This is #9 in our "Twelve Stocks of Christmas 2025" Series. You can review the full set here.

The Pitch

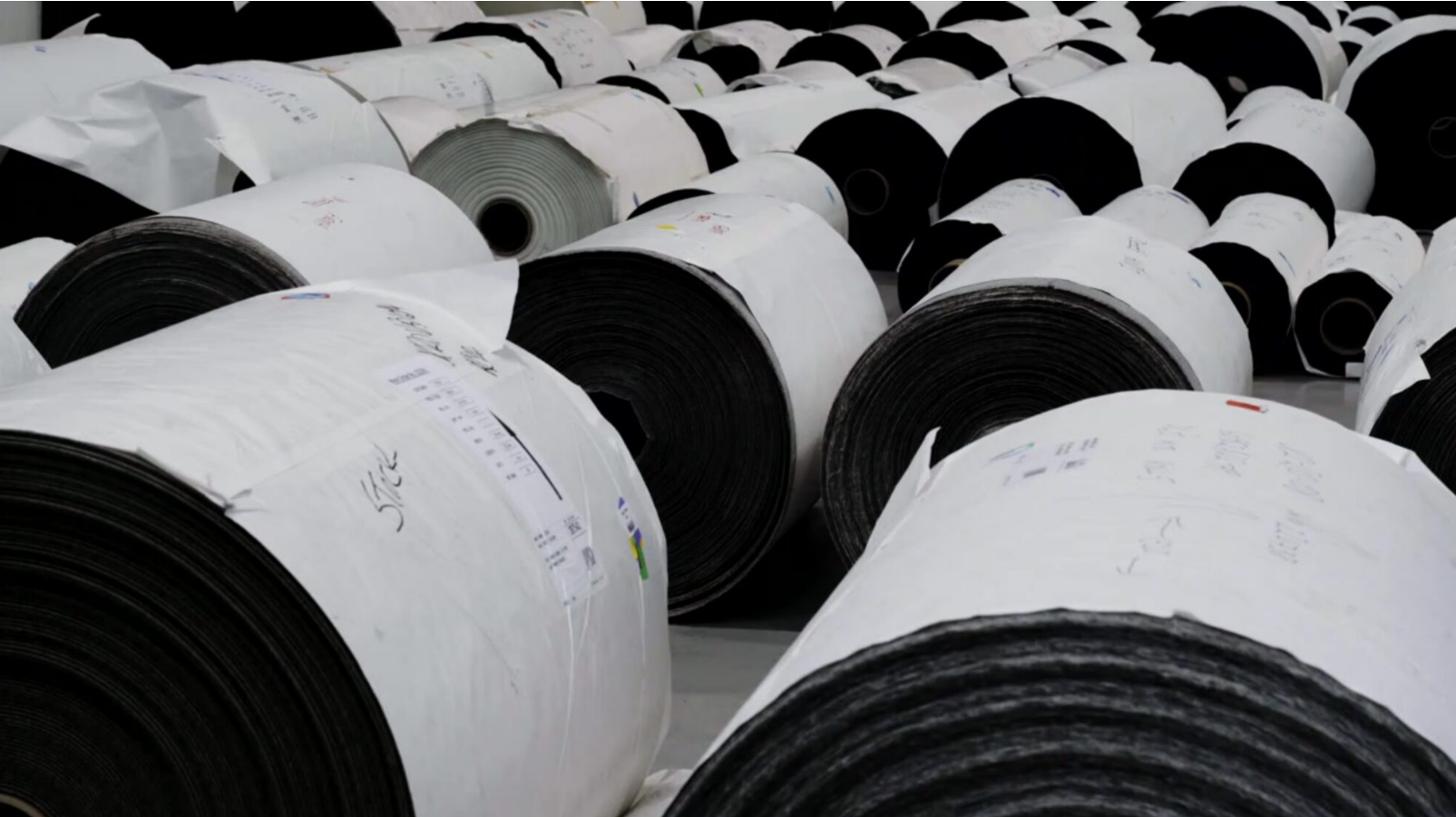

James Cropper (LON:CRPR) is a family business containing a legacy Paper & Packaging division and a much more profitable and fast-growing Advanced Materials operation. This latter unit serves customers in high-tech industries such as aerospace, defence and energy.

A StockRank of 98 that’s led by high Quality and Momentum scores highlights the potential of the business. If management can return the Paper & Packaging business to sustainable profitability, then investors have the potential to profit from continued growth in the exciting Advanced Materials division.

The Big Picture

James Cropper has been through a difficult period in recent years. Losses in the Paper & Packaging (P&P) business have offset growing profits from Advanced Materials. However, progress is being made restructuring P&P and securing new volumes to replace lost business.

Management is forecasting a return to breakeven for P&P in the final quarter of the current year. Achieving this could allow the value and growth potential of the Advanced Materials business to really shine through:

Growth market opportunity: the Advanced Materials business has a growing presence in a number of nascent markets such as green hydrogen electrolysers and fuel cells. These are smaller businesses at the moment but have high potential growth rates.

Established markets offer revenue security: alongside these nascent markets Cropper generates much of its Advanced Materials revenue from slower-growing but more secure markets such as aerospace, defence and medical. Products are typically designed into OEM products and often have long specification cycles, resulting in reliable repeat revenue once established.

Balance sheet repair: the business has been significantly de-risked by a reduction in net debt over the last 18 months. Leverage and debt levels now look sustainable with increasing headroom to support investment in Advanced Materials and – eventually – the reinstatement of dividends.

Going Deeper

For its size, James Cropper is a somewhat complicated and unusual business. The standout opportunity for the future is the Advanced Materials division. But a closer inspection reveals a number of other areas where small improvements could lead to material gains for shareholders:

Unusually low valuation: the shares look unusually cheap on a historic view, trading…

.JPG)