According to behavioural scientists, cognitive errors in humans can lead to duff decision making. For investors, of course, this kind of weakness can end up being costly both mentally and financially. But while being aware of such flaws won’t always save you from mistakes, it can offer at least some protection from making them.

There are few better places to explore just how big an impact ‘behaviour’ can have in the market than to look behind the scenes of the popular 52 Week High Momentum screen.

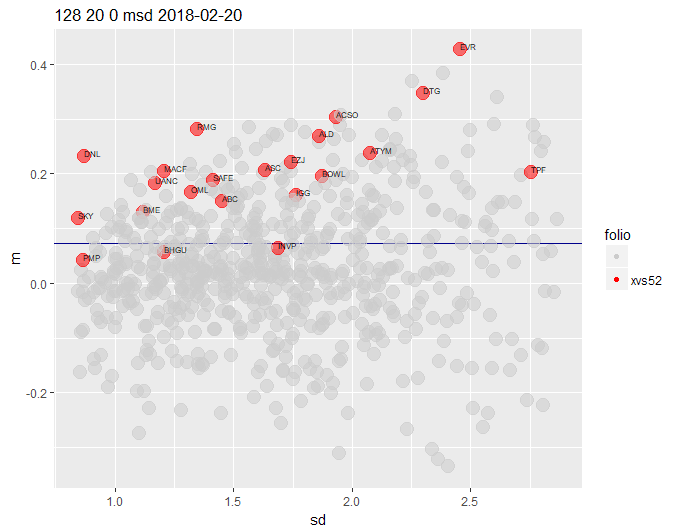

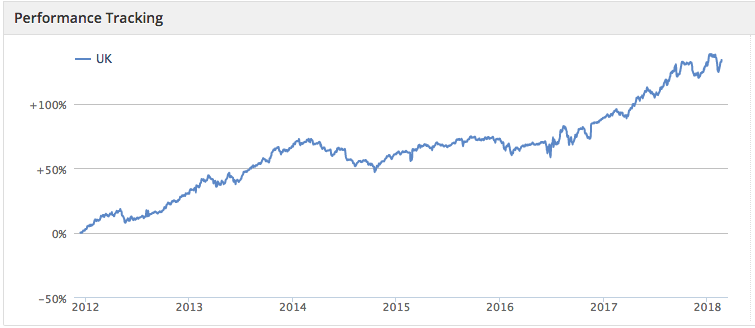

We track this strategy at Stockopedia and it’s up 20.9 percent over the past year - making it a top 20 performer. (It has returned 14.7 percent annualised over the past six years). It has also done well at resisting February’s market volatility.

But like most momentum strategies, one of the interesting things about the 52 Week Highs approach is that it piggybacks on the behaviour of other investors. In particular, it takes advantage of what’s known as Anchoring.

So regardless of what you think about momentum (or whether you’re even attracted by 52 week highs), knowing about Anchoring could change the way you think - consciously and unconsciously - about share prices. It can also explain, at least in part, why momentum is believed to be so powerful.

What is it about 52-week highs?

I’ve covered some of the inner workings of the 52 Week High screen a few times in the past (here’s the most recent article). It’s popular because the 52-week high is one of the most accessible data-points around. One year highs are literally published all over the place - and they tend to catch the eye of investors.

But while the data for the strategy is readily available, the psychology that makes it useful is intricate. To a large degree it calls on the ‘momentum’ investor to know that a share trading close to its 52-week high will probably sustain its upward trend over the near- to medium-term. But why would it do that?

The answer lies in what’s called (mostly in academia) ‘post earnings announcement drift’ (PEAD). As the name suggests, this describes the slow, steady upward trend in a share price that often follows positive earnings news. In essence, it’s the market taking much longer than usual to price in the full…