It feels as though today’s markets bring more downside risk than upside. A gloomy note to start on, but it’s hard to argue against when you look at some of the facts. Depending on how you define it, we are thirteen years into a bull run. Most last for around eight years.

This bull run has been supported by a kind of financial alchemy that up until recently some academics did not even think was theoretically possible (coincidentally, the acronyms for these monetary policies sound like the villains in a bad sci-fi film: ZIRP, NIRP, and QE). Historically low (and even negative) interest rates have inflated financial assets. Unprecedented levels of QE (bond-buying) programmes across some of the largest global economies have also contributed to an artificially favourable environment for these financial assets.

Meanwhile, the political situation is unsteady. China and the US continue to throw tariffs at each other, like warring pupils on either side of an unruly classroom - and the rest of the class isn’t behaving much better. Germany’s growth is stalling, as is the UK’s. Around the Eurozone, upstart political parties are staking a claim and threatening to change the complexion of politics across the continent.

Add to this the small matter of Brexit. Uncertainty kills business confidence - and it seems like there’s a lot of uncertainty around at the minute. More than a decade after the last big financial crash, and at a time of fairly weak global economic growth, you might think that Britain’s exit from the European Union is perfectly poised to be the straw that breaks the camel’s back.

But being a contrarian is what a lot of successful investing is all about. With all this doom and gloom around Brexit, might battered UK domestic stocks actually be one of the most attractive contrarian plays around?

Overseas buyers certainly seem to think UK assets are good value right now if the recent spate of M&A activity is anything to go by. Asset-backed, UK-focused leisure stocks easyHotel and Greene King, for example, are both getting snapped up by overseas buyers.

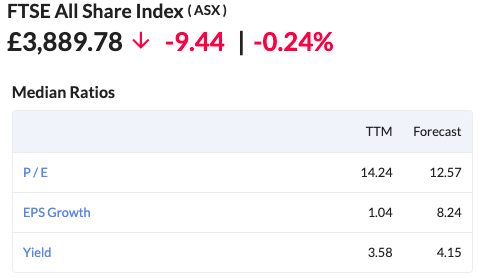

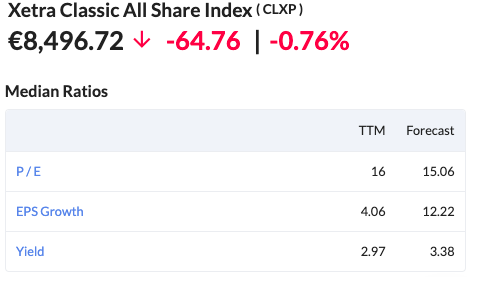

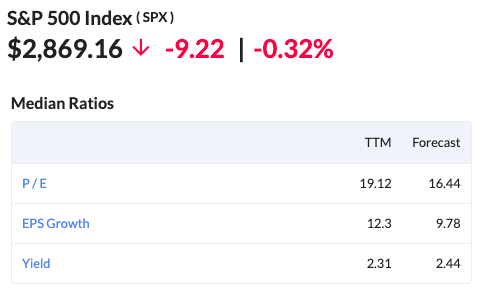

Comparing the FTSE All Share IndexReport to Germany’s Xetra Classic and the US S&P 500 does appear to indicate that UK stocks are trading at something of a discount:

.jpg)