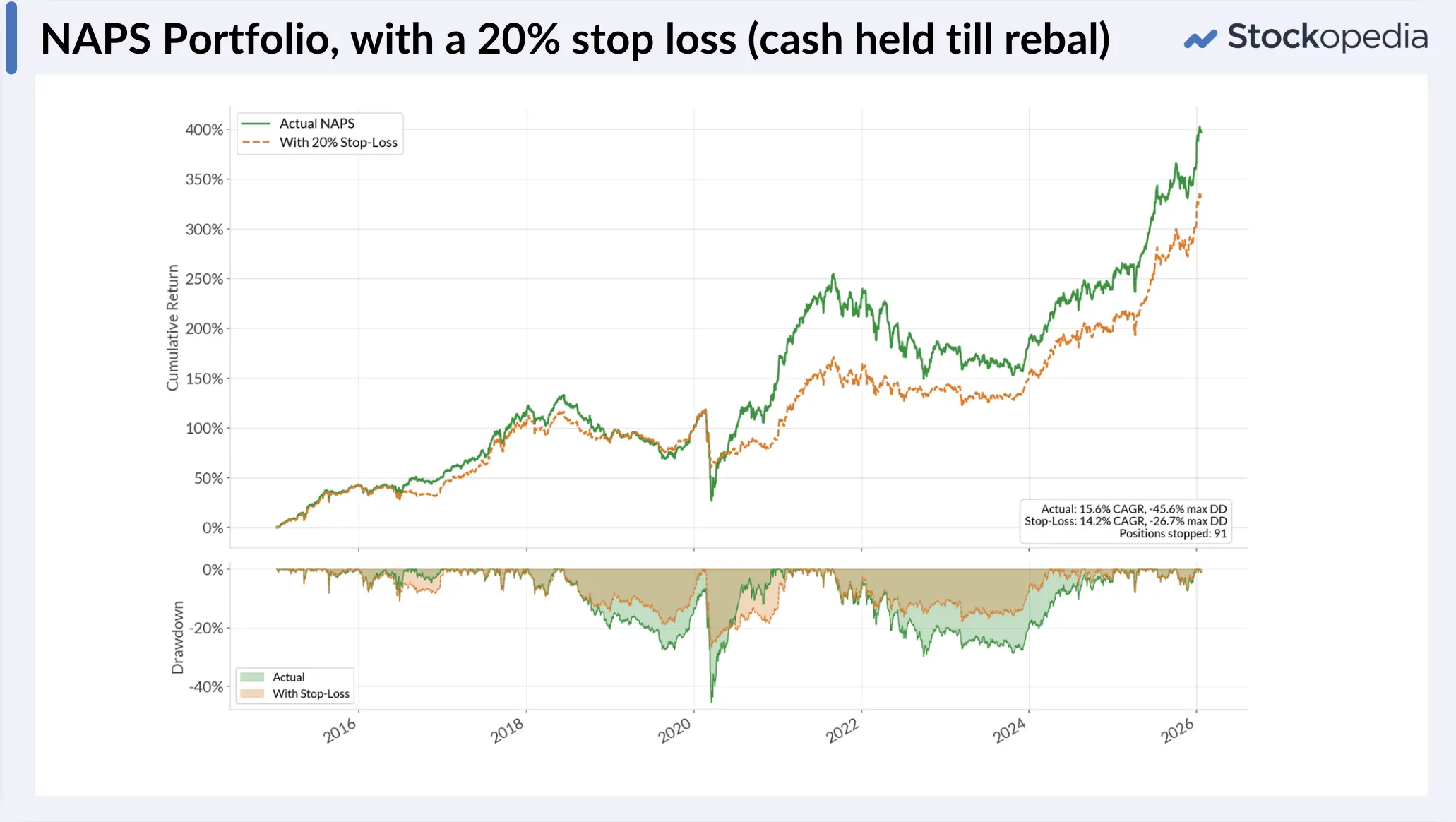

Many subscribers have been attracted to the NAPS portfolio approach. The headline ~15.5% annualised returns over 11 years, plus a couple of percent in net yield on top, is quite magnetic. But let’s be under no illusions - a fully invested share portfolio with exposure to small and mid-cap shares is guaranteed to deliver some savage drawdowns. And the recent market volatility in precious metals and info stocks has given many of us a small teaser for what could happen in harder times.

In the pandemic crash of March 2020, the NAPS bottomed at a 46% drawdown. That decline wiped out nearly five years of accumulated gains. I know many investors who threw in the towel entirely during that period and I’m not surprised - it was awful. You have to ask yourself the hard question: Can you sustain a savage drawdown? And if not, how can you minimise it?

So one question I get asked more than any other is: could stop losses help reduce the drawdowns in the NAPS? A couple of weeks ago, in our extensive 100 minute NAPS Portfolio Webinar, I tried to answer this question.

The simulation

I simulated the NAPS portfolio with a 20% stop-loss applied to each position. The rule was simple: if any holding fell 20% from its purchase price, it was sold and the proceeds held in cash until the next annual rebalance date in January.

That cash-until-rebalance rule is an important limitation to understand upfront. In the real world, you might try to reinvest sooner. But it gives us a clean baseline to isolate the pure effect of stop losses on the base NAPS approach.

The drawdowns do shrink dramatically

The headline result was striking.

That 46% pandemic drawdown in the unconstrained, fully invested NAPS? With a 20% stop-loss, it shrank to roughly 27%. Still painful, but a fundamentally different experience. That's the difference between a bad period you can ride out and a crisis that makes you throw in the towel.

This matters far more than most people realise. It's one of the most important mental models in investing, and I wrote about it at length in A Practical Guide to Keeping Losses Small: the larger the loss, the ever larger the recovery required. A 26% drawdown needs a 35% gain to recover. Manageable. But a 46% drawdown needs an 85% gain.…