Hi

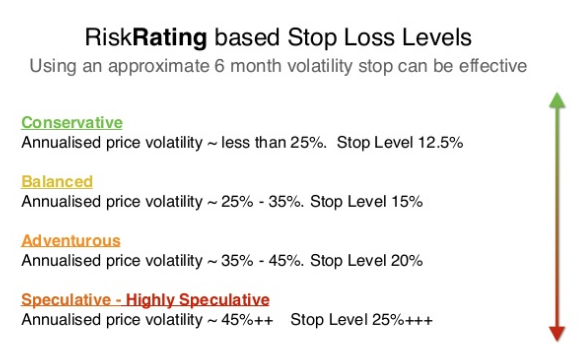

I am currently reviewing the performance of my stop loss' in the last couple of months to see what I can be doing better in terms of protection of capital, which some are obviously helping versus missing the bounce back where there is a sharp spike down even if it is over 1 or 2 days.

So I can think of some total disasters such as Boohoo (LON:BOO) and Marston's (LON:MARS), where I stopped out on the way down and totally missed the bounce (maybe this is just the lack of courage of conviction to quickly lick my wounds and buy back in again?), or Hammerson (LON:HMSO) where it protected some of the gain having revised it the day before it went downwards...

Thoughts beyond a simple 10% below investment or current value, and wisdom appreciated!

Thank you

Tom