7%, while the FTSE AIM All Share Index (FTSE:AXX) has managed about 6%. This really matters, because most private investors like us invest in small caps.

Across all UK shares in my database - around 1,260 stocks - the median price return in 2025 was zero. Restrict the universe to shares above a £10m market cap (983 stocks), and the median return barely improves, at 0.27%, with a mean of about 5.8%.

In other words, the typical stock - and probably the typical private investor portfolio - earned around 5%. Ignore the indices - that’s your real benchmark.

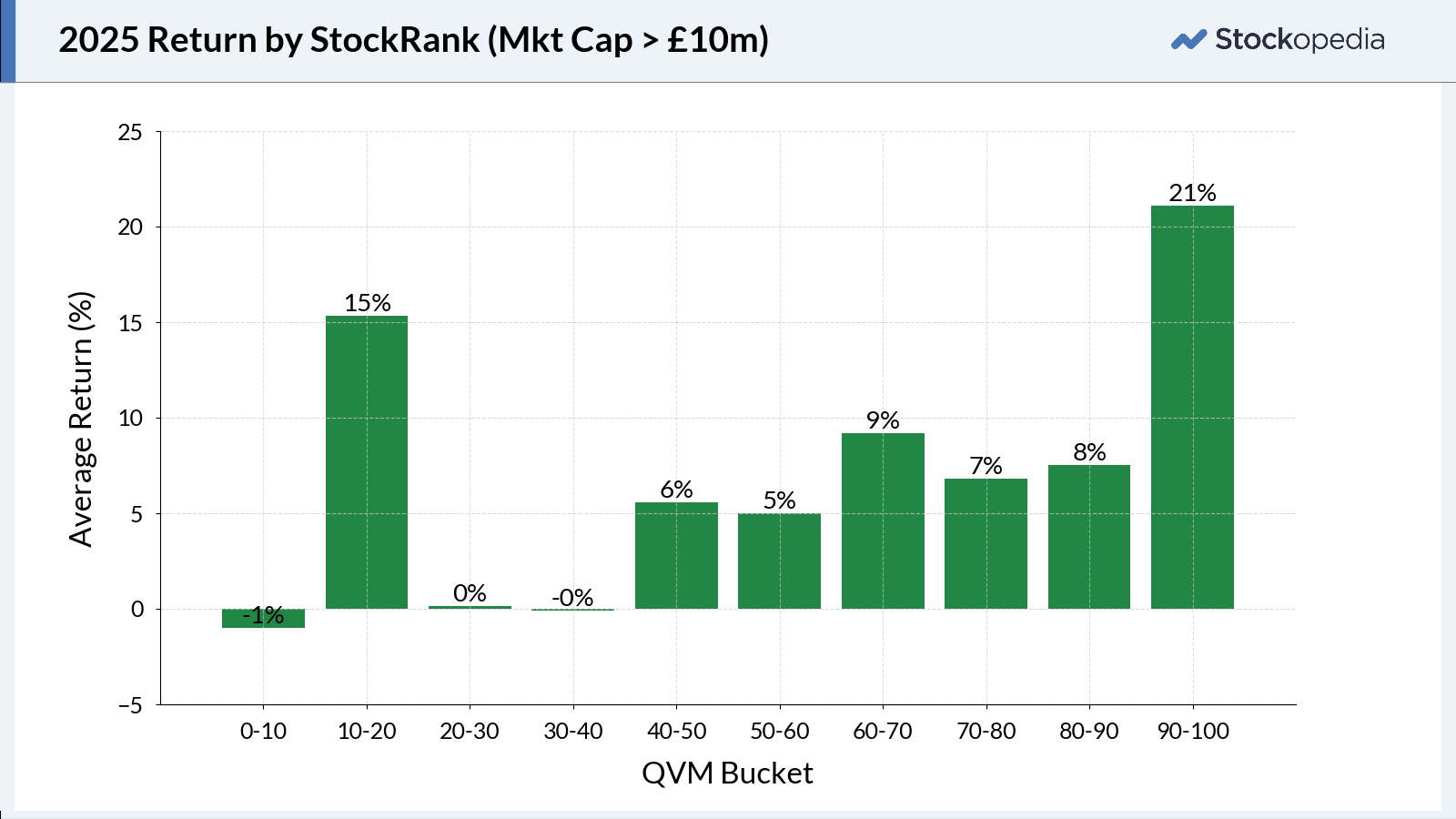

The StockRanks did their job - again

90+ StockRanks delivered a clear advantage.

