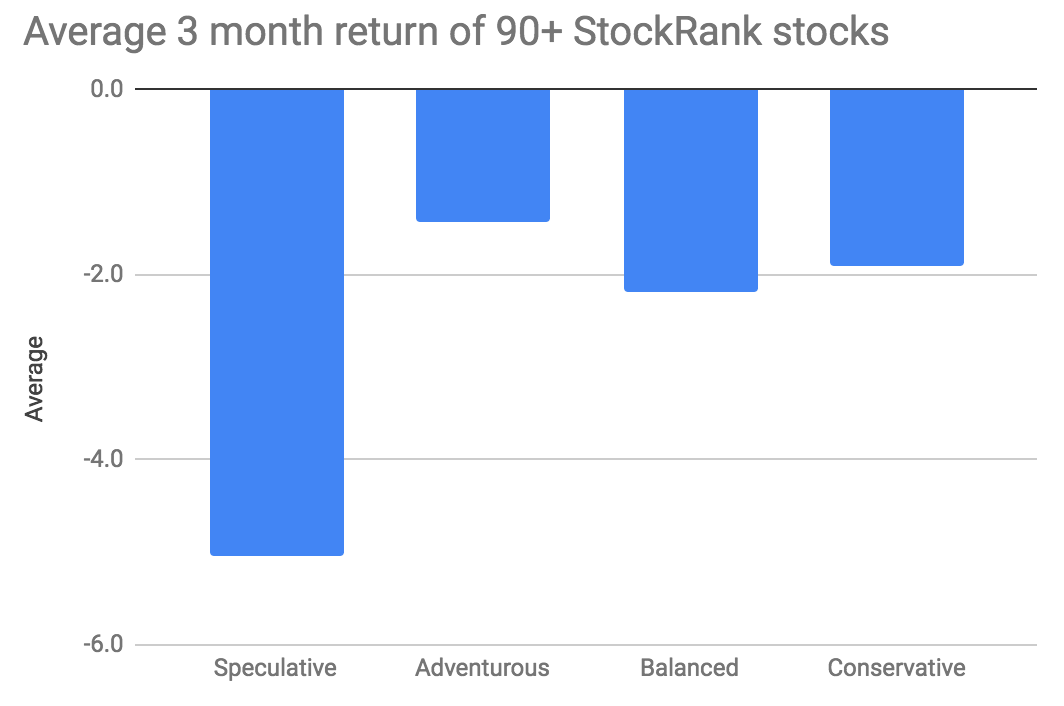

I am following a high stock-rank screen which tends to pay dividends. I have been beaten by the markets recently with the whole portfolio down by 11% in last 3 months.

Cenkos down 30%

IGG down 25%

Bonmarche down 25%

Griffin Mining down 30%

Royal Mail down 15%

Numis down 15%

Wynnstay down 10%

Hanstten down 10%

All these shares had a SR of 99+ when I bought them about 2 months ago.

I hope this is the 1/3 of probability of picking losers from the high stock ranks is playing out!

Hi

An excellent posting, thank you.

Might you do an equivalent for some stocks you do indeed favour (I have seen several of these across the threads but would be interested to see them in a single post).

I found your reasonings in this post about the negatives of stocks with regard to their respective market/business contexts to be very thought provoking. A nice exemplar about taking a wider perspective and how to articulate that information succinctly.

Regards

Howard

.png)