This is #4 in our "Twelve Stocks of Christmas 2025" Series. You can review the full set here.

The Pitch

Ingenta (LON:ING) is an AIM-listed software company. With a StockRank of 99 and a cash-rich balance sheet, subscribers have started to realise that this is a high-quality, cash-generative business on a value multiple. After a significant period of consolidation, management is starting to focus on growth again. Their content management business counts some of the most well-known organisations in the world as its customers, such as the UN. While in its content lifecycle and royalty management division, existing customers include some of the world's largest publishing houses. While historically the focus has been on the book publishing industry, the TAM for its solutions is huge, also encompassing music and games publishers worldwide.

The Big Picture

Ingenta has two business units that provide software and services to customers:

- Ingenta Content has two solutions for hosting and discovering digital content

- Edify is a premium platform designed to host, manage, and monetise digital content, primarily used by scholarly publishers and NGOs.

- Connect is a shared aggregator portal hosting content from hundreds of publishers for over 25k institutions.

- Ingenta Commercial provides:

- A Content Lifecycle Manager for product creation and workflows;

- Royalty management software that is able to take data from multiple sources and present it to artists much more comprehensively and quickly than customers were previously able to; and

- A system that can manage the entire sales process, from order management to warehouse fulfilment and shipping.

Deploying Ingenta’s solutions enables its customers to build much greater engagement and trust with IP owners, such as authors and artists. Competition in this space is often from slow and difficult-to-maintain solutions, such as bespoke Excel sheets.

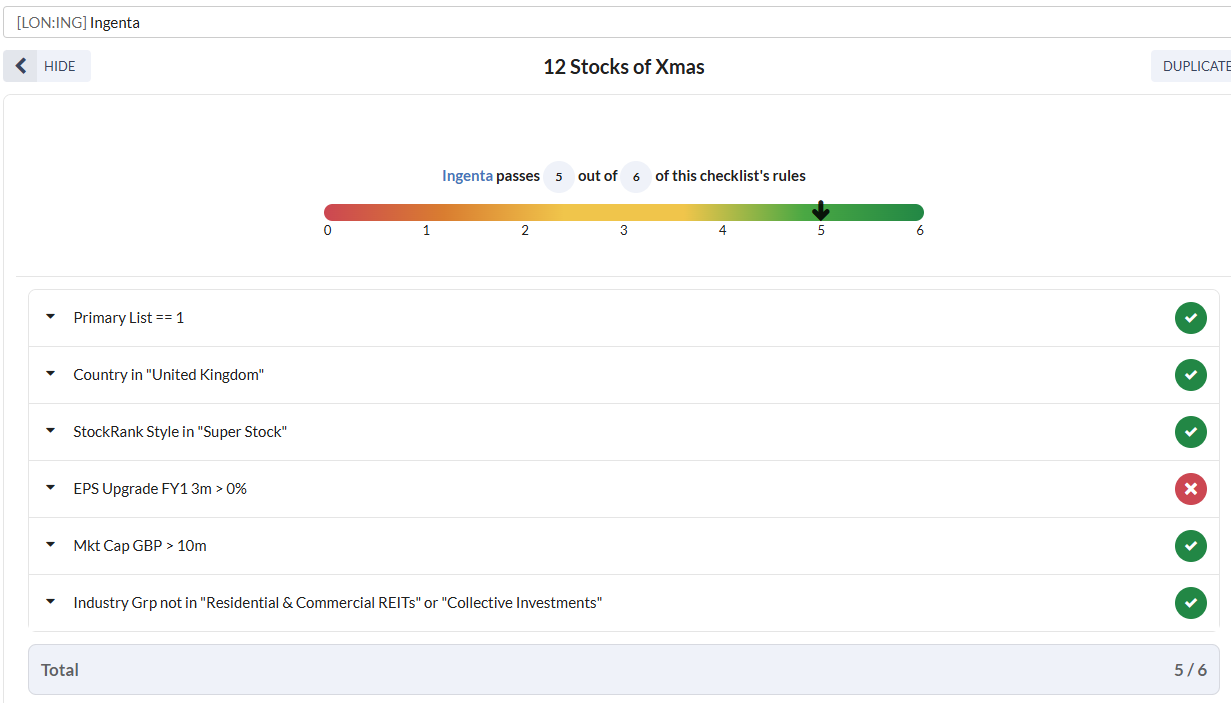

Ingenta is my Quality pick for the “12 Stocks of Christmas” with a Quality Rank of 99.

- Quality at a Very Reasonable Price: Since the current management team has driven a turnaround in the business, the Return on Capital Employed has averaged over 30%, suggesting a significant competitive advantage. Conservative accounting means that almost all earnings have converted to free cash flow, making the recent Cash Flow Return on Invested Capital over 40%.

- Overhangs cleared: It is rare for a software company to trade at a single-digit P/E, let alone one with such strong Quality metrics, but the company has been hit in 2025 by two major shareholders exiting due to…