See all the previous Monthly Recaps here.

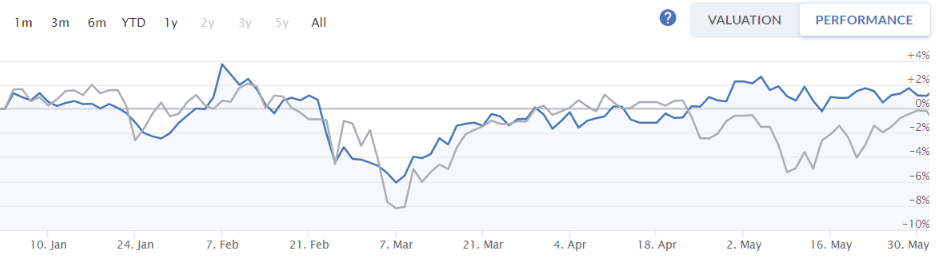

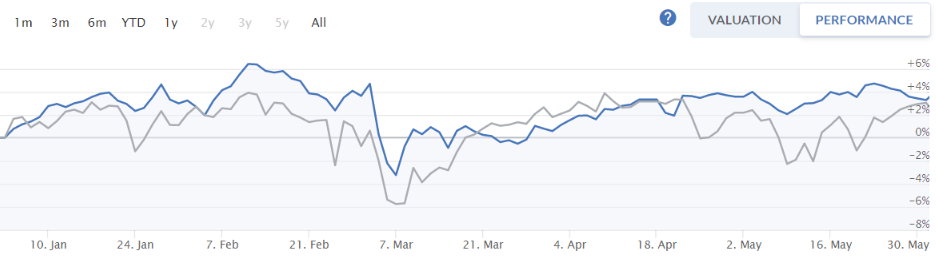

May Performance -0.7% vs FTSE All-Share benchmark +0.4%

YTD Performance +2.3% vs FTSE All-Share benchmark -0.1%

(Part Time) Fund Manager’s Report

May was a frustrating month for me. The first half saw blistering outperformance, as much as a +5% outperformance vs benchmark MTD. The markets had lurched downwards, while both my ISA and SIPP held their values up well. However, by the end of the month, the markets had recovered most of their losses, while my holdings were barely unchanged. As a result, May ended down -0.7%, while the FTSE All-Share benchmark was up +0.4%. The AIM-100 was down -4.5% in May, where the majority of the shares in my portfolio are from.

YTD the AIM-100 is down -20%, while my ISA (all AIM shares) is up +1.1%.

Five months in, I am up +2.3% overall across my SIPP and ISA, a privileged position to be in. Charts below.

ISA YTD Performance (vs FTSE All-Share in grey)

Sipp YTD Performance (vs FTSE-100 in grey)

Earlier this month, it suddenly dawned on me that I might now have too many companies in my portfolio. Last year, I ran a concentrated portfolio, and my goal was to diversify. However, has the pendulum swung too far? I now have 15 companies (excluding my two ETFs). I know many other investors run a larger portfolio. But for me, as a part-timer with a demanding day job, is 15 too many? And I still have quite a bit of cash (28%) in both portfolios to deploy. Your thoughts in the comments below would be much appreciated.

May was a month dominated by the “missed opportunity” theme. Not in terms of buying, but in terms of selling. I had correctly identified that Spaceandpeople (LON:SAL) might have been a bit toppy at c15p during early May, and sold, but only half my holdings. It then went as low as 12.5p, and now at 13.5p.

Similar goes Zytronic (LON:ZYT) – I decided to sell at c170p right after results, but got distracted that day and didn’t execute, and the price has fallen ever since. I succumbed to the investor weakness of waiting for a bounce-back, and the shares at now at c155p.

I firmly believe that being decisive, but not rash,…