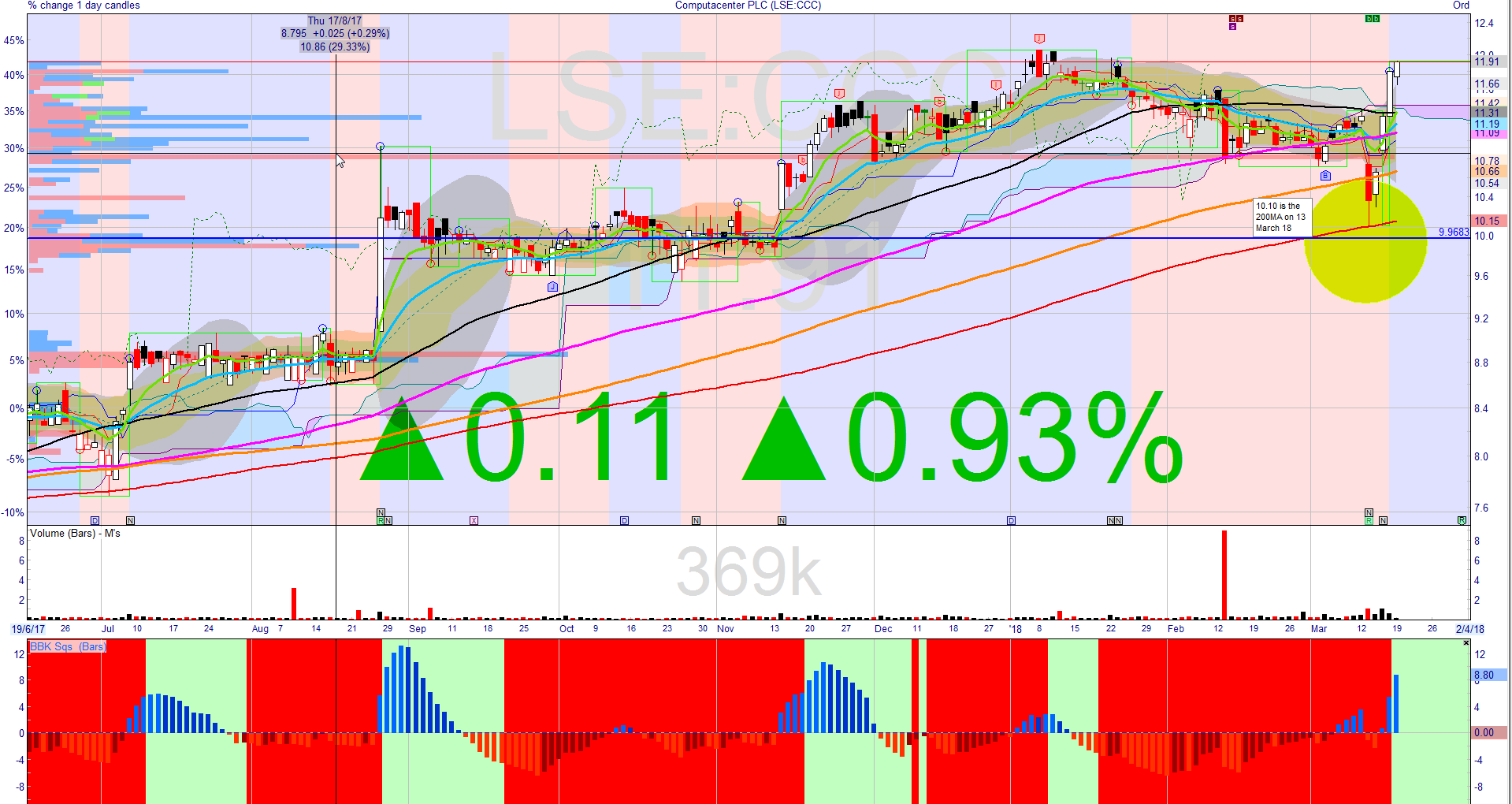

Very unhappy with share price action of Computacenter (LON:CCC) a 2018 NAPs selection) as smacks of market manipulation. Annual results issued on Tuesday 13th March with considerable pessimism about prospects for 2018 from director speak despite excellent 2017 results. Market price dropped to close to £10.10 activating my stop loss only to rebound on the day. What followed was two director buys on Wed & Thur averaging £10.50 as well as two separate positive broker reports which saw the price hit £11.80 by Friday’s close. This looks to me like the private investor being taken for a ride by company management & broker/analysts. Interested to hear what other holders who might have been stopped out think. For me demonstrates automated stop losses not a good idea!

Acounsell,

I hope you will take this in the spirit it is intended, that is one of helpfulness.

I think be calling "foul" and "manipulation" you are distracting yourself from your own errors. You are not alone in making mistakes with stop losses, I've been there, done that but the key thing is to learn from it rather than feel cheated.

I cannot see anything unusual in what you describe above.

I think you need to be asking yourself (as I have had to in the past) :

Why was your stop loss at 10.10?

- Was it because that represented the maximum you were prepared to risk on this share? (If so, regardless of the subsequent recovery it did what you intended)

- Was it because you felt that this was the price level that would signal a downtrend which you would not wish to ride? [ In which case it would seem so far that you were wrong]

- Was it to enable you to leverage you position by only putting up sufficient margin to where you thought the lowest price would be? [In which case you have been taught that volatility is greater than you thought and will need to set future stop losses accordingly].

There are of course other possibilities, but the key things to consider imho are :

- What you set out to achieve.

- Why it didn't work.

- Whether you can do things differently in the future,

It can take time (it did for me), but the sooner you can become sufficiently detached that you can treat events like this as learning experiences and adapt as a result, the sooner your investment returns will improve.

Maybe you are even right and it was manipulation (I honestly don't think so) - so what? You're not going to get any form of compensation, so the answer is still to learn to avoid this situation going forwards,

I'm sure that sounds a bit harsh, but sometimes you need to be wounded in the wallet in order to learn, if you refuse to take the lesson then that's just dumb.

Regards,

Gromley