5-May-21 : Just a footnote here for anyone happening on this article in the future. I'll shortly be leaving Stockopedia (at least for now), but I will be continuing this experiment, so if anyone wants to keep track of how it turns out; you can follow it at https://campozo.net/Gromley_writes the content will be up by 10th May.

Update

(16-Dec-2020)

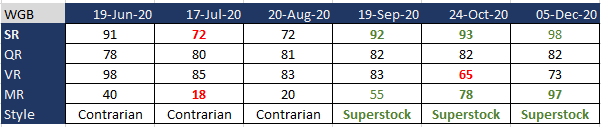

Just a quick update to reflect that Walker Greenbank (former ticker LON:WGB) recently renamed themselves as Sanderson Design (LON:SDG) . This to reflect their primary brand.

Also, over a year has ticked on since I originally published this; so it is probably worth providing a short pre-amble.

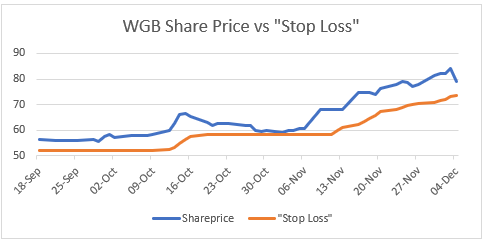

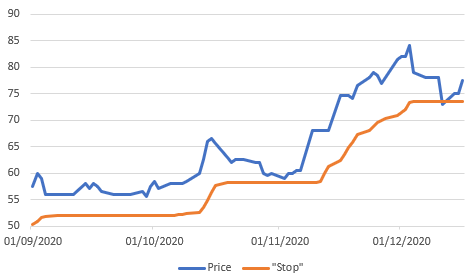

This is a working experiment in "when to sell" - I am applying this basic approach to a large part of my portfolio (and it is looking good so far) but I chose to highlight one stock for this summary.

The experiment had a bit of a false start : I bought in June 2019 & by October 2019 my "stop loss" / "stop think" rule and I sold out my personal position but did not consider my theoretical/experimental position closed as my actual sell decision was more deeply rooted in the thought that the stock had not properly met my buy criteria in the first place. So perhaps I should add to my sell criteria - "when I admit (to myself) making a mistake"

I considered my theoretical position closed, a few weeks later in November 2019.

It was nothing but good fortune to not be holding when the coronavirus crash kicked in.

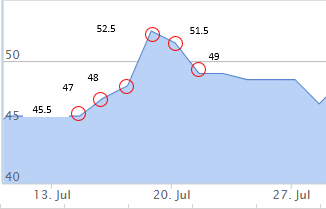

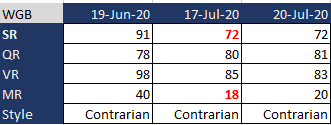

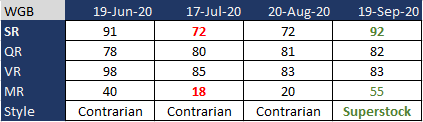

I bought back in June 2020 (which was nice) and the experiment got properly back on track. It's probably a fortunate and unusual entry point, but never-the-less the basis sell criteria I think still hold.

Back to the original article :

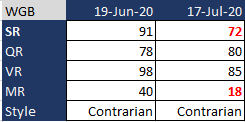

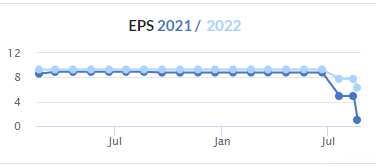

Given that I only just bought my Walker Greenbank (LON:WGB) shares today, this may seem a little premature.

However, prompted by Jack Brumby’s piece Why are we so bad at selling I thought to try out a little thought experiment and spell out publicly under what conditions I would sell.

Why I bought

Very briefly I believe this to be a high quality business which represents excellent value and as I noted in today’s SCVR…