Shares with a StockRank of 90 or more returned around 21% on average in 2025. That’s a substantial premium in a year when the gap between good and bad narrowed.

Unlike the long term chart, which shows a smooth progression from low rank performance up to high rank performance, it was a little more uneven. Nonetheless, 90+ was the place to be.

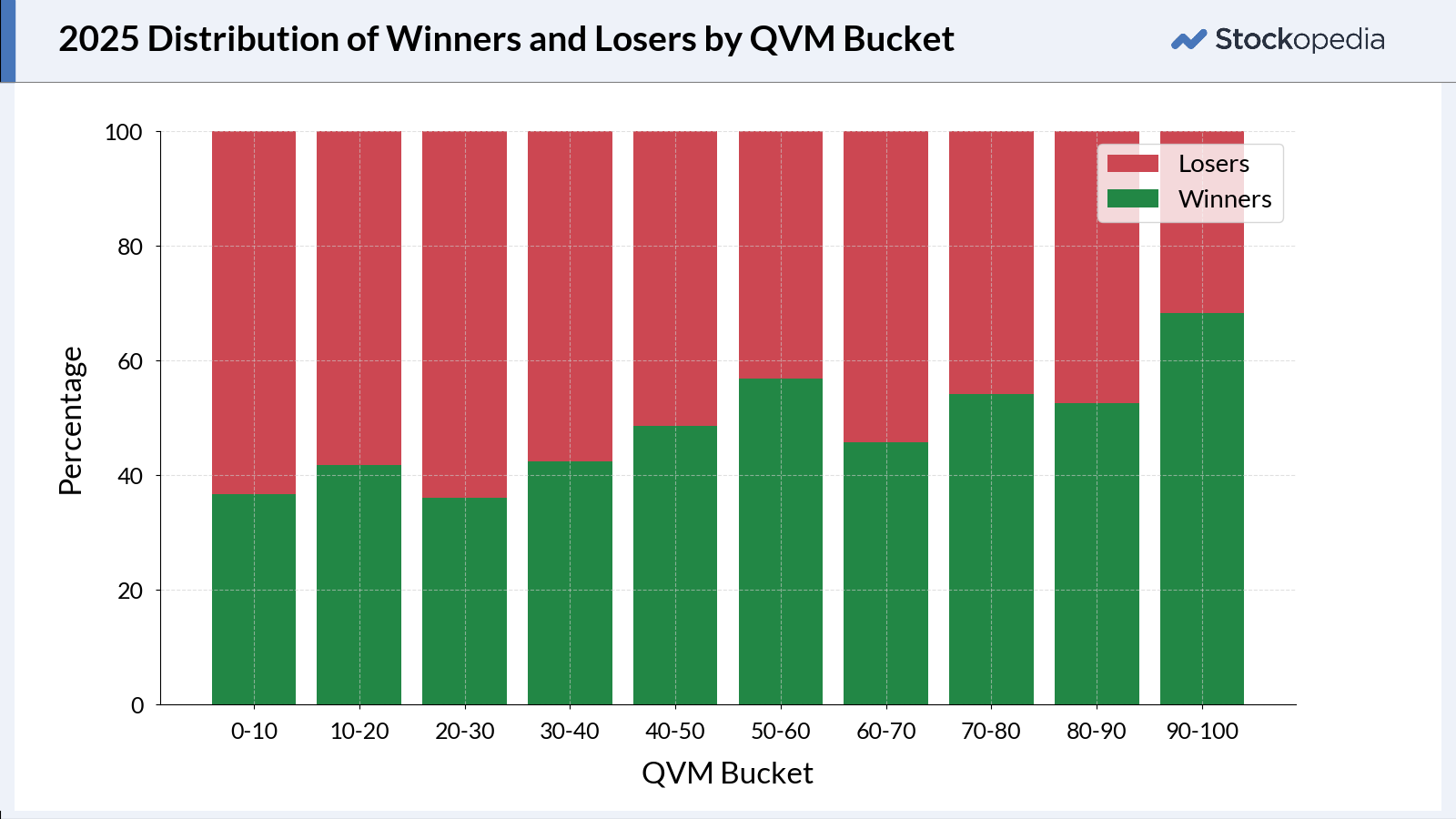

What’s more, in the 90+ bucket, you had roughly a 68% chance of picking a winner. A double whammy of the best odds and the best returns.

When winners worked, they worked well.…