Introduction

I’m currently reading The Little Book of Behavioural Investing, and one of the key lessons is having a plan and sticking with it when emotions want to take over. So, with that in mind, here is a letter to my panic stricken self when the market goes bear.

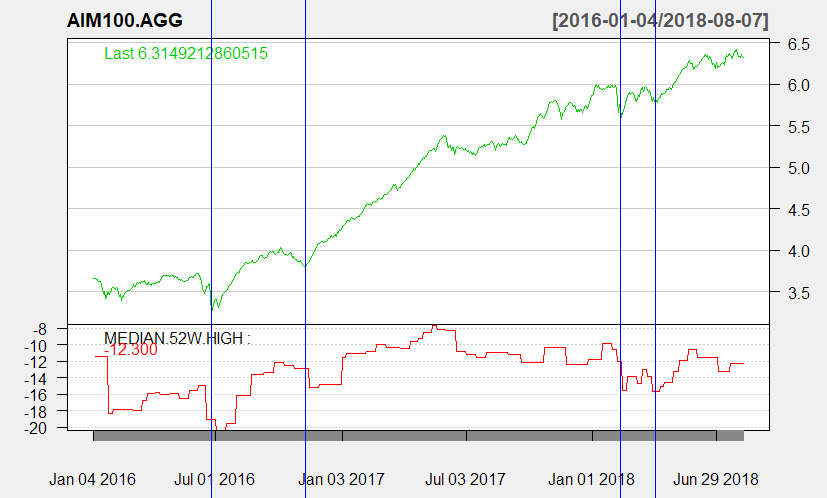

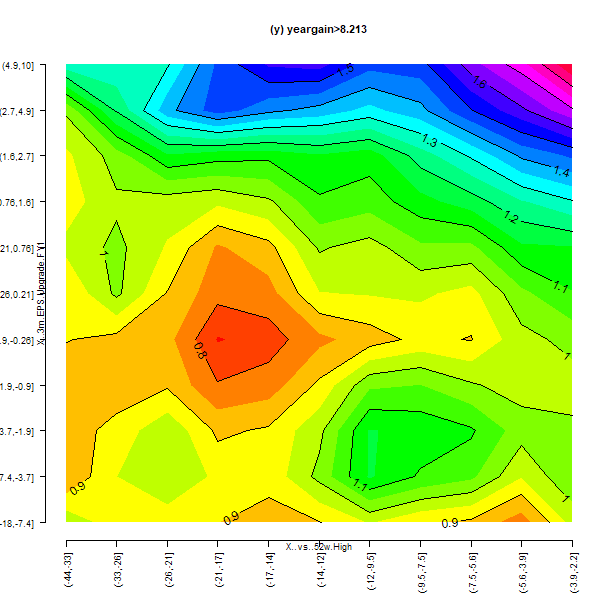

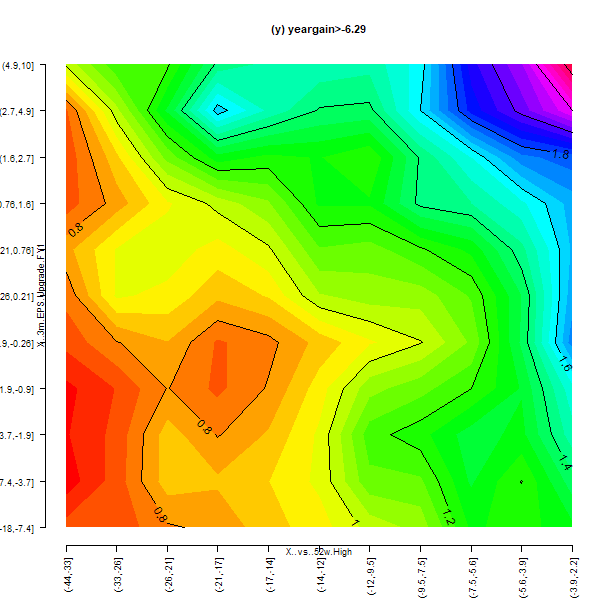

In writing this, I discovered a flaw in my rules. My current 52 week high rule might do well to get me out when the market is doing down, but it will keep me out when it starts to recover. This is something I’ll need to formally review next month. For the purposes of this, however, I’m assuming a ‘temporary’ rule based on the market bottoming out and starting to recover.

Letter

Dear me

Sit down, shut up, and grab a coffee. Yes, you can afford to still spend money. No, you are not a terrible investor (ok, you’re not good, but you’ll be ok). Now take a deep breath, and follow the plan.

Rule 1: Don’t change the plan

You came up with this plan for a reason: when it comes to picking stocks, judging bottoms, calling tops, and making decisions under pressure, you are at best, taking an educated guess, or more likely, making exactly the wrong call. Don’t change the plan. No excuses

Rule 2: Follow your rules

You’ve got two types of buy and sell rules. Ones based on stock ranks, and ones based on price. The StockRank ones are ranks, so there will always be stocks ranked with great momentum ranks, even when the market is going down the drain. However, your price markers will be sensitive to a spiralling market. If everything is off their highs, and there is nothing coming up, that means there is nothing to buy, so hold the cash, and review weekly. The only exception to this is forgoing shares that are close to being excluded because of their price rules (i.e going down and close to % off 52 week high limit) – if they are going down and within 5% of this rule, you can forgo that share.

(Note to self - you already sometimes give yourself 5% desecration with this rule for shares heading down. Time to just make this part of your usual rules?)

Rule 3: Use the built in flexibility

You’ve got permission within the…