If you are anything like me, when you started investing in the stock market you read furiously to generate ideas. I subscribed to every newsletter I could get hold of. I hunted high and low for stocks that had the capacity to change the world. I searched the web for proof that other investors were buying them. This led me to the big bulletin board websites.

As a UK investor, I found advfn, iii and lse where there seemed to be thousands of investors bantering on almost every stock imaginable. I lurked for months, intimidated by the apparent expert knowledge of all the loudest voices before gradually contributing myself. It was the most expensive mistake I’d ever make.

I’ll explain why it was so expensive for me in a short while, but it wasn’t just me. Reading bulletin boards may be the most expensive mistake that anyone makes.

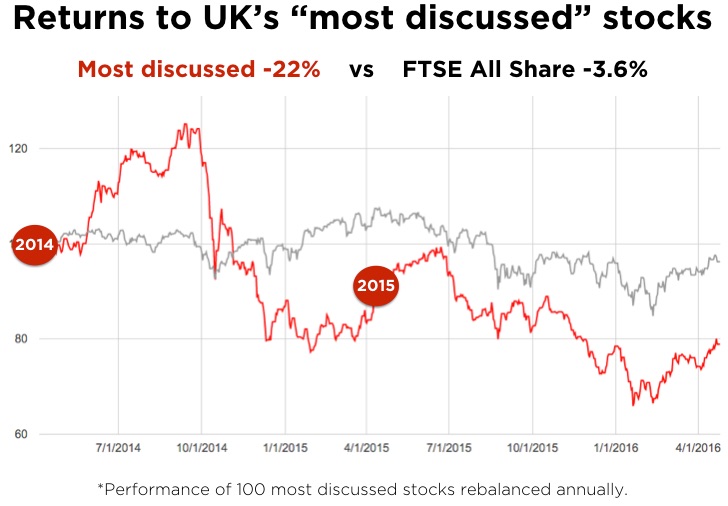

Since my own calamities in 2008, I’ve taken a huge interest into how and why bulletin boards are able to so deceive us into losing money. A few years ago I decided to start tracking the performance of the 100 most discussed stocks on the most popular online bulletin boards. I first revealed this chart at the UK Investor Show and haven’t updated it since, but even so, the results are damning.

It’s a picture of heart-wrenching ups and downs and consistent underperformance. For every story of someone who paid off his mortgage and sent his kids to private schools by ten-bagging on Rockhopper, there are hundreds of others whose crowd following have led to serious capital losses.

The typical punter investing in a collection of the most discussed stocks online would have been zeroing in on failure. A 10% average failure per year. So much for the wisdom of crowds !

Why do we get pulled into mob thinking?

It was the bull period between 2003 and 2009 that I used bulletin boards the most. I had some savings from my time as a wealth manager and had bolstered my funds with an inheritance after my mother passed away. Being Scottish, I had very good discipline ‘on the buy’. I never liked to overpay. At the time I used a strict rules-based purchase criteria that was very Jim Slater inspired, and for much of the period my exit rules were solid.

But Bull Markets create…