We regularly get emails from users asking us whether the successful European StockRanks have been backtested further than their June 2013 start date. While we don’t yet have the point in time data to do this internally, we can gain insights into past performance by exploring the extensive academic literature on factor investing. Indeed, some of the academics and practitioners that inspired the StockRanks have analysed how value and momentum strategies have performed in Europe since the 1970s. Have these market anomalies always existed in European markets, and if so, how can individual investors exploit them? Let’s take a closer look...

Cheap beats expensive overseas?

Back in 1993 two professors, Eugene Fama and Ken French made their mark in academic finance by pinpointing two factors that drive stock price returns: size and value. In a nutshell, they observed that value stocks beat growth stocks while small stocks outperform large stocks. A few years later -in a paper titled Value versus Growth: The International Evidence (1998)- the two academics examined stock returns between between 1975 and 1995, in order to discover whether the value effect existed in overseas stockmarkets. They found that ‘value stocks outperform growth stocks in twelve of thirteen major markets’ tested.

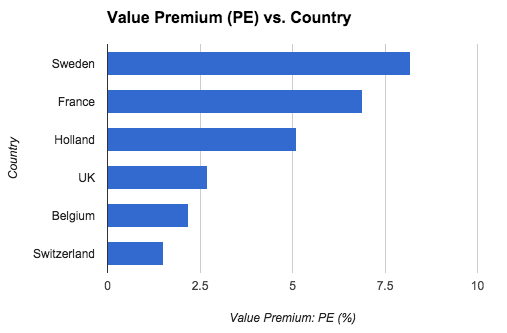

The following charts have been put together using data from Fama and French’s paper: Value versus Growth: The International Evidence. They illustrate the amount by which cheap P/E stocks outperformed expensive P/E stocks (ie. the value premium). In many cases the premium was actually stronger in European markets than in the UK. For example, in Sweden, cheap P/E stocks beat expensive stocks by around 8% per annum.

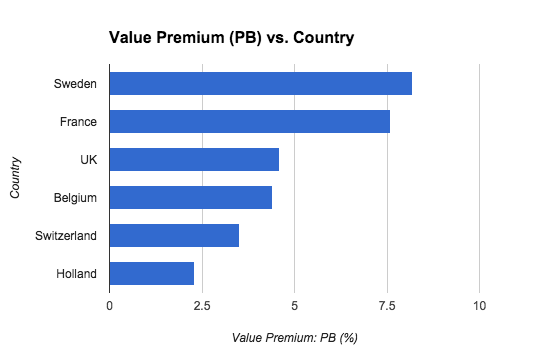

Fama and French also explored whether companies that are cheap against what they own (low Price to Book stocks) beat their expensive counterparts (high Price to Book stocks). Again, cheap stocks outperformed. For example:

- In France, the market appreciated by 11% per annum, while cheap P/B stocks returned 17%. Expensive P/B stocks underperformed the market and returned 9%.

- Furthermore, in Germany, cheap P/B companies appreciated by nearly 13% per annum, beating the market which returned 9.9%. Again, there were cases where the value premium was stronger in foreign markets, as we can see here:

Some readers may be wondering whether the value premium has been arbitraged away since the…